Many people rightly aspire to improve their household's state of resilience through actions such as storing emergency supplies, starting a vegetable garden, and learning basic readiness/maintenance skills, etc. In general, resilience boils down to self-reliance. But like it or not, in our largely urbanized society, true long-term self-reliance needs to include some measure of financial independence.

By 'financial independence' I don’t mean so much wealth that you no longer have to earn a living. Rather, in this discussion, financial independence means owning income streams that you control lock, stock and barrel. Some of this income may be passive (for example, royalties earned off a patent you own) but for most people, 'independent' income is actively earned via their own labor (i.e. self-employment).

Of course, the easiest path to financial independence is being born into a wealthy, well-connected family. But since few of us win that born-rich lottery, this article addresses the important question: How do “the rest of us” carve out financial independence?

How Many Make a Middle Class Income from Self-Employment?

Let’s start by defining 'self-employment' as an enterprise without employees that has more than one client. If a consultant’s entire annual income is from one client year after year, for example, the Department of Defense (DoD), the consultant is more of a proxy employee of the DoD than a sole proprietor. In an era where Corporate America and the government attempt to shed employment costs by hiring independent contractors rather than employees, we need to differentiate between quasi-employees who work for one client and the truly self-employed. Unfortunately, the officially-reported employment data does not distinguish between the two.

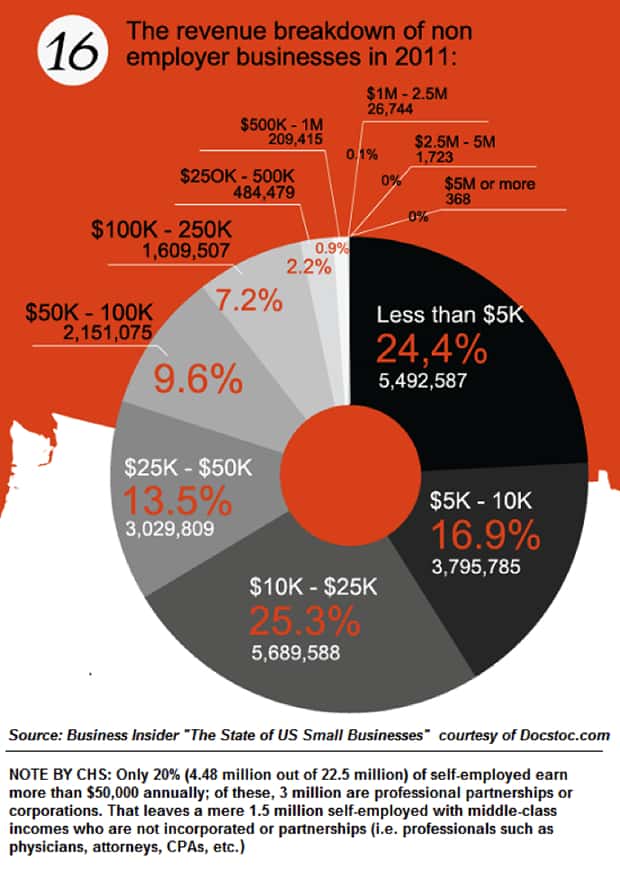

But of greater use is a recent article published in The State of US Small Businesses that included a chart by Docstoc.com regarding self-employment in the U.S. According to Docstoc.com’s research, there are about 22.5 million businesses with no employees in the U.S. that report at least $1,000 in annual receipts. Of these, 3 million are partnerships or S corporations (typically licensed professionals such as attorneys, engineers, architects, etc.) and 19.4 million are sole proprietors.

Docstoc.com found that only 20% (4.4 million) of these no-employee enterprises have receipts of $50,000 or more annually. The remaining 80% earn considerably less: 5.5 million bring in less than $5,000 annually, 3.8 million gross between $5,000 and $10,000, 5.7 million bring in between $10,000 and $25,000, and another 3 million had receipts of between $25,000 and $50,000.

Interestingly, this reflects the Pareto Distribution (a.k.a. the 80/20 rule): the top 20% earn the majority of the income.

In other words, relatively few of these sole proprietorships bring in enough money on their own to fund a relatively middle class lifestyle (i.e. a minimum income of $50,000, though a more realistic minimum in high-cost coastal regions is $100,000 annually).

Checking The Math (Stay With Me Here)

It's not easy to collate meaningful data on self-employment, as various agencies count jobs and income in different ways. The Bureau of Labor Statistics (BLS), for example, measures two types of self-employed workers: the unincorporated and the incorporated. The unincorporated may have employees, but typically do not (i.e. they are sole proprietors). The incorporated have employees, starting with the owner, as the BLS counts the incorporated self-employed as employees of their own corporation.

According to the BLS, there are about 121 million full-time jobs and 27.3 million part-time jobs, for a total of 141 million jobs. But this includes employees working only a few hours a week and self-employed people earning only a few thousand dollars annually.

For a more useful context, let’s turn to IRS tax return data, which isn’t adjusted seasonally or filtered: specifically, the Individual Statistical Tables by Size of Adjusted Gross Income. These tables contain the total number of tax returns and the gross income and taxable income after credits and deductions of all taxpayers.

