At the beginning of this year (2013), I identified eight key dynamics that will play out over the next two to three years (2013-2015):

Trend #1: Central Planning intervention in stock and bond markets will continue, despite diminishing returns on Central State/Bank intervention

Trend #2: The omnipotence of the Federal Reserve will suffer a fatal erosion of confidence as recession voids Fed policy and pronouncements of “recovery"

Trend #3: The Mainstream Media (MSM) will continue to lose credibility as it parrots Central Planners’ perception management

Trend #4: The failure of what is effectively the “state religion,” Keynesianism, will leave policy makers in the Central State and Bank bereft of policy alternatives

Trend #5: Economic Stagnation will fuel the rise of Permanent Adolescence

Trend #6: Income, the foundation of real economic growth and wealth-distribution stability, will continue to stagnate

Trend #7: Small business—the engine of growth—will continue to decline for structural reasons

Trend #8: Territorial disputes will continue to be invoked to distract domestic audiences from domestic instability and inequality

I know it may strike some as “cheating” that my forecast is for these trends to be consequential within a three-year window rather than by a specific date, but note these are trends, not events, and trends tend not to matter until suddenly they do. This is the nature of Pareto Distributions, in which trends are inconsequential until they reach a critical mass of 4% of the populace, at which point the “vital few” exert outsized influence on 64% of the populace.

Let’s see how the trends developed in 2013:

Trend #1: Intervention yielded outstanding returns on corporate profits and stocks, but diminishing returns on employment, household incomes for the bottom 80%, and growth, all of which are historically subpar:

Trend #2: The Fed’s members are still regarded as heroic demigods who benignly manage the Earth’s economy. When (not if) the stock market rolls over in 2014-15, Fed omnipotence will suffer.

Trend #3: This one is difficult to track, but anecdotal evidence (declining circulation of many mainstream print media, declining viewership in some cable news channels, etc.) may reflect rising disenchantment with the media’s coverage of key issues.

Trend #4: I think it is quite clear that the Fed and its posse of experts have no alternatives to ZIRP (zero interest rate policy) and QE (quantitative easing).

Trend #5: This one is difficult to monitor. If we use the percentage of young people still living at home and the rise of “selfies” (photos taken of oneself), then perhaps a case can be made that this trend is already visible.

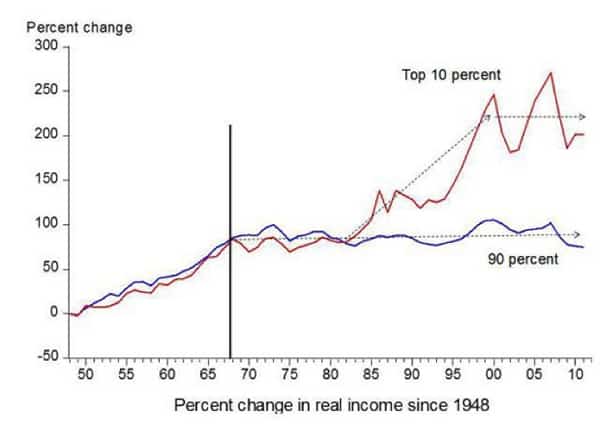

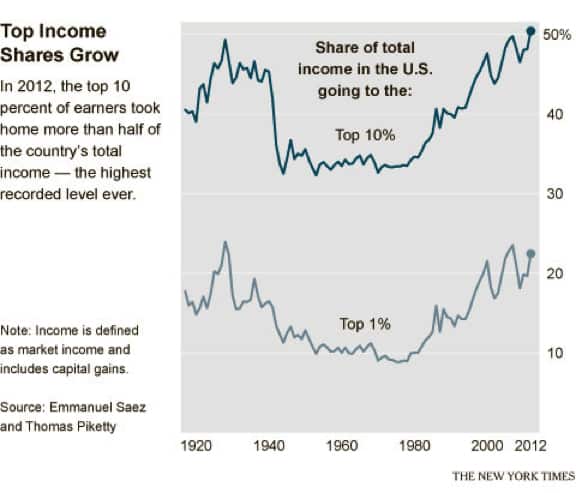

Trend #6: Median household income has edged up, but I suspect this is the result of higher incomes for the top 10% rather than widely distributed gains. Since the top 10% collect 51% of all income, it stands to reason that increases flowing to the top will boost median income even if the bottom 90% sees declines in income:

Trend #7: The unintended consequences of the Affordable Care Act have yet to fully play out.

