Today's financial markets make a mockery out of sanity and logic. The difference between what SHOULD happen and what IS happening is perhaps the greatest it has been in our investing lifetimes.

If you're perplexed, flummoxed, frustrated, stymied, enraged, bored, irritated, insulted, discouraged -- any or all of these -- by the ever-higher blind grinding of asset prices over the past several years, despite so many structural reasons for concern, you have good reason to be.

Something Wicked This Way Comes

For most of those reading this, I don't need to re-hash all of the reasons you already read at PeakProsperity.com and similar sites on a regular basis. Suffice it to say there's an overwhelming plethora of reasons beyond the simple 'reversion to the mean' laws of math: weak economic growth, geo-political risks, sky-high valuations, goosed stock earnings, record-high margin debt, insider sales, consumer confidence, retail buying, high energy prices, continued central bank interest rate suppression, etc, etc, etc...

Here's a smattering of recent headlines on the current macro environment:

-

Russian companies ‘de-dollarize’ and switch to yuan, other Asian currencies

- US Workers In The Prime 25-54 Age Group Are Still 2.6 Million Short Of Recovering Post-Crisis Job Losses

-

US consumer confidence falls on greater pessimism about future income gains

-

Deflation-wary European Central Bank cuts deposit rate to below zero

-

Electricity Price Index Soars to New Record at Start of 2014; U.S. Electricity Production Declining

-

Bank Of America: "A Slowdown In National Home Prices Is Coming"

-

and dozens & dozens of others like these...

Are these the sort of headlines that should justify a stock market hitting new highs week after week after week for the past 5 years, with nary a pullback of material proportion?

No, they decidedly are not.

Instead, these are all warning signs that merit caution, and at least some degree of de-risk. They are factual, data-driven signals indicating that the stability of the status quo is unlikely to be sustained. Yet, they continue to deflect off of the Kevlar surface of the reality-distortion field today's markets have surrounded themselves with.

The fundamental issue at hand is: risk is being mis-priced WAY too low in both the stock and bond markets right now. Therefore, the prudent investor will want to reduce their exposure to the inevitable mathematical reversion of prices.

The Good News In All This Bad Data

And now we arrive at the main point of this article: The current crazy/frustrating/scary/pick-your-expletive level of instability in today's market is actually GOOD news.

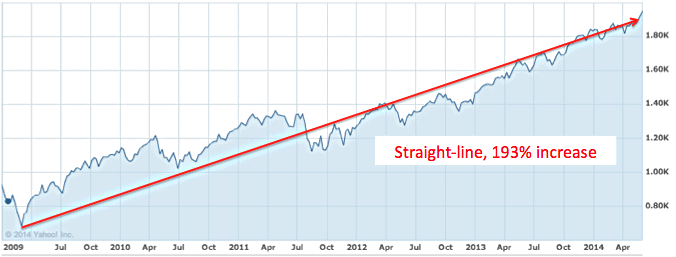

The disconnect between financial asset prices and fundamentals simply must -- per the laws of Nature -- resolve itself. And given the interruption-free 45-degree ramp the markets have experienced since 2009, we can definitively say that we are closer to the coming correction than we have been at any time in the past half-decade (here's a chart of the S&P 500 from its 2009 lows):

The bullet has been dodged for five straight years -- given the instability and the inevitability, how much longer can it be dodged? Not for long, is our conclusion. And given the uninterrupted rise to record highs, the potential energy stored in the system now should be much more kinetically destructive than it would have been had it happened sooner. So, we are at a time in the markets when confidence is high that a big move will happen soon, and happen to the downside.

This is as close as we're going to get in our lives to reading tomorrow's stock prices today. While we can't divine exactly what they're going to be, the odds are very favorable that prices will be lower -- likely a lot lower -- for most assets in the next 6-24 months than they are today.

So, what to do with this insight?

TIME is your great ally here. Wait for the correction to occur, to bring asset prices back down to the point where the math to purchase them again make sense.

This was the main point of the presentation from John Hussman we recently highlighted. Simply wait and let market forces/reversion to the mean remove the risk for you. By opting to take very little risk in the immediate term (i.e., sit on the sidelines), your odds of being able to enter at much safer and much more attractive price points in the not-too-distant future are very high by historical measure.

If the above logic resonates with you, now is the time to build dry powder and to develop your action plan for the correction.

The Case for Cash

Market corrections are deflationary. They create demand for safety and -- as long as the major fiat currency regimes are still in place -- a tremendous scramble for cash.

The falling asset prices and lost income that come with such a correction result in, on a relative basis, fewer people being "cash rich" (especially if we think of the actual paper bills). And these falling incomes and prices, if severe enough, can create negative feedback loops (such as margin calls) that exacerbate the need to raise cash quickly. This will be true both domestically and abroad, and so the hunger for cash -- especially US dollars -- will be high (Charles Hugh Smith has written about this at length).

So this is why in a deflationary environment, cash is king. And why our advice is: Be royalty.

The big picture for the Economic "E" we discuss here at Peak Prosperity is the inevitable Great Wealth Transfer that is underway. These transfers have happened many times in history (Chris and Jim Rickards have an excellent historical discussion in this podcast), and are the "blood in the streets" episodes where good assets can be obtained for pennies on the dollar. During these moments in history, it's vastly preferable to be one of the folks holding the dollars (or whichever assets have retained their purchasing power).

