Insanity is doing the same thing over and over again, but expecting different results.

Federal Reserve Chairman Jerome Powell announced on Thursday that the Fed will now shift its focus from hitting inflation targets and instead prioritize closing “unemployment shortfalls”.

This gives it the aircover to do “whatever it takes” until the unemployment rate is back down into the low single digits. Inflation can now run hotter than 2%, rates can stay at 0% (or go negative) for the next decade+, more QE… all is fair game now in the pursuit of lower unemployment.

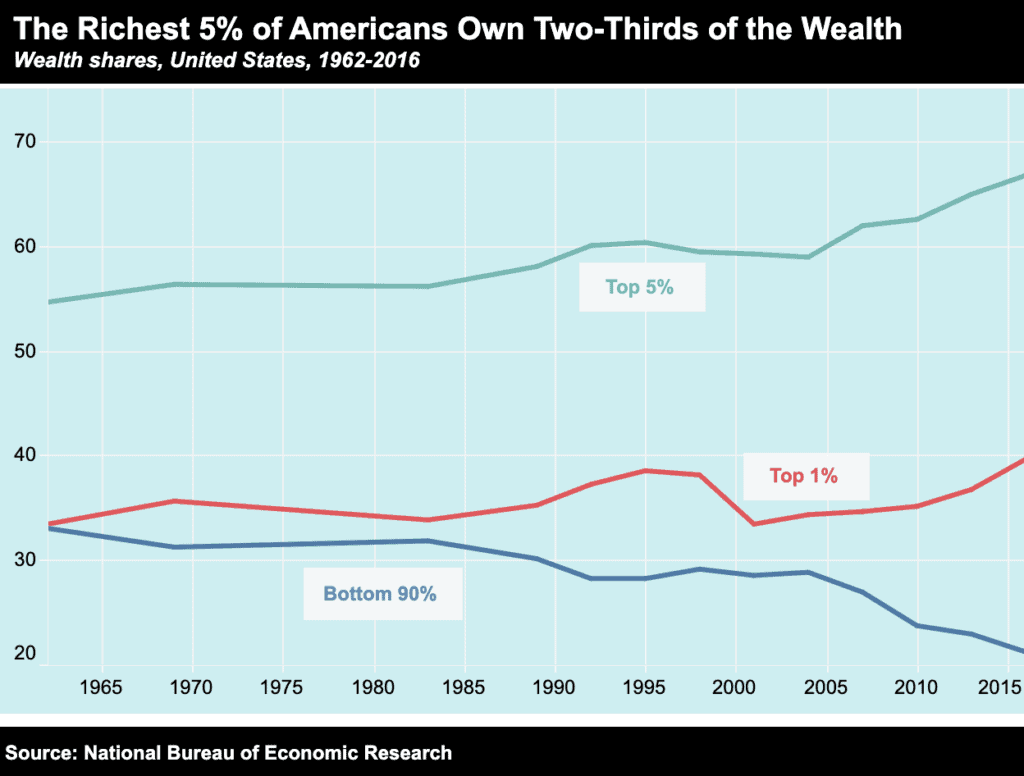

Essentially, the Fed is now tripling-down on the same failed policies that have created today’s zombie economy and the worst economic inequality in our nation’s history.

Perhaps the folks at the Fed are smarter than we think, and there’s actually a grand plan they’re pursuing that’s going to work out to society’s benefit?

Sadly no, reveals this week’s expert guest, Danielle DiMartino-Booth. Danielle knows the Fed inside and out, as she worked as a consultant for nearly a decade to Richard Fischer, President of the Federal Reserve Bank of Dallas, including helping deal with the Great Financial Crisis. She knows how the organization runs, as well as the specific people running it.

And her assessment is that the Fed is trapped in a nightmare of its own making and is merely playing for time at this point. Everything it throws at the situation is designed to hopefully get the system to limp through the next quarter or two without breaking, at which point they’ll scramble to come up with the next short-term “solution”.

In the video below, Danielle breaks down the important takeaways and repercussions of Chairman Powell’s Jackson Hole speech and vents her frustration at both his duplicity with the public and the media’s cowardly refusal to hold him to account.

As our other recent guest experts have warned, Danielle confirms this is an exceptionally treacherous time in the markets for investors, as the Fed’s intervention has and continues to deform and distort prices far beyond reason:

<

Anyone interested in scheduling a free consultation and portfolio review with Mike Preston and John Llodra and their team at New Harbor Financial can do so by clicking here.And if you’re one of the many readers brand new to Peak Prosperity over the past few months, we strongly urge you get your financial situation in order in parallel with your ongoing physical coronavirus preparations.

We recommend you do so in partnership with a professional financial advisor who understands the macro risks to the market that we discuss on this website. If you’ve already got one, great.

But if not, consider talking to the team at New Harbor. We’ve set up this ‘free consultation’ relationship with them to help folks exactly like you.

This is a companion discussion topic for the original entry at https://peakprosperity.com/the-feds-big-lie/