The Federal Reserve is probably not ready to take the aggressive plunge into Nominal GDP Targeting, but it likely will.

Such a policy, which received wider attention during Ben Bernanke's Congressional questioning last year and was also highlighted this year in a paper delivered at the Jackson Hole conference (Woodford, opens to PDF), has not caught any visible traction with Washington policy makers possibly because it’s seen as either too radical, or simply too new.

However, after four years of broad reflationary policy (and another year to come) failing to meaningfully spur U.S. employment growth, the Fed may be willing to try such measures by late next year, 2013.

Indeed, given the Fed’s recent announcement of open-ended quantitative easing (QE), one can already anticipate the incremental move towards Nominal Gross Domestic Product (NGDP) Targeting, which has as its central belief that an aggressive and open-ended promise to pursue growth at the expense of inflation is the booster required to push a structurally broken economy back to normal trend. Moreover, in contrast to Bernanke’s swift rejection last year of NGDP on a conceptual basis, Bernanke discussed the idea in friendlier terms during his post-Federal Open Market Committee (FOMC) news conference.

What’s 'exciting' about the emergence of NGDP Targeting into mainstream economic thinking is that, once implemented, it will provide a real-world test of reflationary policy’s final effort to combat the forces that have led to the end of strong, economic growth. The appearance of the Woodford paper (link above) further highlights the reality that endless amounts of cheap capital will be provided to restart economies, now that we are in energy transition, with the world having lost its cheap oil. The battle between credit and natural resources will be renewed.

What will be the effect on global natural resource extraction in an era of NGDP Targeting?

Simple. All of the remaining fossil-fuel BTUs will be extracted on an accelerated basis, and governments will race to provide the capital to do so.

The Post-Abundance Era

It makes sense that just as the era of abundance is coming to an end – an era which dominated developed world economies over the past 250 years – an enthusiastic, vestigial embrace of Abundance would pour forth from culture. Books such as Abundance: The Future is Better Than You Think and also The Coming Prosperity have appeared in a flourish, all in the past year.

Is it not telling that this outpouring has occurred just as it has become crystal clear that prices of resources were not – even in the post-2008 era – returning to levels of the prior decade?

It is either lurid or tragic that assertions of abundance would flower after energy prices endured a price revolution, agriculture prices did the same, and purchasing power and incomes in the developed world entered decline. The repricing of the planet is a super-trend that has endured for more than 10 years now, and it has wreaked havoc on just about every asset class from stocks to housing. While observers currently cheer stabilization in such prices, it's worth noting that the S&P 500 first reached current levels more than 12 years ago. Therefore, each unit of the stock market buys less of everything. So much for abundance.

It is additionally rather galling to be harangued by Abundance Theorists at a time when OECD economies have essentially failed, both in their financial systems and their ability to produce jobs, and are instead now producers of poverty. As purchasing power declines in the West against energy and food, what can Abundance Theorists possibly be thinking? It is not as if the industrial revolution in the Non-OECD is producing higher quality lives either, as countries like China convert themselves into waste dumps of coal-fired and chemical pollution, and India sees pluralities of its population continue to go without electricity or a reliable water supply.

Abundance would mean that globally, energy is so plentiful that it would be too cheap to meter. On the contrary, global energy prices – and in particular, food prices (which are strongly linked to energy prices) – have completely broken out of long-term trend lines to the upside.

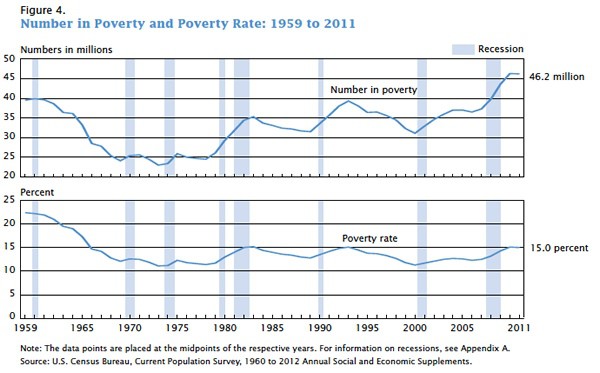

There is no better measure of the aggregate loss of purchasing power against resources than the advance that poverty has made in the past 10 years, especially in the United States. While it’s true that various policy choices have exacerbated income inequality in the West for over thirty years, such explanations were more satisfying from 1975-2000, during a long period of efficiency gains in the economy. As it happens, the U.S. Census Bureau has just released fresh data on U.S. poverty, and while not a surprise, it does not make for pleasant reading. U.S. poverty is at its highest levels since 1993, but the current level -- 15% -- is very near the highs of the last 40 years:

Number in Poverty and Poverty Rate: 1959-2011

(Source - The U.S. Census Bureau)

Some observers have commented that the U.S. poverty rate is actually “not as bad as it seems” because of food stamps, various state and federal assistance programs, unemployment insurance, and other financial aid that the government now provides to the poor. These are collectively known as "transfer payments." However, the income bracket requirements to be placed in the poverty category have such a low ceiling that it seems likely that U.S. poverty remains undercounted. From recent news coverage of the poverty figures at the San Jose Mercury News:

Although the poverty rate didn't rise, the median household income for all Americans declined 1.5 percent to $50,100 in 2011. That was an 8.1 percent decline from 2007, before the recession began, and 8.9 percent lower than the 1999 peak. To be classified as poor in 2011, a family of two adults and two children would have had to make less than $22,811. Some economists had predicted Wednesday's annual report would show the poverty rate hitting its highest level since 1965, when President Lyndon Johnson announced his war on poverty. The fact that the numbers instead leveled off after three consecutive years of increase was a relief to some. Still, the persistent poverty is troubling: the 15 percent poverty rate ties with 2010 as the highest since 1993 and one of the highest since the government began measuring poverty.

