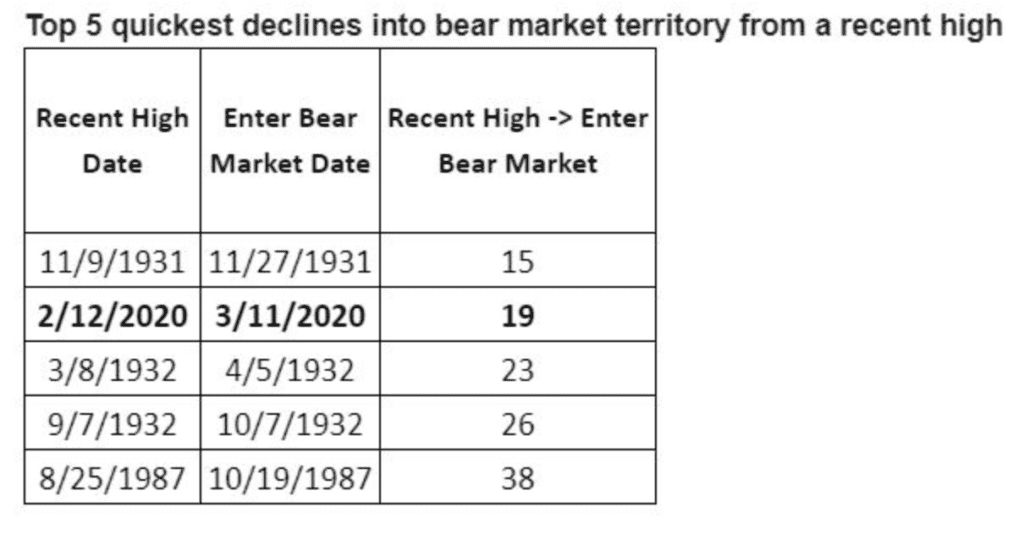

Coronavirus concerns have triggered the second-fastest market plunge into a bear market in history:

Stocks, commodities, cryptocurrencies – nearly every asset class – are being liquidated in a desperate panic.

We here at Peak Prosperity have long warned about the risk of such a “Sell Everything!” event (see here, and here, and here, and here, and here, and…) and have encouraged prudent investors to position their financial portfolios for safety in advance of such a sell-off.

Which is why we’ve often interviewed the professionals at New Harbor Financial, Peak Prosperity’s endorsed financial advisor. We’ve wanted to highlight to folks like you that there are proven strategies for reducing your exposure to sharp sell-offs, and inspire folks to take steps to protect their wealth in advance of the next one happening.

Here’s why this is so important.

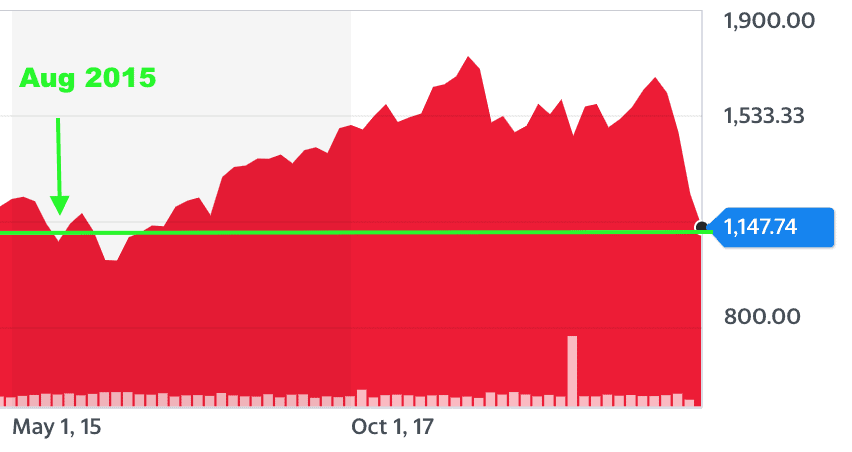

Most traditional investors have just lost years of gains from their portfolios. For example, the Russell 2000 is already back to where it was in August of 2015, that’s 4.5 years of market appreciation vaporized in a mere 3 weeks.

Poof!

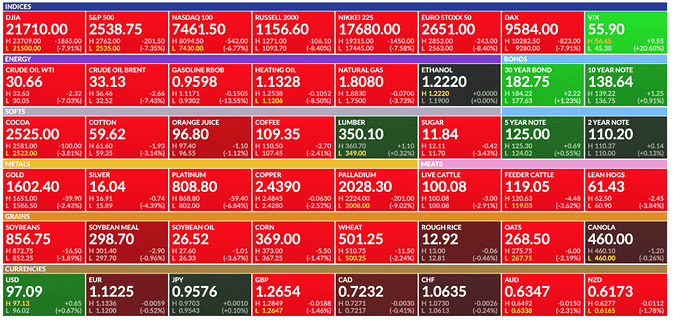

As I type, the Dow is back to the price it was in June 2017. The S&P 500 is back to October 2017. And the NASDAQ is back to Dec 2017.

So when I saw the continued market carnage this morning:

I called New Harbor to see how their general portfolio is faring.

While the S&P 500 has fallen 26% since the February highs, New Harbor’s general portfolio is slightly up over the same period. THAT’S the power of conservative management and prudent risk mitigation.

If you have not watched it yet – especially if your own portfolio has lost money over the past few weeks – please watch this short interview with New Harbor’s lead partners that we released recently. In it, they emphasize that it’s not too late to take smart steps with your portfolio against further market downside:

Anyone interested in scheduling a free consultation and portfolio review with Mike and John can do so by clicking here.

And if you’re one of the many readers brand new to Peak Prosperity over the past few weeks, we strongly urge you get your financial situation in order in parallel with your physical coronavirus preparations.

We recommend you do so in partnership with a professional financial advisor who understands the macro risks to the market that we discuss on this website. If you’ve already got one, great.

But if not, consider talking to the team at New Harbor. We’ve set up this ‘free consultation’ relationship with them to help folks exactly like you.

This is a companion discussion topic for the original entry at https://peakprosperity.com/market-meltdown-mageddon-history-in-the-making/