Originally published at: https://peakprosperity.com/tgt-episode-7-does-sipc-really-protect-my-stock-and-bond-portfolio/

If a broker gets into deep financial difficulty, are your stocks and bonds safe? That’s a more difficult question to answer than it should be.

The only correct answer is “it depends.”

Some of it depends on the type of account you have (cash vs margin), some on how much you have above and beyond the protected limits, and some of it depends on how fair and non-preferential the court system is to Wall Street’s interests vs yours.

In this episode I dive into SIPC insurance protection and what it can realistically cover during a major financial disaster. The short answer is “not very much.”

The longer answer rests on each of our individual assessments of the likelihood of the US government riding in with walls of current cash to be paid back by future taxpayers.

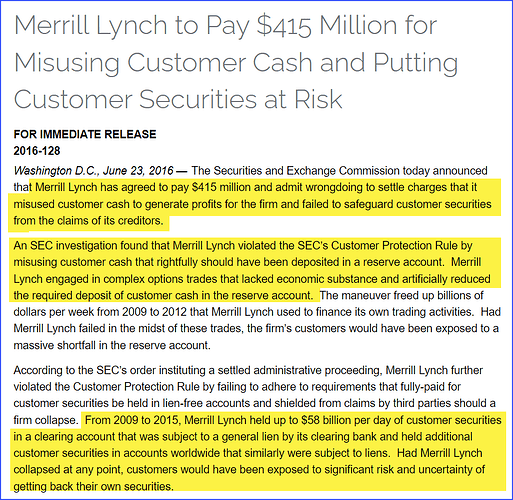

As always, the devil is in the details and I’m here with the necessary context bringing the receipts.

Links:

SIPC 2022 Annual Report

https://www.sipc.org/media/annual-reports/2022-annual-report.pdf

Bankrate on What Does The SIPC Cover?

https://www.bankrate.com/investing/sipc-insurance

SIPC on Pro Rata Coverage

https://www.sipc.org/for-investors/investor-faqs

Margin Debt Chart – Doug Short

https://www.advisorperspectives.com/dshort/updates/2024/03/22/margin-debt-up-5-8-in-february

FINRA statistic on Margin Debt and Cash Account Balances

https://www.finra.org/rules-guidance/key-topics/margin-accounts/margin-statistics