Okay, the Fed's recent decision to boost its monetary stimulus (a.k.a. "money printing," "quantitative easing," or simply "QE") by another $45 billion a month to a combined $85 billion per month demonstrates an almost complete departure from what a normal person might consider sensible.

To borrow a phrase from Joel Salatin: Folks, this ain't normal. To this I will add ...and it will end badly.

If you had stopped me on the street a few years ago and asked me what I thought would have happened in the stock, bond, foreign currency, and commodity markets on the day the Fed announced an $85 billion per month thin-air money printing program directed at government bonds, I never would have predicted what has actually come to pass.

I would have predicted soaring stock prices on the expectation that all this money would have to end up in the stock market eventually. I would have predicted the dollar to fall because who in their right mind would want to hold the currency of a country that is borrowing 46 cents (!) out of every dollar that it is spending while its central bank monetizes 100% of that craziness?

Further, I would have expected additional strength in the government bond market, because $85 billion pretty much covers all of the expected new issuance going forward, plus many entities still need to buy U.S. bonds for a variety of fiduciary reasons. With little product for sale and lots of bids by various players, one of which – the Fed – has a magic printing press and is not just price insensitive but actually seeking to drive prices higher (and yields lower), that's a recipe for rising prices.

Then I would have called for sharply rising commodity markets because nothing correlates quite so well with thin-air money printing as commodities.

That's what should have happened. But it's not what we're seeing.

Instead, stocks initially climbed but then closed red. Gold was mysteriously sold in the thinly-traded overnight markets and again right after the announcement in large, rapid HFT blocks that swamped the bids. U.S. Treasury bonds actually sold off on the news. The dollar hardly budged. Commodities were mixed across the board but more or less flat on the day, with the exception of the metals, and especially the precious metals, which were sold vigorously.

The markets are now well and truly broken. Not because they don't conform to my predictions, but because they are no longer sending useful price signals. Instead, my hypothesis here is that the markets are now just a giant and rigged casino, where a relative handful of big firms and other tightly coupled players are gaming their orders to take advantage of this flood of money.

When your central bank badly misprices money and then bids up everything related to bonds, nothing can be reasonably priced. Risk is mispriced; the few remaining investors (as distinct from speculators, which are now the majority) are forced to accept both poor yields and higher risk – so we know the price of everything, but the value of nothing.

QE4

So what exactly is this new thin-air money printing program all about? Well, unlike any prior Quantitative Easing (QE) announcement, this one was tied to a fuzzy and quirky government statistic: the unemployment rate.

QE4 is Just-In-Time Fed Policy to Avoid Calamity

Dec 13, 2012

We got the most thunderous Just-In-Time monetary policy today that is a substitute for the absence of any degree of stimulative fiscal policy.

You might say that QE4 is now going to act as both monetary and fiscal stimulus– another $85 billion worth of Fed accumulations of Treasury bonds and mortgages- that is meant to keep stock prices moving higher and residential home sales climbing briskly.

The goal is to drive economic activity, especially residential home building, so that unemployment drops from 7.7% to 6.5%. The surprise move is meant to signal the Fed’s awareness of the softening economy; it sees the gritty numbers before we do.

Getting unemployment down to 6.5% without inflation rising to a level higher than 2.5% is not expected to happen until 2014 at the earliest. And it could go longer if there is no deal and we go over the cliff.

But, you should know that the only reason unemployment is 7.7% is because hundreds of thousands of males have dropped out of the search for regular work. A very depressing tale.

The key point here is that the Fed is now actively running both monetary and fiscal policy because it will now be in the business of funding nearly 100% of all the new government deficit spending in 2013. And it is pumping a bit more than $1 trillion of hot, thin-air money into the economy as it does so.

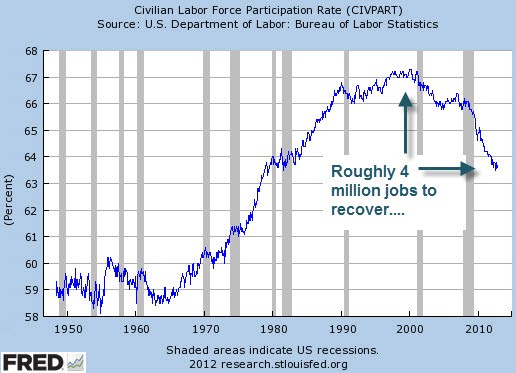

The odd thing here is that by tying their policy to the unemployment rate, we could be in for a very long wait for the stimulus to end. The reason is that the unemployment rate has a couple of moving pieces, one being the number of people who are unemployed, and the second consisting of people who have given up looking for work, which is tracked in something called the 'participation rate.'

