[quote=Christopher A. Harrison]One thing that I think many people miss when they come up with new legal means to curb the influence of corporations is that corporations themselves WOULD NOT EXIST were it not for laws. They are legal fictions, and if the laws supporting them were simply removed, then many, or even most of them would almost immediately cease to exist.

Perhaps the most earth-shaking effect of removing the legal protections for corporations would be in the area of liability. Corporate officers and board members would be directly culpable for the business decisions made on their behalf. In a society that actually concerned itself with matters of right or wrong (instead of profit and expediency), then that would likely result in many of those officers and board members being faced with banishment or the noose or guillotine.

And from a minarchist/anarchist view, such steps would return the locus of decision-making to the local community. While I am not under the naive pretense that this would be nirvana, I do believe that it would be a better fit than what we have right now – a system where those wreaking the most destruction on people and the earth are able to insulate themselves from the effects of those decisions. It would at least move us back to a system where decisions are largely made by those with real skin in the game.

[/quote]

100% agree. This is the direction we need to move to. I'm certainly interested in doing it in one major move but I'm not sure we could get a majority in the U.S. to go with it but we might. I think most folks do not realize corporations function as a specific designation at the pleasure of the public and that can be taken from them.

Whatever MF has said in his more scholarly meme, If you read Naomi Klein's "Shock Doctrine, the rise of Disaster Capitalism", you will see him in a more realistic light. That's all I have to say on the subject.Using the ideas of John Maynard Keynes, Roosevelt set up checks and balances to protect pricing of necessities and built the largest middle class in history.

When we switched to laissez faire capitalism a la Milton Friedman and the Chicago Sch of Business we went back on that. What's worse, this system is no longer contained in a nation-state, but is globalized. The real wealth of a healthy economy has been transfered to the low wage states, like China.

Many of Reagan's economists like David Stockman and Paul Craig Roberts point out the falacies of Neoliberalism.

At the end of the day, one could impose a 1% tax on the stock market transactions and get something back from the $22 Trillion we paid the global banking system. They chose to continue the giant casino of derivatvies instead of lending to businesss. They make the stock market look good for political purposes, but it can pop at any time. When you're old, that's not good, is it?

OK. Lookwe are coming from opposite economic theories, but we do have to agree that this thing is so distorted now that even putting back Glass Stegall and practicing Sherman Anti-trust laws won't turn this ship of fools around.

My original point is that I took issue with the statement that the baby boomers will just accept the end of ss and not fight for it. I say, I'm not so sure, when they see where this will lead…

I've said enough on this…

rhare -I think you are being too particular regarding the words "paid in" and "got out." I would encourage you to read them in the context of the overall article, where I stated clearly that social security as currently constituted was a welfare program for old people, and not a retirement plan with a pot of money, etc.

Perhaps if I added a few words, it would make you happy. For instance, I could say "paid in" taxes, and "got out" in benefits then all would be well. And in fact, that's exactly what I meant.

An analogue to this is the use of the term ROI, when no actual investment was made. For instance, the ROI for our friendly bankers lobbying Congress is massive, but that's not really an investment. The money spent lobbying Congress people wasn't put into a fund, but it communicates quite effectively to people what actually went down. Money was spent by the bankers to buy Congress, and as a direct result of that purchase, a whole lot more money came out the other end. ROI.

[quote=BeingThere]My original point is that I took issue with the statement that the baby boomers will just accept the end of ss and not fight for it. I say, I'm not so sure, when they see where this will lead…

I've said enough on this…

[/quote]

BeingThere,

I'm sorry that you've said enough about this. That usually means that the shallow argument well is dry.

You are likely correct that the Boomers will fight for SS, but not as much as the Silents have. As rhare has pointed out, it was a government sponsored ponzi scheme. Furthermore, the pot is empty (see next paragraph.) I'm not at all thrilled with the idea that I paid into the system my entire working life under false pretenses. You are probably in the same boat. Would you agree that eventually it will fail? Would you agree that others have to pay for you to get "benefits"? At some point, people will have to pay without receiving any "benefits." Does that seem fair to you? Silents won't have as much of an issue letting their children, the Xers pay as Boomers will when their darling Millenials have to fund it.

