The world's major central banks -- including the Bank of Japan (BOJ), the European Central Bank (ECB), and the Federal Reserve -- appear to have finally won a major battle in the deflationary war that broke out five years ago in 2007. While the ultimate victor is yet to be determined, it now seems likely that a period of nominal growth could ensue for another two years, perhaps even longer.

This will not be high-quality growth. And little of the growth will be real.

Commodity prices will surely eat away at most, if not all, of any gains that may occur in global GDP. Additionally, while non-OECD growth actually has a chance of achieving some GDP gains in real terms, the prospects for the OECD are not as encouraging.

The Race for BTUs Has Begun

It’s important to put yourself in the minds of OECD policy makers. They are largely managing a retirement class that is moving out of the workforce and looking to draw upon its savings -- savings that are (mostly) in real estate, bonds, and equities. Given this demographic reality, growth in nominal terms is undoubtedly the new policy of the West.

While a 'nominal GDP targeting' approach has been officially rejected (so far), don't believe it. Reflationary policy aimed at sustaining asset prices at high levels will continue to be the policy going forward.

While it’s unclear how long a post-credit bubble world can sustain such period of forced growth, what is perfectly clear is that oil is no longer available to fund such growth. For the seventh year since 2005, global oil production in 2011 failed to surpass 74 mbpd (million barrels per day) on an annual basis. But while the West is set to dote upon its retirement class for many years to come, the five billion people in the developing world are ready to undertake the next leg of their industrial growth. They are already using oil at the margin as their populations urbanize. But as the developing world comes on board as new users of petroleum, they still need growing resources of other energy to fund the new growth which now lies ahead of them.

This unchangeable fact sets the world on an inexorable path: a competitive race for BTUs.

When Oil Can't Take You There

It was not supposed to be this way.

Less than ten years ago, the universal assumption was that liquid BTUs would ferry the world through its next phase of growth. The central thesis underpinning these forecasts, of course, was a belief in the large size of the world's total resource base. Because this view was so widely shared by geologists, its soundness was not questioned. It’s critical to understand that within the industry itself, there was a nearly universal assumption that higher prices would make the next tranche of oil resources commercially economic -- and easily so.

For example, when ExxonMobil declared in early 2004 that they could bury the market in oil should prices ever move above $40 a barrel, they believed that forecast very strongly.

Let’s consider that the role of the petroleum geologist in this regard, whose task is to locate and make recoverable these resources. It was not then, nor would it be now, a very appealing prospect for that professional to consider that the next set of resources might be so expensive to develop that many economies and regions might not be able to afford them. You can see such perspectives in books that appeared 4-5 years ago, such as The Myth of the Oil Crisis, which correctly identified the vast oil resources still to be extracted, but missed the slow rate at which these resources would be developed. Indeed, if there is a single concept that trips up experts and laymen alike, it is the changing rate at which many natural resources have started to come to market in the past decade.

And because of this, we've seen a number of forecasts for significantly higher oil production coming from the media and the financial sector during the past few years.

Last autumn, for example, I chronicled the flurry of exuberant calls for US oil independence and showed that a 2 mbpd decrease in US oil consumption had been completely marginalized in favor of a 0.5 mbpd increase in order to deliver a positive headline that the US was becoming less dependent on foreign oil because of increased supply. In Selling the Oil Illusion, American Style, I noted that such an uptick in US triumphalism was likely to accompany high oil and gasoline prices, as a way for the US to tell itself a reassuring story while the pressure increases on politicians and policy makers.

Indeed, Dan Yergin’s There Will Be Oil in last year’s Wall Street Journal was the start, I think, of a campaign to pressure the government to open more lands for drilling in the United States. Since then, high gasoline prices have been all the rage on every blog, talk show, public news radio station, and in the media at large. However, not since those naive days of 2004-2005, when oil first crossed the $40 mark, have I seen such an outlier supply call than the one that came through Citigroup in just the past few weeks.

The Latest Big Call: North America as Oil Giant

Ed Morse leads an energy research team at Citigroup and is well known for accurately calling oil’s price in 2008. But Citigroup's recent call for a potential doubling of North America's liquid petroleum production over the next ten years seems little more than a dream-wish.

