I said the headline wasn’t real, not that no kids were ever bullied for being unvaccinated. I will thank you to refrain from putting words in my mouth.

An average or higher IQ does not measure common sense, as we all know.

There are many forms of intelligence.

İ have not followed Kamala Harris at all so i cannot say anything specifically about her.

I am familiar, however, with a certain type of intelligence, in women, mostly, that pretends lack of intelligence as a strategy.

I have used this strategy myself. İt has allowed me to go places where an intelligent woman would be cut out and find out information that people thought was ok to reveal to someone they thought was “less than”.

İt’s called playing dumb.

Could Kamala Harris be using some form of this strategy?

The first two steps are classic communism, as expressed pithily by Lenin himself:

But if you want to really shake the system down, you need a crushing round of deflation to strip the assets away from those at the top of the money pyramid who are not party loyalists.

With each turn of the millstones, the poverty line reaches higher and higher up the wealth pyramid.

Eventually, there’s just a small handful of holdouts…the 0.5%, let’s say.

But there’s variability within the ranks…some who might oppose you. What to do?

This is where a nice, crushing round of deflation comes in. All the true insiders are prepositioned, while the outsiders are not.

Maybe even work to get them levered up first.

Then the rug-pull.

Oh no! Loans still have to be paid back but all your stocks and bonds you used as collateral are not worth the value of your loans! You’re toast!

All your assets belong to us!

That’s the path here.

Note: I passed my post through ChatGPT to try to improve the copy.

Inflation, Taxation, and Deflation: Understanding the Dynamics

Inflation and taxation are concepts most of us grasp easily. But what about deflation? How could it possibly follow inflation?

The Concept of Bifurcation in Inflation and Deflation

To be more accurate, we might see a bifurcation in inflation and deflation. It’s important to remember that money isn’t a fixed-value entity, especially fiat currencies. Its value depends largely on the relative quantity desired in exchange for goods and services.

Inflation and Strong Pricing Power

If the money supply increases and our desires remain unchanged, goods and services with strong pricing power will require more money to acquire the same products. Typically, these are essentials—things we must have to live—especially if their supply is governed by natural forces, such as food production.

Deflation and Optional Goods

In a deflation scenario, money directed towards non-essential items (like luxury houses, cars, stocks, or other agreements) might significantly reprice. This can trigger a chain reaction across related industries, even those considered essential, resulting in lower demand. As prices trend downward, people will naturally delay purchases, waiting for prices to fall even further.

The Impact of Deflation on Debt and Agreements

To Chris’s point, the issue with deflation lies in its effect on current and future agreements tied to higher-priced currency. Most people who took on debt did so with the expectation of repaying it with money of equal or lesser value. While deflation can benefit consumers in the short term, it poses long-term challenges.

The Wave Phenomenon of Deflation

Interestingly, deflation often occurs in waves. Money can be either liquid or illiquid—consider, for example, a retirement account that imposes penalties for early withdrawal.

Why Deflation Might Follow Inflation

To address your specific question: If the inflationary cycle is temporary, whether deflation follows depends on how the public handles inflationary pressures. If prices rise too high, many people may lack the income to sustain their participation in the market. As buyers drop out, demand decreases. If this trend becomes widespread, deflation is the likely outcome.

Net new money drying out is one reason. If money in the system gets and stays sidelined, this is another reason.

In the end, money is the public trust that what they really want in the future will be repaid. A bank only makes money if they get repaid. They won’t lend if they think you aren’t good for it.

Is there a way to know?

It is my tendency to think that people who act in a way unnatural to reality will expose themselves at some point. If you have a video showing a different Kamala, I’d gladly like to see it.

As I understand, the most prudent thing is what most banks do. Reduce their debt exposure and look for sources of guaranteed income, even if the margins are lower.

Of course it’s going to be devastating. It’s also mathematically inevitable.

The longer we wait, the worse it’s going to be.

But that’s not an argument against facing up to the reality…

The only question is whether it’s going to be ruination via inflation (preferred by statists everywhere because it spreads the pain unequally across the little people) or deflation.

Either way; immiseration for the masses.

This is where I disagree with the right leaning people. The only reason global misery would be inevitable is if there was a fundamental reason people couldn’t survive like food shortages or war. We aren’t anywhere near food shortages based on ecological fundamentals, but I wouldn’t rule out war as an option the elites bring in to do their dirty work.

The proponents of Friedman style economics would argue that this misery is necessary, like quickly pulling off a bandaid, as it would force people to re-organize and pursue work and invest capital in the private sector where demand / supply and production / consumption would re-balance as a result of true price discovery in free markets. It would force a restructuring of the economy back into truly “productive” activities.

With time, the misery would lessen as the economy moves back into a more productive structure and overall, prosperity would increase.

