Victor,Thanks for the reply. When you have time, would you be able to hazard a guess as to a weighting in regards to specific actions and their respective contribution to pricing? Or is that a fools errand?

IE in your piece on the muppets (and please correct me if I am wrong), my takeaway is that the dumb money that can’t deal in physical will/is being slaughtered by the producers (or their representatives). And that in the short term, this will influence price downward more than the peak oil decline.

Is that an accurate portrayal or am I completely bass ackwards here?

In regards to Akins. I wonder how many people take the wrong course of action (going public in this case) simply because they have some of the information, but not the whole picture. I guess that’s why markets will never be efficient, but better than centrally planned ones! :)

Gak

Gak,

I think you should really read the original of both the Thoughts! and the Gold Trail:

http://www.usagold.com/goldtrail/archives/another1.html

http://www.usagold.com/goldtrail/

In printed form, it is probably about 300 pages, and it’s definitely worth it.

Concerning the muppets, in my picture, the inflation hedgers are the useful idiots. They are quite predictable and respond well to rhetoric ("…if not, we will strike Iran…"), and they can pony up the funds in order to take some 200mm bbl off the market inside the U.S. alone (it’s not that much money btw).

But the producers (say Saudi Arabia) also need to collude. If they continue selling in the spot market, the muppets can only cause a serious contango, and then that’s it. Only if the producers defer sales and go short the future instead, or if they swap their inventory with the investment banks (say JP Morgan), the speculators can cause the price to increase.

Here is where the politics start. Between mid 2009 and the end of 2011, apparently, Saudi Arabia agreed to keep the oil price high and stable.

Naimi’s letter in the Financial Times may be the official announcement that their policy has changed ("oil is too expensive for Europe", "there is no shortage"). If true, this makes the collapse of the speculation that may have just begun, even more relevant.

If you think about the gold-oil relationship, you will realize that eventually, the gold/oil ratio will have to break out of its 70-year trading range of 10-25. And it will have to break out huge! This will end the preferred role of the US$ as the oil currency and may eventually substantially favour the Euro. Once this change in the gold/oil ratio is in effect, I wouldn’t be surprised to see a decade or two of cheap oil in Euros, say E40/bbl (about half of today’s price). I wouldn’t want to own an Alberta oil sands company in this scenario (for more than one reason).

What about ‘peak oil’? I am not sure it is that relevant to the original question. Yes, crude oil is a finite resource. Once you have burnt it, it is no longer there. True. So what? What we need to understand is what’s the impact on the price.

Given that the present price is artificially high and that a lot of production has been taken offline (either by voluntary abstention of both OPEC and non-OPEC producers or by diplomatic/military actions such as in Iraq, Libya, Iran), we may very well see substantially lower prices for an extended period. I explicitly say one or two decades.

Then the question is how demand behaves during this period. Demand is by no means sticky, even less so if viewed on a time scale of a decade. Just take a look at what the high prices of 2009-2011 have done to U.S. demand.

Unfortunately many of the ‘peak oil’ prophets easily fall for the obvious industry propaganda and tend to relay industry sponsored research without verifying. That makes everything all the more complicated to disentangle.

Victor

Here are some questions that people should ask:

Saudi Arabia. They claim they can produce 12.5mm bbl/day. Until about a year ago, they typically went up to 8mm. The US/UK based oil multinationals have always tried to ridicule the 12.5mm and suggested that the 8mm was already the limit. Now we see them happily pump 10mm. The true answer is probably that with some upgrades, they can go even beyond 12.5mm. Why should they tell the world how much they really have?

Iraq. Before WW2, it was mostly covered by the Red Line Agreement. Then it was under Soviet influence and technically never fully up to date. They got drawn into the Iran-Iraq war in 1979. Then the second gulf war in 1990/1 and a decade of sanctions. Then 2003. Iraq is still largely unexplored and ‘thanks’ to three full-scale wars within 25 years, seriously underdeveloped. If peak oil were so threatening, where are the efforts to get Iraq onstream? They can probably produce some additional 10mm bbl/day for a decade. When I watch the news, however, I don’t get the impression that it was that urgent.

Finally, you should ask why is oil priced and oil trade settled in US$. That’s quite a privilege for the dollar, isn’t it?