Once again, we turn to the Wall Street Journal, which has now shown a definite habit for providing free space to those who call for North American energy abundance and independence. Speaking of Canada, the United States, and Mexico, Mr. Morse writes:

….theoretically total oil production from the three countries could rise by 11.2 million barrels per day by 2020, or to 26.6 million barrels per day from around 15.4 million per day at the end of 2011.

(Source)

What Mr. Morse fails to mention in his op-ed is that the rate at which Canada, US, and Mexico would have to produce this new oil to meet his prediction would require new oil development and production at a rate of growth seen in the boom-days decades ago, a rate that is simply no longer possible.

Yes, the United States doubled its production of crude oil in 30 years between 1940 and 1970. Yes, from 1970 to 2000, Mexico nearly quadrupled its production of oil. Yes, Canada doubled production from 1980 to 2010. But let’s consider the time span of those periods: They were all 30-year timeframes, not 10-year timeframes.

More important is that for the US and Mexico, the peak of oil production is now in the past. The US peaked in the early 1970’s, and Mexico peaked in the last decade as its singular giant, Cantarell, entered decline. Only Canada has been able to inch up production, but there, too, lies an overlooked barrier: Again, the rate at which Alberta Tar Sands oil is developed and then produced is much slower than conventional oil.

Mr. Morse and the team at Citigroup have made the same mistake that was more prevalent a decade ago. They have mistaken the size of the resource base for the actual flows that are now economically, and geologically, possible.

Rate-Limiting Realities

Have you tired yet of the word rate?

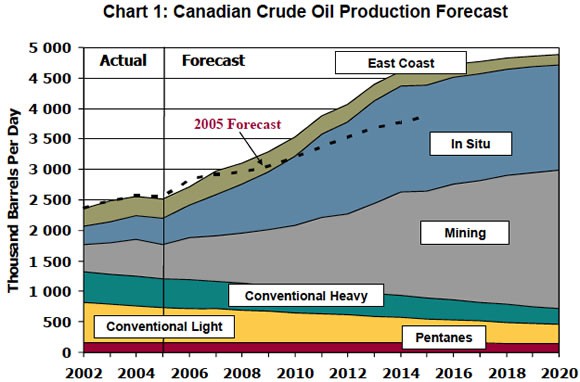

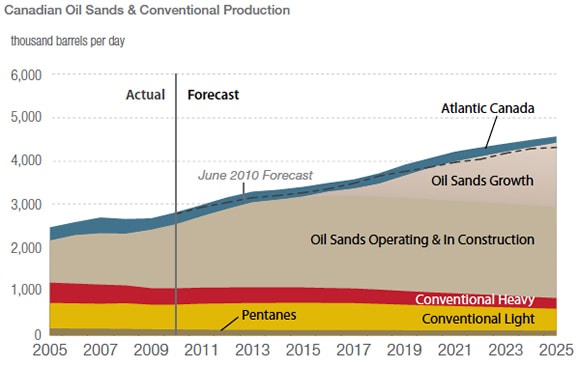

Enrolled members of PeakProsperity.com read my discussion of the two below charts earlier this year. The charts show two different forecasts, five years apart, of future oil production from Canada -- much of which has depended on growth from the Alberta Tar Sands. However, I am using them again in the face of the Citigroup claims so that a wider audience can see how limited the rate of the growth can be, as we face the next set of oil resources.

Recall, too, that it’s not just Citigroup; many Americans and US politicians believe that Canada is a petro-giant that will easily be able to increase oil production quickly to feed future US demand.

Moreover, lest the implication go unnoticed, Ed Morse’s team did indeed (rather foolishly in my opinion) not only call for a potential doubling of liquid petroleum production by 2020, but went on to claim that this would be enough supply to actually move the price of oil downwards, to $85 a barrel by that time:

Excess Canadian crude oil produced from oil sands is expanding at a rate of one million barrels a day every five years. The more that's produced, the less of a market there will be for oil from Venezuela and some other OPEC member countries with similar-quality oil, requiring them to either curtail production or lower prices. Even if oil prices rise in the medium term, we expect 2020 prices to be no more than $85 per barrel, compared with today's prevailing global price of $125.

It is quite incomprehensible that Citigroup could make such a call. I must be blunt: This is not serious forecasting, and there is no support in current trends -- or those of the past 5-8 years -- that would support such a price call.