While there are some elements to the above argument that I think are useful, I disagree with it in several ways. Firstly, I don’t think they understand what wealth production is. There is no such thing as “wealth”. There is food, energy, houses, metal, plastic, clothes, cars, pavement etc. Those are all real world things, but wealth is not. It cannot be produced or consumed because it isn’t real. The only way to understand how this magic thing called wealth is created is to analyze the economy through a thermodynamic lens in relation to all the real world things I listed above. No economists do this, be they left or right leaning. They assume that wealth is created by people fiddling with their magical fingers producing stuff. The different economic schools just argue about how to organize and incentivize all those magic fingers fiddling. No. That’s not what creates wealth. They are all wrong.

The crash, when it inevitably happens, will be highly deflationary, meaning unemployment will skyrocket. The job losses are ultimately 100% unavoidable at some point. All the useless overseas military would come home. The financial sector would die. The construction industry would be decimated since economic growth would be largely finished. There would be some jobs left in rebuilding infrastructure but this would be much reduced. The retail sector will also be decimated since the consumer culture will be finished. Eventually, some local manufacturing industries would rebuild but this would take time and would be limited by the reduced consumption. And of course, the wonderful sick care industry will be with us for a while, our one saving grace for employment LOL.

This inevitable loss of jobs is all exacerbated by technological automation and AI taking our jobs away. So basically, the % employment needed to keep society humming along in steady state, providing for all our basic needs, is a fraction of what it used to be due to technology, regardless of how centrally planned or free market that economy is. The powers that be know all this, and their plan is to get everyone hooked up to central planning, UBI, and government distribution. But there is another solution…

What about this as a scenario to avoid global misery? I’m not necessarily advocating for it or suggesting it could happen, or that it would be fair, but please someone tell me why this wouldn’t minimize the misery?

Every mortgage and all debt gets cancelled and memory holed. So every person who “owns” a house with a mortgage gets to keep it. New monetary system brought in based on gold. Let’s pretend the West still has gold so the currency value would be based on that. No debt-based money creation allowed. Usury banned like in Muslim cultures. All farmland illegitimately accumulated by big corporations over the last century is confiscated and divided up amongst the population. No foreign ownership of real estate allowed. Close the borders. Economic growth would be finished for reasons Chris has talked a lot about. Population growth ends. A true “reset”.

In this situation, it isn’t so catastrophic if 80% of the jobs disappear, since no one would have a mortgage to pay and their monthly expenses would be so much lower. Plus their taxes would be way lower. With farmland to their name, they would be more self sufficient and able to take care of themselves better. Let’s just ignore for the moment that people have largely lost those skills, but I think they could be re-learned. People wouldn’t need the government teet. Isn’t this kinda the way US society was organized 150 years ago?

Those are basically our two options. Central planning and UBI which will result in continued degradation of society and the environment as the government pushes all these nonsense industries to keep this train wreck chugging along, vs. something along the lines of what I proposed above. The third Friedman-style option equals misery with 80% unemployment and rampant homelessness. Which will we take? Do “we” have a choice in the matter?

The Friedman-style approach of gutting public spending and letting the free market have its way simply won’t work because too many people have no assets to their name and have nothing to base a restructuring on. The wealth inequality is far too great for this unrealistic ideology to be practical in an economy that can no longer grow, and in which there will hardly be any jobs available.

I think not possible is being conflated with something else, because it certainly is possible. We lack the political will to do it.

Maybe I’m speaking out of turn, but I think most of us aren’t looking for a balanced budget as much as spending public money on things which have a real chance at being beneficial to the people in relation to the spend.

If the government borrows money to fritter away on ineffective projects, the buying power goes back into the real economy (inflation today), with us normies on the hook to pay it back (taxes tomorrow).

Technology and good decisions are naturally deflationary. The biggest reason that deflation is “bad” is because we associate it with sudden deflation. If it was a natural outcome of reliable money and technology, it is not obvious to me that it would be harmful.

Reducing friction in transacting is a valuable service. In my opinion, the biggest issue we have is that we’ve socialized the problems of bankers who fail to do their job of managing the question of trust. If he gives out subprime mortgages and loses, it should be his loss, not mine.

Not to be overly confrontational. You have not made a case that you understand what wealth is, either.

As I define them:

rich - an abundance above that which is required

wealth - the source of that abundance

For example, if I had 1000 lbs of butter, that would be “rich” in butter. If I owned the cow, that would be wealth.

Separating promises (money) from that which we want to spend the money on is also a useful disambiguation when we are discussing financial topics.

Are you saying that zero wealth is created by labor? I don’t understand at all.

AI is unlikely to take the job of anyone doing useful work in the near term. Work that is simply a byproduct of not having a better way is definitely at risk. Just as newspaper delivery people are not in high demand.

If you need a discrete example. When I make slides for a presentation, I used to grab clipart and put them in the slides. Looked like something an elementary school child might do. These days, a meme or AI generated image is likely to be used. At no point did anyone lose their job, because I was not ever going to hire an artist to make a slide for my presentation that would be seen for all of 30 seconds. AI will fill a need for low quality content between none and some. What Chris Martenson is doing won’t be replaced with AI. If you didn’t have time to watch/read his content, AI might give you a summary, but I don’t think you would subscribe for AI summaries.

