Change is coming. The problem is humans really only have two main ways of changing, and one of them is painful.

For this week’s Throw Back Tuesday we’ll be revisiting one of my favorite pieces posted on March 3, 2018: “Make Your Choice: Change By Pain or Insight.”

As my long-time followers will recall, back then I was intent on laying bare the harsh realities of our flawed, growth-dependent systems—ecological, economic, and energy—and the urgent need for adaptive strategies. I fervently believed then, as I do now, that we as individuals and communities can proactively prepare and adapt before we’re forced to by circumstance.

More and more people are ‘getting it.’ Something is wrong. The edifice of our infinite growth illusion is now showing cracks. The narratives we have taken for granted are faltering in the face of harsh environmental, economic, and geopolitical realities. While Elon Musk’s electric dreams vie for dominance with the stark realities of dwindling oil and mineral reserves, our natural world suffers under the weight of our growth-at-all-costs mentality. The consequences of our actions—deforestation, species loss, climate change—are all more immediate and more dire than many are willing to acknowledge.

The future can seem bleak, but I am here to emphasize that while we can’t prevent every crisis or mend every flaw in our system, we have the power to control how we respond. And it is a mighty power indeed! With forethought and strategic action, we can turn insight into resilience, preparing ourselves and our communities for what’s to come. We can choose change by insight, not by pain. We can choose to thrive.

Enjoy and then join the discussion.

Originally Posted March 3, 2018

Part I

Most experienced investors know the four most dangerous words are: This time is different.It never is.

And yet one of my key predictions here at Peak Prosperity is that The next twenty years will be completely unlike the last twenty years.

So am I saying that things really will be different this time?

Yes, I am. But to understand why, you have to look closely at the unprecedented moment in history in which we live, as well as how the Three E’s – the Economy, Energy and Environment – all tie together now in a way they never have before.

For those who prefer their conclusions right up front, the simplest summary I can provide is that everything we think we know about “how things work” is just plain wrong.

This explains why, among many other grotesque distortions, the stock and bond markets are spectacularly overpriced and overvalued right now.

This danger is important to be aware of because when things correct, as they inevitably must, the next crash will be incredibly damaging. It could be as profound as that which dethroned Spain as a world power, permanently.

Peak Prosperity user Gyurash put this risk in context within his comment to our recent podcast on Economics for Independent Thinkers:

The mention of Paul Volker was interesting. I remember listening to a lecture given by Mr. Volker played on public radio in the mid 80s. He talked about the Spanish empire in the 16th century and the easy money train they had coming from South American gold and silver. He said that although it seemed to create great wealth it also made for a false economy in Spain. In addition to creating price bubbles, the Spanish did not use it to build much of anything other than big villas, built by itinerant foreign labor by the way, so when the gold and silver flow slowed when the biggest mines were effectively depleted, their economy crashed so hard that it never recovered, even up to today.

Delusional Thinking

What’s worse than wishful thinking? Delusional thinking.The sort of ideas that harm rather than help those who hold them.

Of the many current policy delusions I could rail about, perhaps the greatest of them all is the quite-impossible belief that we can have infinite growth on a finite planet.

I know, I know, refuting this is so brain-dead easy to debunk that it seems pedestrian, if not childishly so, to raise it here again. It’s quite an impossible proposition.

Even the most cursory of reviews of mining data (just one of many possible examples), show that many critical ores and minerals are vastly more difficult and expensive to extract and bring to market than they were just a few decades ago. And the trendlines keep getting worse.

But let’s go through this once again, because it’s such an important point. For those of you already on my side of the boat, please bear with me. Perhaps something new will emerge for you on this next go around.