Firstly, today oil trade is settled in US$ because it was the case yesterday. But originally, when the US$ went off gold convertibility, it was the main swing producer, Saudi Arabia, who basically had the power to decide. They went for US$. Why?

The key to this question is the gold/oil ratio. Note that this ratio has been in the range 10-25 since WW2. As long as the gold/oil ratio remains reasonably low, say <= 20, the oil producers can invest a small portion of their export surplus in gold at a very favourable price. That’s enough to agree to settlement in US$.

Now the difficulty for the U.S. is that with the introduction of the Euro, there has no longer been any further international support for a low gold price. Take a look at the Washington Agreement in 1999. In fact, the gold price in US$ has been rising since spring 2001.

So, unfortunately, the U.S. can keep the gold/oil ratio low only if they accept (and actively maintain!) a high oil price in dollars. Of course, this cannot go on forever simply because the economy wouldn’t survive it. But they managed to pull this off until the end of 2011 which is quite remarkable (and quite reckless as well).

This is why a potential new Saudi policy favouring a low dollar oil price is so explosive. Oil can easily go down by 30% or more, say to $70/bbl or less. But try this with gold ($1200/oz) and the system might run out of reserves. So the train is heading for a massive concrete wall.

Victor

[quote=victorthecleaner]And then Kissinger just topped everything by getting the Shah to blatantly raise the price during the OPEC embaro of 1973 (when Iran was the primary Middle Eastern non-embargo supplier). Yamani says he figured this out only when he talked to the Shah. Akins must have learnt it from Yamani. Poor Akins made the mistake of going public with this information, immediately getting himself fired, of course.

Victor

[/quote]

According to below :

Akins didn’t get fired for this reason at all :

And Akins was also clearly pushing for a price rise, at least in 1972, he was the one suggesting $4 or $5 in an OPEC meeting in Algiers, that he mentions also in his 73 paper :

http://www-personal.umich.edu/~twod/oil-ns/articles/for_aff_aikins_oil_crisis_apr1973.pdf

He was the one that audited US capacity in 71 so perfectly aware of the situation.

Overall for me peak oil is vey real, we are currently on the top of the production rate curve, and most if not all countries produce as much as they can.

I don’t believe either in a major influence of speculation (on futures and derivatives market) on oil price, but have the more simple view of :

- the conomy grows, oil production and consumption as well (typically 2004 2008 period)

- production approaches its current limit

- high volatility, price spike

- price trigger demand destruction (2008), ie recession

- price fall, production as well, going below max current prod

- more or less back to 1)

Typically also the view described in Nature jan 26 article below :

http://tribune-pic-petrolier.org/wp-content/uploads/2012/03/Murray12oil.pdf

By the way below a petition/call initiated before french presidential election but still active, please do not hesitate to sign it up ! :

Mobiliser la société face au pic pétrolier

I am interested in why people think "inventories at a 21 yr high" means anything. Could mean we’re using less but buying the same amount. May not mean a single thing or may mean a lot. Personally, I think it means we have oil in inventory and that’s about it.

As far as I can tell, US oil production has increased by a small amount and is, relatively, meaningless in the scope of things. I am far from an expert on energy issues but it looks to me like the whole issue if far too complex to be dealt with in any single article or any one person’s opinions. The gist of it all, appears to me, to be we’re in a world of hurt, there aren’t any viable solutions and endless hours are being spent with "what ifs, could be’s and future technology will". At 70, the real hit will, probably, come after me but if I were a young person, I’d quit bickering and look for a hole to crawl into.

Victor,

I have been reading Thoughts! & The Gold Trail, as well as FOFOA, (as well as the new kitco archives) for the last 2 years. I haven’t mastered them & I frequently have to re read portions, but it is slowly sinking into my dullard cranium.

