It’s no secret that housing and employment are correlated, and the causation is intuitive. If more people have jobs, then more people have incomes that support the purchase of a home. In the other direction, the more houses that are built to meet rising demand, the more jobs will be created in construction and real estate.

It’s no secret that housing and employment are correlated, and the causation is intuitive. If more people have jobs, then more people have incomes that support the purchase of a home. In the other direction, the more houses that are built to meet rising demand, the more jobs will be created in construction and real estate.

We can see the correlation in this chart from the St. Louis Federal Reserve displaying one measure of employment for workers age 45-54 and the index of home prices.

As employment of those in their peak earning years rose, so did home prices. This is partly a function of basic supply and demand: Rising demand pushes prices higher.

As employment fell, demand declined, and so did home prices.

The Federal Reserve famously has a dual mandate: to maintain stable inflation and employment. The Fed attempts to pursue these goals with monetary tools such as setting interest rate targets, while the Federal government supports housing by subsidizing mortgage interest via tax policy and guaranteeing mortgages via the housing-lending agencies of Fannie Mae, Freddie Mac, and the Federal Housing Administration (FHA).

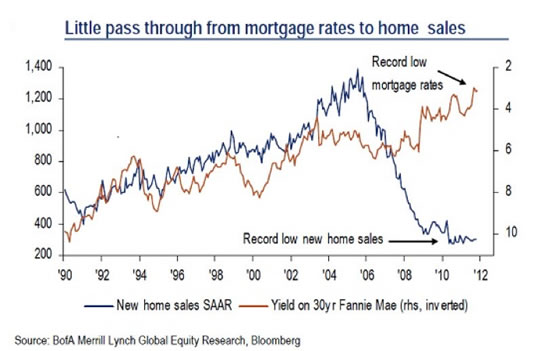

The Fed’s primary tool for stimulating demand for housing has been to lower mortgage interest rates, by buying the US Treasuries that set the baseline cost of long-term debt and also mortgage securities. Indeed, the Fed’s first quantitative easing (QE) program was to buy about $1 trillion in distressed mortgage debt outright. This removed the impaired debt from banks’ balance sheets and also served to lower mortgage rates.

The Fed’s assumption was that lower rates would stimulate demand for houses. As this chart illustrates, lower rates have stimulated precious little demand.

(Source)

Part of this failure can be traced to the decline in employment. Fewer people have the wherewithal to support buying a house. But demand is only part of the picture, as millions of foreclosures and defaults have created a huge overhang of excess supply that is estimated to number some 2.5 million homes.

What is not expressed in charts of mortgage rates, employment, and housing inventory is the implosion of housing as a speculative market. Millions of households bought more than one home as a speculative play; according to a recent report from the New York Fed, one-third of all home mortgages issued in 2006 were to people who already owned another home.

Millions of others bought homes with low down payments, while millions more added second mortgages or home equity lines of credit (HELOCs) to their existing first mortgages to extract equity.

As a result, “owner equity as percentage of household real estate,” as measured by the Federal Reserve, has fallen from 60% in 2005 to a mere 38.6% in the third quarter of 2011. When we consider that roughly one-third (33%) of all homes in the US are owned free and clear (i.e., have no mortgage), then we can see that equity in the remaining two-thirds with mortgages is a razor-thin 5%-6%.

Interestingly, despite millions of foreclosures and write-downs, mortgage debt has actually risen from its 2006 level of $9.86 trillion to $9.93 trillion in the third quarter of 2011. (So much for deleveraging.) The “ForeclosureGate” MERS/robo-signing scandal is another systemic wild-card in the housing deck that is has created a legal logjam in the foreclosure pipeline. Since no one can predict the eventual resolution of this logjam, we will set it aside, noting it as an additional impediment to the clearing of the housing market.

With this dramatic contraction of equity in mind, it is understandable that 10.7 million (22%) of all homeowners with a mortgage are “underwater” -- that is, they owe more on their mortgage than their home is worth, while another 5% have negligible equity.