The Harsh Math

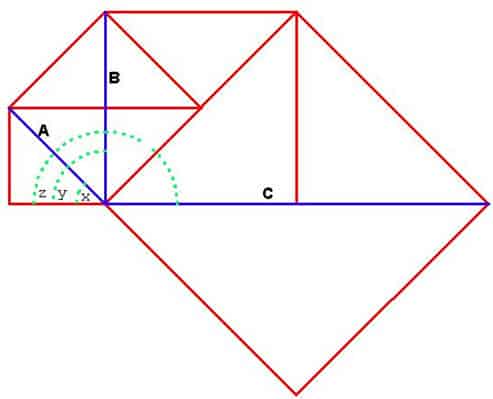

Exponential expansion requires not just some new minerals coming to market, but exponentially more.It works out like this. Suppose that 100 units of copper were produced in year 1, and output (as demanded by economic growth) was expanding at a 3% rate. How long would it take for production to double? The answer is that after 24 years we’d find that 203 units were being produced. So a 3% growth rate means that it takes only 24 years to fully double production.

However, the more interesting fact is that over that same 24-year stretch, if we add up each year’s production into a cumulative total we discover that 3,546 units of copper had been produced. How much copper would you guess was produced over the prior 24-year stretch (the one that got us to 100 units in the first place)?

The answer is just 1775 units. In other words, half the amount produced during the next doubling. Going back further and adding up all of the doublings of copper production throughout all of history we’d discover that each new doubling produced (and consumed) as much as the sum total of all the prior doubling periods combined.

You can prove this to yourself by looking at a doubling sequence such as 0.25, 0.5, 1, 2, 4, 8, 16, 32 etc. Note that 4 is larger than (0.25 + 0.5 + 1 + 2) and that 8 is larger than (0.25 + 0.5 + 1 + 2 + 4) and that 16 is larger than (0.25 + 0.5 + 1 + 2 + 4 + 8) and so on – into infinity.

Again, each new doubling involves an increase that is larger than the combined values of all the prior doublings in history.

For the visually-minded, here’s that same idea expressed in an image:

How Many More Doublings Can We Possibly Have From Here?

Only the most delusional would argue that we can dependably double our extraction of key natural resources forever.Every two decades (or so), will we always be able to use twice as much farmland, twice as much fish in the sea, twice as much oil in the ground, as has been used before throughout all of human history?

Of course not. Planet Earth is a finite system.

This is why I claim that everything we think we know about “how things work” is wrong. Our entire economic and financial systems, their associated monetary models and their current financial asset prices, are predicated on the principle of continuous growth. And not just any sort of growth: Exponential growth. Predictable doubling – forever.

Look, it’s ridiculously easy to prove that there won’t always be twice as much copper (or nearly any other key natural resource) as has been extracted throughout all of prior human history. Things run out. They deplete. They become more dilute as the high grades are exploited first.

At some point, doubling becomes impossible. That’s when you’re past the point where half has been extracted and half still remains in the ground. After that, there are exactly zero doubling periods remaining! That’s just elementary math.

Why care?

Because once the doubling periods are over, every single economic model and financial asset that is predicated on continuous expansion breaks. Our systems stop steadily growing; and instead start increasingly shrinking.

This not a hard concept to grasp, intellectually, for most people with an open mind. But in practice, because it challenges our comfortable understanding of the world, because it collides with an entire Disney World of incompatible social belief systems, it’s pretty much impossible for the many people to even begin to wrestle with. Forget about a mainstream economist or central banker, whose salary requires them to adhere to the status quo.

The warning here is that we our deluding ourselves as a society. We are herding ourselves, lemming-like, straight towards the cliff ledge.

Think Critically!

Our mission here at PeakProsperity.com is to Create a World Worth Inheriting. While we help people make informed decisions to imbue their lives with greater abundance and satisfaction today, it's our dedication to the long-term picture that shapes everything we do.Very few voices are standing about waving their arms in the air like we are, warning of the approaching cliff. We’re aware that the point of no return might still be several decades out into the future, but we also realize that it could already be behind us. It’s nearly impossible to know right now given the complex system that is our planet – but given the existential risks involved, our opinion is that everyone should be mobilizing in response to this arriving (arrived?) crisis.

We often get labeled as narrow-minded “Malthusians”. Or accused of failing to account for human ingenuity. (Neither is accurate, we think.)

