Increasingly we live in a world of Now. Instantaneous access to digital real time data and news has simply become a given in our lives of the moment.

You may be surprised to know that the Federal Reserve has taken notice.

GDPNow

To the point, GDP data that routinely comes to us from the US Bureau of Economic Analysis (BEA) arrives after the fact. From the perspective of the financial markets and investors -- who are always looking ahead and trying to discount the future -- GDP data is “yesterday’s news.” Moreover, revisions to quarterly GDP can come to us three months after the original data release (with final revisions sometimes years later), essentially becoming an afterthought in terms of relevance to decision making.

Recently the Atlanta Federal Reserve has developed what they term a GDPNow model. This model essentially mimics the methodology used by the BEA to estimate real GDP growth. The GDPNow forecast is constructed by aggregating statistical model forecasts of the 13 subcomponents that comprise the BEA’s GDP calculation.

Private forecasters of GDP, such as the Blue Chip Consensus, use similar approaches to “forecast” GDP growth. These forecasts are usually updated monthly or quarterly, but many are not publicly available, and many do not specifically forecast the subcomponents of GDP that speak to the character of the top-line number.

The Atlanta Fed GDPNow model acts to circumvent these shortcomings. By replicating the key elements of the data used by the Bureau of Economic Analysis, the new Atlanta Fed GDPNow model forms a relatively precise estimate of what the BEA will announce for the previous quarter’s GDP prior to its official announcement. For now, the model is still young, but it's beginning to be discovered more widely among the analytical community.

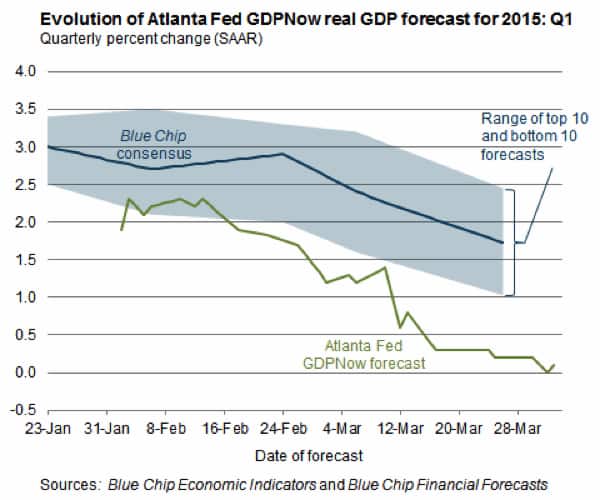

The reason I highlight this new tool to you is that I’ve incorporated it into my ongoing top down review of the US economy. More important to “here and now” thinking is the current reading of this new model. As you can see in the below chart, the current forecast by the Atlanta Fed for Q1 2015 US real GDP growth is 0.1%, up slightly from 0% at quarter end. As is also clear from the chart, as of the end of the March, Blue Chip Economists were collectively predicting a 1.7% number, quite a differential relative to the Atlanta Fed's real-time forecast:

Chart Source: Atlanta Federal Reserve

Get Ready For More Economic Weakness

Why the sudden drop in the Atlanta Fed's real-time forecast for Q1 2015 real GDP?

As we look at the underlying numbers in the model, we see recent weakness in personal consumption. Many had predicted an increase in consumption with lower gasoline prices, but that has not played out, at least not yet. Weakness in residential and non-residential construction has also played a part in the downward revision. Weather on the East Coast has not been kind to builders as of late, but that’s a seasonal issue easily overcome by sunshine. Also important, slowing in US exports and equipment orders meaningfully influenced the March drop-off in the Atlanta Fed model.

We know global currencies have been weak, with the highlight over the last six months being the Euro. With a lower Euro, European exports have actually picked up as of late. The message is clear, the strong dollar is beginning to negatively impact US exports. I do not see this changing anytime soon. As you know, the importance of relative global currency movements has been a highlight of my discussions over the past half year.

Finally, durable goods orders (orders for business equipment) have been soft as of late due specifically to slowing in the domestic energy industry. Again, a trend that is not about to change in the quarters ahead given dampened global energy prices.

Like any model, the Atlanta Fed GDPNow model is an estimate. Whether Q1 US real GDP comes in near zero growth remains to be seen, but the message is clear: there is downward pressure on US economic growth singularly. This is set against a backdrop of already-documented slowing in the non-US global economy.

What Lies Ahead

Perhaps most germane to what lies ahead for investors in 2015 is what the US Fed will do in terms of raising interest rates, or not, if indeed the slowing the Atlanta Fed model predicts materializes. I believe this slowing the Atlanta Fed model shows becomes a real dilemma for the Fed this year and a potential perceptual issue for investors. The Fed has been backed into quite the proverbial corner. A slowing US economy, or otherwise, the Fed is going to need to start raising interest rates for one very important reason.

It just so happens that the end of the second quarter of 2015 will mark an anniversary of sorts. It will be six years since the current economic expansion in the US began. As of July, ours will be tied for the fourth longest US economic expansion on record (since the Fed began keeping official track in 1945). There have been 11 economic expansions over this period, so this is no minor feat.

The second quarter of this year will also mark the six and a half year point for the US economy operating under the Federal Reserve’s zero interest rate policy. You’ll remember during the darker days of late 2008 and early 2009, the Fed introduced zero percent interest rates as an emergency monetary measure. It was deemed acceptable as crisis policy. At least as per Fed policy since, the current economic cycle has not only been one of the lengthiest on record, but apparently simultaneously the longest US economic crisis period on record as per the continuation of the crisis zero interest rate policy. As we look ahead, the “crisis period” in the eyes of the Fed is coming to an end as they contemplate higher short term interest rates.

Although it still remains to be seen what the Fed will decide and when, there is one very important consideration that must be entering their interest rate policy decision making at this point in the economic cycle. A consideration they will never speak of publicly.

The Key Question From Here

At some point, maybe sooner than later, the US economy will re-enter recession. Historically, that's the time when the Fed would lower interest rates in attempt to spur economic growth. But today, interest rates are already at 0%. That's what's so dangerous for the Fed about its current ZIRP policy -- it leaves no gunpowder left in the low-interest-rate bazooka. The Fed will enter its next battle defenseless.

This is clearly a situation the Fed wants to avoid, so raising rates -- soon -- is an urgent priority. But....practically, can the Fed (and other central banks) really raise rates now without killing the already-moribund global economy?

In Part 2: The Future Of Interest Rates, we delve into the Fed's dwindling set of options and discuss what the most likely outcomes are, and what their implications will be. Some key questions explored include: could the Fed actually adopt a negative interest rate policy (NIRP), as we're seeing elsewhere? And: is it already too late for the Fed's next actions to matter?

Click here to read Part 2 of this report (free executive summary, enrollment required for full access)

This is a companion discussion topic for the original entry at https://peakprosperity.com/has-the-fed-already-lost/