This is an article that first ran on Aug 22, 2020. We’re re-running it now because it’s an important piece of “framing” which we define as “a way of seeing the world that can help make sense of it or condense the topic in a way that allows us to process the world faster.”

As a reminder, our usual two-part content appears on Fridays now, same as last week, and every week going forward (excepting vacation or travel interruptions in my schedule).

This piece helps me understand humans and why they sometimes do things that don’t seem moral or defensible. It turns out we’re not all that complicated. All it takes is for the consequences of our actions to be separated by “one step” and that’s good enough for most folks. Their conscience is clear!

Part I

Millions of people are about to enter a financial purgatory, becoming little more than modern-day slaves.While they’ll be reported by the media as those “evicted” or “foreclosed on”, if we define a slave as someone forced to work for another by existing legal circumstances or approved cultural norms, then that’s exactly what these people should actually be called: slaves.

Too harsh?

Allow me to make my case.

Being 'One Step Removed' Is All Evil Needs

Slavery can exist when there’s a system that allows it. It’s a combination of morals (or, rather, lack thereof) and laws that allow one human to control the daily actions of another. Neither a slave’s time nor personal freedom belongs to them.I learned a long time ago that most humans, at best, have what we might call ‘shallow’ morals. There are chemical engineers who would never dump a toxin directly into a child’s cereal bowl, because that would be immoral; but they’ll casually and routinely inject toxins into groundwater tables (which may eventually end up in the local milk supply) because they have an EPA permit to do so.

If questioned, these same engineers know that there’s a chance, maybe even a very good chance, that the injected chemicals could end up somewhere unintended. But because their actions today are one step removed from the consequences of tomorrow, that’s enough to get them off of a moral hook.

In other words, their morals don’t extend past that first action – they stop right there. They are therefore ‘shallow’ morals.

‘Deeper’ morals would include a sense of responsibility for the entire lifespan of the chemicals in question.

Similarly, mortgage companies are staffed to the gills with people who could never themselves forcibly eject an elderly person and all of their possessions onto the curb outside the home they’d lived in for 50 years. It would be morally upsetting.

But they routinely submit the paperwork that causes these things to happen nonetheless.

Luckily for the mortgage company workers it’s the sheriffs deputies who actually handle the evictions. Luckily for the sheriffs involved, somebody else’s decision was responsible for the eviction. Both the sheriffs and the mortgage company employees are similarly insulated from any moral qualms because neither was directly responsible for Granny or Grampa’s plight. They’re just “following orders”.

One step removed. That’s all it takes.

The point here is that as long as people have just one degree of separation from their actions, that’s sufficient to dodge any moral qualms that may arise. What we cannot stomach to do ourselves can be more easily overlooked if someone else is performing the deed.

The Immoral Fed

The largest and most obvious one step removed ‘dodge’ in play right now is the US Federal Reserve’s evasion of moral responsibility for making the wealth gap explode wider, destroying the financial futures of tens of millions of American households.After printing up a bubble that ruined many in the 1990’s, eventually bursting in the year 2000, the Fed set about blowing an even larger bubble. That burst in 2008. And now they are back at it again.

Every step of the way, the Fed policies resulted in the rich getting richer, the middle classes and the poor being financially eviscerated, and future generations getting hosed.

How do the Fed’s staffers sleep at night?

By delusional thinking like this:

(Source)

The necessary one degree of separation for Jay “pants on fire” Powell to say such obviously flawed things is provided by “the markets”, which is where the trillions of dollars freshly printed by the FEd quickly end up.That goosed markets then benefit the already-rich is simple to deduce. Those who own lots of stocks and bonds as well as those who operate the most intimate details of the financial machinery are rewarded instantly by higher prices. They become instantly richer. Which means they can afford to buy more ‘real’ things like land, buildings, businesses, factories, gold, fine art – you name it.