But to this thread, Fofoa pointing me to The Gold Trail was what opened my eyes to the thought that looking at selected pieces of data in isolation means that one will never see the big picture & consequently will miss the all important Forest because one is so focused on a particular tree. As FOA writes,

“We must view the world in a broad context, just as much as in a detail perspective. The larger perception can be just like looking at a river the valley from the ridge above. From far away it's easy to see what direction national trends are flowing. The whole body moves as one, always towards the sea. The problem comes when we get too close and interpret things using only a small river section in front of us. More often than not, the white water we see only hides a deeper flowing truth.” FOA (2/23/2000; 19:49:22MT - usagold.com msg#6) http://www.usagold.com/goldtrail/archives/goldtrailone.htmlThat is one of the reasons I like CM’s site with the emphasis on the three E’s and how they interconnect. Now, that doesn’t mean that Chris (or anyone else) gets it right (IE looks at all the variables), which is why I asked my question of Gregor. Why does one dismiss Secondary factors? How does one put a weighting on them to figure out how important they are to the overall question? I happen to fall in the camp that believes that we are in Peak Cheap Oil. However, I do think (and as a former oil hand, I have seen it firsthand) that those secondary factors do play a role. I think those secondary factors (More so than flow rates) is what drove the price of oil to $147 & then back down into the $30 range. But I think that they were more pronounced because we are in an era of peak cheap oil combined with FOFOA's peak $ credibility. IE bumping up against a max flow rate threshold in both products :) I think your line of thought about the POLITICAL reasons for why KSA, Iraq & others don’t produce more is important to determining what is going to happen to the price of oil. I think that the interplay between physical Gold, Oil, the Euro, the Dollar, Foreign Policy goals, Western Consumer demand destruction and many other items all go in to the hopper of secondary factors & that they do affect flow rates & decisions about bringing fields online. I think westerners make the faulty assumption that KSA values the dollar as much as westerners do. To KSA, oil in the ground is better than a devaluing currency & as long as the gold flows the oil will flow. But eventually, the flow will lesson. The question for me, is how long is eventually in this context. Gak

Thanks, ty75, you are right about Akins. My mistake above towards the end of #18.

Victor

I’ve been reading a lot lately in the Wall Street Journal(love my free subscription!) about fracking - specifically, how the US oil companies have developed it, how we have been able to open up new fields(Bakken) while re-energizing old oil fields(Texas) and how the technology is just now being exported to other countries for their use. While I don’t believe this will cause a new oil boom, I do believe that this new oil being extracted in the US and eventually worldwide will help to smooth out the current effects of Peak Oil, perhaps for several years. At least, that is what I am hoping.

yt75,

I’d like to comment on the article by Dreyfuss you cited:

http://www.motherjones.com/politics/2003/03/thirty-year-itch

I agree with the facts presented or at least find them plausible. However, I think the interpretation is completely bass ackwards. The "Kissinger plan" of invading the Middle East and to seize the oil was not an actual plan that he wanted to pursue, but it was rather the rhetoric that helped underpin the artifically high oil price created at that time. So the purpose was not to have cheap access to the Middle Eastern oil, but rather to scare Europe and Japan in order to sustain the artificially high oil price.

Furthermore, I find it entirely plausible that the Bush/Cheney administration revived the successful "Kisiinger plan", but with its original intention. The plan was not to get access to cheap oil, but again to scare everyone and keep the oil price artificially high. I think if you compare this with the reality of Iraq post 2003, it is pretty obvious that getting access to the Iraqi oil was not at all the goal, quite the contrary.

So here is what I expect for the coming one or two decades:

-

oil trade will switch from dollar settlement to other currencies, presumably mainly Euro

-

the U.S. will largely withdraw from the Middle East (I even think there is no point in starting yet another shooting war as it would cause too much damage to their own economy)

-

the Middle East will be donimated by Europe, Russia, China, who will have access to cheap oil in non-US currency for an extended period

Victor

PS: The Financial Times is confirming that Saudi Arabia is producing in excess of 10mm bbl/day and shipping the stuff into the increasing inventories around the world. (I think the price target of $100/bbl or $90/bbl is a distraction - the target must be substantially lower in order to render all the new expensive supply uncompetitive)

www.ft.com/intl/cms/s/0/512b72c4-a57d-11e1-a77b-00144feabdc0.html

Victor,

I’m not sure, I’m in no way an expert in oil geopolitical history (and scientific/technology background more than economics).

Also think that the facts are correct (publications and reason for Akins being fired), and that the threat wasn’t very serious (and not done directly), but indeed a way to cover up the fact that high oil price was also a US strategy. But for me in the balance here there might be more the US public opinion, that is making sure that for the public (it occured in 1975 so right after 1973), it stays as "the Arabs/OPEC are the bad guys imposing these prices", and not us, or even for the whole western public opinion.

