Financial markets the world over are increasingly chaotic; either retreating or plunging. Our view remains that there’s a gigantic market crash in the coming future -- one that has possibly started now.

Our reason for expecting a market crash is simple: Bubbles always burst.

Bubbles arise when asset prices inflate above what underlying incomes can sustain. Centuries ago, the Dutch woke up one morning and discovered that tulips were simply just flowers after all. But today, the public has yet to wake up to the mathematical reality that over $200 trillion in debt and perhaps another $500 trillion of un(der)funded liabilities really cannot ever be paid back under current terms. However, this fact is dawning within the minds of more and more critical thinkers with each passing day.

In order for these obligations to be reset to a reality-based level, something has to give. The central banks have tried to modify the phrase “under current terms” by debasing the currency these obligations are written in via inflation. Try as they have, though, they’ve been unable to create the sort of "goldilocks" low-level inflation that would slowly sublimate that massive pile of debt into something more manageable.

Wide-spread inflation has not happened. Why not? Because they've failed to note that plan of handing all of their newly printed money to a very wealthy elite -- while a socially popular thing to do among the cocktail party set -- simply has concentrated the inflation to the sorts of assets the monied set buys: private jets, penthouse apartments, fine art, large gemstones, etc. So yes, their efforts produced price inflation; just of the wrong sort.

Even worse, all the central banks have really accomplished is to assure that when the deflation monster finally arrives it will be gigantic, highly damaging and possibly uncontrollable. I'll admit to being worried about this next crash/crisis because I imagine it will involve record-setting losses, human misery due to lost jobs and dashed dreams, and possibly even the prospect of wars and serious social unrest.

Let me be blunt: this next crash will be far worse and more dramatic than any that has come before. Literally, the world has never seen anything like the situation we collectively find ourselves in today. The so-called Great Depression happened for purely monetary reasons. Before, during and after the Great Depression, abundant resources, spare capacity and willing workers existed in sufficient quantities to get things moving along smartly again once the financial system had been reset.

This time there’s something different in the story line: the absence of abundant and high-net energy oil. Many of you might be thinking “Hey, the price of oil is low!” which is true, but only momentarily. Remember that price is not the same thing as net energy, which is what's left over after you expend energy to get a fossil fuel like oil out of the ground. As soon as the world economy tries to grow rapidly again, we’ll discover that oil will quickly go through two to possibly three complete doublings in price due to supply issues. And those oil price spikes will collide into that tower of outstanding debt, making the economic growth required to inflate them away a lot more expensive (both cost-wise and energetically) to come by.

With every passing moment, the world has slightly less high-net energy conventional oil and is replacing that with low-net energy oil. Consider how we're producing less barrels of production in the North Sea while coaxing more out of the tar sands. From a volume or a price standpoint right now, the casual observer would notice nothing. But it takes a lot more energy to get a barrel of oil from tar sands. So there's less net energy which can be used to grow the world economy after that substitution.

Purely from a price standpoint, our model at Peak Prosperity includes the idea that there’s a price of oil that’s too high for the economy to sustain (the ceiling) and a price that’s too low for the oil companies to remain financially solvent (the floor). That ceiling and that floor are drawing ever closer. When we reach the point at which there’s not enough of a gap between them to sustainably power the growth our economy currently is depending on, there’s nothing left but to adjust our economic hopes and dreams to more realistic -- and far lower -- levels.

When this happens most folks will undergo a "forced simplification" of their lifestyles (as well as their financial portfolios), which they will experience as disruptive and emotionally difficult. That's not fear-mongering; it's just math. (And it's the reason why we encourage developing a resilient lifestyle today, to insulate yourself from this disruption, as well as be able to enter the future with optimism.)

Too Much Debt

Our diagnosis of the fatal flaw facing the global economy and its financial systems has remained unchanged since before 2008. We can sum it up with these three simple words: Too much debt.