Well-connected entities like BlackRock are actually in bed with the Fed, getting richly rewarded merely for helping it spend its vast gobs of newly-created currency :

BlackRock Is Bailing Out Its ETFs with Fed Money and Taxpayers Eating Losses; It’s Also the Sole Manager for $335 Billion of Federal Employees’ Retirement FundsJune 4, 2020

Today [June 4, 2020], BlackRock has been selected in more no-bid contracts to be the sole buyer of corporate bonds and corporate bond ETFs for the Fed’s unprecedented $750 billion corporate bond buying program which will include both investment grade and junk-rated bonds. (The Fed has said it may add more investment managers to the program eventually.)

BlackRock is being allowed by the Fed to buy its own corporate bond ETFs as part of the Fed program to prop up the corporate bond market. According to a report in Institutional Investor on Monday, BlackRock, on behalf of the Fed, “bought $1.58 billion in investment-grade and high-yield ETFs from May 12 to May 19, with BlackRock’s iShares funds representing 48 percent of the $1.307 billion market value at the end of that period, ETFGI said in a May 30 report.”

No bid contracts and buying up your own products, what could possibly be wrong with that? To make matters even more egregious, the stimulus bill known as the CARES Act set aside $454 billion of taxpayers’ money to eat the losses in the bail out programs set up by the Fed. A total of $75 billion has been allocated to eat losses in the corporate bond-buying programs being managed by BlackRock. Since BlackRock is allowed to buy up its own ETFs, this means that taxpayers will be eating losses that might otherwise accrue to billionaire Larry Fink’s company and investors.

(Source)

On the one hand, BlackRock is busy buying all sorts of things to stuff on the Fed’s balance sheet.

On the other hand, BlackRock has access to unlimited capital at the most favorable terms/prices in the world.

On a third hand, BlackRock is busy buying up distressed properties from recently foreclosed Americans who couldn’t manage to stretch a $1,200 stimulus check across 8 months of being out of work.

Add it all up and these recently dispossessed Americans will find themselves no longer owning a home. Instead, they’ll rent one from the no-bid contract winners like BlackRock, who were literally hand-picked by the Fed.

When there’s no money to be found to help working-class families, you can be certain there are still unlimited billions available to keep outfits like BlackRock supremely well incentivized to… uh, keep doing what they already were doing anyways: Getting obscenely rich.

Now, instead of working for themselves to pay off their own homes, these newly dispossessed Americans will still have to live somewhere. Many of them will end up renting from Wall Street entities like BlackRock.

How do I know this? Because that playbook page already exists. It’s an observed reality. It’s been done before and it will happen again.

We saw this in the aftermath of the housing crash/Great Financial Crisis:

When Wall Street Is Your LandlordFeb 2019

[T[he government incentivized Wall Street to step in. In early 2012, it launched a pilot program that allowed private investors to easily purchase foreclosed homes by the hundreds from the government agency Fannie Mae. These new owners would then rent out the homes, creating more housing in areas heavily hit by foreclosures.

Between 2011 and 2017, some of the world’s largest private-equity groups and hedge funds, as well as other large investors, spent a combined $36 billion on more than 200,000 homes in ailing markets across the country. In one Atlanta zip code, they bought almost 90 percent of the 7,500 homes sold between January 2011 and June 2012; today, institutional investors own at least one in five single-family rentals in some parts of the metro area.

I talked with tenants from 24 households who lived or still live in homes owned by single-family rental companies. I also reviewed 21 lawsuits against three such companies in Gwinnett County, a suburb of Atlanta devastated by the housing crash. The tenants claim that, far from bringing efficiency and ease to the rental market, their corporate landlords are focusing on short-term profits in order to please shareholders, at the expense of tenant happiness and even safety. Many of the families I spoke with feel stuck in homes they don’t own, while pleading with faraway companies to complete much-needed repairs—and wondering how they once again ended up on the losing end of a Wall Street real estate gamble.

(Source)

In today’s reality, the Federal Reserve is deciding, unilaterally and without any effective oversight or requiring a single vote from a single American, who should be the winners and who should be the losers.

