The other day I was in my local branch of a Too Big To Fail bank where I have a few accounts. One of them is a savings account in which I keep some of my "dry powder" cash stored.

It had been a while since I had checked what kind of return the savings account offered. I knew it was pretty low, but there have been a few Fed rate hikes since the last time I had checked. So I asked the teller to look up the current rate the account was yielding.

Any guesses?

It's 0.06%.

Not 0.6%. And definitely not the 6% I remember receiving when I was a teenager. 0.06%.

As in, put $100,000 into your savings account and get back a whopping $60 per year.

Are you kidding me? $60 to have a hundred grand parked in an account subject to withdrawal restrictions and penalties, along with the usual smattering of administrative fees both overt and hidden? At a bank that stumbled mightily during the Great Financial Crisis? One with the potential to legally confiscate your savings through a "bail in" should another crisis hit?

Oh, and if you factor in the government's trailing 12-month inflation rate of 2.2%, your "savings" account has a negative (-2.14%) real rate of return. Your compounded savings actually loses purchasing power over time. And as we all know the official inflation rate is farcically understated, your loss of purchasing power is even more dire than it at first appears.

"Thank" The Fed

Savings accounts were created to provide an incentive for people to plan for the future. Put money away today, let it grow through the miracle of compounding interest, and have more tomorrow.

Prudent savings is essential to a healthy economy. It offers resilience during downturns, and provides seed capital for productive enterprise.

But we are no longer a nation of savers. Not only does our culture indoctrinate us to spend and consume -- and makes it possible to do so by spending future prosperity today through the use of debt (the very opposite of saving) -- but the Federal Reserve has very intentionally driven down interest rates to historic lows.

To show just how far, let's take a look at historic interest rates savers have enjoyed over the past few decades.

Here's a chart of the return offered on 6-month bank CDs, from the Fed's own data. Returns plummeted from 10% in the mid-1980s to less than 1% after the Great Recession began:

//fred.stlouisfed.org/graph/graph-landing.php?g=dVK9&width=670&height=475

Notice how the data series was discontinued in 2013. Perhaps the Fed was concerned the picture it painted showed too clearly the war being waged against savers?

But a new similar data series was begun afterwards, which shows that the carnage continued. Between 2009 and today, 6-month CD returns have declined by a further 90%:

//fred.stlouisfed.org/graph/graph-landing.php?g=dVKb&width=670&height=475

So there's no incentive remaining to save your money in a "safe" place. As mentioned, you lose purchasing power due to today's negative real rates. Plus, you have bank risk (bail ins, etc) on top of that.

As we write about extensively on PeakProsperity.com, this is not an accident of fate. The Federal Reserve has very deliberately engineered this situation. It has chosen to sacrifice the many -- the savers and those dependent on a fixed income -- to benefit an elite few. Rock-bottom interest rates are greatly helpful to the banks, as well as the financial assets that the bankers and their wealthy clients own.

And just to add to the outrage factor here, when your local TBTF bank stores its own money at the Fed, the Fed pays it a full 1% in interest -- nearly 20 times what your bank is paying you. Your bank simply pockets the rest as pure risk-free profit. (Don't believe it? Watch Chris explain in this video)

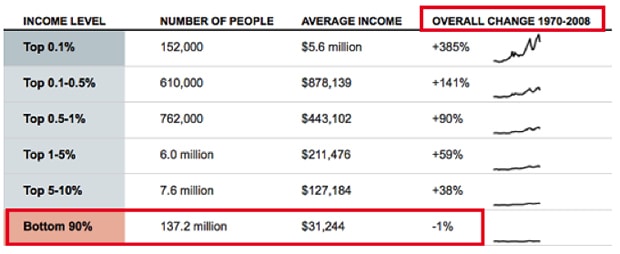

The data clearly shows that this suppression of interest rates, combined with the central banking cartel's Herculean efforts to flood the world with liquidity (to the tune of $1 trillion so far in 2017), accrues benefits in a grossly lopsided and unfair manner to those at the top of the wealth pyramid:

Meanwhile, while the income prospects for everyone in the bottom 90% have stagnated, the cost of living has skyrocketed. The masses are getting badly abused in both directions.

Financial Repression

As mentioned earlier, this is NOT accidental. As we have written about time and time again, the fundamental economic predicament facing the world is having Too Much Debt.

This is a situation societies have found themselves in before. In fact, it has happened so often throughout history that there's actually a playbook (for the government) when you get to this stage. It's called Financial Repression.