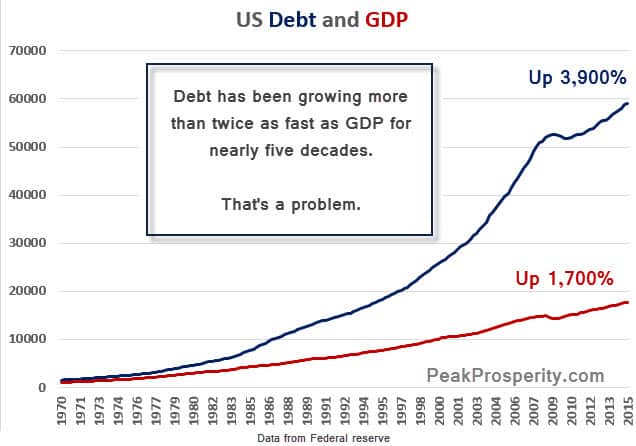

The chart below visualizes our predicament plainly. It has always been mathematically impossible (not to mention intellectually bankrupt) to expect to grow one's debt at twice the rate of one's income in perpetuity:

All but the most blinkered can rapidly work out the fallacy captured in the above chart. Sooner or later, borrowing at a faster rate than income growth was going to end because it has to. Again, it's just math. Math that our central planners seem blind to, by the way -- all of whom embrace "More debt!" as a solution, not a problem.

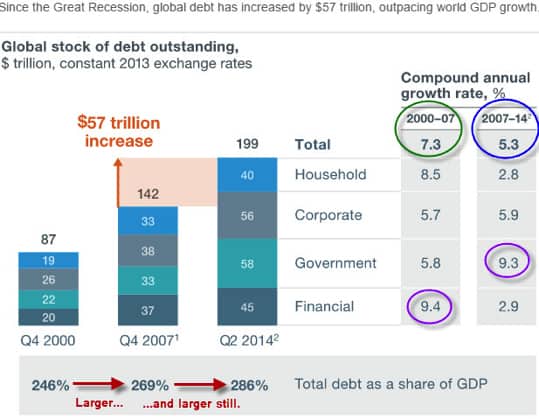

Despite being given the opportunity to re-think their strategy in the wake of the 2008 credit crisis, the world’s central banks instead did everything in their considerable power to create conditions for the most rapid period of credit accumulation in all of history:

Lesson not learned!

The chart's global debt number is only larger now, somewhere well north of $200 trillion here in Q1 2016. But consider, if you will, that entire world had ‘only’ managed to accumulate $87 trillion in total debt by 2000 (this is just debt, mind you, it does not include the larger amount of unfunded liabilities). Yet governments then managed to pour on an additional $57 trillion just between the end of 2007 and the half way point of 2014, just seven and half short years later.

Was this a good idea? Or monumental stupidity? We’re about to find out.

My vote is on stupidity.

Banks In Trouble

In just the first few weeks of 2016, the prices of many bank stocks have suddenly dropped to deeply distressed territory. And the price of insurance against default on the bonds of those banks is now spiking.

While we don't know exactly what ails these banks -- and, if history is any guide, we probably won’t find out until after this next crisis is well underway -- but we can tell from the outside looking in that something is very wrong.

In today’s hyper-interconnected world of global banking, if one domino falls, it will topple any number of others. The points of connectivity are so numerous and tangled that literally no human is able to predict with certainty what will happen. Which is why the action now occurring in the banking sector is beginning to smell like 2008 all over again:

Gundlach Says 'Frightening' Seeing Financial Stocks Below Crisis

Feb 5, 2016

DoubleLine Capital’s Jeffrey Gundlach said it’s “frightening” to see major financial stocks trading at prices below their financial crisis levels.

He cited Deutsche Bank AG and Credit Suisse Group AG as examples in a talk outlining bearish views at a conference in Beverly Hills, California, on Friday. Both banks fell this week to their lowest levels since the early 1990s in European trading.

