Originally published at: https://peakprosperity.com/gold-and-silver-markets-are-exposing-a-long-running-scam/

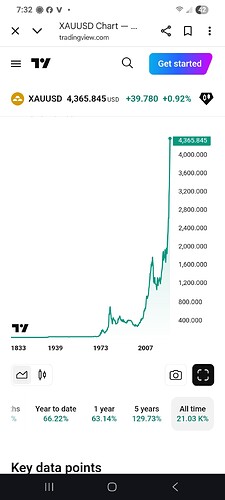

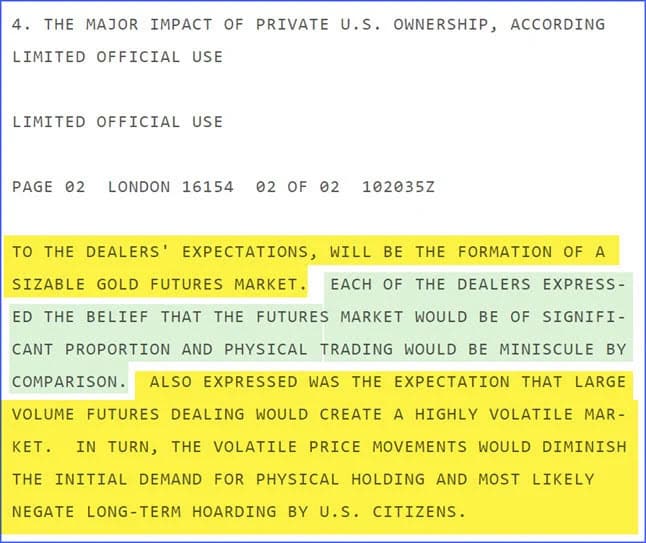

Of course, we bring receipts. The first is this 1973 cable between London and the US, describing to a “T” exactly how the newly formed paper gold derivative (i.e., ‘futures’) market would be used to cause Western gold buyers to lose interest.

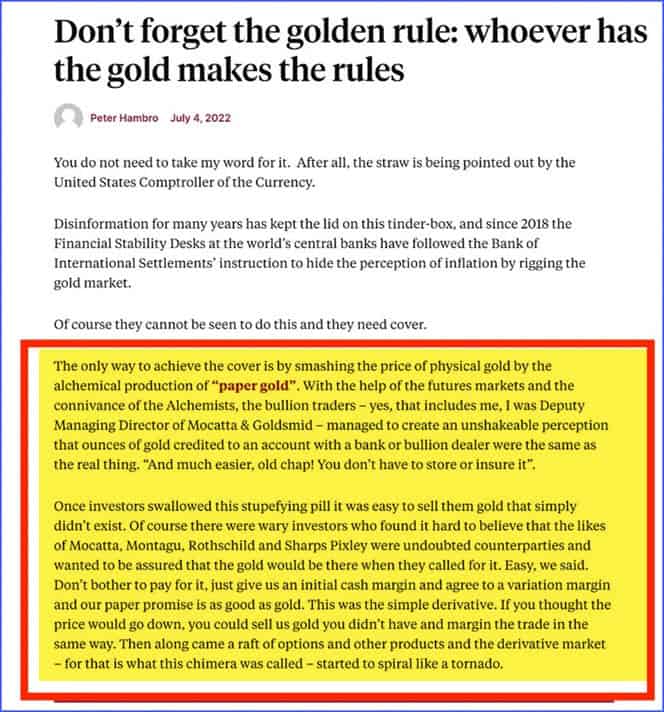

This scheme was perfectly laid out in this article by a person who was an insider running the scheme for years:

That was the scam: to convince everyone that paper gold and silver were equivalent to real gold or silver, and to do it often enough and for long enough that people truly believed in the system.

The only problem?

The gold and silver didn’t actually exist.

It was ‘fractional reserve gold (and silver) lending’ and it worked brilliantly so long as too many people didn’t show up all at once asking for their gold or silver.

Unfortunately, this was the scene in London last week:

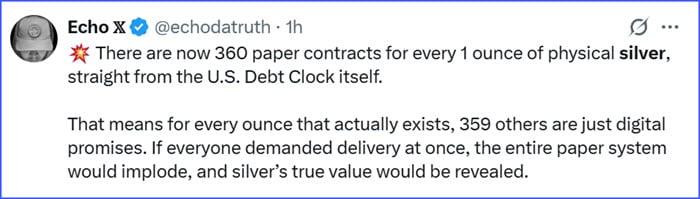

And it’s not like the paper silver price riggers are just a little short of silver, they are massively short silver:

Now what this means is that a long-running fraud has been exposed and is blowing up in the rigger’s faces. It’s currently unclear how they can get out of the pickle they are in, but what’s absolutely the case is that the usual tricks they’ve deployed over the past several decades are no longer working.

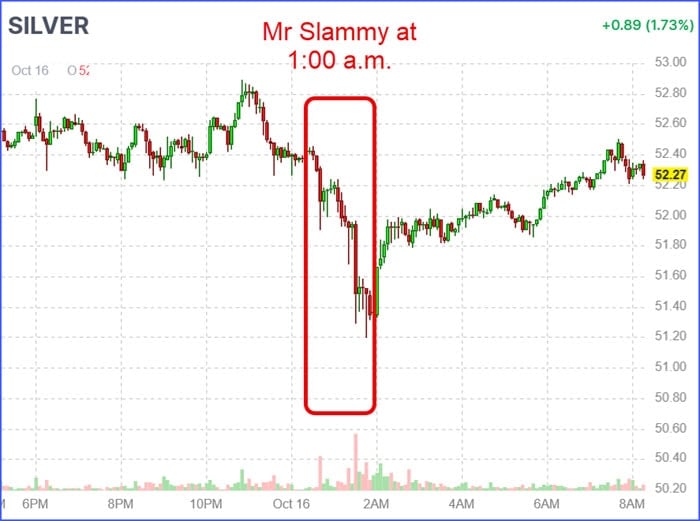

Here’s one of several 1:00 a.m. silver price slams they’ve tried that failed – this one from the night of 10/16/25:

What’s “supposed” to happen is that the slamsters show up, crush the bid stack by overwhelming it with sell orders during the thinly traded overnight hours, and then all the ‘longs’ are supposed to chicken out and keep the selling going.

That didn’t happen last night. Nor did it happen two nights ago, nor last week.

Queue the definition of insanity…

Now here’s the thing that Paul and I really dove into. The overt fraudulent practices deployed in the silver market are the same as those deployed in the gold market. Ditto for oil, naked short selling of equities, and bogus collateral “backing”: trillions in loans and quadrillions of derivatives.

I think you can see where I am going with this: “They” can’t risk one of the frauds being revealed because that might expose all the rest.

Silver could be the proverbial thread that unravels the whole rug.

That’s the risk here.

Which means that having a risk-managed portfolio strategy is more important than ever, as is having a financial advisor who sees these larger risks the same way that you do. To schedule your free, no obligation portfolio review and wealth strategy session with Kiker Wealth Management, just click this link, fill out the simple form, and someone from KWM will get in touch with you within 48 business hours to schedule your session(s).

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOR PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.