LBJ created the Unified Budget so he could fight his war on poverty and the war in Viet Nam without appearing to raise taxes. Instead of raising taxes, he borrowed from the Social Security Trust Fund. The extra money coursed through the economy. That was the source of the high inflation we experienced in the '70s. That is why Nixon had to "temporarily" close the gold window. Government programs start out well intentioned, but morph into monstrosities with far reaching consequences. Will more government fix the problem? Has it ever?

Keynesian monetary philosophy had back ended austerity built into it. The last time the US actually had a fiscal surplus was in 1961. Even that is questionable given the SS imbalances in the system today. It was easy for FDR to follow Keynes. At the beginning of a Keynes cycle, there is manna from heaven (money from DC) being spread throughout the land. When the economy recovers, the money was supposed to be paid back through higher taxes. Apparently, economic conditions have never been good enough yet. When will that occur? Can we ignore the cost forever?

I would argue that FDR's policies (sanctified by Keynes' theory) worsened the depression and built the largest dependency class in history.

Grover

read Keynes stuff, but as I understand it, one of its major assumptions was that the money supply was limited vs. our never ending world of ctrl-P, meaning the money spent pushed and pulled - I think thats correct, maybe not…what I want to know is who's gonna give away scooters and hover-rounds and $20,000 shower/bath combos for old people when this thing folds up like a cheap tent…poor souls with wants (not needs) and no money…like the old guy I talked to who beat the 'claw-back' bragging about how he dumped his bills on the fed…seriously…as he gets out of his new Audi A4. Honestly, you should've seen the look he gave me when I told him to his face 'people like you are the problem' - I though he was gonna cry or scream, still not sure which. Another fine elder making sure the future is better and brighter - for his people, not you. I notice anyone defending this broken mess always cites their right to do wrong since there are much, much larger thefts taking place. So its okay. Because I said so. Listen to your elders and do as your told, not as I do. New day, more crap.

[quote=treemagnet][I haven't] read Keynes stuff, but as I understand it, one of its major assumptions was that the money supply was limited vs. our never ending world of ctrl-P, meaning the money spent pushed and pulled - I think thats correct, maybe not.

[/quote]

treemagnet,

Keynes' theory will not work with honest money. In essence, his whole idea was that governments should borrow and spend when recession hits to get the economy growing again. Then, when times get better, taxes should be levied to pay back the borrowing. The government would then act as a giant flywheel that keeps the economy in the "just right" sweet spot.

If you have a static money supply (e.g. gold based,) when government starts borrowing money, the available supply of savings decreases and interest rates have to increase to coax more of the limited funds out of savings. That makes private borrowings more expensive and therefore less likely to be funded. Paying one person to dig a hole and another to fill the hole only gets funds flowing. It doesn't accomplish anything. Then, more productive work has to be taxed later on … to pay back the stimulus. Those who get the "benefit" aren't necessarily those who pay the price.

Since we had already ventured down the fiat currency path, interest rates were supposedly set by central bankers. Government borrowings could then be accomplished without immediately increasing interest rates. For the time being, it appeared as if we could have our cake and eat it too.

Keynes' theory gave legitimacy to ever increasing fiat currency and big government. Politicians love the power that bigger government provides them. Since the real costs of borrowing (increased interest rates) can be hidden, politicians can borrow from tomorrow and enjoy the fruits today. The costs can be pushed down the road until the road suddenly ends.

Grover

I understood what you were saying and I agree it is welfare for the old people, but when you use terms like "paid in" and "got out" it leads the reader to believe it is a "investment" type program, when as you point out, it's not. It's why people act like they are owed it, when if they accepted that it's old-age welfare paid via taxes, they might view it differently. Yes, it's semantics, but as long as we keep letting people like the AP publish articles that present it that way, it frames and limits our conversation. We need older people to understand they have been lied to for years by their government.