Should we be surprised that the big institutions are the winners and ‘we the people’ the losers?

To be fair, this isn’t BlackRock’s fault, right? It’s simply how the system is currently set up. It’s just the prevailing legal and moral framework, right?

What do they say on Wall Street to point out the one step removed angle: “Don’t hate the player, hate the game”? Well, maybe that works in pro basketball. But in finance, where the players have a strong say in writing the rules, I don’t think that saying provides much air cover.

Here in August 2020 after the coronavirus (combined with a desperately poor series of managerial decisions by politicians and career health ‘authorities’) laid waste to the economy, it’s perfectly clear that much actually was learned from the 2008 crisis.

The wealthy learned that you can pretty much get away with anything you want. And so they’re at it again.

Corporations learned to hoover up the free money as fast as possible.

Speculators learned that the Fed would always cover their losses and to ‘buy the dip.’

Nowhere along the way did anybody seem to learn the importance of community, watching out for your fellow citizens, having integrity, or caring about the future. Savers and the prudent alike have been literally punished for being responsible.

Finding The Way Out

Once you see through the ‘one step removed’ lens, you’ll begin to see it everywhere.Too many people do things that aren’t even remotely justifiable (let alone moral) once the totality of the actions are taken into account.

A corollary to this is that the measure of a person can be observed in their actions when nobody is looking.

Far more impressive than the thousands YouTube clips showing a supposed samaritan help an unfortunate soul (while a camera just happens to be recording from a perfect angle followed by a quick upload to 8 different social media channels) is the person who helps another when no one else is there to watch.

“The system” is providing the necessary legal and moral cover for BlackRock and other similarly fabulously wealthy parties to sweep in and take advantage of current circumstances to make a few billion extra bucks.

When the dust settles after the pandemic subsides, we’ll find that another large fraction of the assets of our nation – it’s houses, soil and productive enterprises – will have been transferred (again!) to the tiny minority already at the top of the wealth pyramid.

The process used will continue to be simply this: the Fed prints new currency out of thin air, hands it to Wall Street, which in turn buys up the productive assets of the country. If challenged, each party has its own ‘one step removed’ cover story ready to go.

Once upon a time, our cultural and legal principles sadly allowed the productive output of people called slaves to belong to people we called slave owners.

Today ,there’s a codified system of financial rules and a supporting legal framework that assigns the productive output of the poor and middle classes to corporate owners.

The former process was direct. The latter process has the same outcome; it’s just simply one step removed.

Part II

So how do we free ourselves from the shackles the system is trying so hard to place us in?I have to confess, I’m kind of worn out here. I’d like ‘my team’ to win a few but we’re just not wracking up any wins. Who’s on ‘my team’ and what do we do?

I feel like I’m on the side of commonsense, integrity, and prudence. I feel like fundamentals ought to matter as much for stocks as they do for farmers. In the field, if you don’t account on a fundamental level for the nutrients in your soil, then your yields will suffer.

But in the stock market, or “”market”” I should say, fundamentals haven’t mattered since – oh – about 2008. All that’s mattered is how much new currency the Fed is going to inject.

In the case of Covid-19, I had rather naively thought that science and data would win the day. After all, it’s a medical issue. The data is what it is. But time and again I watched as Fauci lied about common drugs with great safety profiles that at worst wouldn’t hurt and at best save lives while also completely ignoring providing any lifesaving advice about such lifesaving supplements as Vitamin D. I cringed as doctors and scientists skewed data, set up trials to fail (with lives on the line!), and even committed massive fraud.

I watched both major political parties pretend as if the public had the memory of a goldfish by repeatedly asserting things that were obviously and patently false.

In every major policy area, I feel desperately out of step with the powers that be. Worse, nearly every one of their preferred approaches is the exact opposite of the one that I’d like to take.

