The long-awaited global financial market correction has arrived. We are seeing collapses in all major markets and across all major categories.

As usual, the pain has started at the edges, in the weaker elements (emerging markets, junk bonds, weak companies, etc.) and is rapidly spreading towards the center.

How far this goes before the central banks overtly step in (you can be sure they are covertly doing whatever they can to stem the damage) is anybody’s guess. Our assessment is “not too long" because the central banks are deathly afraid of the Frankenmarkets they have created.

They are worried that these grotesquely-inflated ""markets"" will begin to implode, gather steam, get further away from their control, and end up causing real damage to one or more major banks (the only entities that central banks actually care about). Or even possibly one or more small countries.

That is, they are afraid of a deflationary impulse destabilizing the $200 trillion edifice of debt they have carefully erected. Or perhaps we should say carelessly erected.

As we’ve always said: bubbles expand in search of a pin. As we look around for the pin to this one, it helps to ask: What was the trigger for this latest bout of global financial deflation?

It Begins With China

2015 ended weak but essentially where it started, with the US equity indexes just barely green for the year. There was no big Santa Claus rally, which was a bit of a bummer for the Wall Street year-end bonus crowd. But neither was there any big decline.

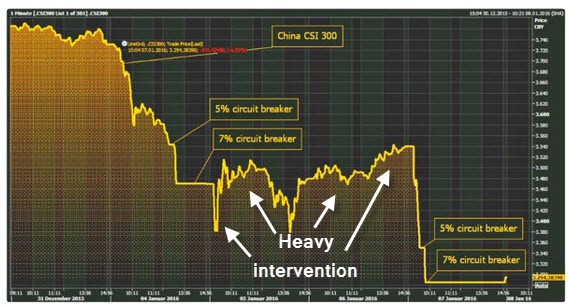

China’s market appeared more or less stabilized by the year end, however it began 2016 with a circuit-breaking wave of panic selling, losing -7% on the new year's first day of trading before the markets were simply closed by authorities.

(Source)

After a couple of days of very heavy-handed intervention, the Chinese stock market again broke down and was again shuttered for trading after tripping the daily circuit breakers.

The lesson here is that perhaps intervention and preventing people from selling does not calm their feelings of panic after all?

Well, consider how the circuit breaker actually works, and the answer is almost certainly “no”. Controls like these do not calm things down, they make them worse:

This week, China debuted a new "circuit breaker" system that was designed to bring calm to its ever-chaotic market and is accomplishing exactly the opposite. When shares on a benchmark index fall 5 percent, trading pauses for 15 minutes so everybody can stop to contemplate what's going on and maybe pop a Xanax.

After a 7 percent drop, buying and selling end entirely for the day. While this issomewhat similarto the way American markets work, the range within which stocks are being allowed to trade is apparently too small for China's markets, which are prone to big swings.

When stocks have started falling this week, investors have responded by rushing for the exits, knowing it might not be long until shares fall below the 7 percent mark and the door shuts on trading.

Once you account for Thursday's 15 minute breather, traders only had an EP-length14 minutesto sell, sell, sell. As one Chinese fund manager succinctly summed up the situation toBloomberg: “This is insane.”

(Source)

Yes, if you only give people a window of just a few minutes to sell, then you probably are going to get a lot of selling during that time. It’s sort of the reverse of the Walmart Black Friday phenomenon where fights break out over rice cookers – people get crazy when they are exposed to conditions that provoke either extreme greed or extreme fear.

If we look back a little bit further, we see that the Chinese stock market is down 15% just since Dec 20th, 2015:

To put that in context, this would be similar to the US Dow losing 2,500 points over 3 short weeks; trading at 14,500 instead of near 17,000. Trust me, the Federal Reserve would be utterly in freak-out mode if that were the case, no different from their Chinese counterparts.

Now, the big question is: Why should the global markets in Europe, Japan and the US care if the Chinese stock bubble loses some air?

