Most experienced investors know the four most dangerous words are: This time is different.

It never is.

And yet one of my key predictions here at Peak Prosperity is that The next twenty years will be completely unlike the last twenty years.

So am I saying that things really will be different this time?

Yes, I am. But to understand why, you have to look closely at the unprecedented moment in history in which we live, as well as how the Three E’s – the Economy, Energy and Environment – all tie together now in a way they never have before.

For those who prefer their conclusions right up front, the simplest summary I can provide is that everything we think we know about “how things work” is just plain wrong.

This explains why, among many other grotesque distortions, the stock and bond markets are spectacularly overpriced and overvalued right now.

This danger is important to be aware of because when things correct, as they inevitably must, the next crash will be incredibly damaging. It could be as profound as that which dethroned Spain as a world power, permanently.

Peak Prosperity user Gyurash put this risk in context within his comment to our recent podcast on Economics for Independent Thinkers:

The mention of Paul Volker was interesting. I remember listening to a lecture given by Mr. Volker played on public radio in the mid 80s. He talked about the Spanish empire in the 16th century and the easy money train they had coming from South American gold and silver. He said that although it seemed to create great wealth it also made for a false economy in Spain. In addition to creating price bubbles, the Spanish did not use it to build much of anything other than big villas, built by itinerant foreign labor by the way, so when the gold and silver flow slowed when the biggest mines were effectively depleted, their economy crashed so hard that it never recovered, even up to today.(Source)

Delusional Thinking

What’s worse than wishful thinking? Delusional thinking.The sort of ideas that harm rather than help those who hold them.

Of the many current policy delusions I could rail about, perhaps the greatest of them all is the quite-impossible belief that we can have infinite growth on a finite planet.

I know, I know, refuting this is so brain-dead easy to debunk that it seems pedestrian, if not childishly so, to raise it here again. It’s quite an impossible proposition.

Even the most cursory of reviews of mining data (just one of many possible examples), show that many critical ores and minerals are vastly more difficult and expensive to extract and bring to market than they were just a few decades ago. And the trendlines keep getting worse.

But let’s go through this once again, because it’s such an important point. For those of you already on my side of the boat, please bear with me. Perhaps something new will emerge for you on this next go around.

The Harsh Math

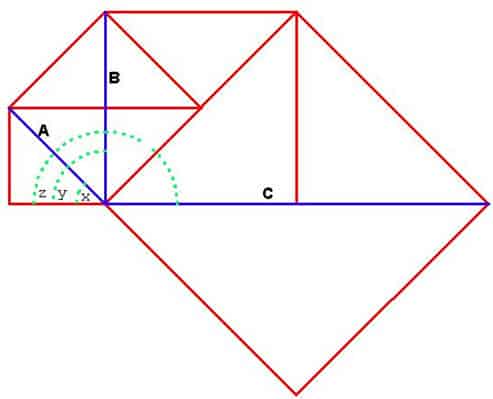

Exponential expansion requires not just some new minerals coming to market, but exponentially more.It works out like this. Suppose that 100 units of copper were produced in year 1, and output (as demanded by economic growth) was expanding at a 3% rate. How long would it take for production to double? The answer is that after 24 years we’d find that 203 units were being produced. So a 3% growth rate means that it takes only 24 years to fully double production.

However, the more interesting fact is that over that same 24-year stretch, if we add up each year’s production into a cumulative total we discover that 3,546 units of copper had been produced. How much copper would you guess was produced over the prior 24-year stretch (the one that got us to 100 units in the first place)?

The answer is just 1775 units. In other words, half the amount produced during the next doubling. Going back further and adding up all of the doublings of copper production throughout all of history we’d discover that each new doubling produced (and consumed) as much as the sum total of all the prior doubling periods combined.

You can prove this to yourself by looking at a doubling sequence such as 0.25, 0.5, 1, 2, 4, 8, 16, 32 etc. Note that 4 is larger than (0.25 + 0.5 + 1 + 2) and that 8 is larger than (0.25 + 0.5 + 1 + 2 + 4) and that 16 is larger than (0.25 + 0.5 + 1 + 2 + 4 + 8) and so on – into infinity.

Again, each new doubling involves an increase that is larger than the combined values of all the prior doublings in history.

For the visually-minded, here’s that same idea expressed in an image:

How Many More Doublings Can We Possibly Have From Here?

Only the most delusional would argue that we can dependably double our extraction of key natural resources forever.Every two decades (or so), will we always be able to use twice as much farmland, twice as much fish in the sea, twice as much oil in the ground, as has been used before throughout all of human history?

Of course not. Planet Earth is a finite system.

This is why I claim that everything we think we know about “how things work” is wrong. Our entire economic and financial systems, their associated monetary models and their current financial asset prices, are predicated on the principle of continuous growth. And not just any sort of growth: Exponential growth. Predictable doubling – forever.