I’d prefer less of a wealth gap, not a larger one. I’d like to see money flowing to small family farms not gigantic agribusinesses. I’d like us to become more serious about getting off of fossil fuels, not pretending as if we’ve got all the time in the world to figure that process out. I’d prefer a stronger and broader middle class, not a weaker and smaller one. I’d prefer a stock market that’s actually a market, not a policy tool of the Federal Reserve. I’d prefer to not be at war with any countries at all let alone ones where nobody can even state what the strategy is or why we’re there. I’d prefer spending vastly less on the military and vastly more on the nation’s infrastructure.

As I said, I’m pretty much out of touch with the direction of things. Maybe you are too.

I Might be Wrong But I’m Not Confused

Our approach at Peak Prosperity is to begin at the top and then work down. We’ve got a framework for understanding the world and assigning priorities to our actions.The big picture view is this; infinite growth on a finite planet is impossible. Yet our entire system of money and our economic systems are all predicated on the idea of infinite growth. Quite the conundrum, eh?

To me there’s no contest and no conundrum to solve. Reality wins out every time. If you overfish the seas and the fisheries collapse, then the reality of that wins out over whatever ‘the market’ demands. Fish prices could double-quintuple and still no fish will result. The stock price of Star-Kissed could be $1000/share and still no fish from the sea.

The most basic reality that we all live under – yours truly especially included – is that fossil fuel energy delivers pretty much everything we see around us, everything we consume, and supports everything we do.

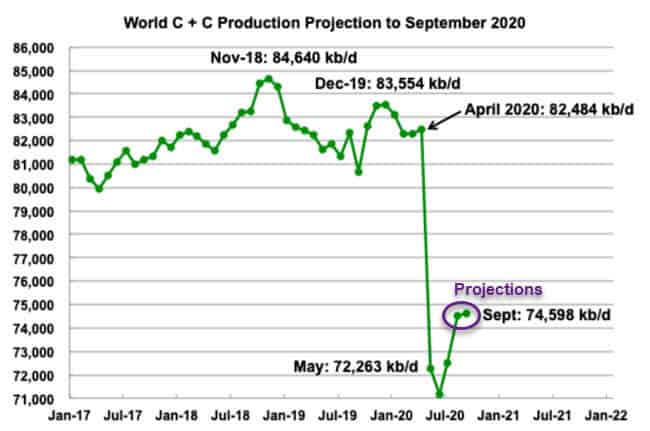

Even with some rosy projections for August and September, it’s clear that the “infinite growth” club has taken a blow.

That massive decline in oil production is a consequence of a massive decline in oil demand. That reduction in oil demand means that a whole lot of economic activity has not taken place. It’s very hard to assemble all the things that have not happened, let alone predict how all that will play out in the coming weeks and months.

But one thing is easy to state; those on the bottom economic rungs of society have been hurt by all this far worse than those at the top.

Whether or not oil demand and production will ever recover is an open question. It’s entirely possible that the vast losses in US shale oil production will not ever be made whole due to a combination or burned investors and relentless geological decline of well output. Maybe it will, but probably not is my thinking.

Once you strip away all the noise, it turns out that a nation’s energy production and consumption is perfectly correlated with its economic activity. Which makes sense right?

This means that the US might well have experienced its peak of oil output during the month of November 2019.

(Source)

That might be it in terms of oil production. As in, forever. If true, then everything the Fed is now doing to pump the economic patient back to life by printing currency (and mainly handing it to ultra-rich people and financial and Wall Street firms) would be the equivalent of pouring gasoline on a dying campfire.Sure, that fire will burn brightly for a while, but the remaining wood fuel will only be consumed that much more rapidly. If the intent was lasting warmth, the effort will backfire.

The collapse in oil production is absolutely legendary. It is without precedent. The impacts will reverberate for a long time. Oil is reality. The Fed’s currency printing is not.

As always, I default to reality as the thing that will win out. Less oil used means less economic activity. Period.

Less economic activity with more money tossed into the ring means inflation. Right now that’s inflation of stocks and bonds (and gold and silver a little bit) but you haven’t seen anything yet.

