The title of this blog is not mine, it belongs to Paul Ferrell of CBS Marketwatch who used it in a piece penned and posted yesterday to one of the largest financial websites in the business.

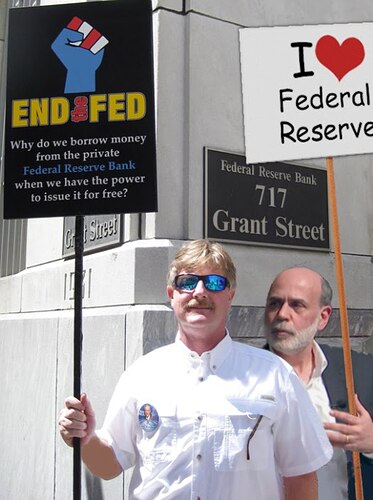

I am reposting a portion of it here because I find it interesting as an indicator of social mood. Let's face it, a growing swath of people are not comforted by the V-shaped return of the stock market but instead see a continuation of the policies and power structures that got us into this mess in the first place.

More and more people are simply fed up with the financial and economic looting that has already taken place and downright angry to see that it is continuing unabated.

To the list of looted items tossed onto an already well-lit bonfire we can now add "the future" and "time" because the various stimulus programs and bailouts have done nothing to get us onto a sustainable path of repair.

But seeing such things openly in print in the mainstream media reveals a profound shift in attitudes.

New bull, new bubble, new meltdown by 2012

Americans are not going to put up with the "Wall Street Conspiracy" ripping off investors and taxpayers much longer. Wall Street got rich sticking us with mountains of debt for generations to come.

Expect a major house-cleaning, a second American Revolution. We predicted the "Great Depression 2" around 2012. Well, we doubt taxpayers will passively sit one more time, like in the 1930s, in 2000, and the past few years. Next time voters will take a page from the history books about past revolutions in the American Colonies, France and Russia. A perfect storm will erupt in a massive global credit meltdown, bringing down Wall Street and the clandestine $670 trillion shadow central banking system. And the collateral damage will be massive and widespread, in areas such as these:

- Lobbyists' power is lethal to our values. Special interests are running and destroying American democracy, will self-destruct.

- Derivatives: Cap 'n trade will crash worse than subprime. The Goldman Conspiracy's spending millions lobbying for trillion-dollar derivatives.

- "Too-greedy-to-fail" big banks will trigger harsh backlash. Banks pay huge bonuses yet modify only 9% of 4 million stressed home loans.

- America's wealth gap will trigger grass-roots rebellion. Wall Street's greed is so pervasive, gluttonous and obvious the rest will rebel.

- The "Goldman Conspiracy" will be a target for retribution. Goldman's hubris is most egregious and flagrant. Their arrogance will backfire.

- Wave of creative destruction will revive commercial banking. Investment bankers are killing commercial banking, Glass-Steagall will return.

- Secrecy protecting Wall Street's unethical behavior to end. Wall Street's control over Washington's lawmaking will come to an end.

- The Fed's shadow banking will collapse under excess debt. Central bank balance sheets overdrawn, feeding new bubble with cheap money.

- A "Black Swan" of huge unintended consequences. Next bubble, highly unpredictable, huge collateral damage on Wall Street.

Make the most of this new bull. Then get out -- before you're the collateral damage.

Part of the anger stems from the fact that it is patently obvious that the entire rescue is aimed at banks, by banks and for banks with any ancillary benefits accruing to citizens a matter of accident.

With interest rates held at zero percent several classes of citizens are harmed. Savers now receive next to nothing on bank deposits and those dependent on cash flow from safe, fixed-income bonds for their living expenses can attest that it is tough going out there.

But banks? Banks love being able to borrow at near zero percent and then loan it out at much higher rates. That is, in fact, the precise recipe for returning banks to financial health.

You might think that banks would carefully tend their public images by sharing some of the bounty offered by the zero percent financing provided central banks, but you'd be wrong.

Banks are making the highest profits on mortgages since records began

11 Aug 2009

The difference between the interest rate that banks charge and the rate at which they borrow is the biggest since the Bank of England started collecting data 15 years ago.

The figures demonstrate that, two years after the credit crunch began, consumers are being hit harder than ever, despite the Bank cutting interest rates to an all-time low of 0.5 per cent.

Last night senior politicians and campaigners called on banks, many of which have been propped up with billions of pounds of taxpayers’ money, to “play their part” by lowering borrowing costs.

Today Mervyn King, the Governor of the Bank, is to unveil his latest quarterly predictions for the economy. He is widely expected to say that lenders are failing to pass on billions of pounds of government support to consumers and small businesses.

According to analysis by Michael Saunders, the chief UK economist at Citigroup, the difference between these rates and the rate banks charge each other is at a record margin. Banks are making a full 2 percentage points of profit on fixed rate mortgages – the first time this has happened, the Bank’s data indicated. Two years ago, lenders made 0.1 percentage points profit on a five-year deal.

At every turn we have banks acting rapaciously and with an extraordinary sense of entitlement and unlimited greed. It is almost as if banks have lost the ability to understand that it is they who live off the efforts of others, not the other way around. Politicians (such as Mr. King above) have remarked and complained about this mind-set and related actions, but so far have proven unwilling to apply any real force to the situation.

Even as public money has saved their profession and individual companies, banks and credit card companies have jacked up fees, yanked lines of credit, and feasted on the widest spreads in decades on their way to posting record profits in some cases.

And so people are becoming angrier and angrier and an increasingly lost Wall Street and Washington DC crowd, hopelessly tone-deaf to everything but the voices in their own echo chambers, seems unable to comprehend why this should be.

Which is why I sincerely hope that the trillions spent have not been utterly wasted and will provide some lasting benefit. Because if it turns out that the trillions have all been thieved or diverted as seems to be the case, and the economy crashes back again, I can easily see the social mood turning just a little bit darker.

Let's hope not.

This is a companion discussion topic for the original entry at https://peakprosperity.com/revolution-coming-with-next-meltdown-2/