I’m a peak oiler from 2004. I remember reading LATOC late at night - if you don’t know what that was - you’re a newbie. I’ve read Heinberg’s “Party’s Over” and “Powerdown” and dozens of others. I founded and ran an activist group (wonderful volunteers!) who presented to our state politicians. I got permission from the producers of “End of Suburbia” (enlightening!) to do a half hour cut of their movie and burned it to DVD and sent it to every State and Federal politician in Australia. I spent every day and night online. I lost sleep. We presented the ASPO graph as part of a peak oil kit in the NSW State parliament theatre - and had some big names in to speak about the urgency of weaning off oil. We helped run a Richard Heinberg tour of Australia in 2005, organising speaking and book selling events. I get it. I was there. I was a freaked out reluctant doomer - looking for a way out of ‘energy decline’ and not finding it. I was almost ready to wear a placard downtown. And I did all that while I should have been focusing on my 5 year old boy who was sick with cancer! So I GET IT - OK?

But now decades later? Everything has changed. It seems ‘energy descent’ collapse is now avoidable. It seems like many of the old issues I used to read about late at night for years on end are now solved! But I know how easy it is to deceive myself - so I want to find out what my blind spots are. I thought I had collected enough peer-reviewed data and answered most of the questions. But then a year ago Michaux raised a new potential blind spot - minerals!

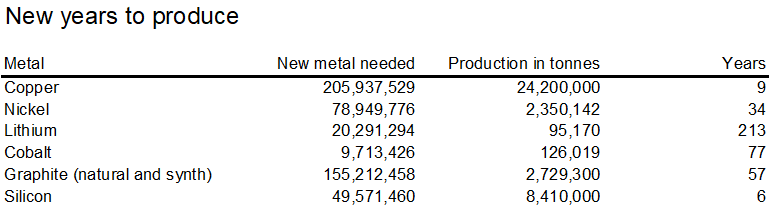

Yet eventually I saw that if we just swap out his expensive NMC EV supercar batteries for what the market will probably turn to - cheaper sodium and OFF-river pumped hydro - run the numbers - and his OWN PAPER shows we have enough minerals for the energy transition! Michaux sans batteries | Eclipse Now

Consider what has changed in the 20 years since I basically thought I had to get my boy through cancer (he made it) and maybe then get out to some kind of Prepper compound:

FACT: Back then renewables were over 10 times as expensive as they are now. While technically feasible - a 100% renewable grid was economically possible. But now EVEN WITH Overbuild - renewables are modelled to still be cheaper!

FACT: Even the EROEI of renewables has improved from more efficient material use and factory production. EG: Solar panels now use 1/3 of the silicon they did 20 years ago - but have the same insolation efficiency. Wind EROEI has increased as the tower size has increased and helped it reach ever higher, more abundant wind.

FACT: EV’s were expensive toys for the uber-rich. They’re now vastly cheaper - with the Dolphin mini (Seagull) possibly coming to Australia for $31k. (EV’s don’t need servicing and can get free fuel from our rooftops solar - so I could count $10k of that purchase price as a ‘prepaid lifetime servicing and fuel discount’).

FACT: The “When trucks stop running” scenario is gone now that the Tesla Semi has a half hour charge during a compulsory lunch break - can drive further than the driver is legally allowed on a shift. Also - every percentage increase in EV sales is a percentage decrease in oil and diesel demand - giving the mining industry time to go electric.

FACT: Janus Australia can do a 1 minute battery swap for 100 ton trucks! (Probably every 400 to 500 km.) This means even lower density sodium batteries could work in trucking - given it’s only 60 seconds for a guy on a forklift to swap the battery out. https://www.youtube.com/watch?v=9eYLtPSf7PY Will big mining EV’s battery swap - or charge on overhead catenary lines like the EV trucks in Canada do?

FACT: Thermal brick batteries can store heat at 1500 C and only lose 1% per day of bad weather, enabling industry to charge up from wind and solar but have a ready stream of heat as they need it.

FACT: EV’s are on a growth trend.

Sure - that’s slowed down a bit in 2023 due to inflation and interest rates, etc.

”In total, global sales of EVs, including BEVs, PHEVs (Plug-in Hybrid Electric Vehicles), and FCVs (Fuel Cell Vehicles), reached 13 million units in 2023, with a growth rate of 29.8% compared to 2022. The number, however, represents a significant slowdown from the 54.2% growth rate in 2022.”

https://www.visualcapitalist.com/visualizing-global-electric-vehicle-sales-in-2023-by-market-share/