But in reality, we’re simply data driven. The facts are what they are. Logic is what it is.

And we get it. It’s both a factual and a logical nightmare for the infinite growth crowd that the earth is finite.

But as Einstein famously quipped:

This programming is subtle, reassuring and ubiquitous; which makes it hard to resist. Here’s a prime example:

(Source)

To an economist like Bernanke, there are only virtuous expansions. Of course, the sort of expansion he refers to is exponential growth. Which is absolutely destined to fail in the long run (and now, maybe, the short).And when that happens, the fallout will be spectacular and highly destructive to the hopes and dreams of literally billions of people.

Make Your Choice: Change By Pain Or Insight

What’s unclear to me is if there can be any meaningful recovery from this next crash, whenever it happens and however long it takes.To return to the opening piece of this article, while I know that this time is different are dangerous words for investors to believe, the impending collision between delusional infinite growth thinking and resource limits and other realities will appear to the average observer like a gigantic change. But, in fact, it simply will mean that humans are subject to the same limits as any other life form on earth.

In other words, it really won’t be different this time.

In boy-meets-girl story form, the plot line of the natural process for all forms of life is:

- organism finds tasty energy source

- organism expands exponentially into that energy source

- energy source dwindles even as organism continues into population overshoot, and then

- happy times turn into tough times, and organism population plummets

How can I protect myself, my family and those I care about? How can I secure a prosperous future? What do I need to do to develop the right mental models and belief system to deal effectively with the coming challenges?

You can either address these questions head-on now, while the world still works the way we’re accustomed to. Or later, under crisis conditions.

We’ve learned that there are two ways that people change their beliefs and then their actions: by pain or by insight.

Most people go the pain route. And in the process, they waste a lot of valuable time that could have been spent constructively. It’s only after the heart attack, the divorce, the backing over the family dog while drunk—moments of extreme pain—that most people will begin to actively face the idea that they need to make different decisions in life.

But it doesn’t have to be that way. Part of the beauty of being human is that we can learn from observation, reflection and experience, and can adapt. Critical thinkers have this ability to change by insight. They use new information to put new behaviors into practice until those practices become new habits. And with better habits, we achieve better destinies.

So which route will you choose? Pain or insight?

The story told by the Three Es is loaded with the potential for plenty of painful moments over the next few decades. Sadly, a lot of people will not take precautionary steps far enough in advance to matter. They’re just not focusing on the risks right now. As a result, much of the world will be forced to change its behavior via the pain route.

Use this awareness as a sense of urgency to prepare now. To secure your future prosperity, as well as to help those regretting that they didn’t follow your lead.

Part II

Why So Hard?

One of the things I struggled with early on was why it was so darned hard to get people to actually change in response to the data in the Crash Course.Worse, we’re now half-way through the twenty-year period I originally defined back in 2008, and things haven’t changed nearly as quickly as I had thought they would.

As it turns out, I had rather hopelessly (hopefully?) deluded myself with the idea that when people are presented with incontrovertible evidence, that they’ll change their minds and therefore their actions.

I now have a much better appreciation for the fact that information alone causes very few people to change what they do or think.

Inductive reasoning has a few powerful psychological enemies including confirmation bias (when we seek out data to confirm what we already believe), and the backfire effect (when non-confirming data finds us):

The Backfire EffectThe Misconception:When your beliefs are challenged with facts, you alter your opinions and incorporate the new information into your thinking.

The Truth:When your deepest convictions are challenged by contradictory evidence, your beliefs get stronger.

Once something is added to your collection of beliefs, you protect it from harm.You do it instinctively and unconsciously when confronted with attitude-inconsistent information. Just as confirmation bias shields you when you actively seek information, the backfire effect defends you when the information seeks you, when it blindsides you.

Coming or going, you stick to your beliefs instead of questioning them. When someone tries to correct you, tries to dilute your misconceptions, it backfires and strengthens them instead.

(Source)

If we really are in this period of disruptive transformation as I’ve outlined it, then both confirmation bias and the backfire effect are your mortal enemies. Maybe not for you directly because you’ve already made the switch away from the perpetual growth fallacy but certainly indirectly as the vast bulk of humanity clings to its old ways of thinking.

