Originally published at: https://peakprosperity.com/or-is-it-something-worse/

NOTE: I’m at the IMA conference in Atlanta, and wouldn’t you know it, the markets decided yesterday and today were the right days to melt down? But, as luck had it, Paul Kiker is also at this conference, so after my emcee duties were over, I sat down with Paul in between panels and dinner to record this special episode for you.

Executive Summary

Dow’s plummet of over 2200 points, following yesterday’s losses, signals what I believe to be a 2008-style liquidity crisis. This is a significant event, and if it truly is a liquidity crisis, preparation is key because in such times, everything gets sold off indiscriminately.

Understanding A Liquidity Crisis

A liquidity crisis is not the same thing as a sell-off. It is an event driven by forced selling driven by big-money players who borrowed to juice their returns. It’s all happiness for their returns on the way up (and to the right), but a sudden nightmare when the worm turns. They are extremely rare events, most recently experienced in 2008/09.

After Lehman Brothers’ collapse, we saw a similar scenario where there were no buyers, and everyone was scrambling to close out their positions before they were liquidated out from beneath them by their creditors. This led to a massive sell-off, with the S&P dropping 18% in just four days. The current situation feels reminiscent of that time, with high trading volumes indicating forced selling or deleveraging. It’s a moment where everything, from stocks to commodities, is being sold off, and one of the ‘tells’ is that the usual safe havens like bonds aren’t rallying as expected.

The Role of Leverage and Market Dynamics

Leverage plays a crucial role in these scenarios. Hedge funds and Wall Street players often operate with high leverage, seeking substantial returns. But when the market turns, even a small percentage loss can wipe out their capital, leading to margin calls which, if they cannot be met, lead to forced selling. I believe this is what we’re witnessing now, with massive sell-offs across various sectors. The speed of these market moves is accelerated by algorithmic trading, which now accounts for a significant portion of market activity. This mechanized trading can exacerbate market volatility, as seen in the rapid declines we’re experiencing.

