There's no way to sugarcoat the dismal performance of the precious metals in recent months. But a revisitation of the reasons for owning them reveals no cracks in the underlying thesis for doing so.

In fact, there are a number of new compelling developments arguing that the long heartbreak for gold and silver holders will soon be over.

A Hard Look in the Mirror

The past two years have not been kind to holders of the precious metals. The price of gold is down over $500/oz since the record high (nominal) price it hit in August of 2011. That's a decline of 28%. Silver has seen a decline of 56% over the same period.

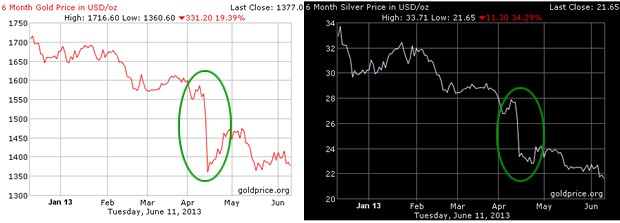

A healthy amount of that decline came in the past seven months, which have pretty much seen a steady price deflation punctuated by sharp (and historic) downdrafts:

On top of these grim charts, daily headlines touting, often with delight, the demise of gold appear nearly everywhere in the media.

And forget about PM mining stocks. They have been absolute widow-makers for investors:

(Source)

It's hard to argue that PM mining stocks aren't the most hated sector in today's markets. The chart below shows that last month, the bullish sentiment on gold miners dropped to 0%. Can't go any lower than that:

Wasn't reckless central-bank money printing going to flood the world with paper currency, sending gold prices – and those of its "poor man's" sister, silver – to the moon? Weren't the markets going to crack as the unresolved economic and financial rot in the U.S., EU, and Japanese systems became further exposed, sending capital fleeing into the bullion market and driving prices much, much higher? Weren't escalating mining costs going to march up the price floor for the precious metals?

Why haven't any of these scenarios happened? Were we wrong in our reasons for purchasing gold and silver?

Are we the clueless patsy at the poker table?

The Way of the World

These are very understandable questions to be asking. You wouldn't be human if you didn't.

So, it's wise to return to the #1 lesson of investing: Never fall in love with your positions. Be sure to question your rationale regularly and often. Remove emotion from your decision-making, look to what the data tells you, and continually ask yourself: Ignoring my past decisions, would I purchase this investment today? If the answer is no, lightening up your position is almost always the right decision.

Chris and I follow the precious metals markets on a daily basis, and we frequently challenge the logic behind our support of them. But at this time, we can find nothing – nothing – that has happened over the past two years that invalidates the principal reasons we've laid out for owning precious metals. You can review these reasons in detail on our foundational report, The Screaming Fundamentals for Owning Gold & Silver.

The hard truth for us investors is that secular market trends take time to play out. Nothing moves in a straight line. And they are many false signals along the way. There are no sure bets, no risk-free winning options to pick.

But the good news is that the laws of physics and rationality always prevail in the end. If you can identify the right endgame and position yourself for it patiently, the messy volatility along the way really won't mean much in the big picture.

But Has Anything Really Changed?

Let's look at the key reasons why we originally recommended that investors look to the precious metals as a safeguard:

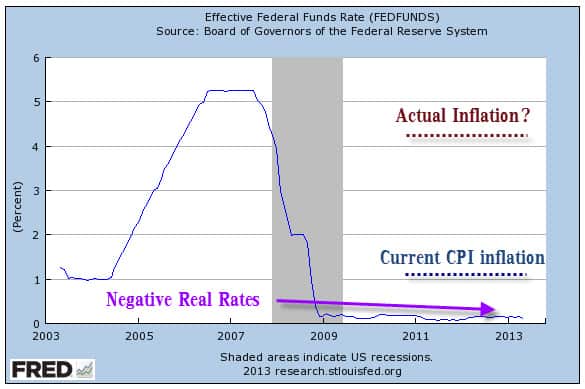

- Negative real interest rates

- Fiscal deficit spending and unserviceable sovereign debts

- Loose, if not reckless, monetary policies

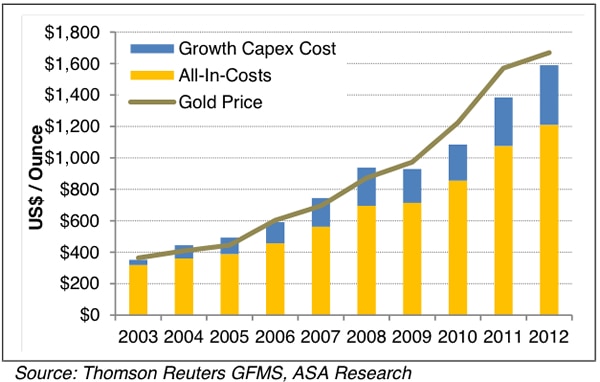

- The price of newly mined ounces continues to climb higher and higher, due both to reduced ore grades and higher costs for fuel and equipment.