However, no matter how accurate your belief systems are today, there will come a time when they too will need to be modified. Life is change. What we know to be true today may not be as true tomorrow. So understanding the backfire effect and confirmation bias are very helpful mental tools that can be put into practice.

Mine include questioning everything I read. Not taking anything as ‘true,’ and having developed and encouraged my sense of humility. The older I get the less I know for sure.

Each passing week seems to bring some new scientific discovery that shakes up everything I thought I knew right down to its foundation. What I thought I knew about time itself, DNA, heredity, the role of our non-human symbiotic passengers (the gut biome), and the nature of matter and consciousness have all been completely reformed. And they probably will be again. So it’s best to always remind myself that what I know is only what we know today, and that tomorrow we may well have a new understanding.

Additionally, I read from all angles. When reading about shale oil, for example, I read the company presentations (very bullish!) and Oil and Gas Journal (neutral) and as many competent petroleum engineer sources as I can (usually much more bearish, especially the closer to the ground one gets).

As I am increasingly fond of saying now, I may not know the truth, but I can smell bullshit (from a mile away). Sometimes just being able to call BS on something is enough to insulate me from having to waste any further cycles on the topic.

This helps to keep the confirmation bias and backfire effects dimmed to manageable levels, and help to assure that I can stay clear and focused so that I can continue to improve my life and prepare for the future.

I’m Calling BS On This

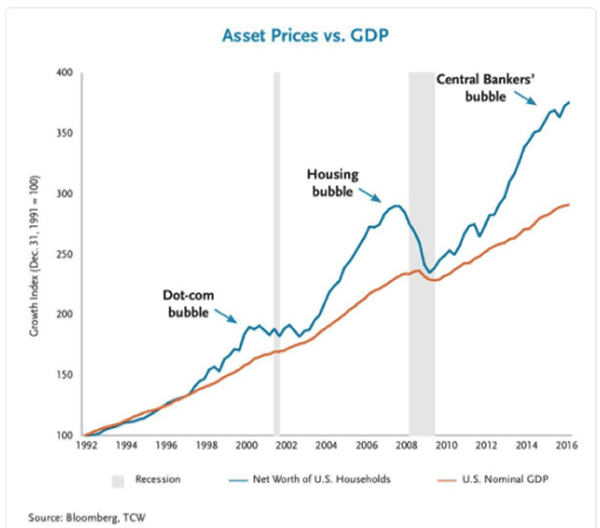

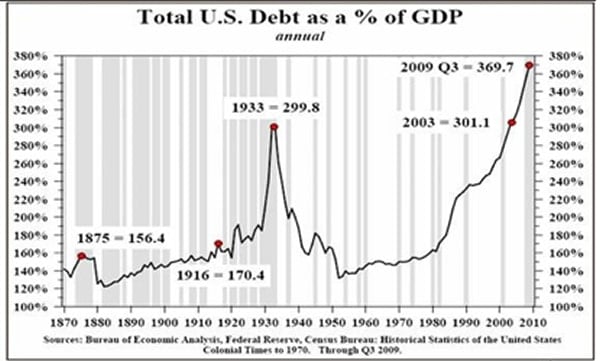

It’s perfectly understandable that nearly everyone holds a distorted view of wealth, financial assets and how the world works because the last 50 years have been the most unusual and deformed in all of history. So it’s more than half a typical human lifetime of things being completely distorted, and there’s been a concerted marketing effort by Wall Street and its paid shills (the MSM) to perpetuate the myth.Seen on a longer-term chart the deception is easy enough to spot:

As we’re fond of pointing out, stocks and bonds and other tertiary forms of “wealth” are actually just claims on wealth. Real wealth comes from real things being made and distributed by real people. Or these days I guess I have to add real robots.In other words there has to be some relationship between the real stuff and the claims on them. The above chart shows that the Fed has goosed asset prices 3 separate times in the past 20 years. It ended miserably the first two times for the very obvious reason that bubbles always burst (because a bubble represents a too-large departure between asset prices and income/GDP).

