"Straight Talk" features thinking from notable minds that the PeakProsperity.com audience has indicated it wants to learn more about. Readers submit the questions they want addressed and our guests take their best crack at answering. The comments and opinions expressed by our guests are their own.

This week's Straight Talk contributor is Frank Barbera, one of the top experts on precious metal mining companies and editor of the respected Gold Stock Technician newsletter. In his analysis for investors, Frank overlays a macro outlook on top of highly-rigorous technical analysis, and employs a market-timing based approach to reduce the inherent volatility within this high-beta sector. For many years Frank has also managed private equity capital, most notably for the Caruso Fund, with particular focus on precious metals, energy and currencies.

This week's Straight Talk contributor is Frank Barbera, one of the top experts on precious metal mining companies and editor of the respected Gold Stock Technician newsletter. In his analysis for investors, Frank overlays a macro outlook on top of highly-rigorous technical analysis, and employs a market-timing based approach to reduce the inherent volatility within this high-beta sector. For many years Frank has also managed private equity capital, most notably for the Caruso Fund, with particular focus on precious metals, energy and currencies.

p.p1 {margin: 0.0px 0.0px 6.0px 0.0px; font: 13.0px Verdana}

1. How do you view gold and silver prices at current levels?

Gold and Silver both look to be in fairly good shape technically, with Gold still acting exceptionally robust.

For the GLD ETF, there is strong support at $143, and prices are consolidating in orderly fashion. We are concerned that some kind of exogenous shock in the Middle East, possibly between Saudi Arabia and Iran, or Israel and Iran could emerge to push up oil prices and gold prices. The commodity markets seem like a coiled spring, and while it is possible that a further correction could play out, we believe it is just as possible that prices push forward to new highs on any number of potential sparks. The unraveling of the Euro and proximity to another round of Greek bailout monies could also easily act as a bullish tonic to precious metals. SLV is definitely weaker then gold right now, and seems range-bound with $38 resistance and $31.80 to $32 as support. Sentiment on gold is a tad bit high, but nothing that would cause us alarm given the extraordinary extremes that have been readily sustained in the past 18 months, while sentiment on silver is trending down toward the low end (pessimism) of the range. Hold all metal-related investments.

2. Precious metal mining equities have underperformed the physical metals so far this year. Typically they exhibit greater movement in whichever direction metals prices are trending, due to their leverage. Do you expect this historic correlation to resume anytime soon?

Over the last few days, gold stocks have been dragged down on the back of a sinking equity market, and this decline came on top of a prior outsized decline that had beset just the precious metals miners. In a way, the mining stocks are almost doubly bombed-out, because not only are they oversold in an absolute nominal sense on their own accord, but they are also oversold and depressed relative to the market. Late last week, we noted that the GDX broke below its prior May 13th low at $53.37 but never below the January 25th low at $52.46. Often, we can see a quick throw over decline, where a prior reference low is temporarily broken effective hitting any number of closely placed stop losses, followed by a rapid upside reversal back above the “broken” low. This can make it easy to be early in prognosticating a breakdown, or a early in calling a bottom. We decided that giving the market a little more leeway was probably the best idea. Over the last few months, we have noted that the gold stocks have been slipping down the ladder of the Investors Business Daily Sector Group Rankings list, ending this week at #146 of 197 sector groups, while the broader category of Metal Ore Mining is #167 or 197. Mining seems distinctly out of fashion, and maybe, just maybe, that could be a good thing. As with the S&P, we can see that the dollar-weighted GST Short Term Ratio of Put to Call Premiums is deeply oversold, and ended the week above 1.50 with a close on Friday of 1.801. This, along with a new TRIN that is now all the way back up above 1.60 suggest that sentiment from a contrary point of view is excessively bearish, and this implies that like the stock market and the precious metal mining stocks are due for at least a sharp near-term trading bounce. After a sharp bounce, we would not be surprised to see still more downside ahead, as the bias toward risky assets seems to be in the act of an important cyclical shift and the deflationary risks in Europe seem to be getting stronger. While we still believe that early July will see some kind of Greek aid package, the situation in Greece now hangs on the delicate balance of political outcomes such as whether the current Prime Minister can get enough of the parliament to support ongoing deep austerity cuts. Should that support fall away, a major banking crisis could be unleashed upon the world, and that would be very difficult on risk assets like the mining stocks. Precious metals are apt to thrive and surge ahead in such an outcome.

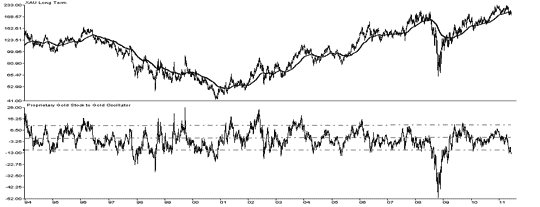

But, in the immediate term, the selloff in mining stocks appears overdone, especially by historical measures. For example, the ratio of gold stocks (bottom) to the price of gold (top) below is entering oversold territory:

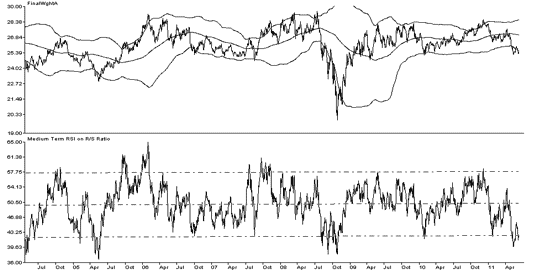

Another intersting view of the mining stocks shows that assets in the precious metals stocks stands at near multi-year lows while precious metal fund assets as a percent of all Rydex sectors is also near absolute low levels.

