Originally published at: https://peakprosperity.com/luke-gromen-peak-cheap-oil-will-drive-the-next-sovereign-debt-crisis/

One of the more difficult conversations to have even with the most sophisticated of investors, is in the connection between oil and the economy.

Either they don’t see it, or can’t see it, or don’t want to see it.

Luke Gromen has no such trouble.

He’s one of the more respected financial analysts and observers out there, and today we collect his deep insights into the energy markets, gold, and, importantly (financially speaking), the most likely path the Fed and US Treasury Department will be forced to take.

Those entities are now in a box canyon of their own making. The decision is now down to (a) protect the dollar or (b) protect the bond market.

Past history is 100% clear on the matter, at every possible chance they have chosen to protect the bond market. They will print and print and print even more to preserve the bond market.

If they don’t and the US cannot refinance itself, it’s game over.

With printing it’s also game over (for the dollar) but at a slower pace and one which mainly harms the bottom 90% at first, so this is the preferred path.

Is there another way out?

Luke and I grabbed at that issue every which way but there aren’t many options left.

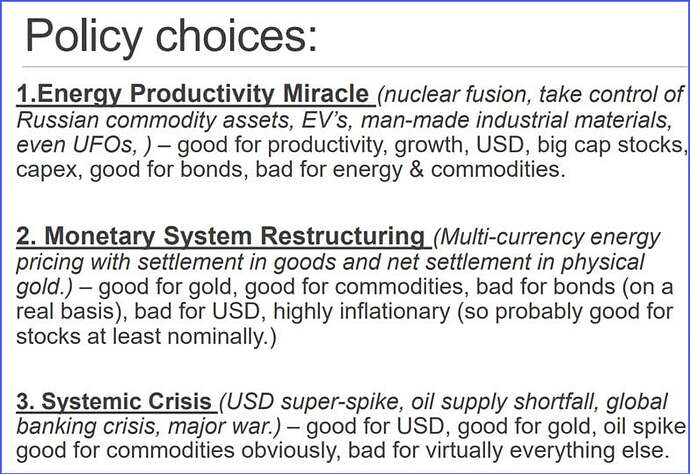

In Luke’s view, there are three options left from a macro policy perspective:

Will it be door #1, door #2, or door #3?

(Source: FFTT-LLC)