Originally published at: https://peakprosperity.com/how-brics-is-driving-the-gold-price/

Executive Summary

Gold has recently surged to $2,800, driven by significant central bank buying, particularly from Eastern nations. The BRICS conference has highlighted a shift towards de-dollarization and the establishment of a new monetary system, potentially backed by gold. This episode explores the implications of these developments on global finance, including the impact on treasuries and Bitcoin, and the potential for geopolitical tensions to influence markets.

Central Bank Gold Buying

The rise in gold prices is attributed to central bank purchases, primarily from Eastern countries, as part of a strategy to back a new BRICS currency with tangible assets like gold. This is not a speculative rally but a strategic move to underpin future monetary systems.

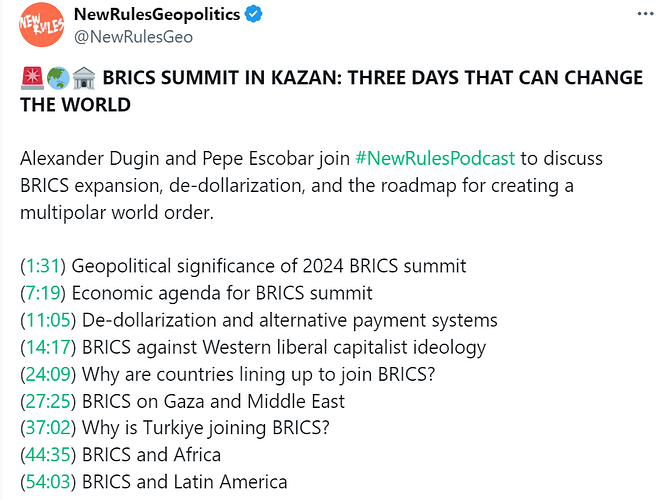

BRICS and De-dollarization

The BRICS nations are working towards reducing reliance on the US dollar by establishing their own trading systems and potentially a new currency backed by precious metals. This move is seen as a response to geopolitical tensions and the weaponization of the dollar.

Geopolitical Tensions

Increased geopolitical tensions, particularly in the Middle East, and the potential for a new world order are influencing global markets. The BRICS nations are preparing for a shift in global power dynamics, which could impact the stability of the US dollar.

Key Data

- Gold has reached $2,800, driven by central bank purchases.

- The BRICS nations represent 40% of the world’s population and are moving towards de-dollarization.

- US net interest expense is nearly a trillion dollars, highlighting fiscal challenges.

Predictions

- Continued central bank gold buying is expected to support gold prices for the next few years.

- The BRICS nations may launch a new currency backed by precious metals.

- Geopolitical tensions could lead to increased defense spending and impact global markets.

Implication

- The shift towards a BRICS currency could reduce the global reliance on the US dollar.

- Increased geopolitical tensions may lead to economic instability and impact investment strategies.