"Straight Talk" features thinking from notable minds who you, the PeakProsperity.com audience, have indicated that you want to learn more about. Readers submit the questions they want addressed and our guests take their best crack at answering. The comments and opinions expressed by our guests are their own.

This week's Straight Talk contributor is G. Edward Griffin -- political lecturer, film producer, and author. In his best-known book, The Creature from Jekyll Island, Griffin details how money is created and exposes the anything-but-boring history of how the Federal Reserve came into being. The book provides one of the best explanations of how our monetary system works, as well as a prescient foreshadowing of the Fed's bailout of the financial system at taxpayer expense.

p.p1 {margin: 0.0px 0.0px 6.0px 0.0px; font: 13.0px Verdana}

1. Practically everything that you outlined in your book The Creature From Jekyll Island has come to pass. Bailouts, increased centralization of power, all of it. Now what happens? We are having a hard time envisioning the current debt-based fiat money system surviving for much longer (let alone forever). If not fiat money, then what? What are the next moves for those who might wish to see the continuation of their extremely lucrative franchise?

GEG: What happens next also is portrayed in my book, and it isn't pretty. It is a total collapse of the old order replaced by a command economy and a loss of meaningful personal freedom. All collectivist systems end that way. There is no escape as long as collectivists continue to be in power and make the decisions. A change to the Republican Party majority will change nothing except party label. Most Republicans are collectivists, as are most Democrats.

2. Robert Zoellick of the World Bank recently ruminated on the possibility of resurrecting the gold standard. Some claim that there's not enough gold to serve this purpose; you've claimed otherwise. Could you explain?

GEG: First, the World Bank does not want a true gold standard because that would limit the degree to which local banks can lend money, and that would greatly reduce their ability to make money. Beyond that, there is plenty of gold in the world, most of it not yet mined and/or in personal hoards, to supply enough gold to back our currency. Scarcity of gold is what makes it valuable and why it is an ideal backing for money. The less there is, the more valuable it is. The argument that there is not enough gold is spurious. Any amount will do, but a free market will motivate miners and hoarders to produce just the right amount to balance supply against demand. The problem is not the amount of available gold, but the demise of the free market.

3. In your book, you said that the various Central Banks and other world organizations want to get all countries onto a single global currency. Then why are the governments and banks attempting to fix the current system through more money printing and stimulus? Why not just let it collapse to hasten the demand for a universal currency?

GEG: I believe that they do not want the national currencies to collapse until the global system is in place to replace it. They are working on that now, and I feel that the time to jettison national currencies is drawing near.

4. The Fed just celebrated the 100th anniversary of the “meeting that never happened,” that led to its creation, with a lavish party on Jekyll Island. Some say they’ve achieved much of their original secret goals; some say the Fed won’t survive ten more years. What are your thoughts here?

GEG: In my view, they have achieved far more that they thought was possible when the Fed was formed in 1913. They have every reason to celebrate. However, the game has changed now, and I think the bankers now are ready to allow the Fed to become merely a second-level component of a global central bank. If opponents of the Fed are successful, it will be abolished as soon as possible. If they are not successful, it will last indefinitely as part of the global system.

5. To what extent is the current economic mess the logical, expected, even mathematical conclusion to a debt-based money system, and how much is this simply due to operating it poorly? That is, are we experiencing a design flaw, or operator error?

GEG: It is a design flaw. There could be no other outcome. However, it is more than likely that the creators knew that from the beginning and proceeded anyway. We must remember that the Fed is a banking cartel. As such, its primary objective was never to stabilize the economy, but to benefit members of the cartel. In that sense, it was not even a design flaw.

6. Assume for the moment that oil drives economic expansion and that oil is a finite resource. At some point the rate of oil extraction will peak and then decline. Yet our entire financial edifice relies upon a constant (if not exponential) increase in debt. If tomorrow's growth is the collateral for today's debts, and growth depends on oil…well, how do we square that circle? What happens to (1) today's debts and (2) the money system itself (assuming it is deprived of dependable growth)?

GEG: I cannot accept the assumption that growth is dependent on expansion of oil resources, or, if it is, that the supply is soon about to peak. That aside, expanding government debt and the Fed's role in making that possible is a classic Ponzi Scheme in that it depends on an increasing demand for money greater than the expansion of goods and services. This is not really growth; it is merely postponing the day of reckoning and increasing the size of the loss.

7. How do you see the next few years playing out for the US economy?

GEG: The patient cannot be kept alive much longer by administering more of the toxic drugs that cause his illness in the first place. As long as the quack doctors (politicians and bankers) are retained to administer the therapy, there is no hope for recovery. The exact time frame is unknown, but it is near.

8. What question didn’t we ask, but should have? What’s your answer?

GEG: What to do about it?

Answer: Inform the people about the true nature of the crises, the true cause, replace all the politicians who have tolerated or supported the Fed, and then replace the Fed with an honest and responsible banking system without the ability to legally plunder the people. Really quite simple, but not easy. We have much work to do.