Negative real interest rates have always been supportive of gold prices. While admittedly that's not been the case for the past two years, we now see that historic relationship re-expressing itself.

After all, when the return on cash savings is virtually nothing and the money printers are running, inflation eats away at fiat purchasing power. Gold, as money, offers protection from this.

Perhaps things are different this time, but we're thinking not.

The degree of fiscal and monetary recklessness has taken us by surprise, both for the intensity of the actions already taken, but also for the fact that financial markets have adjusted to the practices and now treat them as normal, if not desirable. While the U.S. deficit has been declining from its record highs, much of that is due to accounting shenanigans, all while our dangerously high debt-to-GDP ratio (as well as those of most other developed countries) continues to worsen.

Mining costs have been on a steady march upwards over the past decade, setting an average "all-in" cost floor now very close to the current price of gold:

Even exploration costs have skyrocketed, which, importantly, is happening in parallel with a marked decrease in discovery volumes:

(Source)

Gold, it seems, is getting both harder to find and harder to get out of the ground.

And to the above list of original fundamentals, we must sadly add several new drivers:

- MF Global proving that client accounts can be looted and then drawn into a lengthy and unsatisfying bankruptcy/creditor process

- Cyprus proving that the banking system intends to make depositors pay for its mistakes

- Politicians openly calling for various wealth taxes to be levied on anybody who has managed (dared? bothered?) to save up funds

And one last big one: a new secular change in rising interest rates that threatens to create havoc in world economies and financial markets across the world.

(Source)

After a decade of low and declining interest rates, yields are back on the rise. The low cost of debt that the markets have become used to has created a worldwide bubble in bond prices, about which experts like Bill Gross have been increasingly vocal in issuing dire warnings. A popping of this bubble will increase borrowing rates for governments/business/consumers, depress home prices, make mortgages more expensive, and basically act like kryptonite to any "recovery" in the world economy.

Wall Street has certainly taken notice. And it's worried about the implications:

In a Shift, Interest Rates Are Rising (The New York Times)

“I think you all should be ready, because rates are going to go up,” Jamie Dimon, the chief executive of JPMorgan Chase, told a financial industry conference at the Waldorf-Astoria Hotel in Manhattan on Tuesday.As investors brace themselves for a new era of higher interest rates, global markets in bonds, currencies and stocks have experienced spasms of turmoil.

Bond bubble threatens financial system, Bank of England director warns (the guardian)

A key Bank of England policymaker has warned of the risks to global financial stability when "the biggest bond bubble in history" bursts."Let's be clear. We've intentionally blown the biggest government bond bubble in history," Haldane said. "We need to be vigilant to the consequences of that bubble deflating more quickly than [we] might otherwise have wanted."

60% chance of global recession: Pimco (CNN Money)

Pimco's founder and co-chief investment officer, Bill Gross, argued last month that central banks' ultra low interest rate policies and ongoing bond-buying programs have resulted in a financial system that is "beginning to resemble a leukemia patient with New Age chemotherapy, desperately attempting to cure an economy that requires structural as opposed to monetary solutions."

Lastly, there is the wild-card possibility – improbable, but certainly worth considering because of the gains to be had – of gold being re-monetized as a means of balancing and settling international accounts. Should that transpire, gold will be worth many multiples of today's value.

The Light at the End of the Tunnel

For all the reasons above, the bruised precious metal investors out there should still sleep well at night, secure that the foundational rationale for holding gold and silver remains intact.

But, excitingly, there are numerous new compelling new reasons to hold on to – or add to – your precious metals stack.

In Part II: The New Game Changers for Gold & Silver, we delve into the very positive, very noteworthy developments afoot, including:

- A seismic change in the commercial trader positions, returning to a bullish stance not seen since 2004 (and changing the incentives for any potential price manipulators)

- "Unprecedented' retail investor appetite for bullion

- Accelerating East-to-West demand for physical gold and silver

- Continued accumulation by world central banks

- Shockingly depleted Comex inventories available for delivery

And we revisit the signals to watch for that will indicate that the secular bull market has run its course (none of which are remotely visible at this time.)

Trying times like these are designed to wear you down and force weaker hands to capitulate before reversing. We remain steadfast in our conviction that the precious metals investment thesis remains healthily intact, and that the real price action in the gold and silver story has yet to be seen. And we see increasing evidence indicating that the next big upward reversal is near at hand.

Stay disciplined.

Click here to read Part II of this report (free executive summary; enrollment required for full access).

This is a companion discussion topic for the original entry at https://peakprosperity.com/is-gold-at-a-turning-point/