Though the mainstream financial media and the blogosphere differ radically on their forecasts—the MFM sees near-zero systemic risk while the alternative media sees a critical confluence of it—they agree on one thing: the Federal Reserve and the “too big to fail” (TBTF) Wall Street banks have their hands on the political and financial tiller of the nation, and nothing will dislodge their dominance.

Given how easily the bankers bamboozled the Washington establishment into bailing them out in 2008 to the tune of tens of trillions of dollars in backstops, guarantees, subsidies and zero-interest loans, this is a reasonable assumption. Especially when coupled with the free hand the Fed has to reward the banks with zero-interest loans and limitless liquidity.

Add in the unsurpassed political power of the banks’ lobbying and campaign contributions and the hog-tying of regulatory agencies, and it’s no wonder few see any threat to the Fed/financial sector’s dominance.

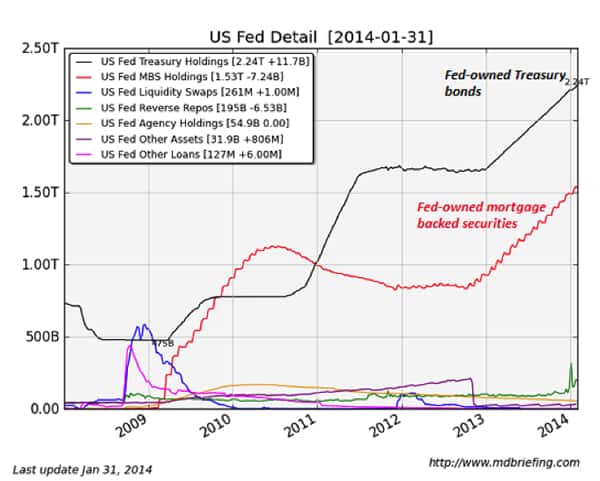

There’s also a compelling narrative that supports the Fed’s policies of keeping interest rates near-zero by printing money to buy mortgages and Treasury bonds: were the Fed to allow interest rates to normalize back up to the historically average range, credit-based consumption and housing sales would dry up, pushing the nation into a recession or even a depression.

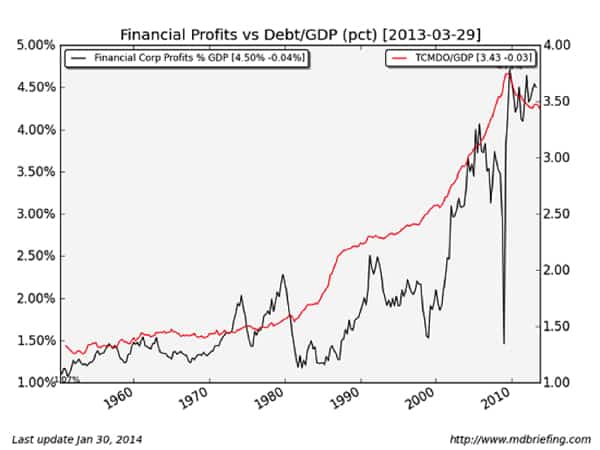

What’s left unsaid is that such a contraction in credit would severely undermine the banks’ profits and solvency, and that it’s that which is driving the Fed policy more than a concern for Main Street. Take a look at what happened to phenomenally robust financial profits in 2008: a contraction in credit caused financial profits (and solvency) to absolutely crater.

Interestingly, the collapse of financial profits back to 1.5% of GDP (gross domestic product) merely returned the financial sector to the level of profit it had earned in the 1960s and 70s. No one reckoned the high-growth 1960s were a depression, yet the collapse of financial profits back to the level of the go-go 1960s triggered the systemic insolvency of America’s financial sector.

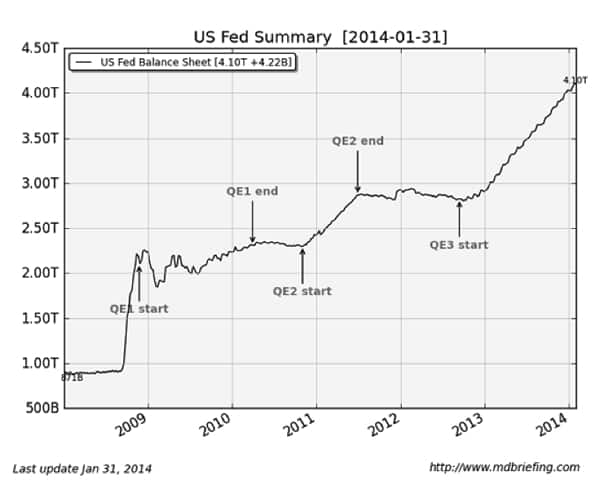

Simply put, the only way the financial sector (Wall Street and the banks) could continue to grab almost 5% of the nation’s entire output as profit is if the Fed keeps interest rates near-zero and floods the system with the limitless liquidity of expanding credit and money-printing. Here is a snapshot of the Fed’s balance sheet, which reflects its unprecedented expansion of money:

- Any contraction in credit would once again imperil the financial sector’s profits and solvency.

- Since Wall Street is politically dominant, the Fed will not allow credit to contract.

- Mainstream economists and politicians fear a recession triggered by credit contraction more than they fear a collapse of the U.S. dollar.