It's for this reason that, at this particular moment in time, the combination of dry powder + patience is likely the single smartest financial investment to make.

Somewhat surprisingly, it's a difficult step for many investors to embrace. After decades of being marketed to that "investing" means holding stocks and bonds, many investors fail to realize that, sometimes, cash can be THE best investment for the near-term. It's important to be able to recognize those times. Our conclusion here at PeakProsperity.com is that now is one of them.

Remember, both mathematically and emotionally, it's much better to avoid loss than miss out on gain.

Moreover, in a market like today's where asset prices are being driven higher by central bank liquidity much more than anything else, you have two big challenges. The first is that, as everything rises, it's much harder to identify which ones are the stars and which are the dogs. The liquidity flood is obscuring the details (as Warren Buffet famously said, until the tide recedes, you can't tell who's swimming naked). And the second is that, as prices get driven much higher than fundamentals merit, it's hard to know what "fair value" is. It becomes a much more subjective call, versus an empirical exercise.

Which is why our advice is to build cash and wait. Wait until the mathematically-inevitable correction occurs, and then start considering re-entering the financial markets. You will have the twin benefits of buying the same assets at lower prices AND have a much easier time evaluating the "slam dunks" from the stinkers using tried-and-true quantitative methods of valuation. Remember, too, that bubble burstings over-correct on the downside, so your odds of finding exceptionally good entry prices will be unusually high. Moreover, if you have discretionary capital to invest as a market decline is clearly underway, it gives you the opportunity to make speculative bets to the downside (this shorting strategy is discussed in greater detail in the Stocks & Bonds section in Part 2 and most definitely is NOT appropriate for everyone).

As you increase your cash positions, take measures to protect them should they become large enough. For instance, if they come to exceed the $250,000 limit covered by FDIC insurance ($500,000 for joint account), place the excess in a new account; ideally in another bank. At (and definitely above) that level, it begins to make sense to diversify your cash holdings into multiple currencies. Consult your financial advisor about good strategies for this.

Many of you may be wondering: But isn't cash a risky asset in the long term? After all, we spend a lot of time here at PP.com writing about the loss of fiat purchasing power and the inevitability of a currency crisis. And about the dangerous of wealth confiscation through government measures like the bank "bail-in" seen in Cyprus. Have those concerns changed?

Not at all. But timing is key in this story. We can easily experience a deflationary rout before a subsequent hyperinflationary one (see the Ka-POOM theory), which would first see cash treasured, and then later reviled. This is more or less what Chris and I see as likely to happen.

But since no one -- including us -- has a crystal ball, we will be tracking monetary developments closely every day here at PeakProsperity.com and will issue alerts to our enrolled members as we see outcomes becoming more or less certain.

And in the meantime, we'll continue advising the build-up of dry powder.

Why Planning Is The Top Priority Now

He who fails to plan is planning to fail.

~ Winston Churchill

Fortune favors the prepared mind.

~ Louis Pasteur

As Pasteur implied, having a "prepared mind" when others are losing theirs greatly increases your odds for success. Bubble corrections are vicious and always occur much faster than the run-ups that preceded them. During them, time is short and emotions are hot. So you'll want to be as cool-headed and surgical in your decision-making as possible.

To do that, you'll need a good plan devised well in advance of the chaos.

Your plan should cover positioning for:

- Pre-correction: notably, where to best protect the purchasing power of your wealth (relevant to everyone) & speculative bets to the downside (for experienced investors with discretionary capital ONLY)

- Intra-correction: less speculative bets once downside momentum is clearly in play (for experienced investors)

- Post-correction: identifying attractive target assets and favorable entry price points for deploying dry capital (for everyone)

Some steps of your plan will be taken in the near term, which will be relatively easy to perform while the environment is stable. Others will be put in place now, but lie in wait, ready to be triggered by market developments. When it comes time to deploy them, there's likely to be a lot of stress, confusion and uncertainty in the air -- which is exactly why you want to make your decisions now, in advance, calmly and logically.

It should go without saying that such a plan is best developed working with a solid professional financial adviser who appreciates the market risks raised within this article. Most people reading this (myself included) are not well-positioned from an experience and/or bandwidth standpoint to construct AND manage plan deployment on their own, and especially once volatility and trading volumes return to the markets. Work with your adviser, or find a good one if you don't already have one. (Having trouble finding a good one? Consider talking to our endorsed adviser). But do it soon.

In Part 2: How To Position Yourself Now, we lay out a detailed roadmap of the specific strategies and vehicles a good action plan should consider for stocks & bonds (both long & short), real estate, precious metals & miners, debt management, income, local investing, and more. Our longest report of the year so far, it offers useful structure and guidance for the investor to follow in building a customized plan around their own goals and risk tolerance.

With the current wide discrepancy between asset prices and fundamentals, don't be caught as vulnerable as you were in 2008. And, with a little planning and prudence, position yourself to take advantage when reality returns.

Click here to access Part 2 of this report (free executive summary, enrollment required for full access)

This is a companion discussion topic for the original entry at https://peakprosperity.com/the-good-news-in-all-the-bad-data/