Originally published at: https://peakprosperity.com/how-to-avoid-becoming-a-victim-of-financial-scammers-long-bonds-say-creak-pop/

In today’s discussion, Paul Kiker of Kiker Wealth Management recounts how his clients have been experiencing a growing number of scam attacks of increasing sophistication, mainly targeting the elderly.

To protect yourself (or your loved ones), he advises:

- Use a separate email ONLY for your financial accounts (and no other uses)

- Change your passwords monthly

- Use two-factor authentication

- NEVER give any information to anybody over the phone if they have called you

- If someone official-sounding calls you (from your brokerage or state for federal government), and then advises you to look up the number by Googling it, BEWARE! The scammers may have compromised your device, and you will pull up a bogus number during your ‘search.’

- Anybody asking you anything over the phone, HANG UP. If it was a legitimate IRS or FBI (or whomever) inquiry, let them come to your home and detain you and work it out within the court system.

- Do not use debit cards. Use credit cards instead. Debit card charges are much harder to reverse if compromised.

Remember, the system has limited safeguards to prevent you fr om being a victim of fraud, but once you’ve been defrauded, the system has excellent guards in place to prevent your financial institution from bearing any of the expense or responsibility.

In his 26 years of being in the business, Paul has never seen or experienced the level of fraud attacks that are currently underway.

After that timely and important advice, we discussed the bond markets signalling that ‘something is very wrong.’

Japan’s 30-year bond is “blowing out” and with the BOJ being a 52% holder of all Japanese government bonds, this means huge losses for the central bank.

But, hey, somebody somewhere is nursing trillions in losses, which we can surmise from the fact that in 2019 there was more than $18 trillion of negative-yielding debt in the system:

Negative-yielding debt means debt whose rate of interest that it “pays” is below zero. You have to pay someone, like Germany, to allow it to borrow your money. This wasn’t just nuts, but stark, raving bonkers.

As Lawrence McDonald pointed out, the poor saps holding Apple’s 2060 bonds yielding 2.55% are sitting on a 43% capital loss.

Well, 2.55% is a lot better than “below zero,” so it’s likely that all those proud buyers of negative-yielding debt are facing equivalent losses (depending on the duration of their bonds).

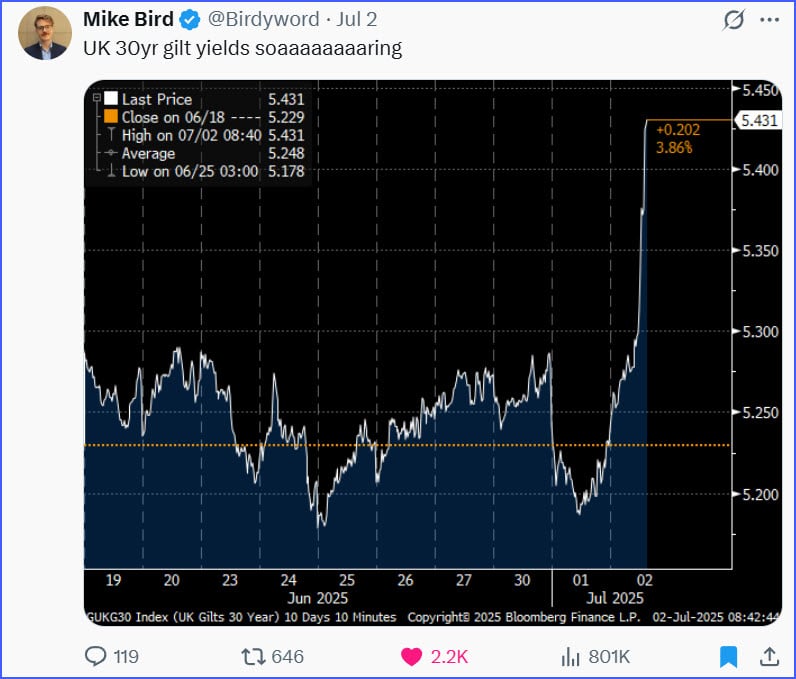

Finally, the UK 30 year ‘Gilts’ are also busy blowing out:

For some reason, the entire financial world has decided that long-term bets on government debt are not all that compelling at the present moment. Gee, I wonder why?

Trade safe, everyone!

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOR PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.