No Way Out?

The thinking goes like this; it’s easy for the Fed to put money into the markets, but it’s socially and politically difficult to take that money back out.On the way in, the money creates rising stock prices and stable bond markets which all the major players seem to like. The wealthy never say ‘boo’ about their portfolios rising in price (whether Democrat or Republican) and politicians never complain either, especially during an election year.

On the way out, however, prices for stocks and bonds reverse to the downside. Because their friends and family members are seeing their portfolios now go down instead of up, Fed officials feel the heat. Nobody likes that, especially not the sorts of academic and morally weak people currently on staff there. Too difficult.

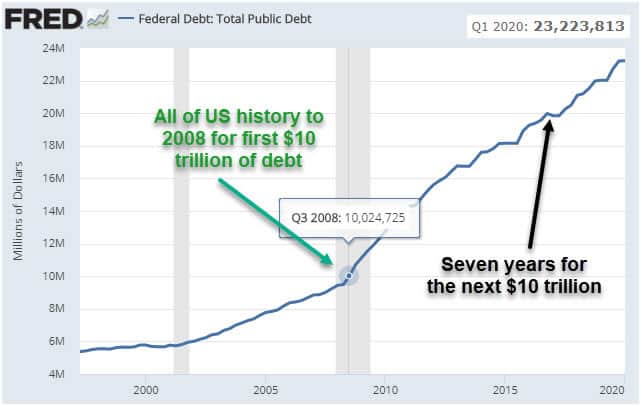

Worse, once money starts to come out of bonds, and interest rates rise, government borrowing costs begin to climb as more and more money has to go to interest payments. Beyond some ridiculously small amount of interest the entire government borrowing machine simply exists to borrow money fast enough to pay off the interest costs.

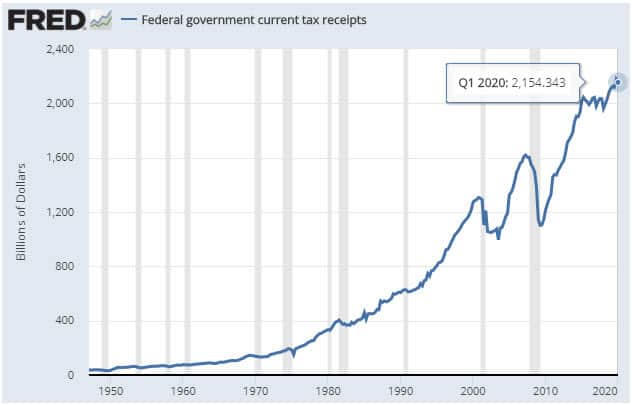

A zombie company is one who operating income is insufficient to pay the interest costs. Accordingly, I propose the idea of zombie government is one whose tax receipts are no long sufficient to cover the interest costs on all their prior borrowing.

In the case of the US government, with debt at $23.2 trillion and tax receipts at $2.1 trillion but spending at $4.4 trillion (for a net loss of -$2.3 trillion/yr.) there is no room at all for interest costs to move higher.

Any additional interest costs here would simply make the federal budget deficit explode higher, cause more debt to be issued, causing interest rates to move higher, and thereby making everything worse.

All of which is a very data rich and kind of fancy way of saying that the Federal Reserve has no way out. It simply cannot withdraw any money from the system. That would cause stock and bond prices to fall and it would kick off a deathly debt spiral for an already tapped out US government.

There is no alternative. So keep going!

That’s the Fed quandary right now.

But let’s back up a second. Isn’t it also true that the main lubricant of economic activity – oil – is in less supply, and further that it will be very hard to get oil ramped back up quickly once the Fed currency ‘hits the streets?’

Yes, that’s the case. What happens when a literal wall of Fed liquidity runs smack-dab into a future of oil scarcity? That’s easy - an oil price explosion. What happens when $200/bbl oil runs smack-dab into a Fed-enabled mountain of debt and debt-addled corporations and households? That’s easy - defaults and bankruptcies. What happens when this sort of economic and financial chaos runs smack-dab into a system of complex and complicated just-in-time global supply chains? That’s tricky - nobody can really say.