3. What do you see as the biggest drivers of the price of the metal and mining stocks over the next several years? What key indicators will you be watching most closely?

It is possible that the world is heading for another “risk off” de-leveraging crisis, in which case all equities could be in a for a difficult path ahead. However, if we do get a heavy dose of deflation, investors need to understand that government revenues will eventually fall and at some point, the money printing will return as government will need to print the money necessary to maintain essential services. This will breed inflation and we suspect that the next time an inflation cycle begins it will be exceptionally powerful and mining stocks will join the party as key leadership, potentially experiencing an 'Internet mania'-style parabolic advance. In the case of the mining stocks, the advance may pack even larger percentage gains in a shorter period of time, as the fear of inflation and currency debasement may be overwhelming. For now, while there is still a chance that a QE3-type outcome could develop in the weeks ahead, it is looking more and more as though equity markets are slipping into a 2008-style bear market. That was tough on a every sector including precious metals miners and we would treat these shares cautiously at this time.

4. Some investors are shying away from mining stocks because they fear they will be brought down along with other equities if the stock market experiences another major decline like the one seen in 2008. You've begun mentioning the growing odds a 'bifurcated' stock market, where resource stocks rise as the overall market falls. Apparently there's historic precedent for this?

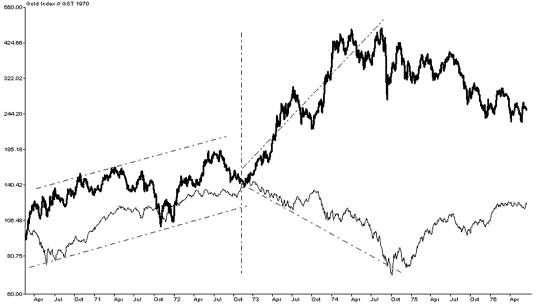

Well, there is historic precedent for this going back to the 1970’s when the world went through a long period of stagflation like it is experiencing today:

However, at the moment, we are not yet seeing enough evidence to feel confident that the precious metals stocks will successfully decouple as volume on rallies has been drying up and expanding on declines. This suggests that while a sharp short-term rally could develop as a result of the near-term oversold condition, once that rally has run its course, we may see the stocks reverse back to the downside and move in downward alignment with the major averages as happened in 2008. While we don’t expect it at the moment, we are watching carefully each and every day for any signs of decoupling, as that would be a huge positive for mining stock investors. For now, we are still cautious.

5. For the average investor concerned about preserving purchasing power in today's environment, what advice would you offer? How about investors with a higher-risk tolerance looking for returns?

My real advice for most investors is to be conservative right now, even for those with higher risk tolerance. In a bear market, he who loses least wins, and we are tap dancing on the edge of a new bear market right now. Just look at the S&P and its close proximity to 1260 and the 200-day moving average. In my view, the S&P could bounce toward 1310-1325, but that may be the next area for a failing high, and then we could roll over and see a much larger decline. I believe everyone should be working on setting up a basic physical long position in gold and silver, where using a dollar cost average entry approach over many months is probably the path of least regret.

If you have not yet seen the other articles in this series, you can find them here:

- Straight Talk with Frank Barbera: Time to Seek Defense Against 'Hyper-Stagflation' - 6.20.11

- Straight Talk with Jesse: Concentration of Wealth & Power Is the Root Problem - 3.28.11

- Straight Talk with John Rubino: The Damage Is Already Done - 3.22.11

- Straight Talk with Catherine Austin Fitts: We Are Victims of A Financial Coup D'Etat - 1.30.11

- Straight Talk with Paul Kedrosky: Don't Depend on Technology To Save Us - 1.21.11

- Straight Talk with Tyler Durden: The U.S. Is Free-Falling Into Bankruptcy - 12.15.10

- Straight Talk with Charles Hugh Smith: Why The Status Quo is Unsustainable - 12.05.10

- Straight Talk with G. Edward Griffin: What's Coming Next Isn't Pretty - 11.29.10

- Straight Talk with James Howard Kunstler: The World is Going to Get Rounder and Bigger Again - 11.17.10

- Straight Talk with Steve Keen: It's All About the Debt - 11.09.10

- Straight Talk with Mike Shedlock (aka "Mish") - 10.26.10

Readers can submit their preferences for future Straight Talk participants, as well as questions to ask them, via the Straight Talk forum.

This is a companion discussion topic for the original entry at https://peakprosperity.com/straight-talk-with-frank-barbera-time-to-seek-defense-against-hyper-stagflation-2/