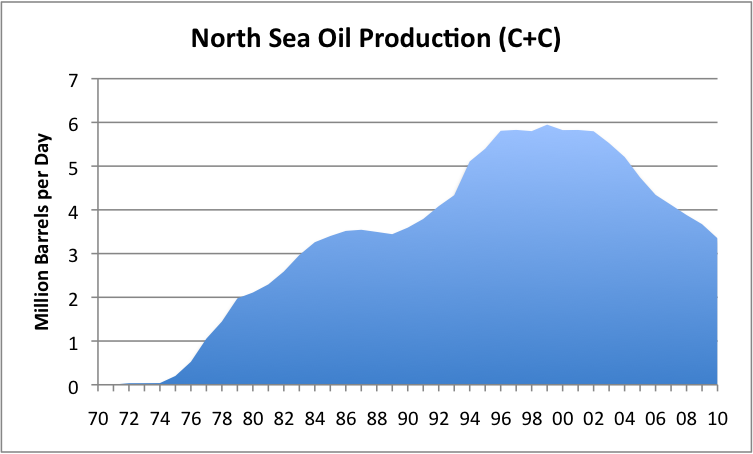

And again these high oil prices were necessary to start Alaska, GOM, North sea, so not sure if they were "artificially high", also the result of the OPEC production quotas being very real at that time.

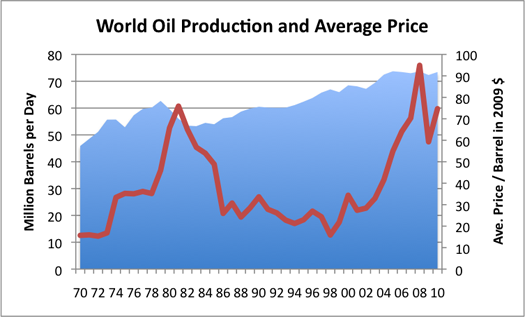

If we look at :

and :

or :

We have this kind of flat price period 74 79, with OPEC quotas and Alaska/GOM/North Sea not online yet :

Then the crash dur to Iran 79 revolution, but Alaska coming online with North Sea :

Then around 85 OPEC production comes back up (Reagan deal with Saudis, Irak /Iran in need of money for their war (and being broke afterwards), also the period when OPEC members all started increasing their reserves to increase their prod quotas I think).

And then the Bushes era (by the way in this doc and book "la face cachée du pétrole" there is also the episode where Bush (the first) was the one that ended the "saudi oil glut" while being Reagan vice president and more or less on his own (and this for US domestic production interests that got quite wiped up by this increased saudi prod/sudden price decrease), or also below :

http://www.youtube.com/watch?v=02F-3l1EKsA

Then the gulf wars (with the first one a lot about Saddam being pissed about Koweit producig too much).

And then more or less a steady increase both in prod and price leading to today period.

As to the future frankly I don’t know, but again quite clear to me that we are around the peak, so that I think it won’t go well at all (even though I don’t prepare anything). But overall don’t think the US will largely withdraw from the middle East at least in the short medium term, especially from Barhrain, KSA, Djibouti, etc, even Irak if more or less direct (a lot of black water type guys there still, Exxon in Kurdistan, etc)

And seems to me it’s somehow still for a while either the US with Europe there, or the Chinese or Chinese + Russian.

Anyway … where are you from ?

(me from Paris)

Edit : sorry not sure how to insert images here, but the URLs should be valid

Victor:

The remarks from Jeffrey Christian about Non-OPEC oil supply (if true, as your reported) are an excellent example of how most people, when they claim to be telling you something about global oil supply and oil prices, are really jut telling you how they feel. Christian has no body of work behind him that woud support his position. So, it matters not what Jeff thinks. It doesn’t matter what I think either. However, the data shows conclusively that not only have flows stalled, and fallen in Non-OPEC over the past decade–especially when we remove Russia–but the data also shows why: the cost to bring the marginal barrel on has raced to the upside, as the resource base descends into lower, and lower quality oil.

There is some indication, in my view, of the Hotelling Rule in OPEC, or scarcity rent if you will, in OPEC supply. Even the Saudi’s have suggested that it’s not prudent to sell as much oil as possible and as quickly as possible. They clearly understand the Hotelling Rule: the value of oil in the ground is appreciating at least as fast, if not faster, than the prospective return that could be obtained using the capital proceeds from such oil sales. Brazil also has noted this too, in a governmental/political context.