All data presented below is from Table 1.1, All Returns: Selected Income and Tax Items for tax year 2012, (the most recent data available) and Table 1.4, All Returns: Adjusted Gross Income, Exemptions, Deductions, and Tax Items for tax year 2012.

When we examine Table 1.1, we find there were about 145 million returns filed, and 93 million had taxable income after credits and deductions. Roughly 22 million workers earned less than $10,000, 35 million earned less than $15,000, and 46.5 million earned less than $20,000.

Of the 93 million who paid some income tax, the bottom 72 million paid a bit over 22% of the total income tax paid, and the top 20 million paid about 78% of the tax. Once again, the Pareto Distribution is visible; as the top 20% paid roughly 80% of the total income tax.

In Table 1.4, the IRS lists about 120 million workers with wages/salaries, 17.5 million with a business or profession, and about 5.5 million partnerships and S corporations. These two add up to around 23 million people with some self-employment income.

As noted above, the incorporated self-employed have one employee—themselves—which partially explains why only 18.6 million taxpayers took the deduction for self-employment taxes: the incorporated self-employed are counted as employees receiving wages/salaries.

Of the 18.6 million who paid self-employment tax (15.3% of earned income, as the self-employed pay both the payroll taxes of employees and employers), about 7 million had gross income of $50,000 or more. This is considerably more than Docstoc.com’s estimate of 4.4 million with gross receipts of $50,000 or more.

It’s important to note that enterprises deduct operating expenses from gross income, so the net income of those with $50,000 in gross income can be considerably less. Enterprises with high operational expenses might declare $50,000 in gross income, deduct $40,000 in operational expenses and declare a mere $10,000 as net income.

Roughly 4.2 million partnerships and S corporations had receipts of $50,000 and up. Since the IRS data doesn’t separate partnerships/S corporations with employees and those with no employees, we can use Docstoc.com’s estimate of 3 million self-employed partnerships/S corporations.

One useful clue to the number of self-employed people who earn enough to support a middle-class lifestyle is the number of people who take the deduction for paying their own health insurance premiums (“self-employed health premium deduction”). As we all know, healthcare insurance in the U.S. is terribly expensive unless it is subsidized by the government or an employer. By definition, there is no employer to subsidize the healthcare insurance costs of the truly self-employed, and those who qualify for government subsidies via ACA (Affordable Care Act, or ObamaCare) will only be able to take the self-employment deduction for the portion of the premium they pay.

About 3.9 million taxpayers took the self-employed health premium deduction. (The incorporated self-employed would have their corporation pay the healthcare insurance, so they would not qualify for the deduction.) Of those who took this deduction, only 2.4 million reported gross income of $50,000 or more.

A self-employed person with a spouse who receives healthcare coverage for the household from her employer would also not report this deduction, as the premiums are paid by the spouse’s employer, not the self-employed spouse.

If we consider all this information, it seems that approximately 15% (23 million) of the 145 million people filing tax returns reported some self-employment income. The top 32 million taxpayers (22%) earned roughly 78% of all taxable income. Based on the IRS data and deductions only available to the self-employed, of these top earners, perhaps 4 or 5 million are self-employed (roughly 15% of the top 32 million taxpayers). Of these approximately 3 million are estimated to be professionals such as accountants, attorneys, architects, engineers, consultants, etc.

The Punchline: It's Hard, But Worth Doing

It's sobering that in a nation of 317 million people (of which 145 million people file tax returns), only perhaps 3% of all those reporting income are self-employed people earning enough to support a middle class life without a working spouse. Around 3 million of these 4-5 million are independent professionals, leaving a few million self-employed non-professional Americans earning a middle class income.

Clearly, while the opportunity to earn an independent income via self-employment is still available to millions of Americans, it isn’t easy to generate a middle class income outside of being employed (or quasi-employed independent-contractor status) by the government or Corporate America.

We have to ask: How meaningful is self-employment in an economy that's now so completely dominated by the government, finance and Corporate America that only 3% of the workforce earns a reasonably comfortable living via self-employment?

On the positive side, 18 million people are augmenting their household income with meaningful self-employment and sole proprietor earnings. These income streams are critical self-reliance/resilience assets that may grow with time as the self-employed learn more skills and increase their income-generating abilities.

And that's the key takeaway here. It's that minority who have worked to create additional independent income streams who will fare much better when the next financial crisis hits, resulting in widespread layoffs across corporations and government contractors alike. Losing some, even most, of your income is much easier to persevere through than losing all of it.

In Part 2: A Promising Framework For Developing Independent Income, we break down the primary sources of independent income, which include but are not limited to conventional self-employment. We will also discuss the promise of the emerging Mobile Creative Model for helping motivated workers develop financial independence.

Click here to read Part 2 of this report (free executive summary, enrollment required for full access)

This is a companion discussion topic for the original entry at https://peakprosperity.com/the-self-employed-middle-class-hardly-exists-anymore/