…of your due dills.http://physics.ucsd.edu/do-the-math/

I plead guilty of writing "mm" for millions. I have no problem switching to "M" if you like that better. I actually do like it better.Secondly, in case someone thinks I am denying that fossile oil is a finite resource - no, I actually know that once you burn it, it is gone. That was not the question. The question is whether you can (1) date "peak oil" around 2007/8 and then (2) conclude that the oil price will only go up from here (about $105/bbl for Brent), except for some <6 month oscillations due to financial market activity. That’s what I am calling bullshit on.

In case you are interested in a quote from the gold trail on this topic. Here is FOA:

FOA (1999-08-06 11:14:24 ID:10496)

[…] It should be clear, by now that the supply of oil to the marketplace was never based on the amount of oil that could come from the ground. Politics and international money values have everything to do with how oil is sold. And these attributes are in a state of constant flux! They don’t control the amount of oil, rather the value of oil.

After all these years and an actual hot war in the middle east, the oil price never went up and stayed up in dollars. As WWC #10461 points out , tanks are as full as ever. Now, suddenly right after the EMU, the price of oil starts rising, as it pulls up the Euro! At the same time, the gold market is sliding into a crisis that, as Mr. Turk wisely observes, has never been seen before?

While many wait for the oil price to come down from "competition" and "the Euro to sink because it could never work", the world reserve currency is being abandoned right before their eyes!

A lot of this is actually even more true today than it was in 1999 when he wrote it.

Sincerely,

Victor

Excellent article by Joe Wiesenthal at Business Insider. You can read the whole thing here http://www.businessinsider.com/why-the-euro-has-been-falling-2012-5

Here are the important bits as it relates to this thread:

Hmm sound to me like currency pairs and producers preferences for a particular currency over another (no pun intended Victor!) may have something to do with what producers do.Citi's Jeremy Hale last year:

Oil prices have been positively correlated with EUR/USD for some time. One reason is the perceived asymmetric policy response by the ECB and Fed to higher oil prices, where the ECB typically responds more hawkishly. Another is that trade flows/ exports to the oil producers favour Europe over the US.

Another key reason he cites is that revenues from oil (accrued to Mideast oil producers) are frequently banked in Euros, creating upward pressure.

So when oil is rising, it's seen as more likely that the ECB will increase (or at least not loosen) monetary policy. And that makes the Euro strong. And when oil is dropping (as it has been lately) the odds that the ECB will cut rates goes up. And that makes the Euro weak.

And how bout this quote:

So rather than seeing EUR/USD as some kind of proxy for the health of the Eurozone (which has been mess for a very long time) think of it as having to do more with the price of oil, and how the price of oil affects monetary policy and currency flows.

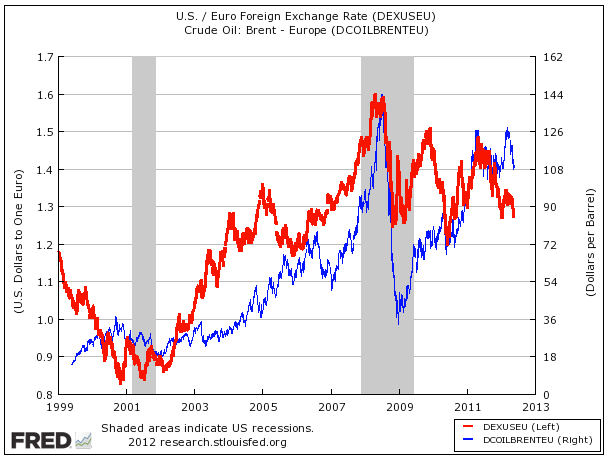

Finally, if you're still not convinced that oil is more important to the euro than the crisis tensions, check out this same chart going back to 1999, since long before anyone thought there might be a Eurozone crisis. The similar movement in the euro and oil is uncanny.

And the chart he references.

So Gregor (or anyone else), please explain again how secondary factors aren’t relevant? And yes, Gregor I did read part II and I agree with 95% off what you wrote (and in general with what you write), but I still haven’t seen you make a convincing case for why secondary factors don’t matter. I think it has been proven that they do.

Gak

P.S. I hope that you email Victor part II so he can comment on it.

Dear Robert Essian,

I’d like to comment on the article by Skrebowski you linked. He writes

"On the latest budget projections Saudi needs an oil price of $90-100/b for its revenues and expenditures to balance and if it is not to run deficits and consume financial reserves. It is likely that many, if not all of the other, Opec members have revenue/expenditure breakeven oil prices comparable to those of the Saudis.

This means that, whatever the public statements, most Opec members now require oil prices around $100/barrel to balance their books and will seek to secure higher prices by restraining supply if necessary. However, under sufficient economic pressure oil prices would fall with severe impacts on Opec budgets."

I’d say he is totally misunderstanding the situation. Since Saudi Arabia only gets paid in dollars, but since they cannot acquire a decent amount of gold at the usual price (gold/oil ratio between 10-25), they have decided to spend all their surplus on various gadgets that are on sale for dollars, including but not limited to US manufactured weapons.

Should the revenues accrue in a different currency, their budget would look differently. Btw you shouldn’t look at their budget, but rather at (1) their trade account and (2) at their production costs.

They could equally well produce at $60-$70/bbl (at which they stil produce profitably - hey, they can probably go for $30-$40/bbl), then purchase gold for a small part of their revenue and forget about spending all that money on gadgets.

