Originally published at: https://peakprosperity.com/the-fed-throws-gasoline-on-the-inflation-fire/

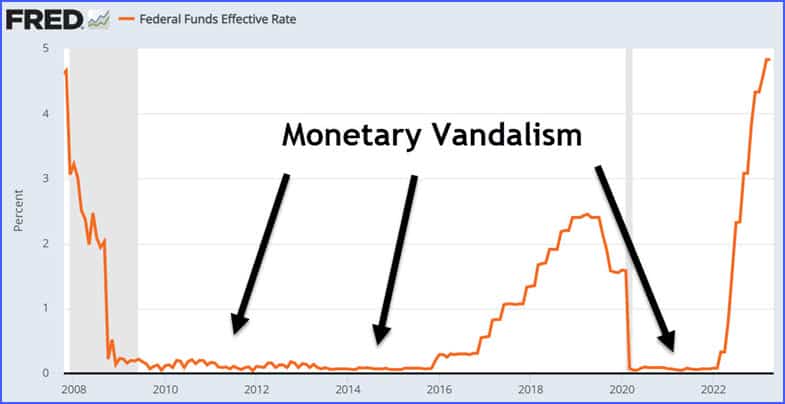

The Fed just made the biggest policy error in recent memory. I know, one could argue that their zero interest rate policies during the twenty-teens were the OG policy error that set the stage for this one, but that does not excuse or minimize doubling down on the error.

First, the case for cutting interest rates was not just weak, but one could more readily make a stronger case that rates ought to have been hiked.

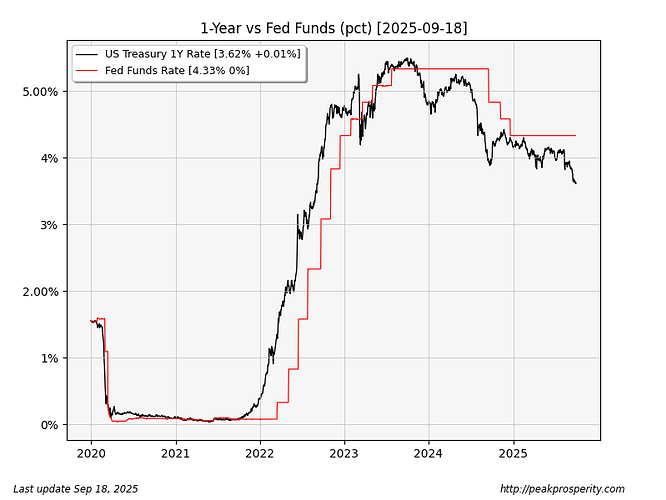

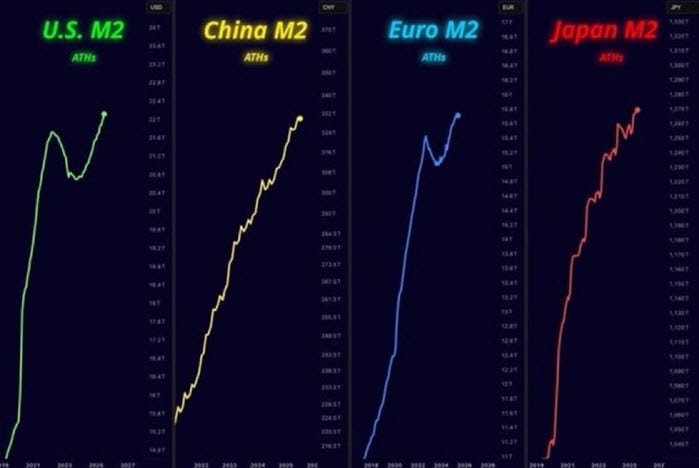

Cutting interest rates is done to make what they call ‘financial conditions’ easier. Well, there’s absolutely nothing ‘tight’ about the amount of money sloshing about the globe right now, as measured by something called ”M2:”

If you can see anything tight in those skyrocketing charts, you probably work for the Fed or on Wall Street.

