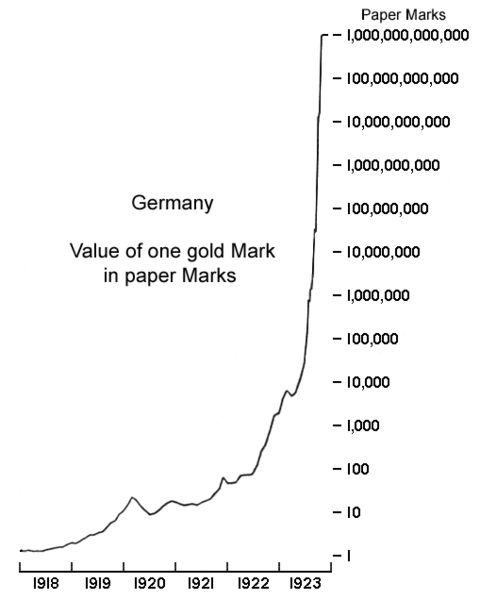

Clearly that is unsustainable. At some point these countries are going to say “No, we want our currencies to depreciate, too. We want to be able to continue to export to you.” So what we will end up with is sort of like what happened in the Depression. Everybody was trying to cut the value of their currencies at the same time. What that leads to, obviously, is global inflation, instead of just localized inflation where a few countries are debasing their currencies. You have got everybody doing it at once. That is because the U.S., with the world’s reserve currency, basically controls this process. We have chosen to decrease the value of the dollar dramatically over the next few years. That is going to force the rest of the world to do the same thing or endure an overvalued currency and recession. No elected politician can put up with that.

So what’s out there? Maybe after a mini-recession or some kind of correction in the next year or two is another round – an even bigger round – of global inflation. Basically, all the fiat currencies of the world start decreasing in value at an accelerating rate. At some point, the whole concept of fiat currency, of governments in charge of their own monetary printing presses, is going to be discredited."

So states John Rubino, proprietor of DollarCollapse.com. In his eyes, the demise of the dollar and other world fiat currencies via inflation is now a sure bet. There is simply too much debt that needs to be repaid, and our political leaders are not going to willingly choose the short-term pain of austerity and/or default. Of course, the resulting collapse of our monetary system will be much more painful and destructive in the long run.

Click the play button below to listen to Chris' interview with John Rubino (runtime 45m:22s):

[swf file="http://media.PeakProsperity.com/audio/john-rubino-2011-05-20.mp3"]

Download/Play the Podcast

Report a Problem Playing the Podcast

Or start reading the transcript below:

Chris Martenson: Welcome to another Chris Martenson.com podcast. I am your host, Chris Martenson. Today I have the pleasure of speaking with John Rubino, publisher of DollarCollapse.com, a popular online hub for news impacting the economy. John is the author of several well-received books foretelling years in advance the collapse of the housing market and the decline of the US dollar. Before starting his website, John was a featured columnist with TheStreet.com, Individual Investor, and a number of other influential financial publications. His perspective on Wall Street and the currency markets is shaped by his past roles as a eurodollar trader. He knows what he is talking about. He was an equity analyst and a junk bond analyst in the eighties. There is lots of experience here. With the dollar recently sliding to what I consider dangerous lows, I have asked John to come and share his thoughts on where it goes from here. Welcome John.

John Rubino: Hey, Chris. Thanks for having me on.

Chris Martenson: Oh, my pleasure. To set the stage, let’s talk about what led you to write The Coming Collapse of the Dollar and how to Profit from It way back in 2004. I am sure way before that was a popular thing to do. I like to think of myself as having been an early warning siren on this same subject, but you and your co-author James Turk; you were way out in front with this message. It was much earlier than most, including myself. So how did you see that? What dark clouds did you see on the horizon? What were you looking at that made you arrive at that conclusion?

John Rubino: During the couple years before that, I had written a book on the coming real estate bust. I went into that piece of research with the idea that it was just the real estate market that was the problem. It would blow up and the US economy would go on as before. But as I dug into the research, I realized that we really had systemic problems. Things were much more serious than just home prices getting a little out of hand and mortgage money getting too easy. We were across the board taking on massive amounts of debt, which would inevitably lead us to do something extreme. Either we would collapse under all that debt and have a 1930s style depression, or we would inflate our way out of it, destroy the currency in order to pay back the debt in cheaper dollars, and have some an inflationary episode.

