According to the stock markets in the US and in Europe, the world’s economy is not just in good shape, but is in the best shape it’s ever been.

The S&P 500 hit an intraday new record high of 1,858.71 on Feb 24, 2014, and is now 18.6% above the peak it hit in 2007, a moment everybody now recognizes was heavily overvalued.

An almost 19% gain above the prior all time high is an enormous and unusual event. Surely, you are thinking, there must be an equally compelling story and loads of fundamental data to support such a bull market?

Well, there really isn’t.

Not a lot has changed between the prior 2007 peak and today. From a fundamental standpoint, not much at all. Per capita income is only up 8.1% between now and then, and yet the equity markets are rallying like the biggest income boom in all of history has occurred.

Worse, the per capita income data is obscuring the fact that what little income gains have been recorded went almost entirely to the top ten percent of the population. So there’s no broad prospering middle class to drive an economic expansion of the sort that stocks seem to be pricing in.

Of course, the main narrative right now has nothing to do with anything fundamental. Rather, it centers on the idea that as long as the central banks of the west and Japan continue to print, everything financial will just continue to go up in price while -- somehow -- price inflation will remain tame.

Our view here at Peak Prosperity is that this narrative is wrong in every respect; except, perhaps, for those using a highly compressed speculation timeline that ignores both fundamentals and history.

In the immediate term, stock prices gyrate based on various assumptions that are often completely disconnected from reality.

But over the medium and longer terms, fundamentals drive prices; as it is ultimately corporate income and ultimately dividends that determine the value we ascribe to equities, and it's the prospect of future earnings growth that drive the price multiple.

We’ll show in a moment just how far equity prices have diverged from the fundamentals.

But First, The Big Picture

Over the long haul, which we think needs to be kept front and center at all times, equities are nothing more than a means of sharing the wealth that companies create, which itself is a product of the extraction and processing of real things from the real world.

Everything we think we know about the ‘fair value’ of equities was developed over a period of time when the future could always be counted upon to expand exponentially.

You know, sayings like "Over the long haul equities return 10%".

Such a statement can only be true in an exponentially-expanding world where exponentially more things are being extracted from the real world as time goes on. In a world where there is only so much 'stuff,' it's not possible for said 'stuff' to always be present in expansive and expanding quantities.

[Wonk note: Equities could also advance via productivity gains, assuming more utility was derived from the same amount of resources. Perhaps we might assume a world where productivity climbs by 10% per annum to deliver our desired equity gains – but that’s never happened, and certainly will never happen for very long because it implies a 100% improvement every 7 years.]

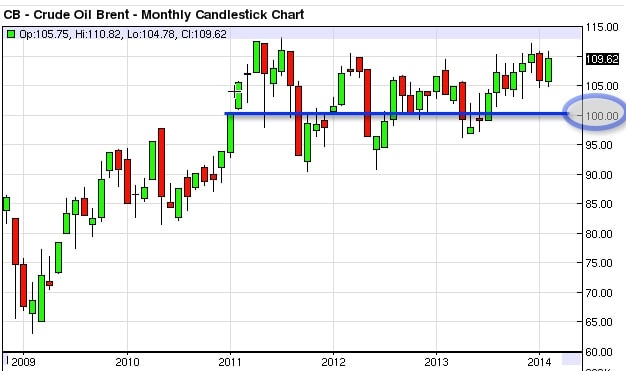

A huge enabler of the economic expansion of the past century has been oil. Without a doubt, petroleum is the master resource for a global economy. And it is no longer cheap. The reason why it is no longer cheap, and never will be again, is a larger story than we have time for here, but recent data should suffice to show that global oil has averaged more than $100 per barrel for more than three years. That's 4x higher than the 1987-2004 average of $23 per barrel:

(Source)

To me, the anemic economic growth in the OECD countries, with their horrible job creation statistics and generally tepid recoveries (at best), is the very predictable result of what you get when oil becomes expensive.

If you hold the view, as we do at PeakProsperity.com, that the future economy cannot possibly grow at the same rates as it did in the past (and that likely someday all growth will cease), then equities are in for a serious correction at some point.

Perhaps that day is still far in the future. But there must always be an eventual reckoning between the number of claims on the world's wealth world and the actual wealth itself.

Further increasing the risk for equities is the fact that, as claims on wealth, they are the least senior of the lot. The holders of bonds and preferred shares come first. So when we wander over to that other, and much larger, corner of the financial universe where debt resides and note that all forms of debt, but especially corporate debt, have continued to grow exponentially both before and after the great 2008 credit crisis, we see that equities are whistling past this part of the story too.

Of course, a huge proportion of all the new corporate debt taken on since that little hiccup in 2009 has been used to buy back shares and thereby goose (through accounting, not by value creation) the earnings per share numbers so widely reported by the financial press.

Eventually, though, all that corporate debt will have to be paid back, and that activity will drain future cash flows and earnings. Again, steadily rising – nay, exponentially rising – levels of corporate debt are a massive collective bet that the future will be exponentially larger than the present.

The only narrative I can imagine that can accommodate a long-term decline of per capita resources coupled to steadily worsening net energy from petroleum, AND simultaneously support the continued exponential expansion of claims against those resources, is one that steadily transfers this wealth into fewer and fewer hands.

After all, if relatively few people end up owning most of the remaining wealth, does it really matter to them that there’s less of it to go around on a per person basis? No, not if they have plenty for themselves.

As the recent travails in Ukraine have showed us, there’s only so far that such a deranged, kleptocratic view can go before it breaks down.

Alternatively, and far more likely, there’s no actual rational narrative of any sort in play right now -- and so the center mass of the investing world is simply operating off of untested and unexamined beliefs that mainly rest on the notion that a prompt and perpetual return to exponential growth is what the future holds.

Again, we see this as dangerously myopic. But sadly, this view is not only rampant on Wall Street, but it's also prevalent with our government as well as endowments, pensions, and insurance pools -- entities with long-term fiduciary responsibilities that really aught to be asking themselves some hard questions these days.

Conclusion

In summary, over the long haul -- by which we mean the next ten to twenty years -- current equity prices are making a colossal bet that exponential economic growth (which itself is linked to cheap oil) is going to quickly resume and persist long into the future. Are you comfortable making that bet? I'm not.

Of course there are a lot of variables in this story; but one could do worse than to simplify one's economic prediction down to this: Until and unless the global supply of oil gets a heck of a lot cheaper, anemic economic growth will persist and therefore the holders of expensive financial assets that are priced for perfection will be badly disappointed.

Spoiler alert: There are no new sources of cheap oil. We've already tapped the easy stuff.

So, there's lots to be concerned about for those holding stocks for the long term. But what about the short term?

In Part 2: The Time To Short The Market Is Approaching, we explain why 2014 is beginning to look an awful lot like 2008; only worse. The ability of stock prices to deviate further from the fundamentals appears to be topping, and a heck of a mean-reversion looks in the cards.

Click here to access Part II of this report (free executive summary; enrollment required for full access).

This is a companion discussion topic for the original entry at https://peakprosperity.com/the-stock-markets-shaky-foundation/