We can easily understand the last twenty years of central bank follies as one of blowing serial bubbles. It’s always easier and more fun to blow bubbles and then be hailed as a hero for blowing the next one.

Again, this cover story on Bernanke galls me on several levels:

Endless growth is such an easy concept to disprove logically, or by simple observation, but first one must dispose of one’s wrongly held beliefs and as we now know, that’s hard work. So it’s the sheer laziness of The Atlantic, et al., that galls me.

Taking the study of equities back a bit further, and by using a log chart where a straight line means exponential growth, we can see several interesting and important things:

(Source)

First, let’s take note of where the Dow deviates from the long-term exponential slope right around 1985 (marked by the green arrow). That’s when the entire charade of ‘financialization’ began and it was funded and enabled by the Federal Reserve in the US, and other central banks elsewhere.It was based on the very dumbest of ideas, so idiotic that it crumbles under its own weight and does not require any knowledge of resources to grasp. The idea, such as it was, consisted of growing debts at a faster rate than income (GDP in this story). Like I said, a really dumb idea. But a lot of people got fantastically rich off the scheme, and most of them were in the 0.1% so it got a lot of support from both bought-and-paid-for sides of the aisle.

Assuming we could sustain an exponential growth model forever, even then we’d have to know that there’d have to be a return to the purple line at some point, possibly even with a corrective overshoot like we see back in the 1920’s and 1930’s. Were that to happen the current correction would bring the Dow to the 4,000 mark, roughly, without an overshoot.

Second, we need to note that perpetual exponential expansion is not possible. The entire sweep of the Dow in this chart encompasses a time when fossil fuels were steadily expanding. Conventional oil peaked in the US in early 1970’s which also saw the Dow struggle along in that second red box. Then, shortly after conventional oil peaked the US went off the gold standard and used excessive debt creation to mask the effects of the loss of additional fuel for the exponential fire.

And not just a little bit of debt, but absolutely massive amounts.

The summary here is that the entire recent financial and economic history of the US is based on easily disproved falsehoods. One being the idea that it’s possible to expand debt faster than income (GDP) forever, and the second being that exponential expansion is some sort of divine birthright or assumable condition that should never be questioned.

In other words, we can call BS on all that.

Insulating oneself from this sort of BS is really not easy. It means investing in ways that will be challenging and far more difficult that tossing some money into an index fund and later becoming rich. We strongly advise everyone (link updated) with invested money to assure that it is being managed as safely as possible in this treacherous environment.

Again, we cannot know when the reality of these latest bubbles intrude into enough minds that they finally burst, and we cannot know how destructive they finally will be, but history suggests these are the last gasps of a decrepit set of ideas that have caused a vast amount of financial and economic damage.

The Larger Predicaments

Unfortunately, these same decrepit ideas have caused a huge amount of ecological damage as well. The changes are now so fast and furious that it’s difficult to keep up.Crazy weather is now the norm, and it’s getting crazier:

Arctic warming: scientists alarmed by 'crazy' temperature risesFeb 27, 2018

An alarming heatwave in the sunless winter Arcticis causing blizzards in Europe and forcing scientists to reconsider even their most pessimistic forecasts of climate change.

Although it could yet prove to be a freak event, the primary concern is that global warming is eroding the polar vortex, the powerful winds that once insulated the frozen north.

The north pole gets no sunlight until March, but an influx of warm air has pushed temperatures in Siberia up by as much as 35C above historical averages this month. Greenland has already experienced 61 hours above freezing in 2018 - more than three times as many hours as in any previous year.

Seasoned observers have described what is happening as “crazy,” “weird,” and “simply shocking”.

(Source)

I’ve personally been on the receiving end of the wobbling Polar Vortex for several years running. Here in New England that takes the form of Arctic cold air moving in and freezing everything solid for weeks on end. This year (2018) was the most severe so far.