He also says

"but there are few, if any, prepared to forgo current income in the hope of greater income at a later date"

as I said I think that basically all of OPEC, plus Mexico, Brazil, Russia, are doing precisely this. Producing at less that the geological limit just because the oil in the ground is much better than dollars in any bank. Only gold in the vault is as good as oil in the ground.

Then, if I am right (btw I am not the first to notice this possibility) and their production has been less than the geological limit for the past 30-40 years, then of course, your estimate of their peak production rate and of their reserves is off as well.

Skrebowski 's article is actually a good example for not realizing that many of his assumptions are the consequences of political decisions rather than necessarily geological limitations.

Victor

Gak,

here is my suspicion about why Weisenthal’s correlation holds:

The gold/oil ratio changes very little (btw: Think about this. There is no reason why this should be the case. In fact, you would expect that the oil price is related to the general price level, but we know the gold price is not. The gold price is independent of economic considerations and only driven by the demand for savings that are free of counterparty risk). So oil is close to gold.

Now it happens that the Euro has a higher correlation with gold than the dollar (if all three are measured in an independent currency, whatever that is). This is because the major theme of the 21st century so far has been the declining global role of the dollar which is being replaced partly by gold and partly by the Euro. Therefore the Euro correlates somewhat with the oil price. In fact, the Euro is the only major currency backed by a gold "reserve" (quotation marks because of the floating price) - some 20% of the outstanding monetary base at current prices by the way, whereas the dollar is backed by gold only at less than 1% of the monetary base (this is because the Federal Reserve has no gold - the U.S. gold belongs to the government and not to the currency).

Finally, why doesn’t the Euro trade lower? This is because the global central banks are shifting their reserves from dollars into euros, knowing that the Euro will survive the coming financial crisis when the dollar loses its reserve role, but the dollar might not. I don’t think the solid performance of the Euro (still more expensive than purchasing power parity) is due to the oil price. It is rather a consequence of central banks buying Euros for dollars.

Sincerely,

Victor

Perhaps a little historical information will reduce the aggravation a bit.When I was a kid just beginning to learn about such things 65 years ago, the metric system was basically unknown in the USA except in science to my knowledge. In commerce Roman numerals were universally used as abbreviations of scale. If I recollect correctly, after the use of M for megahertz and megabits became common in the popular press, M for thousand changed to m for thousand, presumably to not be mixed up with M for million. According to the rule of unintended consequences, mm could be interpreted as meaning millimeters when it was intended as, and context indicated that it was intended as, a scaling abbreviation, not a units of distance indicator. The larger picture, I suppose, is that languages grow like Topsy, and are not necessarily internally consistent.

Best,

JoeM.

G’Day JoeM,You just have to get used to the oil patch acronyms. I’ve never had to use mmbbl/d before, but I always used mmcf/d for measuring the output of a gas wel (million cubic feet per dayl.

Wouldn’t it be grand to use mmbbl/d heaps. The biggest well I’ve come across in the Middle East is 100kbbl/d. Might as well get used to the acronymns. The oil patch has heaps. These are just a few.

Regards,

Woomera

Gregor,

Did you get a chance to take a look at this article?

http://www.businessinsider.com/barton-biggs-saudi-arabia-bankrupt-iraq-iran-2012-5

Snippets relevant to this thread:

I don't know if the Saudi was blowing smoke at Barton or providing purposeful disinformation (either one possible), but this is what I am talking about when I question how you can ignore secondary factors. The article continues:Barton Biggs, the storied hedge fund manager who runs Traxis Partners, recently had an interesting encounter recently over lunch with a Saudi businessman who explained to him the real motivations behind Saudi Arabia's ramp up in oil production and why oil prices will likely continue to fall as a result for an extended period of time.

So now that oil has been under $90 for several days, I guess we have to wait to see if oil stays under $90 more than three months as you stated in your article it could not (part II)."You have to understand our geo-political equation and vulnerability,” he said calmly but intensely.

“Our two most dangerous enemies are Iraq and Iran. Both are Shia, and both are trying to destabilize the Arab world and our Sunni kingdom by funding terrorism. Our only weapons against them are our wealth and our oil. Their current vulnerability is their financial fragility. Their financial reserves are a fraction of ours, and they desperately need money to prop up their economies.

The ruling council has decided that over the next two years we have a brief window of opportunity to impoverish and weaken them by driving down the price of oil. Iraq and Iran need to produce and sell their oil at well over one hundred dollars a barrel. In the next twenty four months, we will gradually increase our production with the objective of breaking the price of crude down to sixty dollars a barrel.

Good luck!

Gak

[quote=JoeMilkedACow] Perhaps a little historical information will reduce the aggravation a bit.

When I was a kid just beginning to learn about such things 65 years ago, the metric system was basically unknown in the USA except in science to my knowledge. In commerce Roman numerals were universally used as abbreviations of scale. If I recollect correctly, after the use of M for megahertz and megabits became common in the popular press, M for thousand changed to m for thousand, presumably to not be mixed up with M for million. According to the rule of unintended consequences, mm could be interpreted as meaning millimeters when it was intended as, and context indicated that it was intended as, a scaling abbreviation, not a units of distance indicator. The larger picture, I suppose, is that languages grow like Topsy, and are not necessarily internally consistent.

Best,

JoeM.

[/quote]

It’s time the US joined the 21st Century. It’s the only country I’m aware of that doesn’t use the SI system. It avoids crashing satellites into Mars for starters…

Mike