I knew James Turk, the founder of GoldMoney.com, because we had done a couple of articles together. I had interviewed him and found him to be brilliant and also a nice guy. I approached him and asked if he'd like to write a book on gold and the dollar. He liked the idea and we worked out a deal. So we spent the next year basically putting that book together. A lot of the writing is mine. A lot of the really deep ideas in that book are his, of course.

The timing was a little early. It was only by about a year or so. It came out in 2004, and the dollar went up for the year after that. So had it come out a year later, it would have been perfect. Even so, gold was about $400 an ounce at the time. Silver was $4 or $5 an ounce. So in the ensuing six or seven years, most of the book's predictions have come true. We have been inflating away the dollar in order to pay off our debts. That has been causing precious metals to go up, which is to say that precious metals have held their value while the dollar has been going down. This process has really just begun. The US has done nothing to manage its finances in the meantime. Things have actually gotten a lot worse, since we have clearly made the decision to try to inflate our way out of all of our debt.

Going forward, I know there are a lot of other things going wrong in the world, but just looking at the US finances would be enough to lead you to say that the world was headed for some a catastrophe. When it’s the biggest economy, the issuer of the world’s reserve currency, doing stupid things on this scale and clearly trying to destroy its own currency, you get a global crisis out there somewhere. That is really what we are looking at now.

Chris Martenson: You know, John, if you said five years ago, “Chris, we are going to get to a point where US Treasuries are going to be at about the 3.4% range and the US government is going to be running its third consecutive multi-trillion dollar fiscal deficit (actually it is going to be $1.6 trillion) and the world has not sort of burst into economic flames,” I would have said that is insane. It is not possible.

Is any of this surprising to you? I mean, you saw the structural imbalances. You see the debt. Then you see the responses, and then here we are. What is surprising to you in this story? What is not?

John Rubino: Well, the general shape of the world right now is pretty much what seemed likely at the time. But the numbers are still shocking. You know the trillion dollar deficits? I would have agreed with you back then that it was almost physically impossible. We would be violating laws of physics to have Treasury bond yields where they are now and a deficit where it is now. It did not seem possible.

What has happened of course is that we have got the government intervening in the bond market to keep rates low by buying massive amounts of bonds with newly created money. This is a situation that is really unsustainable. You have got massive amounts of new dollars flowing into the system in order to keep interest rates low. But the supply of new dollars pushes the value of the dollar down, which inevitably will push up interest rates. Who wants to own a thirty-year Treasury bond yielding 4.5 percent when the dollar is being debased by more than 4.5 percent? You get a negative long-term yield in an investment like that. So the people who are buying Treasury bonds right now are not doing it with an investment return in mind. They are doing it with other objectives. China has been accumulating US bonds for years because they want to keep US interest rates low so we will borrow money in order to buy their stuff.

Chris Martenson: Non-economic participants. Is that what we call them?

John Rubino: Yeah, basically. It is vendor financing. It is like when Cisco lends money to some company so they will buy Cisco’s networking gear. The works until the company you are lending the money to goes bankrupt. Then you are stuck with that debt. China is looking at something like that right now. Basically, the money they are lending us is going to have to be written off at some point. They are starting to figure that out now. The reason this is unsustainable is that all the guys who are buying Treasuries out there, they have more than they want. They are worried about it and are trying to figure out how to get out of their Treasury positions. China especially has been making a lot of noises about shifting out of their dollars and into other currencies and into real assets. They're buying oil wells, gold mines, and farmland around the world.

Click here to read the rest of the transcript.

Before starting his website, John was a featured columnist with theStreet.com, Individual Investor, and a number of other influential financial publications. His perspective on Wall Street and the currency markets is shaped by his past roles as a Eurodollar trader, equity analyst and junk bond analyst in the 1980s.

Our series of podcast interviews with notable minds includes:

- Addison Wiggin

- Simon Black

- Axel Merk

- Paul Tustain

- Francis Koster

- Dogs_In_A_Pile

- Bud Conrad

- John Williams

- Robert McFarlane

- David Collum

- Joe Saluzzi

- Jim Rogers

- Bill Fleckenstein

- Marc Faber

- Willet Kempton

- Dan Ariely

- Ted Butler

This is a companion discussion topic for the original entry at https://peakprosperity.com/john-rubino-get-ready-for-accelerating-devaluation-of-all-fiat-currencies-2/