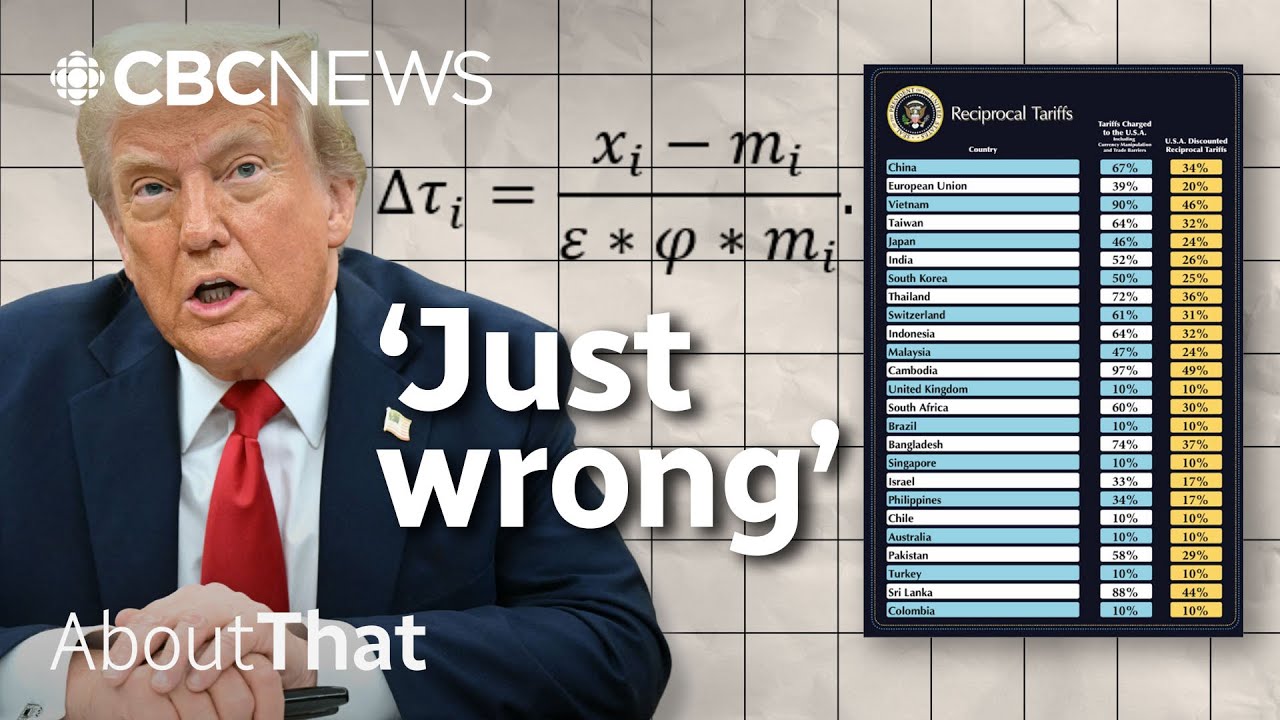

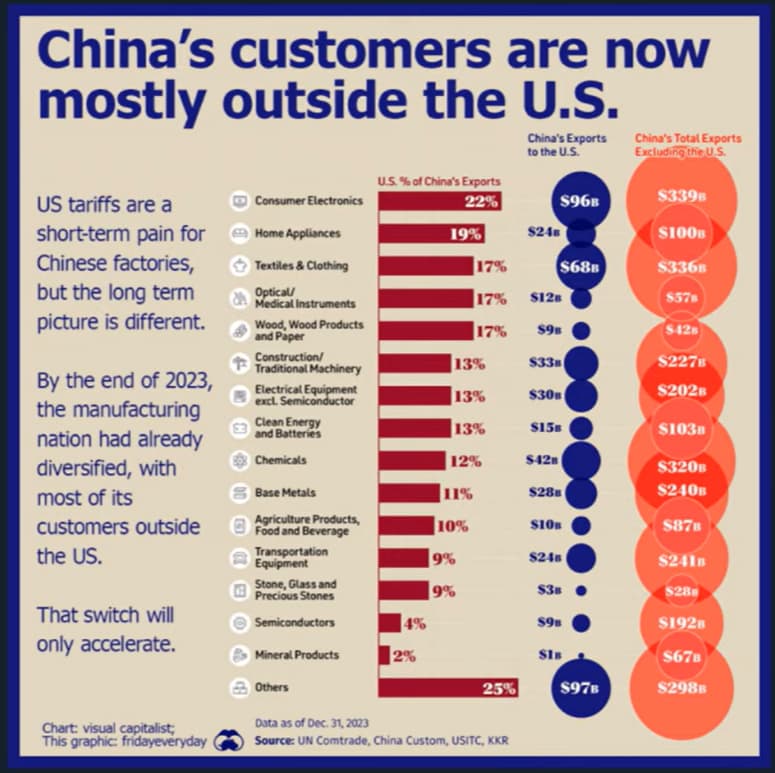

Implications of Tariffs and Economic Shifts

While tariffs are being blamed for the market’s downturn, I don’t buy that argument entirely. The market was already overpriced and primed for a correction. The tariffs might be an excuse, but the real issue is the liquidity coming out of the system. There’s a shift toward supporting labor over capital, which could be contributing to the market’s unease. This shift, coupled with the realization that the Fed might not step in to rescue the market as it has in the past, is creating a perfect storm for a potential recession.

Conclusion

As we navigate these turbulent times, it’s crucial to remain disciplined and manage risk effectively. This is where Paul truly excels.

The market’s current state is a reminder of the importance of having a well-prepared financial strategy. For those who have followed prudent financial management, such as maintaining emergency funds and harvesting profits, this period could present opportunities amidst the disruption. As always, stay nimble and be prepared for whatever comes next. If you’re seeking financial advice, consider reaching out to experts like Paul and his team at Peak Financial Investing. Until next time, stay informed and stay prepared.