(Source)

There is a certain unreality to a measurement that deems a family of four with an income above $22,811 to not be in poverty. How, exactly, could one live as a family of four in these United States with an income of $24,000 or even $26,000 and not be in poverty? For such a household, energy and food prices alone would dictate either a very poor diet, or the need for government assistance in utility and transport costs, or both. Indeed, a new unreality in our accounting now marks many areas of economic life in the U.S. in the post-Abundance era.

Unreality in Energy Costs: The Ethanol Example

Analysts have pointed out for years that a significant portion of the military budget is devoted to the safety of global oil supply, and thus each barrel of oil has “external” costs that the user does not pay at the pump, but instead pays as a taxpayer. This is undoubtedly true.

So what policy has the U.S. pursued in an era when military costs and the price of oil are even more onerous? The policy of mandated ethanol.

Mandated ethanol in the U.S. has done nothing to lower gasoline prices (which are, of course, driven entirely by oil prices) regardless of ethanol content. Moreover, the energy content of all organic material, in this case corn, is so low that by the time the process of converting corn to a liquid is complete, so many other energy inputs have been required that the net energy pick-up is incredibly small. In order to escape the reality of structurally higher oil prices, the U.S. has diverted enormous capital and other resources to a program that is largely symbolic. But billions in tax credits have been devoted to grow and support an industry that could simply not make it without such support, primarily for two reasons: one, because the low energy content of corn does not provide enough profit to pay all entities in the production chain; and two, because ethanol makers are essentially refiners and do not ultimately control the cost of their feedstock (corn).

Ethanol policy has been underway since 2006, when the price of oil had started its price revolution. And aggressive reflationary policy in the US has actually been underway for 12 years, not just the past four years, when the near-zero interest rate policy was first employed (1.00% interest rates). These two policies are an example of how institutions and economies will grapple with both the loss of cheap energy and the tremors such a loss sends out through an economy. Trying to battle, hold back, and generally thwart secular changes in prices and carrying capacity with patchwork solutions not only is destined to fail, but brings with it myriad other consequences.

For example, because the economy was already experiencing energy limits in the early part of last decade, instead of spurring organic growth, reflationary policy simply distributed into the fixed assets of housing. That was confirmation that other barriers to growth were already becoming embedded.

Reflationary policy produced a greater quantity of resources, nor cheaper resources.

Similarly, in ethanol policy, instead of reconfiguring transportation systems or investing in rail, the U.S. foolishly wasted billions trying to produce more liquids when the real problem was the quickly escalating cost of oil supply. As we now understand, agricultural production is not free, but instead tied very much to fossil fuel costs. So the dream of escaping from high oil prices by running large-scale food-to-fuel programs is destined to fail.

No Carbon or Green Solutions at Sufficient Scale Coming

But if you think these measures are desperate, we have only just begun to push energy and financial systems beyond their capability.

The launch of QE3 (and similar measures by the European central bank (ECB) in Europe) is like the crack! of a starting-gun to human psychology that carries the following, urgent message: Hey, humans – go get those resources quickly, before someone else does! Indeed, the most powerful lever for monetary policy remains our capacity for social competition. The open-ended promise to pursue a faster rate of growth at the expense of inflation, mal-investment, bubbles, and the environment places a new and fast pressure on human economies to perform.

Those who are concerned about the environment and climate change should also read the onset of QE3 and the inevitability of NGDP Targeting as the start of the next big leg of resource extraction. And, accordingly, of CO2 production.

While the dream of a green energy transition persists, however, no such transition from fossil fuels to renewable energy is taking place at sufficient scale or speed to effectively shift human economies to new energy architectures. We already have sufficient and clear data in our possession to know with some degree of certainty how energy transition is currently proceeding. In short, while wind and solar resources are growing at near-exponential rates, they remain such a small portion of the global energy mix that even in the best case scenario just 15% of the global powergrid will be free of fossil fuels roughly 20 years from now.

Displacing that much of the powergrid with renewables will indeed be an achievement, but unfortunately, the recoverable reserves of natural gas and especially coal are sufficient to fund incremental growth for at least another 20 years. Even if we project a mostly flat global economy for the next two decades, the energy-funding requirements to run a flat global economy will still necessitate that we extract enormous volumes of fossil fuels each year. And that is precisely what will happen as long as aggressive reflationary policy is pursued.

Accordingly, any global effort to place carbon taxes on economies or to agree to other climate treaties will largely be token and symbolic. In Part II: What Happens Once We've Burned All the Resources?, we take a look at the remaining reserves of natural gas and coal, and roughly model the composition of energy inputs to the global powergrid as economies transition increasingly away from oil. Also, now that it’s clear that this reflationary policy will carry on for years and years to come, we explore at a rough calendar as new programs roll out in Japan, the EU, and the U.S. Those who predicted Infinite QE have now been proven correct.

Click here to read Part II of this report (free executive summary; paid enrollment required for full access).

This is a companion discussion topic for the original entry at https://peakprosperity.com/the-war-between-credit-and-resources/