Here's a summary from our excellent podcast interview on the topic with Dan Amerman:

To understand financial repression, we have to understand that we've been there before. Many nations have gone through periods in the past where they've had very high levels of government debt. And there are four traditional ways of dealing with that.

One of them is austerity. Everyone understands that. You raise the tax rates. You lower the government spending. This is a painful choice. It can last for decades. And what do you think the voters think about that?

There is another option and this we can call this the Argentina option. And that's defaulting on government debts. It’s radical. Everybody understands it. How do the voters feel about it?

There is a third option is rapidly destroying the value of currency. Creating high rates of inflation that very quickly wipe out the true value of a national debt. But that also wipes out the true value of everyone else’s savings and salaries and so forth. It is such an obvious process you can’t really hide it. So how do the voters feel about that?

Those first three – they all work. They've all been done before. But they're all very painful and make the voters very angry.

Now there is a fourth way of doing this. There's nothing controversial about its existence; it's not the slightest bit controversial for professional economists or people who have studied economics extensively. It's financial repression. And it works. It's what the advanced western nations did after World War II. It was a process that took 25 to 30 years, depending on the country. The West went from an average debt as a percentage of national economy from over 90% to under 30%. So we know it works in practice.

To understand what this fourth alternative is where governments like to go is that there are no political repercussions. It's actually just as painful for the population as a whole. You've got to get the money one way or another. But financial repression is, for most people, just complex enough that the average voter never gets it. And because they don’t get it, they're paying the penalty, but they don’t realize it. And they don't see anyone to blame. That's really good if you want to stay in office.

The key is a concept called negative real interest rates. If the rate of inflation is higher than the interest payments you are taking in, savers are losing purchasing power every year. Remember, this is a zero sum game between the borrower and the saver -- with the saver funding the borrower. Every dollar in purchasing power that the savers, which are you and I, are losing every year -- that goes to the benefit of the borrower, which in this case is the Federal government.

0.06% savings rates in a world of 2.2% (and actually much higher) inflation? That's a clear sign we're living in the era of negative real interest rates right now. The purchasing power of our savings is being siphoned off to sustain the government's debt orgy, making the elites filthy rich in the process. The financial repression playbook is well underway.

But while financial repression extends the lifetime of an over-indebted economic system, it does not avoid the consequences of Too Much Debt. It merely serves to shift the worst of the inevitable losses from the government onto the public.

As von Mises' guarantees:

There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final or total catastrophe of the currency system involved.

~ Ludwig von Mises

Negative interest rates are a milestone down the slippery slope of the latter: currency destruction. The central banks are intentionally devaluing their currencies, but betting that they can do so at a controlled pace.

But as von Mises warns and as history has shown again and again, currency regimes burdened by too much debt eventually reach a critical failure point where a uncontrollable cascading collapse becomes inevitable.

Know Your Enemy

At this stage, it's now critical for investors to ask: What are the central banks most likely to do next, and what will the repercussions be?

If you haven't read our latest report Understanding The Fed's Endgame Is Key To Protecting Your Wealth, you really should do so now. In addition to negative real interest rates, it reveals the many other clandestine steps the Fed is performing in the shadows to separate the American people from their hard-earned wealth, and place it in the pockets of the bankers and their cronies. In most instances, it's a case of doing exactly the opposite of what it is publicly promising. You can read that report here (free executive summary, enrollment required for full access)

Understanding the Fed's next moves is also why PeakProsperity.com is offering the upcoming webinar, The End of Money, on this coming Wednesday, June 7. It will bring together David Stockman, Axel Merk, G. Edward Griffin -- experts on the Federal Reserve, global currencies and financial markets. During this 3-hour event, you'll hear their latest intelligence and forecasts and be able to ask each speaker questions directly.

Key themes addressed will be:

- Asset price bubble risk -- How big is it now?

- Central bank intervention, both clandestine and overt, in world financial markets -- What are the implications for price discovery?

- Rising interest rates -- Will the Fed raise rates on June 13th?

- The Fed's endgame -- What long term outcome is Fed trying to engineer?

- The even bigger picture -- What are the goals of the global central banking cartel?

- How to protect our wealth -- Which investment strategies offer protection against central bank meddling in (and quite likely, destabilizing) markets?

This is a not-to-be-missed experience for the prudent investor. And since it's only a few days away, the time to register for it is now.

This is a companion discussion topic for the original entry at https://peakprosperity.com/less-than-zero-how-the-fed-killed-saving/