Hmm, or perhaps not. It might simply be that we have had an explosion in our energy slaves (oil) that raised our standard of living substantially despite all the damage Roosevelt did. After all it was Roosevelt who started this whole SS ponzi scheme.

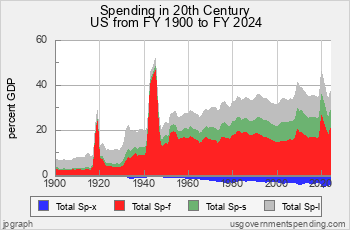

We have never had laissez faire capitalism. If we had we would not have a pretty constantly rising government GDP ratio as you can see here:

I agree, but I don't think there will be a choice. You can't tax enough to meet the promises. So something will give. For a while we will continue to inflate and lie about it, but eventually it will break and any who are not paying attention will be hurt badly.

My whole point is that we really need to be having the discussions about what the role of government should be in our lives and how it interacts with human nature, and we need to think about these things before SHTF. It's so easy to say "There should be a law for that", as I used to think/say that alot. But once you start looking at what government really is, violence by proxy, perhaps people will change their attitudes and decide maybe community (the opposite of government) might be a better solution.

I will reiterate that the people won't go gently into that good night as they are unable to survive without the social safety net. All the old diseases we haven't seen in a century will be back. We'll be joining the third world. Huge dispparities of wealth with little chance to move up…

Talk is cheap, survival and fighting for it is another story. When things go too far, people will respond. Right now we are still discussing hypotheticals and when things become very real, there will be a tipping point. That's happened throughout history.

Bill Black has said that during the Clinton administration, there was a mission toward Restructuring Government, where they claimed that the banks were the Government's client. When Black disagreed and said the people are the client of the government, they said, "You're wrong". (Can you hear the Twighlight Zone theme)

There is much that the American people are not aware of that undermines the finances of the people, while guarneteeing profits to some. Because we demonize taxes, JP Morgan set up Sovereign Wealth Funds for foreign investors from Abu Dhabi mainly who have bought 80 year ownership of midwest highways, as we are unable to support our highway system in some states. (See Matt Taibbi's "Griftopia".) I keep asking if the Right wingers understood that not paying taxes might mean selling off the infrastructure of this country to (yikes, Arabs or Chinese) would they choose to pay the taxes? (Indeed there are no free lunches, afterall)

If the govt continues to prop up the zombie banks to the tune of $trillions that the sucker tax-payers are stuck with, if we can't stop getting into military conflicts around the world to impose globalism, and at the same time privatize the social safety net for Goldman Sachs to administer, will the people fight back?

Is the government spending huge sums of money to private contractors to protect themselves and their specially picked monopolies against us in the guise of fighting terrorism? HMmmmmm

[quote=BeingThere]I will reiterate that the people won't go gently into that good night as they are unable to survive without the social safety net. All the old diseases we haven't seen in a century will be back. We'll be joining the third world. Huge dispparities of wealth with little chance to move up…

Talk is cheap, survival and fighting for it is another story. When things go too far, people will respond. Right now we are still discussing hypotheticals and when things become very real, there will be a tipping point. That's happened throughout history.

[/quote]

BeingThere,

The social safety net has been raided by the politicians who promised too much and pushed the cost into the future. The future gets closer every day. The only way for you and I to get "benefits" is if someone else pays. It doesn't matter what is right or wrong. It is what it is. The voters listened to a story that was too good to be true and bought it hook, line, and stinker. You should be angry about it. But then you should put that anger aside and plan for the inevitable. The sooner, the better.

If Paulson and Bernanke hadn't propped up the zombie banks, the system would have collapsed. There would be no more deliveries because there wouldn't be payments. Within days, the stores would be bare. People would hoard because they wouldn't have any idea when they'd be able to get more. There would be extreme violence as the cheap talk gave way to actual survivalism. The people in the cities would be trapped in a self cleaning oven. They've been trained to wait for government to fix it. They'll stay put until all their resources have been used up. At that point, how could they get out? There would be many tens of millions of casualties across this country.