As more people leave the labor force and the participation rate goes down, the unemployment rate goes down, too. Somewhat confusingly, as more jobs are created, the unemployment rate goes down, too. As you can see, these numbers work in opposition to each other because as more jobs become available, more people re-enter the work force.

Before the crisis struck, the participation rate was around 66.5%. But now it sits at just 63.6%, meaning that, at roughly 1.4 million jobs for each percent, a bit more than 4 million jobs would have to be created just to absorb the folks who left the labor force but presumably would like to work again. As those 4 million folks come back to work, the unemployment rate will not budge at all.

It will require two full years of 150,000 jobs per month just to absorb the 4 million missing workers, which means that this QE effort will be with us for a very long time. Three to four years is my best guess, and that's only if the economy magically recovers. And I have very strong doubts about that.

This means that the Fed is most likely on track to increase its balance sheet by another $3-4 trillion. Ugh. That's 300% to 400% more money created in the next year than was created than during the entire 200 years following the signing of the Declaration of Independence.

The other part of this new QE policy is that they will continue this as long as inflation remains below 2.5%. Again, this is a very fuzzy government statistic subject compared to the usual massaging and political biases, but it has top billing as the one that is most likely to force an early termination of the thin-air money printing efforts.

However, I remain convinced that the Fed will change any rules and move any goalposts it needs to in order to continue its mad money printing experiment. Because there really isn't any other alternative at this point.

Secretly in the Open

Once upon a time, it would have been considered in bad taste to suggest that the world was being centrally managed in secret by a small-ish cabal of bankers whose actions served to either prop up the excessive spending habits of the very governments that conferred upon them the power to print money, or to bolster the health and profits of the banks they mainly serve.

That was then. Today you can just read about it in the Wall Street Journal:

Inside the Risky Bets of Central Banks

Dec 12, 2012BASEL, Switzerland—Every two months, more than a dozen bankers meet here on Sunday evenings to talk and dine on the 18th floor of a cylindrical building looking out on the Rhine.

The dinner discussions on money and economics are more than academic. At the table are the chiefs of the world's biggest central banks, representing countries that annually produce more than $51 trillion of gross domestic product, three-quarters of the world's economic output.

Of late, these secret talks have focused on global economic troubles and the aggressive measures by central banks to manage their national economies. Since 2007, central banks have flooded the world financial system with more than $11 trillion. Faced with weak recoveries and Europe's churning economic problems, the effort has accelerated. The biggest central banks plan to pump billions more into government bonds, mortgages and business loans.

Their monetary strategy isn't found in standard textbooks. The central bankers are, in effect, conducting a high-stakes experiment, drawing in part on academic work by some of the men who studied and taught at the Massachusetts Institute of Technology in the 1970s and 1980s.

While many national governments, including the U.S., have failed to agree on fiscal policy—how best to balance tax revenues with spending during slow growth—the central bankers have forged their own path, independent of voters and politicians, bound by frequent conversations and relationships stretching back to university days.

If the central bankers are correct, they will help the world economy avoid prolonged stagnation and a repeat of central banking mistakes in the 1930s. If they are wrong, they could kindle inflation or sow the seeds of another financial crisis.

If it feels like you are part of a very grand, high-stakes experiment, congratulations! You're exactly right. We are all collectively prisoner to whatever outcomes are in store.

The rather politely ignored truth right now, at least by most news outlets and politicians, is that the world's central banks have wandered very far off the reservation and are running an experiment that really has only two possible outcomes. One is a return to what we all might call 'normal and stable' economic growth. The second is the complete collapse of the fiat money and their attendant financial systems and markets.

While it is technically possible to achieve some other middling outcome, that possibility has been receding to ever more remote territory with every passing month and new round of money printing.

The basic predicament here is that more and more money is being printed while the world economy, predictably for those who follow the net energy story, has been entirely stagnant and constantly threatening to slip back into economic retreat. Of course, more money + the same amount of (or even less) hard assets = the perfect recipe for inflation.

So the rise of inflation will signal the beginning of the end of this slow-motion tragedy. I use the term 'tragedy' here because it doesn't have to end this way. We have other options; we could make other choices and use our time and resources to try and do something other than maintain a broken financial system that desperately needs to be changed.

In Part II: It's Better to Be a Year Early Than a Day Late, I explain the facts behind why I am more convinced than ever that this all ends in one of the most disruptive financial and currency events ever seen on this planet. And while the repercussions will be felt by all, taking prudent action while there is still time can greatly improve our individual odds of weathering them safely.

Click here to read Part II of this report (free executive summary; enrollment required for full access).

This is a companion discussion topic for the original entry at https://peakprosperity.com/qe-4-folks-this-aint-normal/