Growing up as I did in coastal New England, this old rhyme was drilled into us as children:

Red sky at night, sailor's delight;

Red sky at morning, sailor take warning.

Because many of the people in town still made their living on the sea, the safety of person and property depended on being able to recognize the signs of approaching danger.

A notably red sky at morning is usually due to sunrise reflection off of moisture-bearing clouds, signifying an arriving a storm system bringing rain, wind and rough seas. Those who ignored a red sky warning often did so at their peril.

Red Sky In The Markets

I'm reminded of that childhood rhyme because the markets are giving us a clear "red sky" warning right now. One that comes after (too) many years of uninterrupted fair winds and smooth sailing.

The markets have plunged nearly 8% over just a single week. And the losses are across the board. Nearly every asset class from stocks to bonds to commodities to real estate are participating in the pain. Market displays are a sea of red.

We've written so often and recently of the dangerous level of over-valuation in asset prices (caused by years of central bank intervention) that to re-hash the premise again feels unnecessary.

But the chart below is worth our attention now, as it really drives home just how dangerously over-extended the markets have become. It's a 20-year chart of the S&P 500, showing how it has traded vs its 50-month moving average (the thin green line).

Importantly, the chart also plots the Bollinger bands for this moving average. These are the thin red (upper) and purple (lower) lines above and below the green one.

The simple definition of Bollinger bands is that they are measurements of volatility, and serve as indicators of "highness" or "lowness" of price relative to trading history (a more complex explanation can be found here).

What that means is, when the price of the S&P 500 trades near the upper (red) Bollinger band, that's an indication it's over-priced vs its historic trading behavior. And vice-versa when it trades near the lower (purple) band.

Now, the chart below is important because it shows that over the past 20-years, the S&P 500 has *never* traded above the its 50-month upper Bollinger band -- EXCEPT for the 7 months preceding this one. Simply put, the market had not been more overvalued in (at least) the past 20 years as it was last month:

(click here for an expanded view)

But just as frightening, though, is how the 7% drop the S&P has experienced over the past week has only brought it back to just touch the upper Bollinger band. Despite its recent losses, the S&P is still wildly over-valued.

Said another way: it still has further to fall. A LOT further.

If indeed this is the start of a major correction, one that clears out all "excessive exuberance" as happened in 2001 and 2008, we could well see a retracement down past the 50-month moving average, all the way to (and possibly, briefly, below) the lower Bollinger band.

That would put the S&P somewhere around 1,500-1,600 -- a drop of around 40% from where it closed today.

And as we made the case earlier this week when looking at classic asset price bubble curves, a return of the S&P to a price level below 1,000 can't be ruled out.

Time To Batten Down The Hatches

When a storm arrives at sea, sailors hunker down. They strip, tie fast, and stow everything they can -- then they ride out the storm and re-emerge once it has passed.

This is an excellent model for today's investor. If this week's plunge indeed accelerates into a bear market, simply surviving the carnage with a substantial percentage of your capital intact will constitute "winning".

So, if you still have long positions in your personal or retirement portfolios, what should you be doing at this point?

1) Move To Cash

Get your money to the sidelines. Remember that everything is relative during periods of extreme volatility like now. When everything around you is dropping in value, the relative value of your cash position rises.

Those who had already moved to cash now find they can buy 7% more of the S&P with it than they could a mere week ago. That relative rise in purchasing power will only increase should the markets fall farther from here.

Cash is also offering an improving absolute return as well these days, as interest rates rise. Not that you'd know it from what your bank is offering you (surprising no one, banks have kept depositor rates near 0% despite receiving higher interest payments themselves from the Federal Reserve).

But holding your cash in short-term T-Bills (durations of less than 1 year) through a program like TreasuryDirect is now returning yields of close to 1.5%. That's 25-50 times(!) more than what the average bank savings account interest rate is right now.

Given this high relative payout and the extreme safety of Treasurys (the last financial instrument in the world likely to default, as the US will simply print the money to repay, if necessary), this strategy is a clear no-brainer for those with a material amount of cash.

Those looking to learn more about the TreasuryDirect program, including how to open an account there, can read this primer we created.

2) Prepare Your Action Plan

We have long been loud advocates of working with a professional financial advisor. Now, more than ever, you want to review your action plan with him/her.

If you have remaining long positions, battle test them. How do you expect them to perform in a bear market? If the market falls another 10% from here, what will be the expected impact to your overall portfolio? What if the market falls 25%?

Does hedging make sense as a risk management strategy for you? How about building up a short position with a minority percentage of your portfolio?

