Originally published at: Speculation Run Amok: Complacency, Then Crisis – Peak Prosperity

Executive Summary

Chris and Paul discuss the economic challenges facing Europe, particularly the rising cost of gas and its implications for industry, especially in Germany. They also touch on the U.S. stock market’s bullishness despite economic indicators suggesting caution. The conversation includes a critique of past and current economic policies, particularly those related to energy and fiscal management, and the potential risks and opportunities for investors in the current climate.

Europe’s Energy Crisis

They discuss the potential impact of rising gas prices in Europe, particularly due to reduced gas transit from Russia. This situation poses a significant threat to European industries, especially in Germany, which is already facing economic challenges. The conversation highlights the lack of viable alternatives for energy in Europe, given the current state of renewable energy technologies and the political stance against fossil fuels.

U.S. Stock Market Bullishness

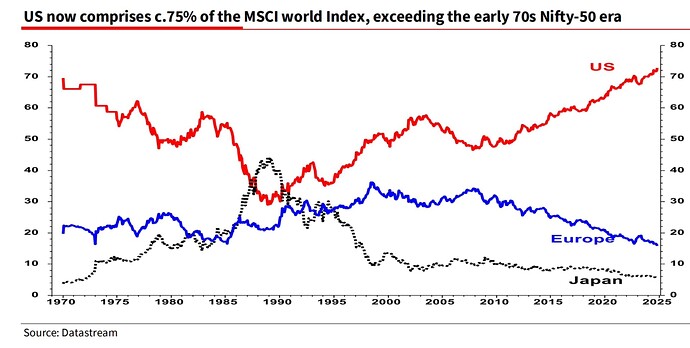

The discussion shifts to the U.S. stock market, where Chris notes an unprecedented level of retail bullishness. Despite economic indicators suggesting caution, the market continues to rise, which Chris and Paul attribute to speculative behavior fueled by past central bank policies. They express concern about the potential for a market correction, given the current economic backdrop.

Key Data

- Europe may lose 10.9% of its gas supply due to reduced Russian transit.

- Germany’s industrial production is at its lowest since 2006.

- The U.S. stock market is at a 200% ratio of stocks to GDP, a historically high level.

- Interest payments on U.S. federal debt are reaching unprecedented levels.

Predictions

- Europe’s energy crisis could lead to further industrial decline in Germany.

- The U.S. stock market may face a correction due to speculative excess.

- Economic power may shift from the West to the BRICS and Eastern countries.

Implications

- Rising energy costs in Europe could lead to higher prices for goods and services.

- Potential job losses in energy-intensive industries in Europe and the U.S.

- Increased financial strain on U.S. taxpayers due to rising interest payments on national debt.

Recommendations

- Build a financial war chest to prepare for potential economic downturns.

- Focus on long-term financial planning and risk management strategies.

- Seek wise financial advice and avoid speculative investments.