Originally published at: https://peakprosperity.com/stagflation-has-arrived-job-weakness-is-apparent-and-stocks-party-on/

Howdy!

After a much-needed back-country vacation, where my phone was an intentional brick, I’m back with another episode of Finance U with Paul Kiker of Kiker Wealth Management.

Today, we dove deep into the current state of the economy, and I’ve got to say, things are looking nuttier than ever. I’m currently struck by the disconnect between the rosy narratives we’re hearing—like Trump’s claims of an economy “on fire”—and the hard data that’s screaming the opposite.

Data like extreme weakness in the employment data and a powerful surge in ‘prices paid’ for services, which are a powerful sign that inflation is back on the rise.

I’m feeling a strong sense of unease, and I know many of you are too, as we keep hearing that something just isn’t adding up.

First, let’s talk jobs. The labor market is showing serious weakness. BLS data indicates job growth is a measly 0.97% year-over-year, a level that historically signals recessionary territory.

Further, white-collar workers are struggling to find employment, with some searching for 60 to 90 days without luck. Where NAFTA stole blue-collar jobs, AI is now stealing white-collar jobs. Talk about bad luck! The non-elite socioeconomic classes just can’t seem to catch a break.

But it goes beyond services. Manufacturing indices are also in contraction, and job openings on platforms like Indeed are down 35% from their peak. On top of that, the BLS had to revise their numbers for May and June down by a whopping 258.

That’s a massive “oopsie,” and it’s no surprise Trump fired the BLS director over it. I’ve always been super-skeptical of the official numbers—ADP’s real-time payroll data seems more reliable, and it’s showing negative prints too.

So, given the labor weakness, how do we make sense of the market euphoria? Despite the many flashing warning signs, retail investors are buying with abandon, perhaps fueled by a belief that the Fed will cut rates and save the day.

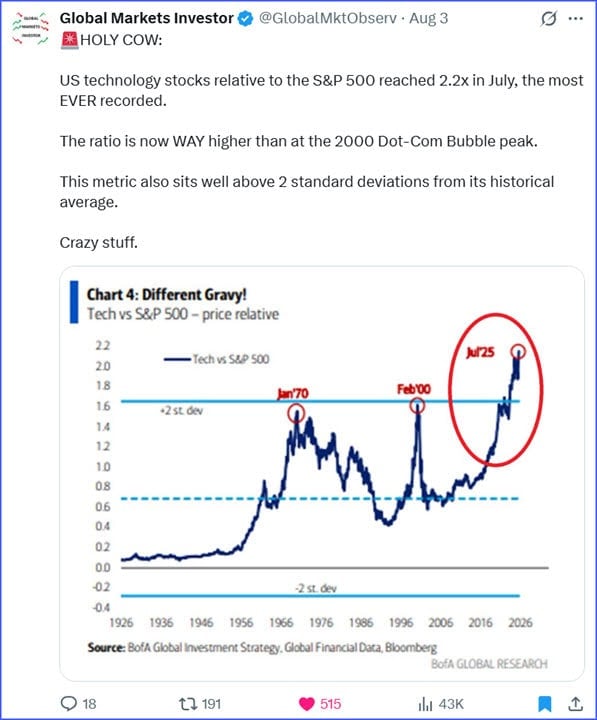

But I’m not so sure. Cutting rates might inflate the equity bubbles further without addressing underlying issues. But then again, stocks are at (literally) unprecedented valuations—tech stocks are 2.2 times the S&P 500, higher than the 2000 dot-com peak.

(Source)

Holy smokes!!

I guess “this time is different?” The average investor had better hope so (and ‘hope’ isn’t a strategy, FYI).

Maybe, but history says “No,” quite convincingly.

Companies like Palantir are trading at 300x forward P/E, and a $60 million revenue beat added $15 billion in market cap overnight. Again, Yikes! That’s frothy, folks. I’ve lived through bubbles before, and this feels eerily familiar.

Housing is another mess. There’s a huge gap between sellers and buyers—500,000 more sellers—and sales are slow because prices haven’t dropped. Insurance costs are skyrocketing, with some homeowners paying over half their mortgage just for coverage and taxes. I dug into claims that climate change is driving these hikes, but the data on hurricanes and flooding shows no significant increase. I suspect it’s more about inflation and insurer greed than weather. Meanwhile, household debt hit $18.39 trillion, with auto and mortgage debt soaring. People are hanging on by their fingernails.

Stagflation is the word on everyone’s mind, defined as stagnant growth paired with rising inflation. Think ‘weak jobs’ but also ‘more expensive housing and steaks.’

The ISM services PMI barely shows expansion in terms of new orders, while prices paid are spiking near 70, reminiscent of early 2008. Employment in services is contracting, and new orders are flat.

What ‘stagflation’ means for most Americans is “life is getting harder” – 73% now say that buying a home is tougher, and 65% struggle to pay bills.

I’m heartbroken by stories like a woman facing $2,627 monthly health insurance, forced to choose between her house and coverage, who now says that she’s given up, that the system is rigged against her. This system feels predatory because it is predatory.

Paul and I agreed that it’s time to build resiliency. I’m not saying sell everything, but taking some chips off the table to create a 12-24 month emergency fund seems prudent and wise.

Market cycles always turn, and with margin debt now over a trillion, the fall could be brutal…and fast. I’m counseling my own family to wait out this housing market, rent for now, and prepare for opportunities when blood’s in the streets, as Buffett advises. Whether it’s a deflationary crash or hyperinflation, pain is coming. I believe education and risk management are key—don’t let euphoria blind you.

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOR PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.