Non-OPEC however is dominated by profit-maximizing enterprises. Christian’s commentary is in addition, just silly because Non-OPEC (ex Russia) is free market oil production.

The work on Non-OPEC production this past decade is vast. The team at Barclay’s in particular have done great work, and there were indications as early as 2004 that Non-OPEC was headed for production problems due to real–not imagined, sentiment based–reasons. Namely, geology.

Best, G

PS: Are you sure Jeffrey Christian really made those remarks? Not that it matters. Just curious. What matters is the data of course, and the historical production record, and the context. Not what anyone says casually.

[quote=Gregor Macdonald]The remarks from Jeffrey Christian about Non-OPEC oil supply (if true, as your reported) are an excellent example of how most people, when they claim to be telling you something about global oil supply and oil prices, are really jut telling you how they feel. Christian has no body of work behind him that woud support his position. So, it matters not what Jeff thinks.

[…]

PS: Are you sure Jeffrey Christian really made those remarks? Not that it matters. Just curious.[/quote]

Well, it was an internet discussion forum (this one, to be precise), and so I couldn’t take his fingerprints and a DNA sample to confirm it was him. But, yes, I do believe it was him as he is obviously rather competent. Just to make sure we know what we are talking about, here is his comment:

Energy is an interesting area to discuss. I happen to not be a ‘peak oil’ believer. Yes, we will hit oil output limits, and annual output will decline globally at some point, but the major constraints on production at present are political, not geological. Russia, Venezuela, Mexico, Nigeria, and some other major producers have seen sharp declines in their oil output over the past decade. In each case, the declines reflected human actions, political or otherwise, and not geological constraints on production. We also have reasons to believe that Saudi Arabia has vastly more oil resources than is commonly believed and assumed.

I do have a problem with your reponse though:

[quote]

when they claim to be telling you something about global oil supply and oil prices, are really jut telling you how they feel.[/quote]

because you also write

[quote]

The team at Barclay’s in particular have done great work, and there were indications as early as 2004 that Non-OPEC was headed for production problems due to real–not imagined, sentiment based–reasons. Namely, geology.[/quote]

Well, this is how Barclay’s feel, isn’t it? You should not forget that they have a lot of skin in the game, and so you should be prepared to see a lot of marketing and not so much resaerch that would deserve the name. In fact, I think it is very tempting to think "peak oil" and then "price must go up" and then go out and look for confirmation of this idea. Of course, you find all the industry sponsored ‘research’ that is out there for a purpose. Precisely for this purpose.

But then, surprise, surprise, you actually admit that Jeff is right:

[quote]

Even the Saudi’s have suggested that it’s not prudent to sell as much oil as possible and as quickly as possible. They clearly understand the Hotelling Rule: the value of oil in the ground is appreciating at least as fast, if not faster, than the prospective return that could be obtained using the capital proceeds from such oil sales. Brazil also has noted this too, in a governmental/political context.[/quote]

So we can add Brazil to Jeffrey’s list. I am glad you agree that OPEC plus Bazil have not been pumping at the geological maximum production rate for the period of 2004-2011. In fact, Saudi Arabia just nicely demonstarted this by increasing from about 8mm bbl/day to beyond 10mm bbl/day.

Do you also agree that the estimate produced by Hotelling’s rule, depends both on how the proceeds of the potential additional production are invested and on what will be the future price of oil? What is your estimate of US$ real interest rates for the coming decade? If you were an oil producer with spare production capacity, how would you manage your production and how would you invest your proceeds?

So I think you just contradicted yourself head on. In the article you claim "OPEC has lost the Power to Lower the Price of Oil", but now you are telling me that they (i.e.OPEC, and you include Brazil while Jeffrey adds Russia and Mexico) don’t produce at the geological limit, but rather according to some financial and/or political considerations.

This tells me that they have not necessarily lost their power to lower the price, but that they have decided to limit production and to aim for a higher oil price for some period of time (that would be roughly 2004-2011).

This is a huuuuge difference, isn’t it? Because the financial and/or political considerations may change. In fact, they certainly will. (Oil in the ground is as good as gold in the vault. It would be wrong to think that oil in the ground were as good as dollars in the bank - it is much better.)