“We see the price of major financial stocks, particularly in Europe, which are truly frightening,” Gundlach said. “Do you know that Credit Suisse, which is a powerhouse bank, their stock price is lower than it was in the depths of the financial crisis in 2009? Do you know that Deutsche Bank is at a lower price today than it was in 2009 when we were talking about the potential implosion of the entire global banking system?”

(Source)

This time it looks like the trouble is likely to begin in Europe, where we’ve been tracking the woes of Deutsche Bank (DB) for a while. But in Italy, banks are carrying 18% non-performing loans and an additional double digit percentage of ‘marginally performing' or impaired loans. Taken together, these loans represent more than 20% of Italy's GDP, which is hugely problematic.

The Italian banking sector may have upwards of 25% to 30% bad or impaired loans on the books. That means the entire banking sector is kaput. Finis. Insolvent and ready for the restructuring vultures to take over.

On average, in a fractional reserve banking system operating at a 10% reserve ratio, when a bank's bad loans approach its reserve ratio, it's pretty much toast. By 15% that's pretty much a certainty. By 20% you just need to figure out which resolution specialist to call. At 25% or 30%, you probably should pack a bag and skip town in the dead of night.

This handy chart provides some of the context for Europe more broadly. I’ve highlighted everything from Europe in yellow, showing how the banks there currently top the list of awfulness:

(Source)

The extreme weakness in European financial shares, combined with other factors, is dragging down Europe’s stock market dramatically. The decline has now wiped out all of 2015’s market gains and has broken convincingly below the neckline (yellow line, below) of a typical “Head & Shoulders” formation:

Since the beginning of the year, the stock prices of these select banks are down (as of COB Friday 2/5/16):

- DB -28.3%

- Credit Swiss -29.9%

- MS -22.6%

- C -22.0%

- Barclays -21.7%

- BAC -21.2%

- UBS -20.3%

- RBS -19.6%

Those are pretty hefty losses over a short period of time, and that’s meaningful. While the headline equity indexes are managing to keep their losses minimized, these bellwether stocks from the critical finance sector are stampeding out the back door.

And when I say ‘critical’, I mean in the sense that a hefty amount of the overall earnings within the S&P 500 and other major stock indexes were fraudulent profits were derived from the banks feeding on central bank thin-air money and front-running central bank policy.

What's there to worry about? Well, just pick something. It could be a combination of headwinds conspiring to drag down bank earnings from here. Take your pick: reduced trading and M&A revenue, and lower profits from ridiculously flat yield curves and negative interest rates.

However, we have to include the possibility that No more bailouts are coming. Why not? Mainly because it would be politically incendiary at this moment to even try such a thing. Public resentment of the banks is high all over the world, and in the US specifically, there’s an election primary that is hinging for the Democrats on Wall Street coziness. Maybe the markets are pricing that in?

Or it could be that these banks have been playing with fire (again) and got burned (again). We know for sure that a number hold a boatload of junk debt from the energy sector that will need to be written off. And we suspect many are staring at losses from writing too many derivative contracts that have turned against them.

But It Gets Worse; A Lot Worse

If only the greatest near-term risks were limited to the bad actions of the banks. But that's sadly not the case.

The collapse in the price of oil has been vicious, but it's likely not done. The oil patch has morphed into a capital-destruction zone for many drillers and as we have been warning all last year, the fallout is going to be worse than we can imagine. And it's just getting underway.

In Part 2: The Breakdown Has Begun, we lay out our prediction for the terrifying wave of defaults that will swamp the energy sector soon, as well as the many, many related industries that service it. Avoiding losses during this period will be the key priority. And precious metals will regain their role as a preferred save-haven asset class -- a victory long-suffering bullion holders should cheer.

We are now in the chaos management phase of this story. Take care to make smart choices now. Your future prosperity depends on it.

Click here to read Part 2 of this report (free executive summary, enrollment required for full access)

This is a companion discussion topic for the original entry at https://peakprosperity.com/the-return-of-crisis/