I think the answer is contained in the action we saw back in August 2015. Let’s remind ourselves of the near-crash the world had back then and what triggered it.

This high-volume swoon (circled in purple) in the equity markets seemingly came out of nowhere:

The origin of that swoon was, oddly enough, a surprise devaluation of the Chinese Yuan. While the devaluation was just 4% in size, that was enough to upset a whole host of carefully tuned computer trading algorithms:

(Source)

My favored interpretation of these events is that the entire world is now one interlinked set of trading algorithms and capital flows. A large number of these trading algorithms are based on 'correlation trading' which means they buy and sell things in related trades.

So it might be “buy the Yen, sell gold, and buy the Nikkei.” There are correlated trades like this being executed 24 hours a day, 365 days a year.

So when there’s a surprise, like a Chinese Yuan devaluation, it throws quite a few of these pair trades for a loop. As soon as something happens that is outside of their pre-established trading parameters, the computers simply close out their trades in the literal blink of an eye (actually, even faster).

The August surprise Yuan devaluation upset of a lot of carefully tuned trades and the rest is history. Markets all over the globe crashed quickly, and at heavy volume.

So fast forward to this past week (1/1/16 to 1/7/16) and what do we see? Not-so-surprisingly, we see a sudden drop in the Yuan that correlates with the drop in the Chinese stock market, which also correlates with the rest of the global market troubles:

(Source)

So as long as we are seeing these surprise and sudden Yuan devaluations, I expect the trading algorithms to have indigestion troubles. This 'indigestion' will manifest as widespread markets declines and strange air pockets in prices.

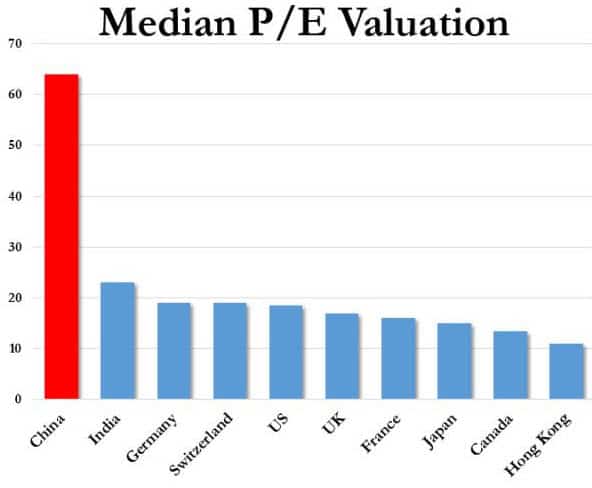

Now, there’s a very good reason for China to be in a heap of financial market trouble right now. Investor selling on the Chinese stock market makes perfect sense to me from a fundamental standpoint, as well as from a bubble dynamic point of view.

Overpriced stocks get sold when bubbles burst. That’s just the nature of things.

(Source)

As to the above chart showing just how badly over-valued the Chinese stock market remains, use it as a relative indicator, not an absolute measure. By a variety of measures that I prefer, the US stock market is also badly over-valued, and I think the above chart is using very optimistic estimates of forward price-earnings multiples to derive the western market levels. Those are inaccurate given the huge rash of earnings downgrades we’ve seen the past two months,.

But however we measure it, the Chinese stock market is still very badly overpriced and that’s even without accounting for the accelerating economic slowdown that is going to wipe out a large number of over-leveraged Chinese companies.

In Part 2: Why A Crash Is Likely, we explain the inter-linking of the world financial markets, and how the troubles in China are by no means unique to that single country. The recent market turbulence is but a preamble of much more dire volatility to come. And the system is in many, many ways, much less prepared to withstand these pressures than it was in 2008...and we all know how that turned out.

Things have been very easy for a long time -- longer than most of us realize. Everything is about to get start getting harder. How well prepared you are in advance will make all the difference.

Click here to read Part 2 of this report (free executive summary, enrollment required for full access)

This is a companion discussion topic for the original entry at https://peakprosperity.com/markets-are-correcting-hard/