All the $trillions did was buy us some more time. Nothing was fixed by these bail-outs. The problems were only papered over. Terrorism was a ruse. (How would you feel if a foreign country built a base in your back yard? How could you fight the occupation with odds so overwhelmingly against you? As Yogi Berra said, "hit 'em where they ain't.") The government's response was to shred the constitution and increase surveillance on everybody. They use private contractors because those are easy to control and it hides the increased size of government.

I wish you would drop the "right wingers" rhetoric. Neither side has all the answers. All sides share the problems that we have. It's time to move beyond the blame and focus on strategies when the inevitable occurs. Shoulda, coulda, woulda needs to occur before it is too late.

Grover

You seem to miss the point of my question. Actually I see the split not with right and left so much as those who believe in nation states and have governments that serve the interests of the people who live in them, and the neoliberal globalist view of things where banking and corporate interests are all that count.My point, since it is the right wing who are fighting taxes is that they seem totally unaware that the buying up of infrastructure by foreign entities is taking place. I think they have a right to know that there are choices and they may be surprised at what choice would further the nation state more.

I had a big argument with some friends over dinner about the people's right to know what the alternatives to not taxing in a country with expensive infrastructure and they said, well they won't get it anyway, so what's the point?

I think people are smart enough to understand that there are alternatives. Unlike Thatcher's TINA (There are no alternatives) And I guess reisistance is futile.

I see little point in continuing so I'll give you the last word. I've discussed this enough.

There is a real problem in the PP community; every commentator Chris interviews on every podcast agrees that Euro was doomed from the beginning and is about to break-up.

Unfortunately, this is nonsense.

The worst are McLeod and Mish chortling at how much more brainy they are than those stupid Europeans

Chris should stop using the blanket term "central bankers" to imply the Fed, ECB, BoE and BoJ are doing the same thing.

Can no-one here see that the ECB is on a radically different path to the Fed, and Central Banks of Japan and England? Nobody??? Have you all been utterly brainwashed by the UK and US goldbugsphere/media ?

A key innovation of the Euro is breaking the link between the currency and national government.

It is idiocy for Howe to suggest that Greece leave the Euro to emulate … Argentina. Of all examples he gives the one that shows exactly why Greece won't leave the Euro.

The last thing a corrupt country like Greece needs is a greek Central Bank destroying its new currency. The only thing Greece has going for it is that the ECB is forcing it to restructure, bringing down unit labour costs. This is harsh medicine, but the PIIGS will be better off, as the ECB refuses to print. High/hyperinflation is coming to the US, UK and Japan, not the EZ.

Yeah I know. I'm totally wrong. Okay. Bye bye.

Thought you have expressed that I agree with…from basic concepts to peripheral fringe references. But, you've stepped up, stated an opinion, and came back. Don't be a quitter. That's the worst thing…ever. This isn't my fight, mine is generational stuff and public unions - don't go there unless you have time to burn. Point is, don't drop your fists so early…my experience in men's hockey is that the best way to lose is to start something and not follow through. Then they know your not committed…see? That's when you loose teeth. And oh, Grover is not someone to toy with unless you really know your shit or just want to piss into the wind, or - as in my case, I just pick my battles and will. not. quit. But, you've got an issue - see it through, learn, win or lose - and we'll learn with you. That's why boomers flame out here/there/everywhere…if they don't receive immediate gratification and accolades they tire, blame and resign for the evening - comfortable in the knowledge that they see what you cannot, or better…will not.