Even CERA (Cambridge Energy Research Associates) has logged the explosion in the costs to bring on the marginal barrel of global supply, as has IEA Paris, and other energy teams such as Barclays.

Essentially, the Citigroup team is calling for a price of oil 8-10 years from now of $85 a barrel, which is essentially the price already needed today to bring on a marginal barrel of supply.

From Africa to Brazil, and from Russia to Canada, there is precisely nothing in the trends of the past 10 years that indicates finding and exploration costs for new oil are either set to fall or even level out. Geology and the cost of energy itself preclude such a possibility.

But as I mentioned, it is not just economists who mistakenly project fast rates of development from the domain of stubborn, slow, physical reality of the world’s resources. The following two charts show the forecast of future production from CAPP -- The Canadian Association of Petroleum Producers. The first chart is from 2006, and projects production through 2020:

Basically, in 2006 (which significantly raised the forecast from the year prior), the industry expected Canada to be producing 3.5 mbpd of oil by 2010; 3.75 mbpd by 2011; and 4 mbpd by 2012!

Now here is the second chart, from 2011, forecasting production out to 2025.

However, 2010 saw only 2.7 mbpd of annual production.

More revealing is that back in 2006 (the first chart), the industry expected Canada to be approaching 4 mbpd of production by 2011-2012. However, the latest data shows that the 2011 annual average only reached 2.9 mbpd, with recent months hitting 3 mbpd. In other words, the industry itself, on a five year time-frame, missed its forecast by nearly a million barrels. That is not a small miss for a country producing only 3 mbpd.

But given that this is the nature of new oil resources, we should only be surprised that analysts such as the team at Citigroup should have the bravado to call for future production growth at a rate totally unsupported by the nature of these resources.

The Race for Resources

What the team at Citigroup and other so-inclined geologists and economists are correct about, however, is that human economies will undoubtedly go after the next layer of fossil fuels -- at least until the economics of such a quest beats us back towards some other set of alternatives.

So while North American oil production has virtually no chance to increase, as believed by the cornucopians, there is little doubt that in the quest to gain relief from permanently high oil prices, every possible BTU in North America will be accessed and utilized. More broadly, as the acceptance of the new era of high-priced oil finally (and I do mean finally) broadens out to the wider public, the scramble for solutions will also unfold.

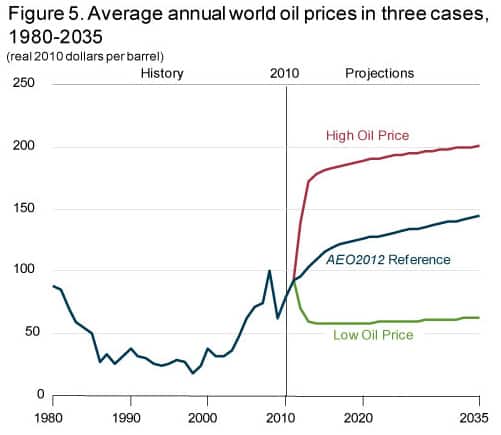

What do I mean by permanently higher oil prices? Well, given that the cost of the marginal barrel has risen so much the past decade and that Asia continues to add to its demand in a relentless fashion, this price forecast from the U.S. Energy Information Administration (EIA) in Washington looks about right to me: (Annual Energy Outlook 2012):

The lower price path offered by EIA is now out of the question. Only a deflationary depression, sustained for more than several years, would allow for such low oil prices.

Because of geology, and because the non-OECD can afford even higher prices, the world faces a price path -- with large oscillations -- between the Reference case and the High Oil Price case.

Transitioning to Other BTUs

In Part II: Promising Investments as the Race for BTUs Heats Up, I lay out the latest global energy data showing how the world is already trying to transition away from oil and slamming the door shut on the prospect for any new net growth in global oil production and supply.

Are we closer than ever before to a tipping point, a regime change in which acceptance of high oil prices will broaden out in society? Four years of extraordinary, emergency provision of new credit by Central Banks should be sufficient to create a two-to-four-year mini-boom dominated by the world digging up fresh BTUs as the realization finally sets in that no more oil is forthcoming.

Finally, I identify areas of investment that will play upon the coming scramble new energy resources.

Click here to read Part II of this report (free executive summary; enrollment required to access).

This is a companion discussion topic for the original entry at https://peakprosperity.com/the-race-for-btus-3/