Originally published at: https://peakprosperity.com/is-an-inflation-shock-next-a-natural-gas-energy-shock-could-be-the-spark/

Long government bonds – those with durations of 10, 20, 30 and even 40 years – are clearly signaling something, and it’s not good.

It’s getting harder and harder not to notice:

“National debt concerns” is code speak for “Dude, they’re going to have to fire up the printers to max speed.”

Under those circumstances, who would want to loan a government money for 30 years only to get a dollar-for-dollar principal return in the year 2055? Lol!

So if long bonds are the canaries, what’s the poisonous gas? In my view it’s the chance that we’re about to almost perfectly repeat the inflationary double-hump from the 1970’s:

(Source)

Now, to be clear, I don’t subscribe much to the idea that charts that happen to overlay each other mean that things will necessarily repeat. But when the charts and the history overlay each, then we’ve got something to consider.

Paul Kiker and I discussed the thesis that this time will resemble last time, when it was an oil supply shock that drove the second hump of inflation. This time it’s likely to be both natural gas and oil that will contribute to future inflation, as will continued government deficit spending.

Where energy shocks provided the spark in 1979, expansionary monetary and fiscal policies amplified and sustained the inflationary bonfire.

In other words, we could be facing an exact repeat of the conditions that drove that second hump in the late 1970’s and early 1980’s.

A second insight from that period is that the humps lasted ~4-5 years. In other words, once the inflation genie is out of the bottle, it takes both time and a Fed Chairman with balls of steel to get it back in its bottle. Of course, I am referring to Paul Volker who hiked short term interest rates to 21%, with long rates as high as 17%, taking enormous political pressure and career risks to get the job done.

Can you even imagine that happening today? No, neither can I.

But wait, where’s this energy shock going to come from?

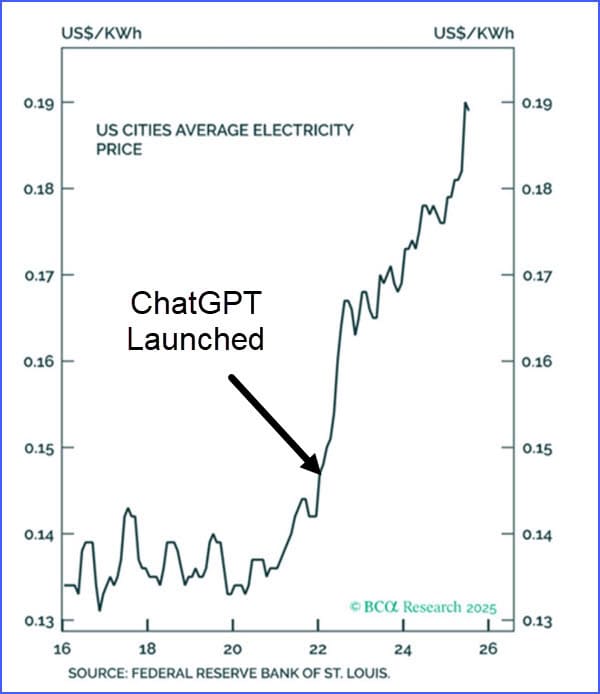

Well, to begin the conversation, it’s already here:

As we’ve been documenting extensively over the past year, it’s almost as if nobody in charge is adding up all the data center demand and making plans for where and how those electricity demands will be met. Which means, for now, US consumers are getting hit with an electricity cost shock, with the average bill up 35% over the past 3 years.

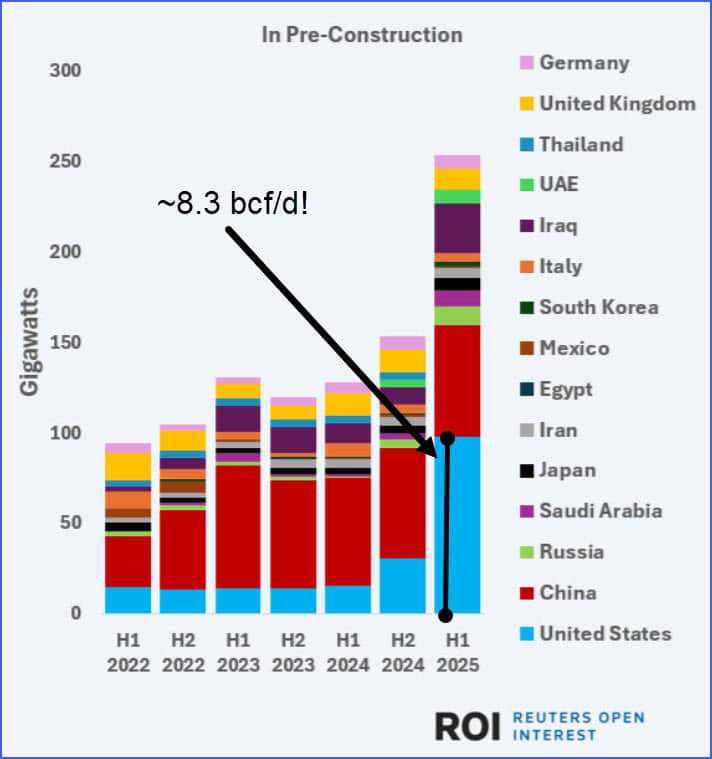

But, maybe that’s okay if we’re building lots of new electrical power generation plants, indeed, they are going in at a furious pace:

With more than 90GW of natural gas electricity generators in the planning stages now (up 6x over the past year), the ‘plan’ is to slap in a bunch of NG-fired power plants, and STAT!