The Fed could respond to this bond buyers’ strike by printing even more trillions to buy even more Treasury bonds than it already buys every year, but the fact that the Fed might be forced to become the buyer of last resort is hardly a vote of confidence in the policies that support financial profits at the expense of market discovery of price and value.

Stripped of obfuscating complexity, a bond is a claim on future national income, and a bet that the currency used to redeem the bond in the future will have the same value as the currency initially traded for the bond. If doubt arises about this, buying the bond or owning the currency is a bad bet.

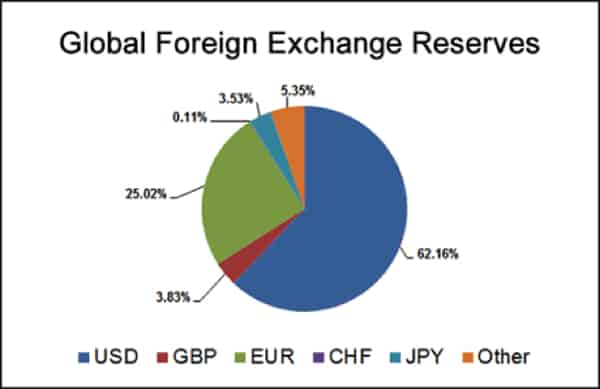

As a consequence, many observers have concluded that the Fed can’t stop printing money and keeping interest rates near-zero (because those policies enable the financial sector to skim its hundreds of billions of dollars in profits) and so the U.S. dollar is doomed to devaluation and eventual loss of its status as the world’s primary reserve currency.

The Reserve Currency

What is a reserve currency? Although the subject deserves a book-length explanation, let’s pare it down to the essentials.First, we need to understand that currency (money issued by nations) is a commodity like any other. The global currency exchange (called the FX market) discovers the price of currencies by supply and demand, just like the markets for wheat, oil, lumber or other commodities. Various nations can arbitrarily peg their own currency to another currency, but ultimately the value of every currency is set by supply and demand.

Second, we need to differentiate between a trading currency and a reserve currency. Many people confuse the two. Let’s say a Chinese company buys sugar from Brazil and a Brazilian company buys electronics from China. The firms exchange Renminbi (yuan) and Brazilian Reals. These are trading currencies, as they facilitate trade between two nations.

A reserve currency is a currency that nations hold as reserves to protect their own currencies from market shocks and as collateral for credit issued by the nation holding the reserve currency.

Gold is one form of reserve/collateral. In a gold-backed currency, the currency is directly pegged to physical gold. When the U.S. dollar was gold-backed, other nations could trade $35 for an ounce of gold.

Nowadays, there are no explicitly gold-backed currencies, though many nations hold gold as a form of collateral.

A reserve currency acts in a similar fashion, as a predictable store of value that can be easily bought and sold on the global marketplace.

When markets lose faith in a currency’s value, traders sell the currency before it loses any more value. This selling lowers the value, creating a self-reinforcing feedback loop of selling triggering more selling. This creates a currency crisis as the currency rapidly loses value. To stop the crisis, the issuing nation must sell collateral (gold, reserves of other currencies) to sop up all the selling. If the nation fails to stem the crisis, its currency collapses once its reserves are gone.

What does all this mean? What it boils down to is the global currency markets impose a discipline on money-printing. If a country prints its own currency with abandon and does not build up equivalent reserves/collateral to back that expansion of currency, eventually the nation’s money-printing devalues the currency. Once the currency loses most of its value, the country no longer has the means to buy oil or other goods from other nations.

There is one general exception to this discipline: the nation that issues the reserve currency can print more currency and as long as there is sufficient demand for that currency as reserves, the issuing country has the “exorbitant privilege” of issuing intrinsically worthless paper and exchanging it for very valuable commodities such as oil, electronics, autos, etc. (For more on this topic, please see Understanding the “Exorbitant Privilege” of the U.S. Dollar)

Currently, the primary reserve currencies are the U.S. dollar and the euro.

Simply put, the U.S. dollar’s status as a reserve currency is a key component of U.S. global dominance. Were the dollar to be devalued by Fed/Wall Street policies to the point that it lost its reserve status, the damage to American influence and wealth would be irreversible.

What if Wall Street is Recognized as a Strategic Threat to the Nation?

As a result, I discern another possibility to the consensus view that the Fed/Wall Street will continue to issue credit and currency with abandon until the inevitable consequence occurs, i.e. the dollar is devalued and loses its reserve status.I propose an alternative narrative for consideration, in which the other power centers of the U.S. government (known as the Deep State) awaken from their ignorance of finance and awaken to the fact that Fed/Wall Street policies constitute a strategic threat to the dominance and prosperity of the U.S. nation-state.

In this view, Wall Street’s power has peaked and is about to be challenged by forces that it has never faced before. Put another way, the power of Wall Street has reached a systemic extreme where a decline or reversal is inevitable.

Part 2: The Implications of a ‘War of Elites’ focuses on how, as a result of its over-reach, Wall Street is at risk of encountering blowback from forces that the financial sector assumed were benign or under its control. Now that Wall Street poses a strategic threat to the viability of the American Project, its dominance may well be about to be challenged in ways few imagine possible.

What would such a power struggle look like? How would it unfold? What would the costs be to society? How will the rest of us be affected?

Click here to access Part 2 of this report (free executive summary, enrollment required for full access).

This is a companion discussion topic for the original entry at https://peakprosperity.com/have-we-reached-peak-wall-street/