So we prepare and become resilient.

My Inflation hedges

I simply cannot calculate how bad all this is going to get. Maybe very bad. Maybe not so bad as I think. Probably somewhere in between.It’s already bad for the millions of people who have lost their jobs and been left entirely out of the Fed’s Leave No Billionaire Behind (LNBB) program.

Food inflation is already quite high. Been to the grocery store lately?

What I cannot account for is whether food inflation will be the worst of it – bad as that is – or whether actual food shortages will someday erupt. That’s quite possible. How does one become resilient in the face of such uncertainty?

By controlling what you can and leaving the rest aside. For myself and Evie this means building soil, building structures, installing fences, and generally acting as if we had no idea if food shortage might erupt tomorrow or in ten years. We simply don’t know.

The garden has done spectacularly well this year. Far better than we thought as it’s our first year on this soil and we had so much to do to get ready.

It went from a quack grass infested square to a raised bed, composted, wood chip covered and spring fed & drip-irrigated wonder.

Central to our efforts to revitalize a depleted field and get its soil back up to snuff are cows. Evie delights in them while I am constantly wondering if they are plotting against me.

Lumber prices this year are up over 100% this year.

Talk about inflation! Yikes! I thought this might be coming and so part of our strategy for being able to build what we need (which includes a full-sized barn next year) includes milling our own lumber.

Unfortunately the company I bought my mill from (Norwood) was caught flat by both spiking demand for its products and a shortage of needed components due to Covid-19. Double whammy.

I built as much of it as I could with the parts on hand. Literally the final box I needed showed up yesterday on the big brown truck of happiness, so I will see how far I can get building it out this weekend.

None of what we’re accomplishing here or across the street at the Brookside Project could be done without an awesome crew. Here’s the team at the end of the summer, soon to turn over a bit as we head into fall.

Honestly one of my favorite things to do is sit around a fire with these people and mull over life and the day’s projects. The community forming here is really sweet and honestly the main reason I am working so hard to tend this place and make it as strong as possible.

I see both very hard futures as a possibility, as well as maybe things being easier and better than I think. In either scenario I see good soil, lots of food production, and a happy community as being the right strategies to pursue.

Conclusion

Because I see no way out for the current feckless national managers, they will have to keep doing what they are already doing. More printed currency, more wealth flowing to fewer people, a more unstable society as a result, and lots and lots of eventual inflation for basic goods.I happen to own a bunch of acres, but truthfully (except for the cow experiment) we are mainly occupying about 3 of them. I could scrunch down even further if we had to, but then we’d be mainly solving for Evie and myself. Maybe one other.

Instead we have a dream of solving for 60 or more people. I think this parcel of land could pull that off. We’ll see. I imagine this place hopping with excited and exciting people. I can foresee the time when the soil is 3x as rich and the plants all that much healthier. I can envision mature plantings and carefully tended forests with supporting structures all around.

That’s going to take 6-7 years. Minimum. I don’t know if we’ve got that long…so…urgency.

As well as gratitude and an eye towards creating beauty as much as possible.

No question about it, I am a very lucky man. Evie is a lucky woman. Together we are the temporary stewards of a fine piece of land and are fortunate to have people around us who share the vision of creating and running a place to experiment with all that needs doing, both agriculturally as well as culturally.

Truthfully, we only have that vaguest of outlines in sight. Mostly this is a launch into the unknown.

We’re very much looking forward to having many more of our tribe come and visit and maybe stay for a while. Until you do, feel free to ask me/us any questions in the comments below and we’ll answer what we can.

This is our way out, which we are taking because the Fed lacks one of their own.

Your faithful information scout,

~ Chris Martenson

This is a companion discussion topic for the original entry at https://peakprosperity.com/tbt-one-step-removed/