Originally published at: https://peakprosperity.com/silver-breaks-out/

After 14 long years, silver has finally busted a move. Today, it cleared and held $39/Oz in the futures pits.

But it wasn’t the only commodity star today, with oil up 2.5%, and other metals such as palladium spiking 7.5% and Dr. Copper adding to the Trump tariff gains and closing at $5.62/lb.

As a long-time holder of silver and a more general advocate of holding hard assets, let me put this as plainly as I can…you need to be in hard assets.

The Trump administration, besides injecting chaos and uncertainty with their trade and tariffs negotiations, has also thrown in the towel on spending restraint. The Big Beautiful Bill seeks higher growth by stimulating more investment and spending.

That might work, it might not, but one thing is sure – we’re going to get more spending and that’s going to lead to higher inflation.

So one signal the commodities are sending by rearing up their heads like this is that you should prepare for more inflation. That leads to hard assets like gold, silver, & inflation hedges like energy.

But the other signal that is being sent has been with us since February 2022, when the Biden administration shook the world by freezing Russia’s official foreign reserves.

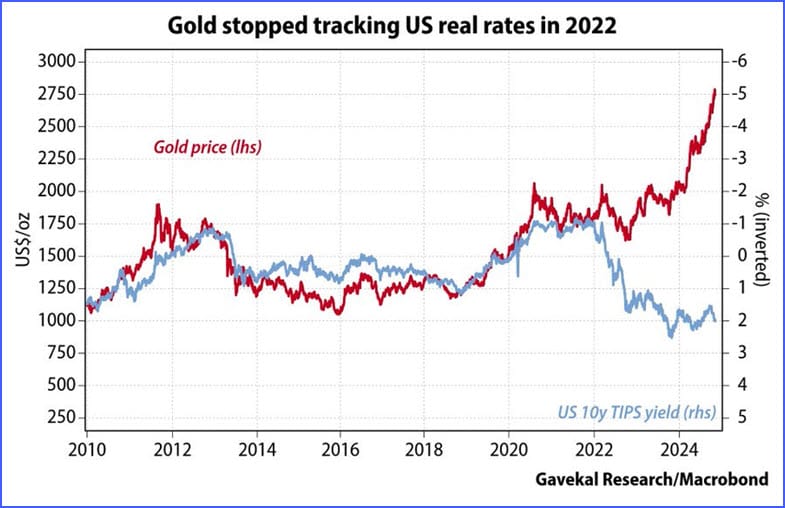

That lit the fuse for the explosive rise in gold, as well as what we’re seeing today. This is completely obvious on this chart:

For my entire history holding gold, it has always followed this chart of being the inverse of real interest rates. If real rates were negative, gold went up. If real rates were positive, gold went down. In other words, gold was behaving like money and it stalked the real cost of US money like a love-crazed fan.

But then the Biden administration came along and wrecked that relationship, permanently.

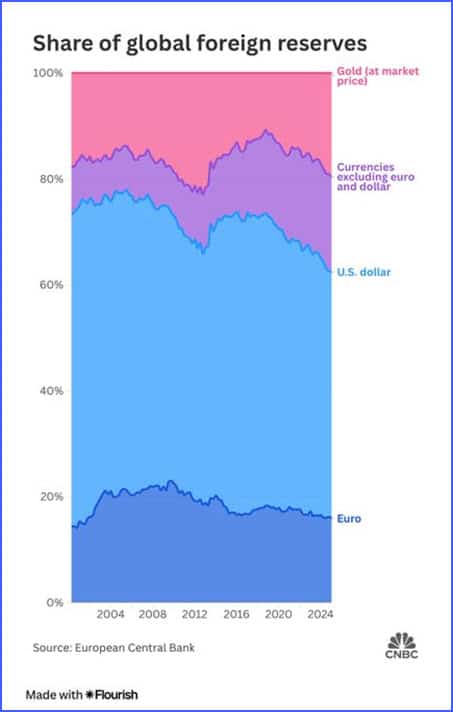

Which sets the stage for this chart, showing that the US Dollar now is now less than 50% of global foreign reserves for the first time in your lifetime.

So all of this says that there’s a sea change underway, and silver’s price is reflecting that.

How high will silver go? How big are the changes underway? If the old rules applied, I’d be somewhat muted, but the old rules are out the window, so I’m going to be quite vocal.

YOU NEED TO BE IN HARD ASSETS!

The chances of the US dollar and financial system remaining intact are not good. We already had massive math problems baked into the prior decades of debt accumulation, and that alone set the odds against an acceptable conclusion. That alone was a major hurdle to overcome.

On top of that, the US is under a sustained attack from within, and it’s tearing us apart. These attacks are not accidental, but rather being actively pushed by various people and entities who, I suppose, hope to gain somehow from the chaos. Otherwise, why do it?

But with a sustained attack along multiple cultural fronts too and no organized resistance? That’s a bit too much to absorb. So, it’s time to become resilient, and it’s time to own hard assets.

And, oh yeah, plant a garden.