The way I see it both heat and cold are ‘assets.’ The Arctic lost a lot of its cold air to other parts of the world, and now has a cold deficit. In other words, I would not be surprised to read later that ice loss is headed back to record-breaking extremes.

The “growth is cool!” contingent will simply shrug and then excitedly note that new sea lanes opening up will mean cheaper shipping and therefore more economic expansion.

Meanwhile, the warning signs are coming from virtually every major species.

No Sign of Newborn North Atlantic Whales This Breeding SeasonFeb 28, 2018

The North Atlantic right whale is already one of the most endangered creatures on earth, and all indications are its situation is rapidly getting worse.

At last count, the entire population was estimated to include just 458 animals, and at least 17 of them died last year. Now, researchers tracking the right whale’s normal calving grounds, from Georgia to Florida, said they have seen no signs of newborns yet this year, at a time when mothers would normally be birthing and nursing.

The National Oceanic and Atmospheric Administration estimates that at least 411 calves were born from 1990 to 2014, an average of about 17 a year. But only five were born in 2017, and if there really are no newborns this year, that would be “unprecedented,” said Charles “Stormy” Mayo, director of the Right Whale Ecology Program at the Center for Coastal Studies in Provincetown, Mass.

(Source)

What will the loss of such a vastly intelligent and sentient species mean? We cannot possibly know. Why are they not breeding? We don’t know.

It is my view that the intense and increasing grief that many people are experiencing, the deep sense of unease, has less to do with the noisy things displayed by CNN (Trump, et al), and far more to do with the snapping strands of the web of life.

We are adapted over many millions of years to be in tune with the world around us, and now that world is not so quietly disappearing before our eyes. We sense that on some level, same as when animals head the hills before a tsunami strikes. That’s my theory, and I think it explains why so many have checked out and turned to numbing behaviors.

To end with some positive news, such as it is, we find that the EU has finally come to the same conclusion we put forward many years ago about a wildly toxic class of biocides (not pesticides which falsely imply some insect specificity):

Total ban on bee-harming pesticides likely after major new EU analysisFeb 28, 2018

The world’s most widely used insecticides pose a serious danger to both honeybees and wild bees, according to a major new assessment from the European Union’s scientific risk assessors.

The conclusion, based on analysis of more than 1,500 studies, makes it highly likely that the neonicotinoid pesticides will be banned from all fields across the EU when nations vote on the issue next month.

The report from the European Food Safety Authority (Efsa), published on Wednesday, found that the risk to bees varied depending on the crop and exposure route, but that “for all the outdoor uses, there was at least one aspect of the assessment indicating a high risk.” Neonicotinoids, which are nerve agents, have been shown to cause a wide range of harm to bees, such as damaging memory and reducing queen numbers.

The Efsa assessment includes bumblebees and solitary bees for the first time. It also identified that high risk to bees comes not from neonicotinoid use on non-flowering crops such as wheat, but from wider contamination of the soil and water which leads to the pesticides appearing in wildflowers or succeeding crops. A recent study of honey samples revealed global contamination by neonicotinoids.

(Source)

The EU at least seems to have some semblance of science and doping the right things left in its composition. The US? Not so much. If you can make money from it, it’s allowed, up to an including killing humans who you have addicted to your wrongly formulated time release opiates as is the case with Oxycontin.

Too Many Predicaments

While there are some positive developments that we can point to, there are far more problems and predicaments cropping up every day. Seen as a collection it is difficult to see how they can possibly be resolved without causing a lot of pain for a lot of people, as well as other organisms.The list of predicaments includes:

- A still expanding human population that is growing by approximately 83 million net new inhabitants every year.

- Loss of topsoil and arable farmland to such things as erosion and desertification such that a third of the world’s topsoils are acutely degraded due to agriculture.

- The record and increasing loss of forests as they are cut down at the rate of roughly 70 million acres per year

- The fact that more than 10 calories of fossil fuels are embedded in each calorie of food that we eat.

The sooner we can collectively wrap our minds around that idea the better off we’ll be.

Unfortunately I don’t have a lot of evidence to support the notion that enough people are catching on in time.