At average generation capacity levels, those 90GW will draw ~8.3 billion cubic feet per day (bcf/d) of natural gas.

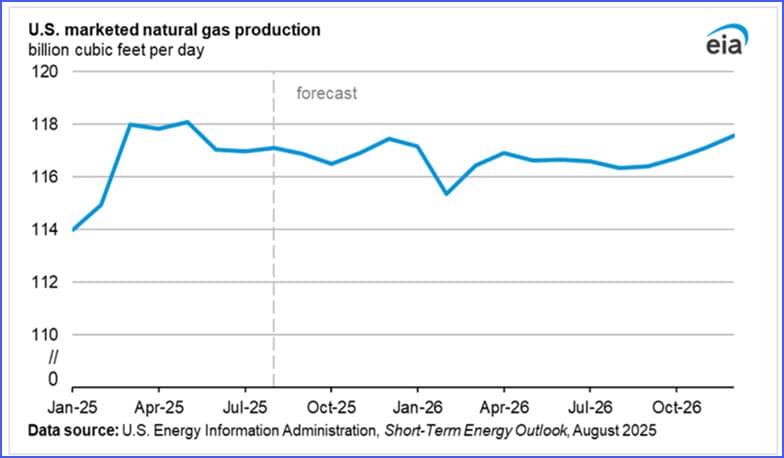

Now wander with me over to the EIA’s projections of US NG production over the next year.

Oops! Zero growth in production is what they foresee. I think that may even be optimistic, and we might even experience some slight declines.

But wait! It gets worse for US NG supplies:

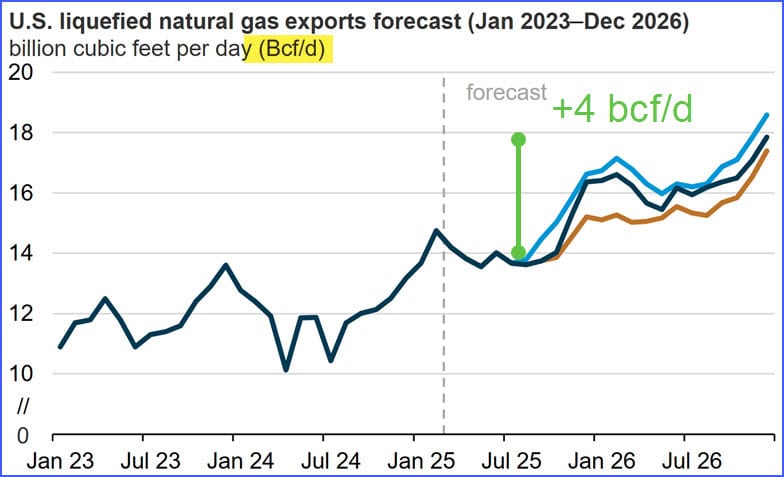

It would seem that newly permitted LNG terminals are going to demand an additional +4 bcf/d by year-end 2026.

Between new power plants and LNG exports, we’re talking about ~12 bcf/d of new demand over the next year. And this possibly undercounts the data centers that are putting in private NG generators.

Which means there’s a non-zero chance of a supply shock happening in NG in the US. Because there’s no such thing as running a deficit in NG, every molecule that comes out of the ground is consumed along the way. This means that our old handy-dandy Econ 101 Supply-Demand-Price chart comes into play, with price being the means of settling a supply-demand mismatch.

In plain English, prices will spike, possibly by a lot, which has happened many times in NG’s history:

Will it happen again? I think so, and it’s going to be called “inflation,” but I think we should more rightly call it “a really stupid failure to plan.”

So that’s the double-hump inflation thesis.

We also discussed:

- Real-World Price Shocks: Anecdotal evidence, like a 60% price increase in beef loin over 15 months, and recent shocking experiences with soaring costs for dining and travel,

- Lying BLS Statisticians: the gap between official inflation metrics (e.g., CPI at 2.7%) and lived experiences, with fast food prices up significantly (e.g., Subway up 39% since 2014), driven by such statistical tricks as “substitution.”

- Bessent’s Housing Emergency: What’s he referring to and how might the US government intervene? We speculated about possibilities like 50-year mortgages or possibly ultra-low mortgage rates being granted to first-time home buyers.

- Gold and Silver’s Breakouts: Gold and silver prices have truly broken out, reinforcing the inflation thesis. Also of note, the Saudi Central Bank’s investment in the SLV ETF and silver’s structural supply shortfall (seven years running) highlight growing demand.

- Economic Policy Critiques: We noted unchecked government spending ($3.8 trillion in additional fiscal spending) and monetary easing, which could fuel inflation.

- GDP Accounting Trickery: Most of the GDP “strength” reported for Q2 was actually driven by declining imports (which are additive to the GDP calculation) which we might also interpret as signaling underlying economic weakness, not strength.

So what comes next? Well, stocks are not priced for a recession, and most people’s portfolios are not ready for an inflation shock. At all.

Having a balanced risk-managed approach is vital during such times to preserve one’s investment wealth. To arrange a meeting with Paul’s firm to discuss your financial plans and goals along with a risk-managed portfolio approach, please visit Peak Financial Investing and fill out the simple contact form.

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOR PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.