Originally published at: https://peakprosperity.com/mitch-vexler-real-estate-taxes-have-become-a-ponzi-scheme-of-biblical-proportions/

What if I told you that property taxes are, in every location studied so far, conducted fraudulently and operate indistinguishably from a massive Ponzi scheme?

Sound hyperbolic?

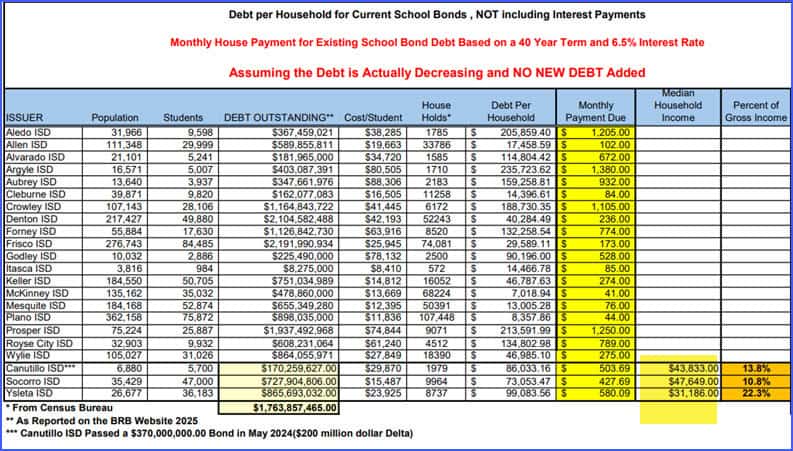

It’s not. In today’s podcast with Mitch Vexler, he outlines in crisp detail how the appraisal process violates the laws it is governed by, and uses simple math to illustrate that there’s no possible way for the school bonds of many locations to ever be paid back.

Consider this table he’s put together for a selection of school districts in Texas. Just from the top row, we can see that the poor residents of Aledo, consisting of just 1785 households, are on the hook for $367 million in bonds.

Since the local taxpayers are on the hook for these bonds, and since there are only 1785 households, that means each household, on average, is responsible for paying off a $205,859.00 loan on top of whatever mortgage they might hold. This might as well be a 100% equity strip that happened while nobody was looking.

If paid back in a reasonable 40-year payback period, this would be equivalent to an additional monthly payment of $1,205.00. But we know two things. First, the bonds will not be paid back but ‘rolled’ into a larger package, and second, the school district will need to borrow more over the next 40 years because they will need new school buildings and such.

That’s a Ponzi scheme right there. Borrowing more and more to pay off the prior borrowings, using deceit and fraud to secure the funds.

Nobody has any intention of paying any of this money back. It is the biggest ticking financial time bomb on American soil. And it’s happening everywhere that Mitch has looked so far.

Are We Actually Free?

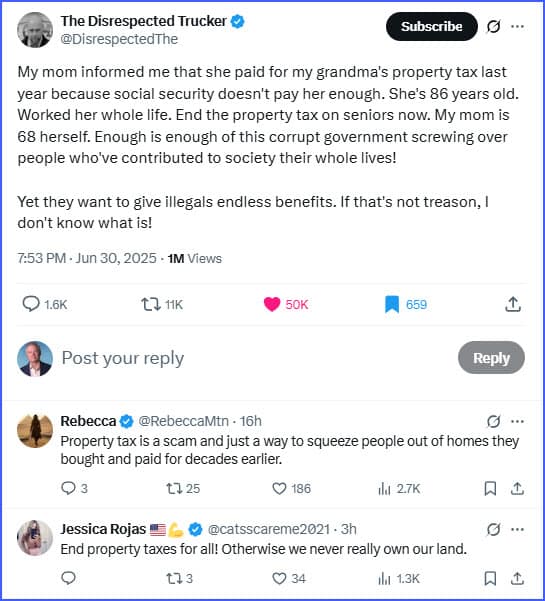

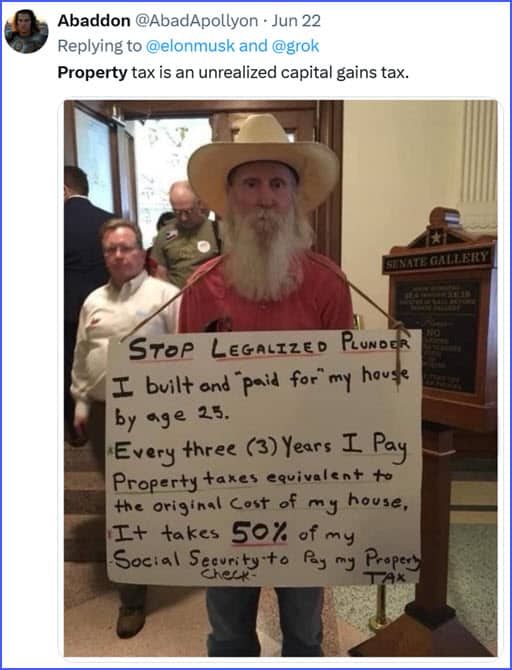

One of the cornerstone ideas of America is that we live in the land of the free.’ But are we ever truly free if we have to rent the property we “own” from our local government under penalty of having it be seized and auctioned off if we don’t pay our property taxes?

Maybe there ought to be some sort of a limit?