Now is the time to address and answer these questions, because if indeed a major correction is nigh, it very well may happen so fast you don't have time to act. (Just ask those holding Bitcoin in January how quickly 50% of your position can vaporize.)

As always, if you're having difficulty finding a firm willing or able to engage in the above with you, consider scheduling a free consultation with Peak Prosperity's endorsed financial advisor.

Also, folks frequently underestimate the effort and time it takes to set up accounts, get funds transferred, etc. Don't set yourself up for the frustration and disappointment of delays should you wait until the midst of a market melt-down to get all this in place. The market may be moving so fast at that point as to make your efforts moot. (Again, talk to the crypto crowd here about their challenges funding accounts and trading through the exchanges last month.)

Instead, get everything set up and prepared now. You don't need to necessarily transfer any funds at this point. But do yourself the service of getting all the administrative hurdles behind you today.

3) Track The Risks & Opportunities Closely

As we've warned for years, we've been living through The Mother Of All Financial Bubbles. When it bursts, the damage is going to be truly horrific.

The ride down in the markets is going to be painful and scary. There are going to be many knock-on effects that are impossible to forecast with precision -- or even to identify -- right now. What will happen with housing, jobs, pensions, entitlement programs, social services, the banking system? All could be impacted.

To what degree? We don't know at this point. Which is why tracking developments in real-time and assessing their likely impacts will be critical.

Similarly, in crisis there is opportunity. There will be speculative opportunities that present themselves during a melt-down (e.g., shorting mortgage insurers during the 2008 crash). And once markets find their bottom and stabilize, there will be the chance to invest in quality assets at fire-sale values compared to today's prices.

Knowing when to deploy your dry powder, and what to deploy it into, will be key.

We'll be doing our best here at PeakProsperity.com every week to offer essential insights to help you stay well-informed and on top of these fast-moving events.

To that mission, we've swiftly assembled a webinar on this coming Tuesday, February 13, 2018 at 8pm EST with Chris Martenson, Axel Merk and several other financial experts to provide in-depth context into the recent market plunge, as well as their best assessment of what to expect from here in the near term. (To learn more about the webinar, click here)

Markets are warning us that even stormier seas lie ahead. Heed that warning, sailor, and hold fast!

This is a companion discussion topic for the original entry at https://peakprosperity.com/red-screen-at-morning-investor-take-warning/

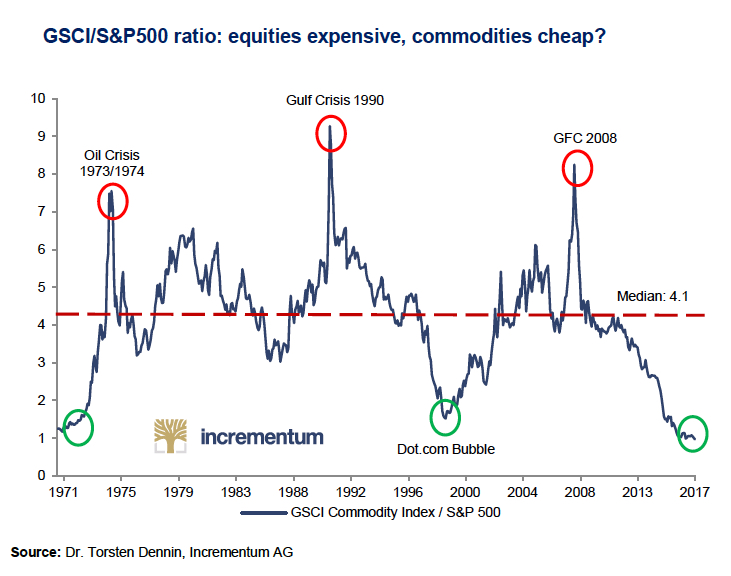

Commodities are at their lowest relative valuation compared to stocks than at any other time in the past half-century. For many reasons, that imbalance can't last. And it will likely be correct by both equities falling AND commodity prices rising.

I do worry that, in the near term, a market melt-down may send commodity prices lower, too, as everything not nailed down gets sold to meet margin calls, etc.

But when they come into their own, I expect the upward re-pricing to be sudden and sharp (meaning: you'll very likely need to have had built your position in advance to participate in it)

Commodities are at their lowest relative valuation compared to stocks than at any other time in the past half-century. For many reasons, that imbalance can't last. And it will likely be correct by both equities falling AND commodity prices rising.

I do worry that, in the near term, a market melt-down may send commodity prices lower, too, as everything not nailed down gets sold to meet margin calls, etc.

But when they come into their own, I expect the upward re-pricing to be sudden and sharp (meaning: you'll very likely need to have had built your position in advance to participate in it)