Grover, I think you have oversimplified/generalized Keynes a bit. He was sensitive to the risks of bigger government and expressed this in his correspondence with Hayak, and the gold standard has not been the epotome of sound economics. Just looking at the period in the US between 1870s - 1910, you can find all sorts of problems (liquidity especially) with a metal backed currency. IMHO, the problem lies in that all these economic theories are just that, theories that are flawed in their representation of reality. The messiness of human behavior (especially irrational behavior and corruption), not to mention the limits of resources are not adequately expressed in the foundations of any of these theories. It may be that we have to combine them in such a way as to better approximate what happens in regard to both of these (behavior and limits). Prospect theory blew holes in the "rational" assumptions made about utility that are often still dismissed, although I'm sure they have been incorporated into the algorithms of hyperfrequency trading.

I think where Howe gets it right is when he says there is a cost, whether seen or not, for every gain. Because of our biases we often see the gains we want to see and not the costs, or at least not until much later. Here's an interesting video between Kahneman and Taleb about the tradeoffs of system fragility and size:

http://www.youtube.com/watch?v=MMBclvY_EMA

It's interesting to see the difference in the delivery of their ideas between the two men. They have very different personalities and come from different generations.

Thanks for this post. I will be listening to this NYPL series.

I find the emergence of the Rip Van Winkles amusing, after 75 years of the (successful) social security program all of a sudden they wake up and determine that this is and has been all along a Ponzi scheme, inflicted upon an unsuspecting population by Roosevelt like a contagion. Who knew?

I’m thankful for the critical thinking skills exhibited in this thread that disabuse me from considering SS as an insurance policy. I have learned that it is now a “retirement” program or perhaps some type of malformed “investment”, which as every supporter of liberty and freedom knows, can be better managed by the proletariat themselves, wherein fine principles like individuality, accountability, delayed gratification, and just the general notion to “hold yer mud” can be relied upon to stave off a post retirement diet of cat food and cardboard domiciles.

For which I am grateful, for if it were merely an insurance policy, than everyone with homeowners insurance, auto insurance, or insurance of any kind would also be participating in a big government conspiracy and it’s related Ponzi scheme. Every car owner of course paying into a bottomless pit of government mandated bureaucratic spending, the average man paying in more than he takes out. And those irresponsible layabouts that get into a car accident, why, they think they’re “entitled” to a payout? Any self respecting purveyor of free markets and truth knows that the need for insurance is proof positive of a moral (and likely a genetic) deficiency. You simply save your money and drive responsibly, like a real American.

Except that it seems that we Americans don’t do so well at the saving money part.

Which is just as well, because for all those stand up souls, those hard working Boomers who delayed their gratification to cobble together a retirement nest egg, they are now rewarded handsomely for their career spanning 40+ year exercise in staid working class diligence. They are rewarded with annual CD rates of 0.5%, which means they cannot really retire at all. Or those with 401k programs, who took 40% losses in the 2008 crisis. Hope they didn’t really need the money, because they couldn’t retire either. Or maybe the ever ascendant rentier class, who perhaps bought a duplex or other real estate investment to support them during their retirement years- how’s that working out?

Gradually, though, the awful truth sinks in. The real Ponzi scheme is that we produce nothing for ourselves- all of our labor power, and I mean all of it, is given to someone else, and in exchange, a wage is given. For virtually every man woman and child, if you do not receive a wage, you do not eat. The calculus is simple, no job, no opportunity to exchange labor power for a wage, no eat. Why would anyone want or need an insurance policy?

In the land of milk and honey, anything was possible. Not any more. Wages have fallen for the middle class for the last two decades. Less opportunity to sock away money for the inevitable time when, due to age, you cannot exchange labor for a wage. And even if you could, what will 0.5% interest rates buy you? What standard of living is that?

Perhaps most insulting is that the Ponzi scheme mafia offers no alternative. Instead we hear hyperbolic statements, cascading circular logic like nesting Russian puzzle boxes, about “sound money” and “free markets”. These statements belie a particularly disingenuous ideology, that all of this would go away with “honest money” and less government intervention.

If only it were true, but this is a fairy tale, an Randian fantasy, the stuff you tell a child before bedtime, the full force of which can only be realized if accompanied by the libertarian wagging finger and associated stentorial voice.

