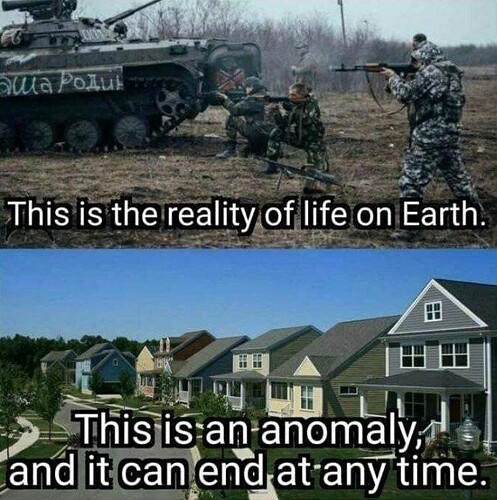

A complete explanation to yesterday’s video. Found in RT.

A great wealth transfer is underway: How the West lost control of the gold market

Pricing power in a market long dominated by Western institutional money is moving East and the implications are profound

The gold price has risen to a series of new all-time highs of late, a development that has received only cursory attention in the mainstream financial media. But as is the case with so much else these days, there is much more going on than meets the eye. In fact, the rise in the dollar price of gold is almost the least interesting aspect to this story.

For thousands of years, gold was the ultimate store of value and was synonymous with the concept of ‘money’. Trade was often settled either in gold itself or in bank notes backed by gold and directly exchangeable for it. Currencies backed by nothing but government decree – called ‘fiat’ currencies – have tended to eventually fail.

However, in 1971, gold found itself cast out of this ancient role when the US unilaterally suspended dollar convertibility into gold as enshrined in the Bretton Woods agreement that established the framework for the post-war economy. Shortly thereafter, in an act that medieval alchemists only dreamed of, gold was created out of thin air in the form of futures contracts, meaning bullion could be bought and sold without any metal changing hands – or even existing.

Besides the obvious ramification of all of this – the removal of gold backing to the dollar and thus implicitly to nearly all currencies – there are two important features of how the gold market has subsequently functioned: first, gold has essentially been reduced to trading like any other cyclical financial asset; second, the price of gold has largely been determined by Western institutional investors.

Both of these longstanding trends are now breaking down. As we will see, the importance of this development is hard to overstate. But let’s begin with a very quick examination of how gold went from being the ultimate source of value to just another ticker moving in predictable patterns in the constellation of financial instruments.

How paper replaced metal

The collapse of Bretton Woods in the late ‘60s and early ‘70s – culminating in the gold window being shut in 1971 – was a messy period of transition, uncertainty, and instability. The dollar devalued and a fixed-rate system was negotiated and soon thereafter abandoned. But what was clear was that the US was steering the world away from gold and Jelle Zijlstra, president of the Dutch central bank, chairman of the Bank of International Settlements from 1967 until 1981, and a prominent figure at the time, recalled in his memoirs how “gold disappeared as the anchor of monetary stability” and that “the road… through endless vicissitudes to a new dollar hegemony was paved with many conferences, with faithful, shrewd, and sometimes misleading stories, with idealistic visions of the future and impressive professorial speeches.” But, he concluded, the ultimate political reality was that the “Americans supported or fought any change, depending on whether they saw the dollar’s position strengthened or threatened.”

Nevertheless, gold was lurking in the shadows like a deposed but still-living monarch and thus represented an implicit guard against the abuse of what had become fiat currencies. If nothing else, as dollars continued to be printed, the price of gold would surge and signal a debasement of the greenback. And this is more or less what happened in the 1970s after the gold window was shuttered. After breaking the $35 per-ounce peg in 1971, gold rocketed all the way up to $850 by 1980.

So the US government had a strong interest in managing the perception of the dollar through gold. Most importantly, it didn’t want to see gold recreate a pseudo reserve currency by strengthening substantially. Legendary Fed chairman Paul Volcker once said “gold is my enemy.” And indeed it traditionally had been the enemy of central banks: it forced them to tighten rates when they didn’t want to and imposed on them a certain discipline.

