Originally published at: Stock Prices: Are They For Real or is this a Crack-Up Boom? – Peak Prosperity

Welcome to this edition of Finance University with Chris Martenson and Paul Kiker.

Have you ever felt like the stock market is more of a riddle than a science, more of an enigma than a predictable cycle? Well, you’re not alone.

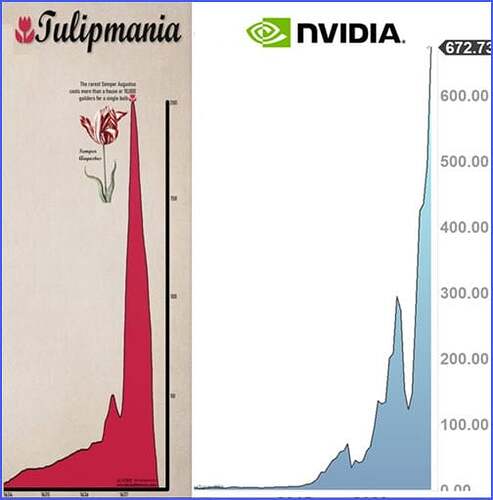

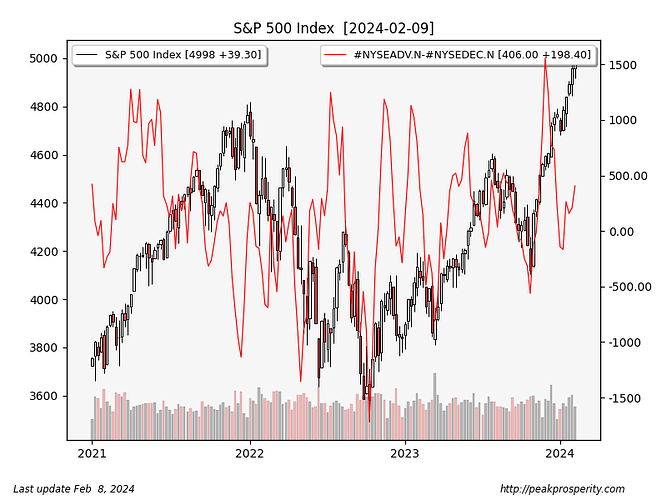

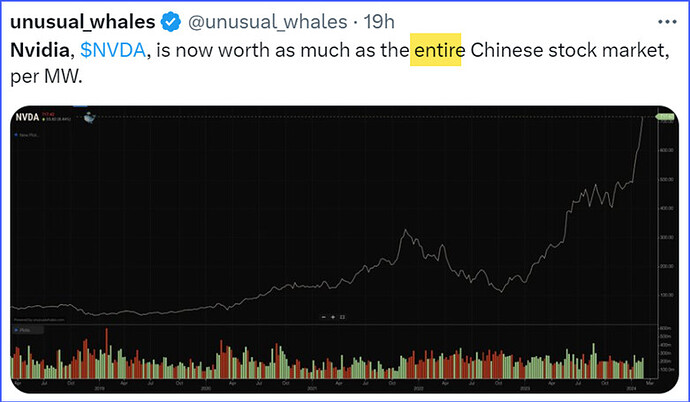

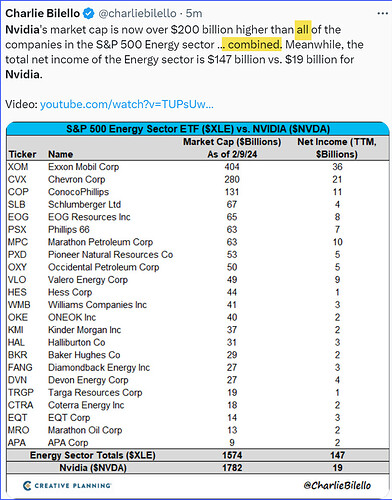

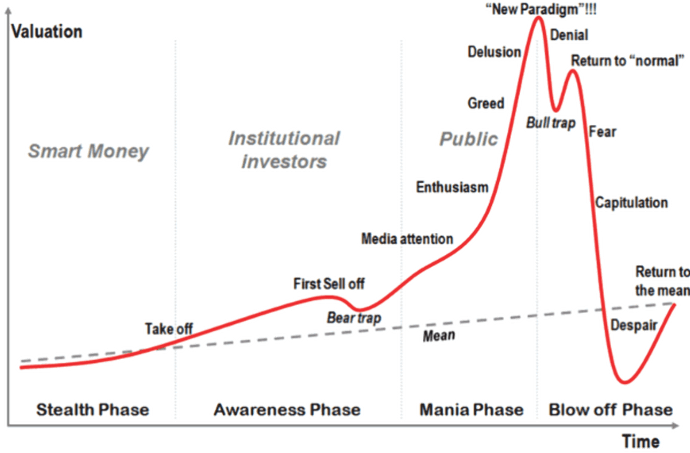

Recently, we’ve been seeing some peculiar trends that are making even the most seasoned investors scratch their heads. From the shift in the stock market from being a discounting machine to now acting as a liquidity measure, to the uncanny resemblance of Nvidia’s stock charts to the notorious tulip bubble mania and the internet craze, it seems like we’re in a whole new world.

But hey, isn’t that the beauty of the markets? They’re constantly evolving, throwing curveballs at us when we least expect them. Like that time NASDAQ closed below those all-important levels back in October, signaling a downside risk. Or when our old friend, the Fed, decided to cut rates, causing a flurry of repositioning in portfolios and injecting a fresh dose of momentum into the market. It’s like a rollercoaster ride, isn’t it? But don’t worry, we’re here to make sense of it all, one crazy market trend at a time. So buckle up, and let’s dive into the thrilling world of stocks and markets!

Peak Prosperity endorses and promotes Kiker Wealth Management’s financial services. To arrange a completely free, no-obligation discussion of your personal financial circumstances and goals with someone who speaks your language and thoroughly shares your outlook on the world, please click this link to go to Peak Financial Investing to begin the process.

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOT PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.