Look, it’s ridiculously easy to prove that there won’t always be twice as much copper (or nearly any other key natural resource) as has been extracted throughout all of prior human history. Things run out. They deplete. They become more dilute as the high grades are exploited first.

At some point, doubling becomes impossible. That’s when you’re past the point where half has been extracted and half still remains in the ground. After that, there are exactly zero doubling periods remaining! That’s just elementary math.

Why care?

Because once the doubling periods are over, every single economic model and financial asset that is predicated on continuous expansion breaks. Our systems stop steadily growing; and instead start increasingly shrinking.

This not a hard concept to grasp, intellectually, for most people with an open mind. But in practice, because it challenges our comfortable understanding of the world, because it collides with an entire Disney World of incompatible social belief systems, it’s pretty much impossible for the many people to even begin to wrestle with. Forget about a mainstream economist or central banker, whose salary requires them to adhere to the status quo.

The warning here is that we our deluding ourselves as a society. We are herding ourselves, lemming-like, straight towards the cliff ledge.

Think Critically!

Our mission here at PeakProsperity.com is to Create a World Worth Inheriting. While we help people make informed decisions to imbue their lives with greater abundance and satisfaction today, it's our dedication to the long-term picture that shapes everything we do.Very few voices are standing about waving their arms in the air like we are, warning of the approaching cliff. We’re aware that the point of no return might still be several decades out into the future, but we also realize that it could already be behind us. It’s nearly impossible to know right now given the complex system that is our planet – but given the existential risks involved, our opinion is that everyone should be mobilizing in response to this arriving (arrived?) crisis.

We often get labeled as narrow-minded “Malthusians”. Or accused of failing to account for human ingenuity. (Neither is accurate, we think.)

But in reality, we’re simply data driven. The facts are what they are. Logic is what it is.

And we get it. It’s both a factual and a logical nightmare for the infinite growth crowd that the earth is finite.

But as Einstein famously quipped:

This programming is subtle, reassuring and ubiquitous; which makes it hard to resist. Here’s a prime example:

(Source)

To an economist like Bernanke, there are only virtuous expansions. Of course, the sort of expansion he refers to is exponential growth. Which is absolutely destined to fail in the long run (and now, maybe, the short).And when that happens, the fallout will be spectacular and highly destructive to the hopes and dreams of literally billions of people.

Make Your Choice: Change By Pain Or Insight

What’s unclear to me is if there can be any meaningful recovery from this next crash, whenever it happens and however long it takes.To return to the opening piece of this article, while I know that this time is different are dangerous words for investors to believe, the impending collision between delusional infinite growth thinking and resource limits and other realities will appear to the average observer like a gigantic change. But, in fact, it simply will mean that humans are subject to the same limits as any other life form on earth.

In other words, it really won’t be different this time.

In boy-meets-girl story form, the plot line of the natural process for all forms of life is:

- organism finds tasty energy source

- organism expands exponentially into that energy source

- energy source dwindles even as organism continues into population overshoot, and then

- happy times turn into tough times, and organism population plummets

How can I protect myself, my family and those I care about? How can I secure a prosperous future? What do I need to do to develop the right mental models and belief system to deal effectively with the coming challenges?

You can either address these questions head-on now, while the world still works the way we’re accustomed to. Or later, under crisis conditions.

We’ve learned that there are two ways that people change their beliefs and then their actions: by pain or by insight.

Most people go the pain route. And in the process, they waste a lot of valuable time that could have been spent constructively. It’s only after the heart attack, the divorce, the backing over the family dog while drunk—moments of extreme pain—that most people will begin to actively face the idea that they need to make different decisions in life.

But it doesn’t have to be that way. Part of the beauty of being human is that we can learn from observation, reflection and experience, and can adapt. Critical thinkers have this ability to change by insight. They use new information to put new behaviors into practice until those practices become new habits. And with better habits, we achieve better destinies.

So which route will you choose? Pain or insight?

The story told by the Three Es is loaded with the potential for plenty of painful moments over the next few decades. Sadly, a lot of people will not take precautionary steps far enough in advance to matter. They’re just not focusing on the risks right now. As a result, much of the world will be forced to change its behavior via the pain route.

Use this awareness as a sense of urgency to prepare now. To secure your future prosperity, as well as to help those regretting that they didn’t follow your lead.

In Part 2: Steps For Changing By Insight, we lay out our prescriptive guidance what what to do now, in a world saddled with record debts, and a debt-based system of money that itself is utterly and completely dependent on infinite expansion, where something’s got to give

If you believe in eternal infinite growth, then sure, stay invested in stocks and bonds and go ahead and buy the dips.

But if you don’t, take steps today to change your life by insight, secure your future prosperity, and serve as a model for others.

Click here to read Part 2 of this report (free executive summary, enrollment required for full access)

This is a companion discussion topic for the original entry at https://peakprosperity.com/make-your-choice-change-by-pain-or-insight/