This framework helps make sense of the rise of the unallocated – i.e. ‘paper’ – gold market in the 1980s and the countless gold derivatives that emerged. This actually started in 1974 with the launch of gold futures trading but exploded in the next decade. What happened is that bullion banks began selling paper claims on gold for which there was no actual gold attached. And buyers were not actually required to pay upfront but could simply leave a cash The setup is reminiscent of the old communist joke that went “we pretend to work and you pretend to pay us.” In this case, the investor pretends to pay for the gold and the seller pretends to own it. This is about as close as you can get to pure speculation.

Thus was born the fractional-reserve paper gold scheme that persists to this day. And indeed, there is now vastly more paper gold than physical, some $200-300 trillion compared to $11 trillion, according an estimate by Forbes magazine. Others put the discrepancy even higher. Nobody really knows. Comex, the primary futures and options market for gold, has also become more paper-driven. According to analyst Luke Gromen, whereas 25 years ago some 20% of the gold volume on Comex was related to a physical ounce, that number has fallen to around 2%.

Gold as just another cyclical asset

What is important to understand here is that the creation of a derivative market satisfies demand for gold that would otherwise go to the physical market. Only a limited amount of gold exists and can be mined but an unlimited amount of gold derivatives can be underwritten. As Gromen explains, when monetary expansion drives demand for gold (due to the inflation this brings), there are two ways this demand can be dealt with: let the price of gold rise as more dollars chase the same amount of gold; or permit more paper claims to be created on the same amount of gold, which allows the pace of gold’s rise to be managed.

There are several important implications of this. The rise of the paper market has clearly played an important role in defanging gold in its role as exerting a hard limit on expansionary policy, thus implicitly reinforcing the credibility of the dollar. But it has also meant that the gold price has largely been determined by investment flows rather than physical demand. And when we’re talking about investment flows, we mean first and foremost Western institutional investors.

Given that gold trades essentially as a cyclical asset, institutional investors have primarily traded gold based on movements in real US interest rates – meaning interest rates adjusted for inflation. Gold is bought when real rates fall and vice versa. The logic is that when interest rates rise, money managers can earn more by switching to bonds or cash, thus increasing the opportunity cost of holding non-interest-bearing assets such as gold. By the same token, lower rates make gold – seen as a hedge against inflation – more attractive. This correlation has been particularly strong over the last 15 years or so and many analysts date it back further than that.

So let’s go a step further and pose the following question: If Western institutional money has been driving the price, who has been on the other side of the trade when actual gold does change hands?

To oversimplify a bit, the model worked roughly as follows, as has been explained by gold analyst Jan Nieuwenhuijs: Western institutions essentially controlled the price of gold and bought from the East in bull markets and sold to the East in bear markets. This makes sense, because the Western side of this trade essentially consisted of investors who in any asset class tend to chase the price higher. The East, meanwhile, was characterized more by consumer demand. Because consumers are price-sensitive, they tend to buy when the price is low and are happy to sell into a rising market.

So gold flowed from East to West in bull markets and from West to East in bear markets. But, as we mentioned above, it was the Western institutional investors who were in the driver’s seat in this trade.

This was the well-established state of affairs up until 2022, which happens to be when the Ukraine proxy war began and the US took the bold step of freezing some $300 billion in Russian central bank assets.

The end of a longstanding correlation

A coincidence or not, what happened that year was that the correlation between US real rates and gold broke down and has not been restored. The first sign of an impending shift was that, in first few months after the Fed embarked on a sharp rate-hike cycle in March 2022, gold did drop but proved much more resilient to the rising rates than correlation models would have suggested. But the real breakdown in the correlation started around September of that year, when gold prices actually started climbing even as real rates remained flat. In fact, from late October 2022 through June 2023, the gold price rose 17%.

Meanwhile, over 2023, US real yields rose (despite quite a bit of volatility), which, according to the old correlation, should have meant a decline in gold prices as higher yields elsewhere would make non-yielding gold less attractive. However, gold rose 15% for the year.