If you have not yet seen the other articles in this series, you can find them here:

- Straight Talk with G. Edward Griffin: What's Coming Next Isn't Pretty - 11.29.10

- Straight Talk with James Howard Kunstler: The World is Going to Get Rounder and Bigger Again - 11.17.10

- Straight Talk with Steve Keen: It's All About the Debt - 11.09.10

- Straight Talk with Mike Shedlock (aka "Mish") - 10.26.10

PeakProsperity.com readers can submit their preferences for future Straight Talk participants, as well as questions to ask them, via the Straight Talk forum.

This is a companion discussion topic for the original entry at https://peakprosperity.com/straight-talk-with-g-edward-griffin-whats-coming-next-isnt-pretty-2/

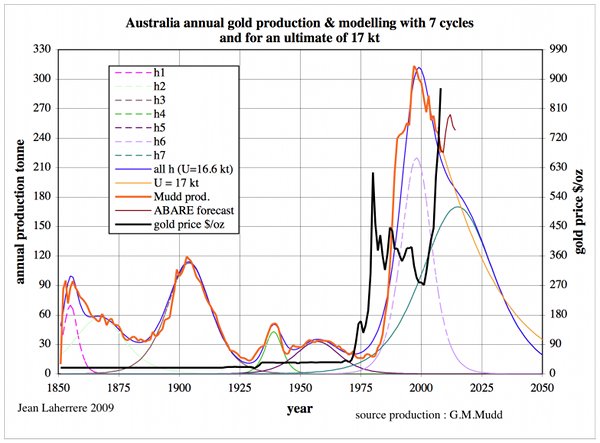

Figure 21: Australia annual gold production & modelling for an ultimate of 17 kt.

Figure 21: Australia annual gold production & modelling for an ultimate of 17 kt.

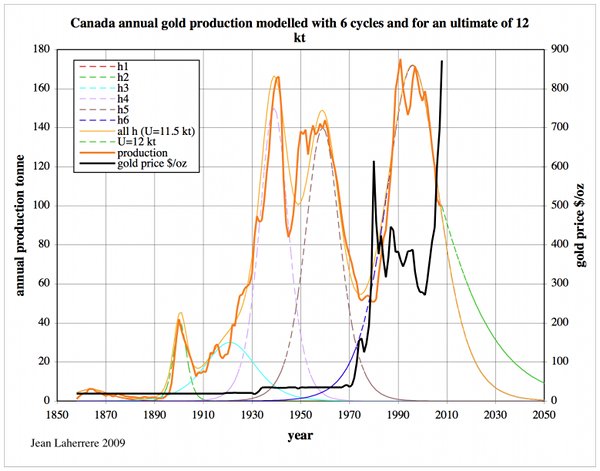

Figure 17: Canada annual gold production and modelling for an ultimate of 12 kt

Figure 17: Canada annual gold production and modelling for an ultimate of 12 kt

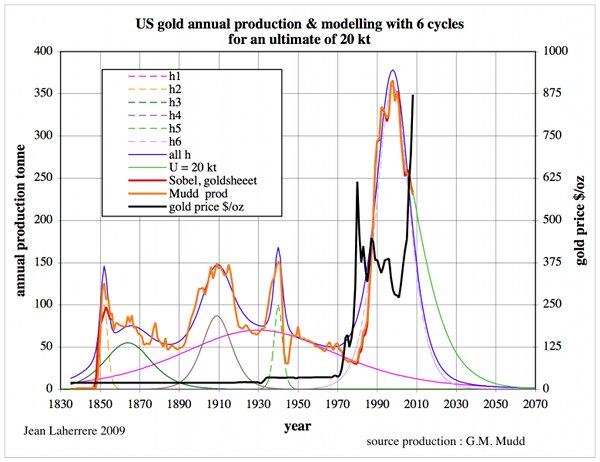

Figure 12: US annual gold production for an ultimate of 20 kt.

Figure 12: US annual gold production for an ultimate of 20 kt.

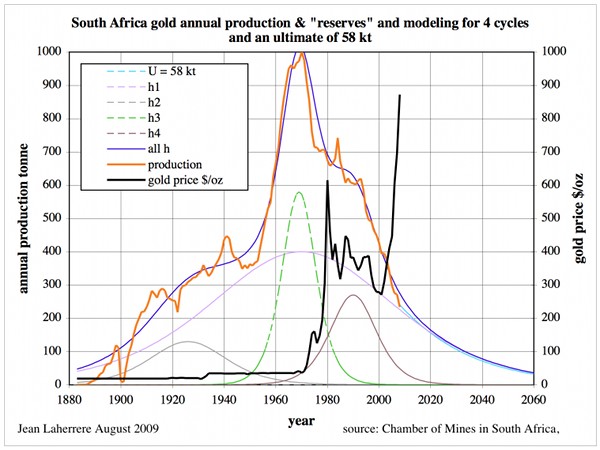

Figure 5: South Africa annual gold production & modelling.

Figure 5: South Africa annual gold production & modelling.