When asked what the biggest risks facing the economy are, David Stockman, lifelong Capital Hill and Wall Street insider, says “That’s easy. There are three: The Fed, The Fed and the Fed.”

After decades of misguided policy and chronically missing its targets, Stockman thinks the Federal Reserve is truly barreling off the rails now, hurtling our market economy towards disaster.

He notes that since, 2008, the Fed has subjected the country to twelve and half years of average annual real negative interest rates of -1.35%. With capital so cheap and no ability to generate a safe return on it, corporations and investors alike have been forced out on the risk curve, which has fostered rampant malinvestment and speculation.

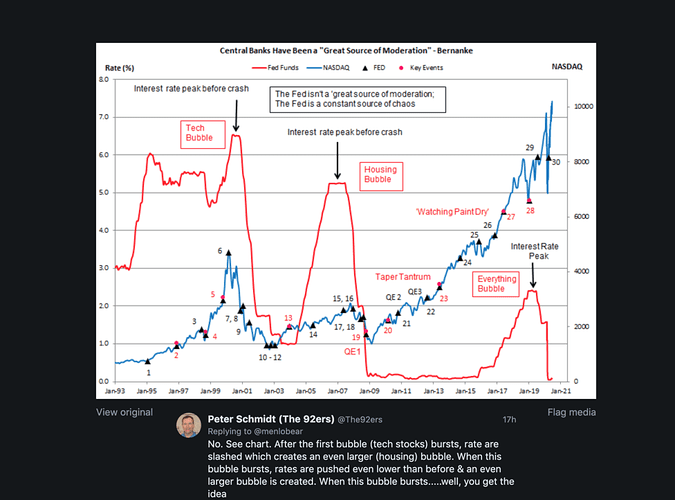

The chart below shows how the Fed’s low interest rate policy has blown serial asset price bubbles that collapse, which the Fed then “fights” by bringing rates even lower for even longer, creating an even worse successor:

The Fed’s ‘leadership’ of our economy will end in tears, Stockman predicts with confidence. What type of shock will topple the system – be it deflation, inflation or civil unrest – is almost immaterial at this point, though all three are highly credible candidates.

Stockman’s warning should carry more weight than perhaps any guest we’ve had yet on this program given his decades of inside expertise interacting with the political and monetary institutions running the show. When someone so knowledgeable and experienced is so worried, the prudent investor should be paying extremely close attention:

<<

Anyone interested in scheduling a free consultation and portfolio review with Mike Preston and John Llodra and their team at New Harbor Financial can do so by clicking here.And if you’re one of the many readers brand new to Peak Prosperity over the past few months, we strongly urge you get your financial situation in order in parallel with your ongoing physical coronavirus preparations.

We recommend you do so in partnership with a professional financial advisor who understands the macro risks to the market that we discuss on this website. If you’ve already got one, great.

But if not, consider talking to the team at New Harbor. We’ve set up this ‘free consultation’ relationship with them to help folks exactly like you.

This is a companion discussion topic for the original entry at https://peakprosperity.com/market-update-dc-wall-street-insider-predicts-coming-shock/