Another notable aspect of this is that Western institutional investors have been net sellers of gold, as evidenced by declining inventory held by Western exchange-traded funds (ETFs) and falling open interest on Comex during the October 2022-June 2023 period mentioned above (when the correlation broke down). In 2023, gold ETFs posted net outflows for the year despite the rising gold price. Meanwhile, so far this year through February, the ETF outflow figure amounted to $5.7 billion, $4.7 billion of which came from North America – all while gold prices have surged to all-time highs.

So coming into focus is a picture of Western institutional investors responding like Pavlov’s dogs to rising interest rates and ditching gold in favor of higher yielding assets such as bonds, stocks, money market funds – you name it. And normally, like clockwork, this would have driven the price down.

But it didn’t. And the two main reasons are the voracious appetite for physical gold on display from central banks and extremely strong private-sector demand for physical gold from China. It is difficult to know exactly which central banks are buying and how much they’re buying because these purchases take place in the opaque over-the-counter market. Central banks report their gold purchases to the IMF, but, as the Financial Times has pointed out, global flows of the metal suggest that the real level of buying by official financial institutions – especially in China and Russia – has far exceeded what has been reported.

According to the World Gold Council, which attempts to track these covert purchases, central banks bought an all-time record 1,082 tonnes in 2022 and nearly matched that figure the following year. By far the largest buyer has been the People’s Bank of China, which as of this past February had added to its reserves for 16 straight months.

Nieuwenhuijs estimates that the People’s Bank of China bought a record 735 tonnes of gold in 2023, about two-thirds of which were purchased covertly. Meanwhile, according to his figures, Chinese private sector net imports totaled 1,411 tonnes in 2023 and a 228 tonnes just in January of 2024.

Where does this all lead?

Let’s now zoom out a little bit and try to put this into some kind of perspective. The first obvious point here is that gold pricing is increasingly being determined by demand for physical gold rather than mere speculation. Let’s be clear: the People’s Bank of China is not loading up on 25:1 leveraged gold futures contracts with cash settlement. Neither is Russia. They’re backing trucks laden with the real thing into the vaults. And in fact we have seen net exports from wholesale markets in London and Switzerland – i.e. representing Western institutional gold. That gold has been moving East.

Nieuwenhuijs argues that the covert gold purchases represent a sort of “hidden dedollarization.” This is being carried out not only because the weaponization of the dollar has introduced a hitherto unimaginable threat to dollar reserves, but also because of the burgeoning US debt crisis, which is looking more and more like a spiral. What is starting to appear as the inevitable endgame of the US debt saga is a lowering of interest rates in order to reduce the cost of funding the government, because the current interest expense is unsustainable. Lowering interest rates and letting inflation surge probably represents the best of a selection of bad options facing US policymakers.

This will, of course, further debase the dollar. For those holding significant amounts of dollar assets, such as China, this is a grim outlook, and it goes a long way toward understanding the current gold-buying spree.

Another aspect to this is that as BRICS countries increasingly trade in local currencies, a neutral reserve asset is needed to settle trade imbalances. In lieu of a BRICS currency, which may or not be forthcoming in the near future, Luke Gromen believes this role is already starting to be performed by physical gold. If this is the case, it marks the return of gold to a place of prominence in the financial system, both as a store of value and a means of settlement. This, too, represents a hugely important step.

As these momentous tectonic shifts take shape, the gold selling by Western investors over the past two years has something of a feel of throwing one’s lot in with the Habsburgs around 1913. The denizens of Wall Street have been slow to understand that the wheel has turned. Mainstream Western analysts have repeatedly expressed surprise that the relentless pace of central-bank purchases has not abated.

There are instances in history when events overtake those living through them and when change is so profound that most observers lack the mental categories to perceive it. In 1936, Carl Jung said: “A hurricane has broken loose in Germany while we still believe it is fine weather.”

The hurricane that is bearing down upon the Western world is the debasement of the dollar owing to the weaponization of the financial system and the spiraling US debt crisis. These are epochal developments that have combined to break the familiar financial world beyond repair. The flow of gold from West to East is both a real transfer of wealth, but it is also symbolic of just how profoundly the West has been underestimating the significance of what is happening.

By Henry Johnston, an RT editor. He worked for over a decade in finance and is a FINRA Series 7 and Series 24 license holder.