Originally published at: https://peakprosperity.com/the-government-shuts-down-jobs-crater-but-stocks-go-up/

Look, my only real fear around the government shutdown is that it will start back up again. I am a huge fan of smaller government, fewer government workers, fewer regulations, and more individual responsibility and freedom.

That said, the shutdown is likely to cause some market perturbations, which Paul Kiker and I discuss in this podcast.

But mainly, we’re in ‘wait and see’ mode, the same as everyone else. Probably this will play out like it has in the past; nothing much actually happens, except for hyperbolic MSM headlines and a few sob stories about hardships for furloughed workers unable to pay their utility bills and US citizens who had their National Park vacation plans disrupted.

However, and far more importantly, gold is telegraphing a ridiculously important signal. While the actual drivers are mysterious, the larger fact is that big money is buying gold and doing it in droves.

We can speculate as to the true “whys” behind this, but it has to be some version of “we currently trust gold more than we trust paper wealth.”

Pick your reason(s), and there are plenty, but gold’s 48% rise YTD is screaming loudly for those who know how to listen.

Markets

Meanwhile, the equity ““markets”” in the US and Europe are trundling along merrily up and to the right as if there were no concerns in the world.

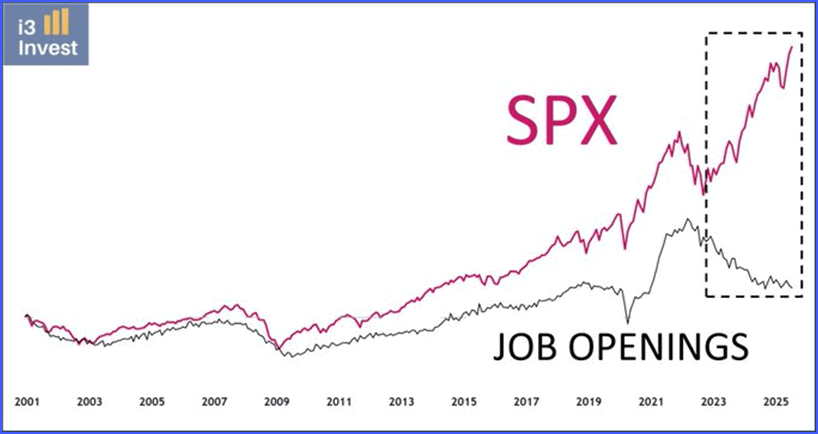

Certainly, the idea of a “jobless recovery” we discussed a few weeks back seems to be in play:

Okay…so, as long as stock are rising, all is well? Is that the idea we’re supposed to subscribe to here?

If so, I’ll take a pass.

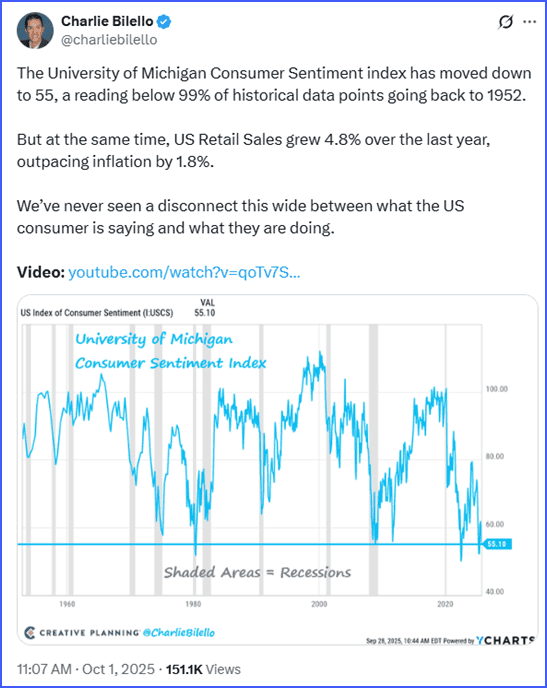

Confirming this idea that the so-called “jobless recovery” isn’t really ‘a thing’ and benefiting everyone, Consumer Sentiment is in the dumps and has been better than it currently is for 99% of all the time between 1955 and 2025:

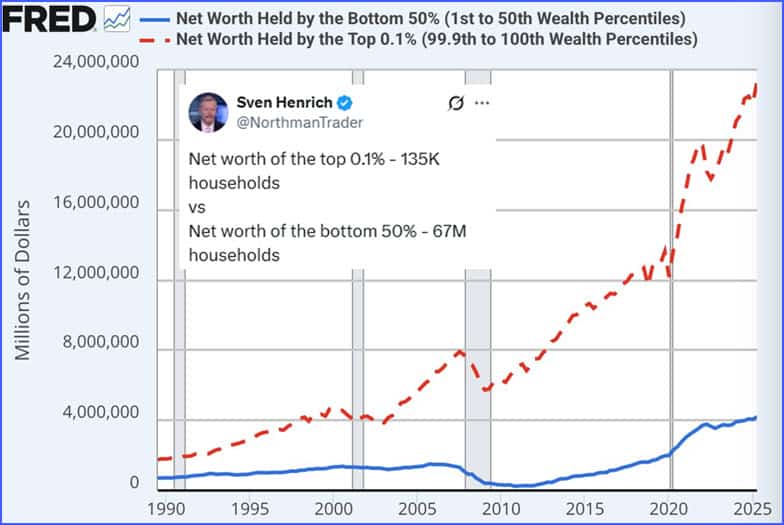

In a further confirmation of the vast societal vandalism performed by the Federal Reserve as they endeavored to keep “financial assets” expanding even to the expense of everyone else, is this data:

Conclusion

Look, the current power brokers are locked into a pattern; higher stock and bond prices, the middle and under classes be damned.

This means we can fully expect ’them’ to continue to print and inflate. This brings us back to gold. Whether the initiating cause is a war in Europe with Russia, or a breakdown in trade relations with China, or the impact of AI destroying jobs and “necessitating” Universal Basic Income (UBI), the story is the same.

More printing.

More counterparty risk.

Gold happens to be the ONLY monetary asset that is not somebody else’s liability. The only one. Assuming you hold it in your hot little hands. Otherwise, it’s still locked in an asset-liability standoff.

As always, you deserve to get ahead of the looming difficulties, and that begins with a comprehensive, no-holds-barred review of your portfolio, needs, and strategies by Paul Kiker’s amazing team. To begin the no obligation process, click here, fill out the short and simple form, and within 48 business hours, Paul’s team will reach out to schedule your first personal and personalized meeting.

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOR PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.