Sincerely,

Victor

Thanks Victor. Let me clarify. In the most simple direct way.So, the assertion that Non-OPEC production has been limited by meangingful factors other than geology is not a view I agree with, or a view that has empirical support. I did mention Brazil, but, Brazil’s take on this is more prospective, and political. In other words, in the case of Brazil, it’s not that they hav,e a trailing record yet of bringing on new supply more slowly. Rather, it’s that when they stood before all their newfound, but very high priced supply, they made political statements saying they would develop it more slowly. But this is rather moot because their new supply is slow, by definition.

As for Barclay’s I try not to impute anything necessarily good or bad to a research team based on association alone. I just really happen to like their work, and it also lines up really nicely with the independent work also done on Non-OPEC the past decade. Including work that I have done. Just a note: I have been studying Non-OPEC for a long time, and radically different persons and institutions have come independently to roughly the same conclusion about Non-OPEC supply. That is, Non-OPEC supply not of liquids, not of biofuels, but of crude oil.

Yes, no one disputes that Saudi built some spare capacity the past 5 years, and they are using it. Also, I use standard accountings from EIA and IEA to gauge total OPEC spare capacity, which although low, does still exist. Say at around 2+ mbpd.

But, you would have to read Part II of this piece to understand more fully why I say OPEC can no longer lower the price of oil on a sustained basis. It’s because of a more complex interplay between price, and the marginal barrel from Non-OPEC. So, my assertion in the piece is not quite so linear.

Overall, it ultimately becomes somewhat unsatisfying to adjudicate these views in short comment threads. But, let me just say that one tries to suss out large factors will which really do kick production higher or lower for sustained periods of time, vs many smaller factors. As for Non-OPEC, sustained prices above $90 will indeed bring on new supply that either arrests declines in some regions, turns declines into advances in others, and may overall slow the decline experienced by Non-OPEC. Meanwhile, OPEC has slightly more discretion in this regard, but, again, it’s important not to convert that into my implying that OPEC has lots of discretion.

Something that really helps: working with the data sets over a long period of time will show that war, strikes, new discoveries, political desicions, and even price, do not kick production higher or lower from the larger trend. It is only when geology or techniques for extraction change dramatically that production trends finally change. I remember when I started out, I was much, much more concerned with the Dollar, political decisions about production, OPEC cartel policy, and so forth. Now I am much less interested in these, and many who find my work frustrating do so because I am now very much on the side of geology. It’s ironic, because I talked so much about the USD factor years ago. Now, I no longer think about it much, as one example.

As many who work in this area will tell you, often assertions which appear to be contradictory are not. That is because each region, and each country, will contain conditions or factors which run counter to the overall characterization. So, Brazil is the one exception within Non-OPEC, in that they have clearly given voice to the Hotelling Rule. But has that affected Non-OPEC production? Nope. Not in any meaningful way. Conversely, many hold the view that the US has some draconian set of enviro regulations preventing increased production here. But, that’s neither true nor much of a factor either. Non-OPEC is a big category. But overall, it’s easy now, given the past decade, to answer whether the systained Non-OPEC trend reflects geology or political decisions.

Best, G

Victor,

you placed this quote from Jeff Christian:

Jeffrey Christian wrote

Energy is an interesting area to discuss. I happen to not be a 'peak oil' believer. Yes, we will hit oil output limits, and annual output will decline globally at some point, but the major constraints on production at present are political, not geological. Russia, Venezuela, Mexico, Nigeria, and some other major producers have seen sharp declines in their oil output over the past decade. In each case, the declines reflected human actions, political or otherwise, and not geological constraints on production. We also have reasons to believe that Saudi Arabia has vastly more oil resources than is commonly believed and assumed.

[...]

Over the past year or so we have been focusing on an alternative energy scenario, in which oil production rises over the next decade or so, natural gas production rises, natural gas takes market share, clean(er) coal technologies come into play, LED lighting and flat screens cut energy consumption in half for many lighting and screen applications, other energy conservation efforts reduce the growth rate in energy consumption, and nuclear power increases its share of energy supplies... and all of these things lead to a period of three to 10 years of lower oil and energy prices.