Trend #8: China’s recent invocation of a “defense zone” that includes the Senkaku Islands suggests this trend is definitely in play.

I also listed eight outcomes:

Outcome #1: The counterfeiting of risk-free assets will continue to be a primary policy of the Status Quo.

Outcome #2: Risk will continue to be transferred en masse to the public.

Outcome #3: Democracy in America is officially dysfunctional.

Outcome #4: Incentives will continue to be structurally perverse, and the rule of law will continue to be bent by individuals, enterprises, and the government.

Outcome #5: Health care (a.k.a. sick care) will continue to be an enormous drag on the economy as diminishing returns, fraud, complexity, and defensive medicine add costs without equivalent improvements in health.

Outcome #6: The costs of complying with Obamacare will act as an inflection point in the decline of small business

Outcome #7: The trend of the Status Quo “solving” perceived problems by adding layers of immense complexity to systems already suffering from marginal returns will continue.

Outcome #8: The informal cash economy will continue expanding, as those who choose to opt out of the Status Quo and those who must opt out as a survival mechanism do so.

Without going into detail, I think a self-evident case can be made that each of these outcomes is already visible at the end of 2013.

Additional Trends to Watch in 2014

Since the trends listed above are still operant, these eight are additional rather than replacement trends:

Trend #1: The Number One growth industry in the private sector will increasingly be lobbying the government for favors. When the State selects the winners and losers throughout the economy, then companies are essentially forced to make their case for special dispensations via campaign contributions and unrelenting lobbying. Elected officials benefit from their centralized powers as the line of corporations anxiously pressing campaign cash on them lengthens in direct proportion to the expansion of State power.

This is the essence of what some call the Corporatocracy that effectively governs the U.S.A. and what I call the Neofeudal Cartel/State system, as the State and its chosen cartels dominate the economy and society in a fashion that can only be described as neofeudal.

Since organic growth from increases in wages and purchasing power are limited to the top 10%, the only sectors that can possibly gain growth from rising sales are Porsche dealerships and other luxury outlets that cater to the top 10%. But since the number of households adding income is a thin 10 million out of 121 million households, moving more luxury goods offers little growth opportunities for the rest of the economy, which is stagnant at best.

As a result, lobbying the central State for favors is the default “growth industry.”

Trend #2: The difference between anemic growth and recession will increasingly be semantic. This is another “How many angels can dance on the head of a pin?” debate in which Ivory Tower/State economists parse juiced or manipulated data to conclude the economy is “growing slowly” or slipping into negative growth; i.e., recession.

Experientially, if purchasing power and discretionary income (what’s left after paying taxes, rent, mortgages, food, utilities, etc.) are both declining for 90% of households, the “growth” in inventories, exports, and other factors that feed into gross domestic product (GDP) are not reflecting the economy we actually inhabit.

Trumpeting what amounts to signal noise as “steady growth” is adept perception management (i.e., propaganda), but if it doesn’t include increases in purchasing power and discretionary income for the bottom 90%, it’s a propaganda embarrassment, like the Fed official hyping the declining cost of tablet computers while someone in the audience shouts, I can’t eat an iPad!

Trend #3: The decline in local government services will accelerate as rising pension/healthcare costs squeeze budgets. Local governments (city, county, state) have avoided the politically combustible collision of rising pension/healthcare costs and angry taxpayers tired of service cuts by accounting trickery and jacking up fees and taxes. Crunch-time has also been put off by rising home values that pushed property tax revenues higher.

These solutions are running out of rope: Property values have topped out, and accounting trickery hasn’t solved the fiscal impossibility of maintaining services and meeting pension obligations in a stagnant economy. When push comes to shove, services must be cut, either by bankruptcy or by negotiation. Since the likelihood that taxes will drop is zero, taxpayers will get fewer services for their taxes.