Once the pressure become too large the normal course of collapse will proceed, which I think Orlov captured rather succinctly a few years back:

Stage 1: Financial collapse. Faith in “business as usual” is lost.Stage 2: Commercial collapse. Faith that “the market shall provide” is lost.

Stage 3: Political collapse. Faith that “the government will take care of you” is lost.

Stage 4: Social collapse. Faith that “your people will take care of you” is lost.

Stage 5: Cultural collapse. Faith in “the goodness of humanity” is lost.

(Source)

If the climate suddenly weirds out too much, and food cannot be grown reliably in its usual places, then all bets are off and we’d have to add another stage to Orlov’s 5 stages above.

Step 0.5: food production is lost. Proceed directly to step 5.

How To Respond

The only rational response to all of this is to become the change you wish to see. We cannot wait for others to pick up the mantle before we do. We cannot wait for the authorities to figure this out and begin to get things right.We need to understand, on a very deep level, that the current conditions are only temporary and that none of us can know when things might turn in a different direction.

But mostly we cannot unlearn what we already know. Between what you know and what you are doing lies fear and anxiety. The only way to close that gap is to change your actions.

Everyone needs to be mentally and tactically ready for the prospect of sudden, jarring change.

For me this means having cash out of the bank, and food in the basement. It means I put in a garden and food-bearing trees and shrubs wherever I live. It means I have the means to protect my family and the skills to do so.

By far the most important set of preparation steps I’ve undertaken involve a series of deep inner explorations and other means of increasing my emotional capital. My preferred model includes the idea that mind, body and spirit all need to be in balance.

By way of example, my ‘bible’ for the understanding part is Healing Developmental Trauma by Laurence Heller and Aline LaPierre. In there one will find a map of the territory that defines why and how people can be more (or less) well connected to self and others. I’m on my fourth reading of it.

Additionally, I’ve listened to The Power of Vulnerability by Brene Brown probably 5 or 6 times as I have it on a CD I play in the car when I’m on a longer drive. In there she unpacks the latest research using amazingly connective (and often self-deprecating) stories as she discusses what lies between people being the whole-hearted and deeply connected people they wish to be. It’s packed with simple steps that one can follow, and ideas for different ways of seeing situations and saying what needs to be said.

Finally, I have a men’s group to which I belong, as well as a life coach I call weekly. Each of these represents the tip of the iceberg in terms of the dedication I’ve put into building my emotional intelligence.

Why have I focused on emotional capital out of all the rest? Because I truly believe the next ten-year window of time – the second half of the twenty years – will be very disruptive. It makes me sad to see so many people struggling and checking out, be that by way of opiates or drinking, or by slipping into demoralization (as a distinct form of psychological low separate from depression). Seeing people respond like this means they are no longer engaged with life. What happens when things outwardly seem to get even harder?

Having a solid emotional base is the key to enjoying life today, and thriving into the future.

My strongest advice is this; get ready.

Conclusion

The entire edifice of illogical belief systems arranged around infinite growth in a finite planet is now crumbling. It’s not something that will come someday, it’s already here. My prediction is that the speed of events will continue to quicken.The ecological signs are such that within my lifetime it’s possible that all megafauna – lions, giraffes, whales, orangutans, etc. – are eliminated from the wild. It’s even possible that the Amazonian rainforest collapses, no longer able to sustain the hydrological cycle due to a tipping point of deforestation.

The energy data is more dire than most suspect, due to the rapid declines of high net energy reservoirs of old being replaced with much lower return wells tapping into the (bottom of the barrel) source rocks known as the ‘shale plays.’ The past four years of oil discoveries are the worst four years in the entire oil data series I have which goes back to the 1930’s.

Somehow we’re supposed to trust Elon Musk and hope that we manage to electric car our way past that bit of bother, but that fantasy does not factor in such niggling worries as having insufficient cobalt and/or lithium to get the job done, let alone deal with the lack of appropriate electrical grid and a woefully insufficient number of charging stations. Somehow all that will magically resolve itself when oil peaks and rolls over despite the fact that the energy demands of everything else will be in competition for those dwindling barrels with that new transportation build out.