There are a mash-up of strange ideas and language in there. With some simple inquiry into the geology and dynamics of oil field production one cannot be a believer in or a denier of Peak Oil any more than one could be a believer in or denier of to, say, gravity. So I am going to presume Jeff meant that he does not believe we are hitting geological production limits right now.

Even then. the important piece of information is not the actual number of total barrels produced but the total net energy delivered from those barrels. The marginal cost of a barrel produced is a convenient, if crude, approximate for EROEI.

But the second mash-up I am having trouble finding a gentle rationale for...

To say that clean(er) coal, LEDs, natural gas electricity generation and growing use of nuclear power will lead to lower oil prices is just...silly.

Oil is not used to generate electricity to any appreciable degree, except on Hawaii. There's no relationship between electricity consumption, prices or efficiency measures and the price of oil of which I am aware. They are entirely separate energy markets for all practical purposes. 70% of oil goes to transportation and 30% goes to industrial uses as feedstock for plastics and chemicals. So when someone conflates these markets I immediately question if they really know what they are talking about. The quoted passage is a flag for me.

Next, the idea that oil production will rise over the next decade is still under some serious doubt in my mind, in part because the declines in existing fields will continue to offset the stingy gains labored out of the shale beds, in part because the shrinking wedge between the price of oil needed to support new production and the price that kills economic growth will serve to stifle production, and in part because the environmental costs of some of these new plays are creating additional local friction.

Remember, as soon as the shale drilling stops, the production declines are extraordinarily rapid. Already there are rumors from the Eagle Ford play that drilling is dlowing down rapidly....the US price for oil is no longer supportive of that play, is how the thinking goes.

Maybe we'll get more oil out of the ground in ten years, maybe not. But if we do, I can assure you that it will have a much higher average cost per barrel to produce than oil today.

Dear Chris,thanks for coming here ‘in person’ to comment. Since Jeffrey wrote it on this very blog (in the thread on the Harvey Organ interview a few weeks ago), perhaps you can just email him and ask him to comment - he is very nice and helpful although sometimes rather busy.

Once you are here, perhaps you can comment on

- What do you think are Iraq’s reserves, their average sutainable production rate over the next decade, and the cost of this production?

- What is OPEC’s true spare capacity (once the necessary repairs and upgrades have been done in Iraq and elsewhere) and how long can this be sustained for?

- What is the reason for OPEC countries and other such as Brazil, Russia, Mexico not to produce at full capacity? Would changes to the form of the payments they receive lead them to reconsider these decisions?

- How did US demand respond to the elevated price since 2009? How did European demand respond?

- There have been plenty of diplomatic and military events involving oil producing countries during the past decades, for example, sanctions, war and chaos in Iraq, partly sponsored civil war in Libya, sanctions against Iran. Do you think

a) these actions tend to increase production and to secure cheap supply

b) these actions tend to decrease production and to ‘preserve’ supply for the future

c) even if no single entity has an all encompassing geopolitical master-plan, each of these actions has a purpose beyond the storyline reported in the media

d) all these actions are just coincidences of world poltics and we shouldn’t suspect that oil plays any role

I’d be grateful to hear your opinion on this.

Victor

Victor,My attempt at answers inline…

Here are some questions that people should ask: Saudi Arabia. They claim they can produce 12.5mm bbl/day. Until about a year ago, they typically went up to 8mm. The US/UK based oil multinationals have always tried to ridicule the 12.5mm and suggested that the 8mm was already the limit. Now we see them happily pump 10mm. The true answer is probably that with some upgrades, they can go even beyond 12.5mm. Why should they tell the world how much they really have?A: They should tell the rest of the world how much oil they have & what their maximum flow rates are so that they can remove their primary political weapon & leverage from world affairs & make themselves completely at the mercy of consumer markets that they have less influence in. :)