Trend #4: Middle-class income, purchasing power, and discretionary income will all continue to stagnate. Unless you define “middle class” as those households earning $150,000 and up (9.1% of households)—and if you define the top 9% as “middle” class, your definition has lost all meaning—what’s left of the middle class will see real and discretionary income continue to stagnate. The causes of this decline in labor’s share of the economy are structural and cannot be remedied by lowering interest rates to zero or jacking up the stock market: Zero-interest rates have deprived households of income, and few in the bottom 90% own enough stock to affect their wealth. (Source: The Distribution of Household Income and the Middle Class)

Trend #5: Junk fees will continue to replace legitimate taxes. Fearful of blowback from ever-rising taxes, local governments have turned to junk fees as the preferred method of “revenue enhancement.” These include sharply higher fees for recreation, parking tickets, permits, etc., and a multitude of add-ons to property taxes and other existing tax structures. Local authorities are counting on the taxpayers to sigh but do nothing as long as the fee increases are small enough to avoid triggering political resistance.

In our small California town, the city has raised the fees for trash pickup by more than 100% in recent years—ironically, their reason is that recycling (which they encourage) has reduced the amount of trash being collected. This sort of nonsensical rationalization for radically higher fees will join the usual justifications; i.e., We can no longer fill potholes and pave streets unless we raise your taxes.

How did they manage to perform these basic services 10 or 20 years ago with much smaller budgets? The answer: See Trend #3, skyrocketing pension and healthcare costs.

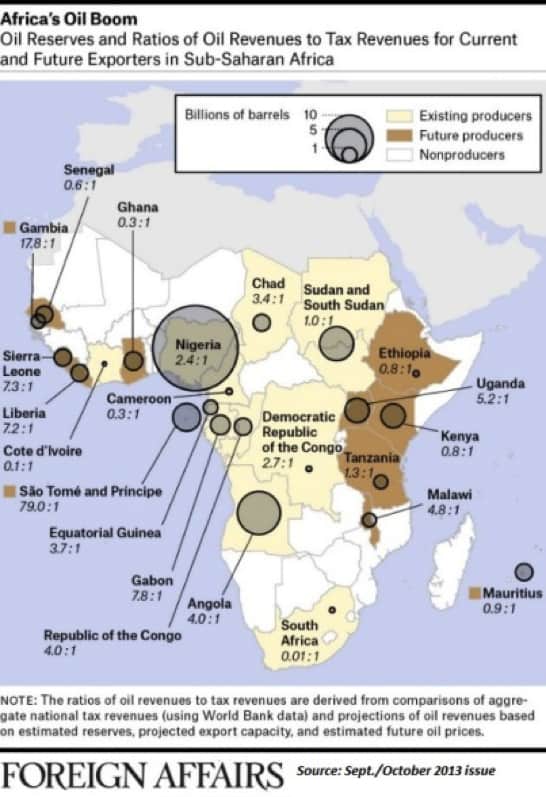

Trend #6: The African oil exporting nations will move from the back burner to the front ranks of geopolitical flashpoints, joining the South China Sea, the Mid-East, and North Korea. I recently discussed The Scramble for Africa's Oil and the “resource curse” that is fueling the potential for conflict over Africa’s untapped oil wealth:

Trend #7: Americans will continue to passively accept the rise of the Police/National Security State. This may eventually change, but for the next few years the existing motivations for passive acceptance of increasing centralization of power will continue to hold sway.

The first is complicity: The 49% of all Americans—156 million out of 317 million—who receive direct transfers/benefits from the Federal government see little reason to rock the boat or put their cash from the government at risk. (Source)

The second reason is a rational fear of State power: fear of getting tear-gassed and arrested should you join a protest, for example, and a generalized fear of putting whatever you still have at risk by confronting a government given to secrecy and retribution against whistleblowers, protesters, etc.

Trend #8: The Federal government will quietly absorb the rising losses from defaulting student loans rather than reveal the bankruptcy of the entire Higher Education/Student Loan Cartel. There are myriad ways to quash the recognition that the Higher Education/Student Loan Cartel is failing to provide useful education while it burdens younger generations with $1+ trillion in high-interest debt: quietly forgive some defaulted loans, stop enforcing collection of defaulted loans, etc. The Federal government doesn’t want to call attention to its management of this powder keg, as widespread recognition that the system is broken will unleash calls for a general debt amnesty that will blow the big-debt-for-worthless-degrees system wide apart.

In Part II: Outcomes to Bet On in 2014, we’ll forecast the most likely consequences of these trends. With such understanding comes the opportunity to position ourselves in front of them for protection and/or profit.

Click here to access Part II of this report (free executive summary; enrollment required for full access).

This is a companion discussion topic for the original entry at https://peakprosperity.com/the-trends-to-watch-for-in-2014/