This would probably destroy a large number of people’s retirements and incomes. People who are “bad” with money would resume their separation from those who manage their money well. Once you agree that we can just say, “I don’t have to pay you, even though I agreed to.” Be aware that this has consequences on our world view. Who would want to trust in a market like that?

Also, your suggestion works great for anyone who accumulated debt and got a free pass. What about those who don’t have much and didn’t borrow? They would be at the absolute bottom. As I see it, you are just suggesting to tempt progressivism with your own ideals.

Agree.

You said:

Sounds to me like you were agreeing with AP that bully the unvaxed kids story is false.

I don’t have to put words in your mouth. Your words are there.

No. Our democratic institutions are an empty shell of their former selves. Unless you’re part of a small, local, materially self-sufficient community, an enslaving financial cage is about to snap shut around you, courtesy of the billionaire globalist overlords and their digital ID/CBDC plans. That to me means widespread suffering is inevitable for most (and especially for those who live in big cities).

Thanks Chris, Mark and John for your clarification. My take away message is to buy whatever you want now while you can and to establish emotional capital in a community.

It’s interesting to think that Western currencies might be like Venezuelan Bolivares are to us now, especially if we want to buy goods from BRICS countries.

In case some haven’t seen it, the following is a genuine photo showing a bust of Lenin on Schwab’s bookshelf.

This explains why the current aristocracy has no interest in nuclear power and flies around in private jets while screaming about cow farts and climate change. They are about destruction of the west and nothing else.

I did not get a chance to read all but what seems to be staged is the following…and it was referred to by a seer in a video from a different topic.

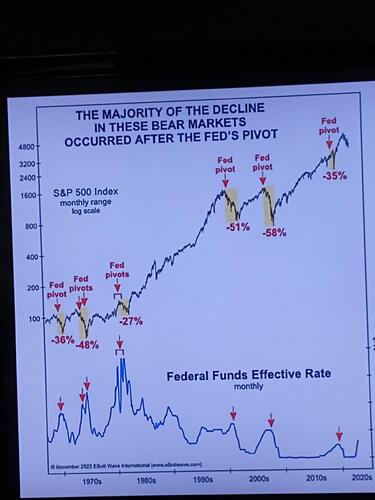

Domald Trump will be allowed (yikes…cant believe im saying this in the free USSA) to win the election. For the sole purpose of the staging as referred above…the BLS spooged employment numbers to appear to force the data driven Fed to keep rates higher for longer although we all know around us in society that these numbers were wrong. Theyre doing it to extend the stock market rally beyond any conceivable means through to the end of the Biden dictatorship. Now by the chart, the Fed already being behind the curve by a fictional year of employment data will need to start cutting rates just in time for the Trump presidency in the face of an overextended bull market and being late to help. The downfall of the stock market when Trump gets elected will rival the Great Depression and the BLS helped buy the time to get them there by falsifying the data of over 800,000 jobs that did not exist.

No doubt they’ll want to apply this new proposed unrealized capitol gains tax to the Billionaires … and the Centimillionaires … most especially the multitude of centimillionares. Congress will write this new tax law and slip it into some must pass 10,000 page bill. Then a few months later some pedantic IRS accountant will look up the definition of the SI prefix “centi”:

You’re being willfully ignorant. I linked the AP article that said that the NYT never ran such an article encouraging the bullying of unvaxxed kids.

That is a good point, John, that Kamala Harris, if she is “playing dumb”, will, at some point, show her true self.

Because i don’t follow her and never have, i don’t know if she has ever acted more naturally to her real self, if indeed, she is smarter than she acts.

İf she has been using the “play dumb” strategy for a long time, that behavior may now be what comes naturally.

Some people are naturally good actors. Not to put down acting, but that does make them good liars doesn’t it?

I try not to judge people by their appearance. Or their intelligence. Not because of moral reasons. But because their appearances and lack of intelligence can fool you.

Perhaps. In the short term, I’m more concerned with the funny money being a result of untrustworthy ledgers than I am with USD collapse.

That’s why I have multiple bank accounts. Even if the FDIC insurance stepped in, who says that I won’t have my life turned completely upside down if it happens?

I also have some ideas I may turn into businesses, but in the mean time, I got a full time job. My farming skills so far are enough to get me all I can eat muscadine jam, hopefully some figs, but not a lot else this year. I’ll need to backfill with what I’m good at until I improve.

The way your comment appeared was that you were supporting the premise that unvaxed kids weren’t bullied. If you just had a problem with the headline being bogus say that in the original comment to remove the possibility of misinterpretation. This form of communication leaves much open to interpretation. If you don’t like the way your comment was interpreted then clarify it. Someone interpreting a vague comment is not them being willfully ignorant. It is your comment not being clear in intent. It happens to most people every once in a while.