Iraq. Before WW2, it was mostly covered by the Red Line Agreement. Then it was under Soviet influence and technically never fully up to date. They got drawn into the Iran-Iraq war in 1979. Then the second gulf war in 1990/1 and a decade of sanctions. Then 2003. Iraq is still largely unexplored and 'thanks' to three full-scale wars within 25 years, seriously underdeveloped. If peak oil were so threatening, where are the efforts to get Iraq onstream? They can probably produce some additional 10mm bbl/day for a decade. When I watch the news, however, I don't get the impression that it was that urgent.A: That’s why I am a “Cheap” peak oil guy. I think that Peak Oil is a scientific fact. The only question is how much & what types of oil did we start with? Without knowing that, we won’t know until well past peak when exactly we peaked. I think that we "may" have peaked in the last couple of years, but the data shows a plateau Take a look at http://www.theoildrum.com/node/7258 Specifically this chart http://www.theoildrum.com/files/World Oil Production and Average Price.png I would say that we have plateaued, but have we plateaued due to geological constraints? Or do those nasty unpredictable secondary factors come into play? Also is the plateau permanent or temporary? Also how does one define Oil production when they say we have peaked? All very important questions when trying to determine what prices are going to do. Also notice the avg price each year (in 2009 dollars). I wonder if any secondary factors played a role in the price fluctuating from $10 to $60 back to $20 up to $95 & back down to $60? And notice that those peaks and valleys have occurred not just in the last decade , but this chart goes back to 1970. And if you go back further in time you will see similar gyrations. In fact, go study the history of oil and learn about Rockefeller wanting to destroy his competition because he hated the volatility. He knew that if he controlled all aspects of production he could produce oil at a consistent profitable amount. Look at the Texas RailRoad Commission & how they controlled world wide production. Yes, they paid attention to geologic constraints, but they paid more attention to domestic producers in Texas that greased their palms. Again my point in asking my questions of Gregor is how can you dismiss all the secondary factors and not include them in your analysis?

Finally, you should ask why is oil priced and oil trade settled in US$. That's quite a privilege for the dollar, isn't it?Firstly, today oil trade is settled in US$ because it was the case yesterday. But originally, when the US$ went off gold convertibility, it was the main swing producer, Saudi Arabia, who basically had the power to decide. They went for US$. Why? The key to this question is the gold/oil ratio. Note that this ratio has been in the range 10-25 since WW2. As long as the gold/oil ratio remains reasonably low, say <= 20, the oil producers can invest a small portion of their export surplus in gold at a very favourable price. That's enough to agree to settlement in US$.A: Because the Saudi’s wanted gold & US military hardware. Gold to protect them against paper currency and weapons to protect against various threats.

Now the difficulty for the U.S. is that with the introduction of the Euro, there has no longer been any further international support for a low gold price. Take a look at the Washington Agreement in 1999. In fact, the gold price in US$ has been rising since spring 2001. So, unfortunately, the U.S. can keep the gold/oil ratio low only if they accept (and actively maintain!) a high oil price in dollars. Of course, this cannot go on forever simply because the economy wouldn't survive it. But they managed to pull this off until the end of 2011 which is quite remarkable (and quite reckless as well). This is why a potential new Saudi policy favouring a low dollar oil price is so explosive. Oil can easily go down by 30% or more, say to $70/bbl or less. But try this with gold ($1200/oz) and the system might run out of reserves. So the train is heading for a massive concrete wall.A: I got my popcorn ready :) Gak

gak, can you please please stop using "mm" for million barrels? mm stands for millimetre… The correct prefix for million is M, which means Mega.It just annoys the hell out of me…!

Mike

[quote=Damnthematrix]gak, can you please please stop using "mm" for million barrels? mm stands for millimetre… The correct prefix for million is M, which means Mega.

It just annoys the hell out of me…!

Mike

[/quote]

Mike,

m is the Roman numeral for 1000, as in mcf or mmbo. It’s an oil patch thing; s.o.p., get over it

Stan

[quote=Stan Robertson]Mike,

m is the Roman numeral for 1000, as in mcf or mmbo. It’s an oil patch thing; s.o.p., get over it

Stan

[/quote]

No it’s not… it’s M. C for a hundred, X for ten, V for five. But then some people think V is for victory, and X is what you sign when you can’t write…

But we don’t use Roman numerals… Remember?

m is milli, as in millimetre (mm)

c is centi as in centimetre (cm)

d is deci as in decilitre (dL)

k is kilo as in kilogram (kg)

M is Mega as in Megabyte

A million barrels a day is Mbbls/day… and why there are two b’s is beyond me! Must be an oil patch thing!

Mike

DtM,

I am pretty sure that if you take a close look at what I wrote, the only time I used mm was when I directly quoted Victor . I don’t change what people write when I quote them.

Hopefully the chart I linked was up to snuff ![]()

Gak