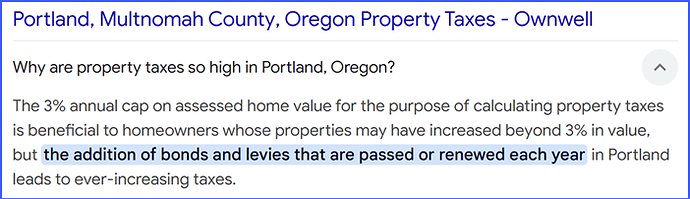

Alternatively, we might note that it is immoral and unethical for the government to both create massive inflation and then tax your unrealized “gains” on your house that are, in fact, just the effects of inflation making things cost more without improving their value one iota.

We all intuitively understand that taxing unrealized gains on, say, stocks or Bitcoin, would be a disaster, so why do we submit to the idea when it comes to our homes?

It’s a bad idea for any asset, especially houses, and now that scheme has just about run its course.

People are waking up the scam. But, unfortunately, there are now more than $5 trillion of municipal and school district bonds outstanding, and nobody seems to have the slightest clue how to get things back on track.

How Do You Fight Back?

Mitch suggests that each of us with an interest in the matter should become familiar with the laws governing our own locations and verify that they are being followed carefully and rigorously.

Spoiler alert: Quite often, they are not.

Visit Mitch’s website by clicking this link, read the First Amendment to the criminal complaint, understand the depth of this issue. If you’re invested in these bonds or have a pension, it’s time to start asking some tough questions.

This isn’t just about saving money; it’s also about saving our communities from being equity-stripped by a system that’s fundamentally broken.

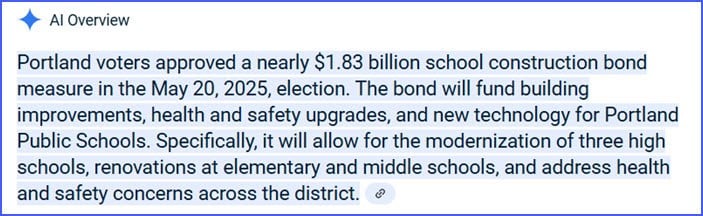

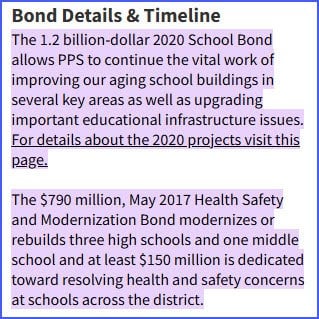

It’s also important to involve yourself in your local politics where often seriously large bond referendums are passed by a ridiculously small number of engaged local voters. Know how they plan to spend the money, and on what, and whether you consider that a good investment.

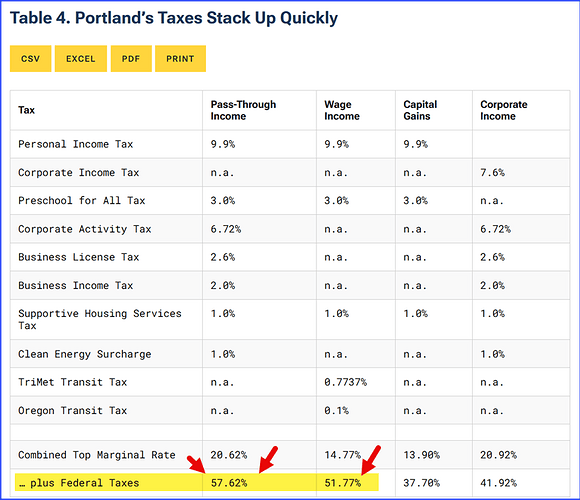

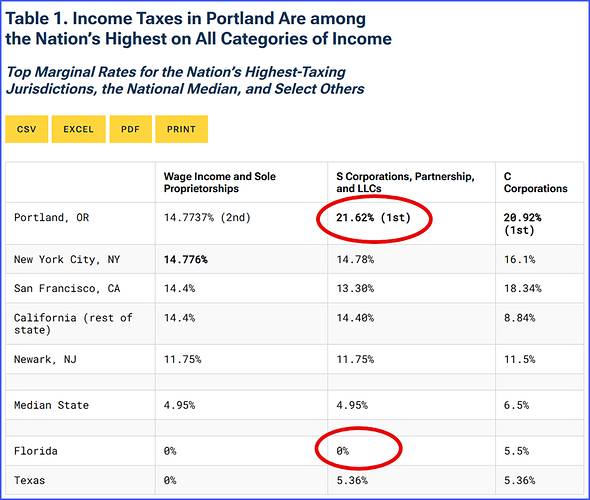

For example, recently Portland Oregon voters decided 58-42 to okay another $1.8 billion (with a “b”) for a variety of school projects:

It modernizes three schools. And this is on top of the $1.2 billion in 2020, and the $790 million in 2017.

Mitch explained how school districts, just like Portland’s, all across the U.S. are issuing bonds ofttimes not to fund new projects or improvements, but merely to pay the interest on existing debts, creating a cycle of debt that only ever spirals higher.

Mitch has been pushing for legislative changes, like replacing property taxes with a state sales tax, which would be more transparent and fair. However, the resistance from those benefiting from the current system, including politicians, public ‘servants,’ and appraisers, has been significant.

Conclusion

The keepers of the system have instead been treating it like their personal piggy bank and construction fund.

Along the way they forgot to perform simple math.

This is an exponential problem where the expense side of the equation is screaming higher and out of touch with the income and equity side of the story.

This ends badly, but it didn’t have to be this way.