Because these “practitioners” refuse to acknowledge that we have created a ruse, a game of musical chairs with 7 participants and only 4 chairs. And they defend and valorize this ruse to the bitter end, certain that those 4 that are seated when the music stops playing are deserving, and to be celebrated, and those that are left without are deficient and deserving of their comeuppance.

The “honest” money advocates do not question the number of chairs, just those that are left standing. They conveniently ignore that fiat money is the only manifestation of currency that will support the free market schemes that they themselves advocate, and to abolish this, or even to modify this (fiat money) in any meaningful fashion will in fact deal a death blow to the capitalist means of production, destroying the mechanism by which millions exchange their labor for substinence income.

Thin gruel indeed.

It is good to hear Nassim Talib talking but I would prefer him to be more generous in his conversation style. It is good manners to allow the other person to speak. Nassim tried on several occations to allow Daniel Kahneman an opportunity to talk but was unable to repress his tongue.Here are the two exerpts that I agree with.

The economy must support risk taking by ensuring that the risk taker gets to eat. The object of the support is not charity, it is to encourage risk taking.The top of the totem pole can look after itself and needs no state support.

"The mistake people tend to make is to think that whatever you don't understand is stupid" Fat Tony explaining Nietzche to Socrates. That can be applied in spades when it comes to Cold Fusion. People reject it because it is not accounted for in their models of reality (Left Brain) .

BeingThere,I've found that people who have broad categories (e.g. Right Wingers,) generally assign other stereotypical attributes along with it. As soon as you call someone ______ (fill in the blank,) you've discounted their argument and elevated your own enlightened status without having to defend anything. Perhaps I'm being stereotypical. When you try to observe your actions through other's eyes, do you see anything like this?

When is enough enough? How high do you think taxes should be - for the super rich, rich, middle class, lower class, destitute? Where should those funds go? Should we invest in infrastructure, social issues, defense, etc.?

When you talk of selling off public infrastructure to foreign entities, you really are describing a component of creative financing. The politicians are bringing future revenues to the present so they can use the funds here and now. The buyers view it as an investment. Is it right to toll a highway that has been built with public funds? Highways need maintenance and have to be patrolled. How should that be paid?

It seems that everybody loves the infrastructure they use as long as someone else pays for it and it isn't near their back yard. I wish we could have adult sized conversations that drill into financial facts before committing funds. Projections are generally too optimistic and costs creep higher than expected. Doesn't that anger you?

Hopefully, this won't come as a shock. I think taxes are too high. With all the promises and projects, taxes need to be higher to adequately fund everything. Creative financing pushes the cost into the future. When the future arrives, we've got more demands for the limited funds. That is where we are today. And yes, it bothers me too.

Grover

[quote=gillbilly]Grover, I think you have oversimplified/generalized Keynes a bit. He was sensitive to the risks of bigger government and expressed this in his correspondence with Hayak, and the gold standard has not been the epotome of sound economics. Just looking at the period in the US between 1870s - 1910, you can find all sorts of problems (liquidity especially) with a metal backed currency. IMHO, the problem lies in that all these economic theories are just that, theories that are flawed in their representation of reality. The messiness of human behavior (especially irrational behavior and corruption), not to mention the limits of resources are not adequately expressed in the foundations of any of these theories. It may be that we have to combine them in such a way as to better approximate what happens in regard to both of these (behavior and limits). Prospect theory blew holes in the "rational" assumptions made about utility that are often still dismissed, although I'm sure they have been incorporated into the algorithms of hyperfrequency trading.

[/quote]

gillbilly,

I'm reminded of a Monty Python skit where contestants in a game show were tasked with "summarizing Proust." So, I gave it my shot. How would you boil down Keynesian theory to its essence?

Granted, my example was chosen to show the absurdity. Would Keynes prefer to disseminate funds by paying someone to dig a hole and paying someone else to fill it in? No. He would prefer projects that have a return on investment. If there were no good projects available, would he resort to paying for nothing? Or would he admit that his theory was limited?