Meanwhile the geopolitics of all this are playing out like a macro version the social stress reflected in the data on individuals. Russia is busy reminding the US that it has superior nuclear weapons and China is busy fending off one diplomatically indelicate event after another from the US.

(Source) (Note: Looks like Reuters killed the link. Left for historic reference)

The prospect of a trade war now is really just the sort of pin every bubble seeks.

(Source)

As always, my view is that we should all be prepared, well in advance, of anything really bad happening. By the time it’s obvious to everyone, it will be too late to really do much of anything, besides being irresponsible and possibly harmful (if it’s hoarding during a time of crisis).These “”markets”” are heavily manipulated by well-meaning but certainly misguided central planners who’ve entirely lost the plot line and now believe they are responsible for everything from full employment to market volatility to assuring higher stock and bond prices.

Because of this, they’ve gone far, far above the trend line and are due for a major snap back. Either that or the currency involved has to suffer a major decline which will serve the same purpose of destroying the appearance of wealth.

I want you to thrive. I want you to understand that you can control a lot about your circumstances and how you react. While none of us can prevent more central bank printing, all of us can own gold and/or silver. I cannot fix declining conventional oil reservoirs, but I can make myself less dependent on oil.

I cannot force the US EPA to stop the use of neonicotinoids, but I can buy organic vegetables and grains whenever possible.

I seemingly can’t prevent the loss of the whales, but I can recognize the deeper impact that has on me and allow those emotions to flow rather than accumulate.

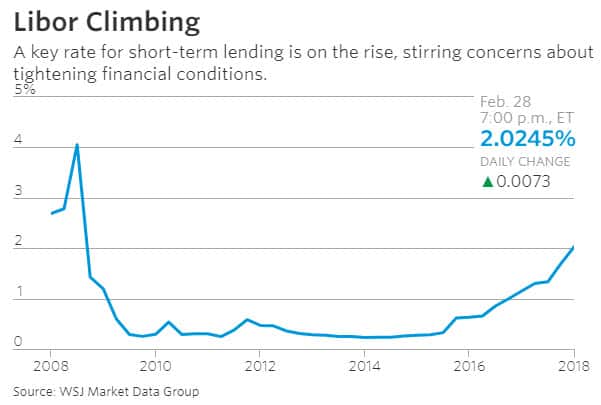

As we wait for the long-term situation to play out, we can note that in the near-term interest rates are rising, and that’s not good for everything from housing (sales have already reacted negatively) to refinancing trillions in outstanding loans that are tied to LIBOR.

Libor’s Climb Past 2% is Unnerving Some InvestorsMeanwhile the US equity markets seem to have rolled over.Mar 2, 2018

A benchmark used to set borrowing costs on trillions of dollars worth of loans is on the rise, stirring concerns about the effect of higher U.S. interest rates on consumers and businesses.

The three-month U.S. dollar London Interbank Offered Rate, or Libor, surpassed 2% this week for the first time since 2008. That will lift rates on more than $100 trillion in debt and derivative contracts that are linked to the U.S. benchmark, from business and student loans to home mortgages.

(Source)

All I do know is that in a world saddled with record debts, and a debt-based system of money that itself is utterly and completely dependent on infinite expansion, something’s got to give. I know I would personally prefer that the “something” that gives be human derived and meaningless like a big swath of the financial markets, or a major set of banks, but I know that it’s possible those carry on, perhaps on central bank life support, until something truly terrifying and sad gives away like the loss of the amazon basin as a rainforest, or the collapse of oceanic ecology.

One way or another, big change is on the way, we can all feel it, and that’s part of the reason that this moment of alleged full-employment and economic growth feels … off.

Your opportunity is to see that coming in advance, change by insight, and be a model for others.

~ Chris Martenson

This is a companion discussion topic for the original entry at https://peakprosperity.com/tbt-make-your-choice-change-by-pain-or-insight/