Another aspect of the Fed’s failure to boost demand by lowering rates results from the Fed’s misunderstanding of how risk is priced when interest rates are kept artificially low via official intervention and manipulation. If we place ourselves in the shoes of a mortgage issuer, we realize that artificially low rates deprive the lender of a means to price risk. In an open, transparent market, interest rates rise and fall according to the perceived risk that the borrower might default and/or the asset underlying the loan might decline substantially in value.

In the current housing market, falling prices make it clear that there is still downside risk of homes declining further in value going forward. Furthermore, the unstable employment environment means that a household could shift quickly from low-risk to high-risk if the principal breadwinner's job was lost and could not be replaced.

Since rates have been artificially suppressed to goose demand, lenders have no way to compensate for the risk of issuing a mortgage except to insist on very substantial down payments or to simply avoid lending to all but those with the very best credit scores.

Anecdotally, this is precisely what we see happening. Households that easily qualified for jumbo mortgages in the boom years are being turned down for refinancing mortgages. From the point of view of the mortgage issuer/lender, why take a chance of massive future losses for a paltry 4% interest rate?

The tragic irony of the Fed’s policies of buying impaired mortgage debt and suppressing mortgage rates is that this has impeded the market from properly pricing houses, mortgages, and risk. And when the price of assets, debt, and risk cannot be discovered by transparent market forces, then participants must remain wary of future price discovery.

In other words, manipulating and impeding the market only increases the risk, driving the risk-averse out of the market. That leaves only the reckless in the housing market — those plunking down 3% for an FHA-backed mortgage and those lenders who have transferred the risk of default to the Federal agencies: Fannie, Freddie, and FHA.

This “moral hazard” — the separation of risk from gain/loss — leaves the taxpayer on the hook for not only making good the staggering losses already recorded by Fannie Mae and Freddie Mac, but also for future losses in mortgages backed by FHA, which has seen its mortgage portfolio explode from 3.8 million to 5.7 million in just the past two years. As anyone could predict when down payments get as tiny as 3%, a slide in home values of a few percentage points can easily put the homeowner underwater, and consequently the default rate on FHA mortgages has been rising.

With a paper-thin supplemental cash reserve of $2.6 billion supposedly backing up its $1.1 trillion mortgage portfolio — a mere one-quarter percent of the portfolio -- FHA will soon need a taxpayer-funded bailout in the billions of dollars to keep afloat.

The Federal Reserve and the Federal government have attempted to boost the housing market’s demand and valuations by introducing moral hazard on a vast scale and by making it impossible for the open market to discover the price of housing, mortgages, and risk. Prudent lenders and buyers have been forced by this systemic risk to withdraw from the market, even as artificially low mortgage rates, near-zero down payments, and government-backed mortgages have created generous incentives for the most reckless buyers and lenders to take their chances. After all, if you can’t lose more than 3% by buying a spot on the real estate roulette wheel, and all mortgage losses will be made good by the taxpayers, then why not gamble?

In this manipulated market, the reckless have nothing to lose, while the prudent cannot possibly assess the real risk or price of assets and debt. The grand irony is that in attempting to “save” the housing market by suppressing mortgage rates and the market’s discovery of the price of homes, debt, and risk, the Fed has systemically crippled the housing market.

There is a subtext to the Fed’s fervent intervention in the mortgage and housing markets: By propping up housing prices, it also props up the sagging balance sheets of its favored (and politically powerful) “too big to fail” banks. From this perspective, we can see that the Fed’s public concern for employment masks its real concern, which is keeping the “too big to fail” banks from a market recognition of their insolvency.

When will the housing market “recover”? Housing can only find solid footing if the market is freed to discover the prices of property, mortgages, and risk. Until then, the market will drift along in a haze of moral hazard and official support of the imprudent and reckless.

In Part II: How Low Will Housing Prices Go?, we explore the macro-economic trends likely to further depress housing prices in the coming years, as well as look at several time-tested models for determining how much downside is left for housing prices and how we'll be able to estimate when the housing market finally reaches a bottom.

Click here to access Part II of this report (free executive summary, enrollment required for full access).

This is a companion discussion topic for the original entry at https://peakprosperity.com/headwinds-for-housing-2/