Adolph Hitler was the first national leader to embrace Keynes' monetary philosophy. Hitler had no intent of ever paying back the funds he borrowed. The German people adored him for bringing prosperity back. He used the funds to build his war machine. Had the Germans been aware of the outcome of his ambitions, would they still support him?

Look at FDR and the alphabet soup agencies he created to fight the depression. Did it work? Did he get credit for ending the depression? Did he ever intend to pay back the funds he borrowed in our name? In 1961, we had our last US fiscal surplus. Since then, nothing has been paid back and we're deeper in debt than ever. We keep digging deeper - and we use Keynes' theory to justify it. That is my biggest complaint about it.

The economic climate under the gold standard in 1870-1910 wasn't a smooth sail. There were many panics. Does that condemn a gold standard? Perhaps the problem was that bankers treated the gold as fractionally reserved because most people preferred to keep it in the bank's safes. I'd work on fixing that problem before dismissing a gold standard.

The allure of high profits tempted bankers to lend out too much. When the downturns came, the people made runs on the bank to get their savings out. Eventually, the gold was gone. I'm sure more than one banker was lynched for cheating the depositors.

The bankers came up with the idea of a central bank to protect themselves. There would always be paper available (at a price) to satisfy depositors. When the federal reserve was first instituted, they claimed that the paper notes were "good as gold." They instituted 40% gold reserves to back the currency. That means there was 2 1/2 times the money as there was gold backing it. Again, during good times, people preferred the convenience of paper over bulky gold. When the system broke down in 1929-32 and bank runs commenced, people preferred gold over paper promises. By design, there wasn't enough gold to satisfy depositors.

That is where the "liquidity" issues arose. If bankers had been honest about their deposits, these problems wouldn't have happened. If people want interest from a banker, they should be accepting the risk that their gold won't be returned. If they don't want the risk, they should be able to pay the banker to store it - similar to a safe deposit box. Bankers should be held to a higher standard. Just the opposite is true.

Grover

Grover, I know you knew you were generalizing, but I guess that was my point:-) The problem again returns to the fact that economic models and standards are made to reflect the behavior of "human" markets. The models we have currently don't seem to fit the dynamic nature of human and ecological behavior we have currently. Most opinions that are expressed on this site are out of date in regard to what we know (I include my own). I think that's why there is so much emotion involved…everyone is grasping for something that will make sense, but we are trying to make sense of distorted and incomplete models that don't fit our current predicament. For instance you wrote:

If bankers had been honest about their deposits, these problems wouldn't have happened. If people want interest from a banker, they should be accepting the risk that their gold won't be returned. If they don't want the risk, they should be able to pay the banker to store it - similar to a safe deposit box. Bankers should be held to a higher standard. Just the opposite is true.

and...The allure of high profits tempted bankers to lend out too much. When the downturns came, the people made runs on the bank to get their savings out. Eventually, the gold was gone. I'm sure more than one banker was lynched for cheating the depositors.To me, If/then statements like these seem logical only hindsight, and "the allure of high profits" is a structural component of our capitalist models of utility and risk. It is impossible to know what was really going through the minds of the bankers of that time. There wasn't electronic trading, a global reserve currency, hypothecating, etc. Do you think if we changed back to a gold standard that bankers would miraculously be honest now? Would HFT trading go away? Would the fractional banking system that so many in the finance world depend on and benefit from go away? Would rehypothecation of gold go away? Aren't there too many businesses reliant on all this systemic manipulation? I'm trying not to sound nihilistic, but I think the honest answer is that we don't have a model or picture of the world that gives a solution and/or can predict what is going to happen in the future. Now I see an article today about $10k gold in the future. What does that really mean at a time which Chris says is a time when we know the price of everything and the value of nothing? It may reach a price of $10k, I don't know, but the value of it may be $100 in current real value. No one can say for sure what will happen in the world in an hour from now, let alone in five or ten years. I've stopped thinking I'm building resillience to prepare for a collapse that, in all honesty, I don't know will ever come. I build resillience to improve my own personal value of life, and hopefully will improve the lives around me.