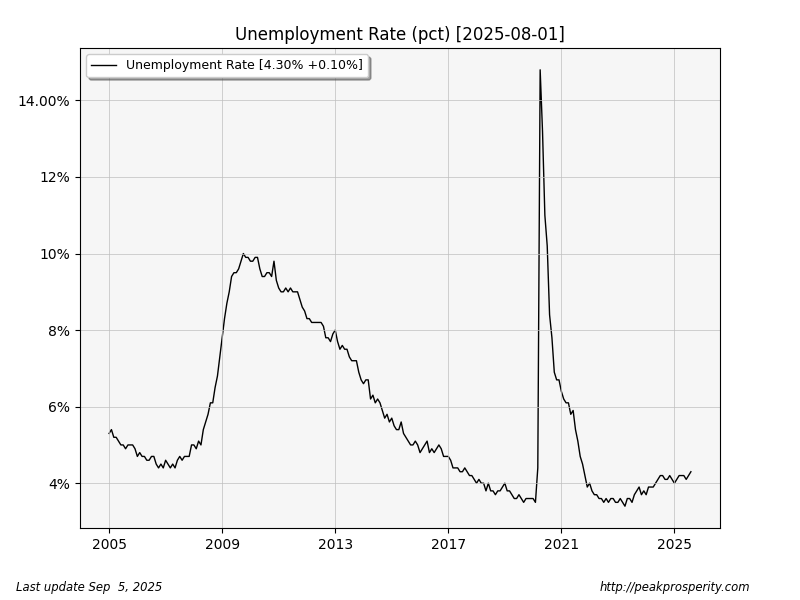

Worse for US citizens (I refuse to call them the derogatory term ‘consumers’ any longer), is that inflation has been running extremely hot for the past five years, and far beyond the Fed’s laughable and completely ignorable lip service about a 2% target:

The prediction here is simple: there’s a lot more inflation on the way.

Inflation was already not contained, and the Fed decided to throw more gasoline on that smouldering fire.

Which means the Fed opted, once again, to reward financial asset holders (principally the top 10% of society) and make the other 90% foot the bill in terms of stolen purchasing power, which the Fed and its MSM apologists euphemistically call “inflation.”

Paul Kiker gave us an extensive discussion about how his firm goes about strategically managing risk and dynamically switching financial sectors when their tools say to. It’s well worth a listen, and hopefully it sparks some questions you can ask your current portfolio manager. Or give Paul’s firm a chance to take you through a thorough financial planning and strategy process by clicking this link and filling out a simple form to get the process started.

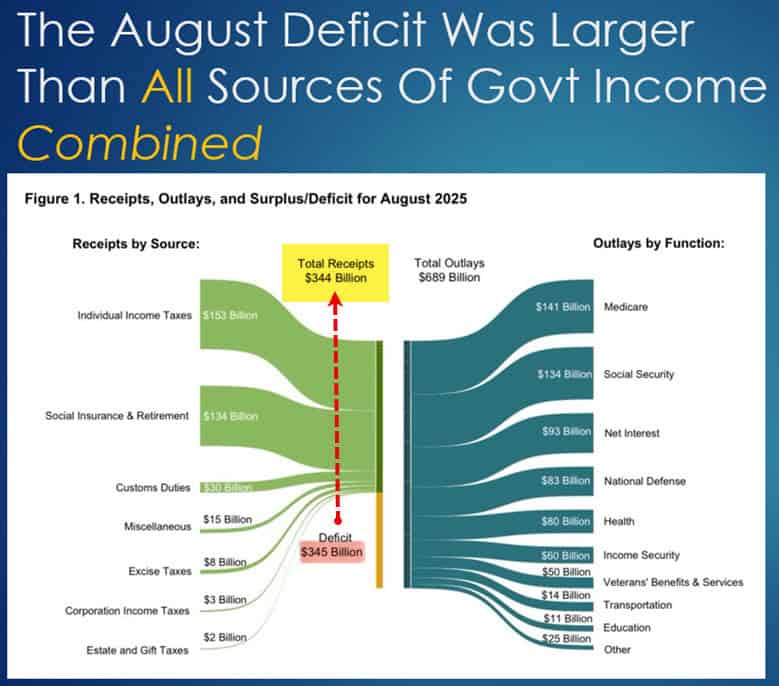

We also discussed how the Trump administration has completely thrown in the towel on anything even remotely resembling fiscal restraint. How bad is it?

In August 2025, the deficit was as large as all sources of income for the US government, meaning they took in 1x and spent 2x.

The future is remarkably easy to foretell: more printing, more spending, and more inflation. That’s the current trajectory, and we see nothing that’s going to deflect it from that path.

Plan accordingly. It’s going to take nerves of steel and a nimble approach to investing to avoid being ground up by these accumulating policy decisions.

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOR PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.