Western central banks have tried to shake off the constraints of gold for a long time, which has created enormous difficulties for them. They have generally succeeded in managing opinion in the developed nations but been demonstrably unsuccessful in the lesser-developed world, particularly in Asia. It is the growing wealth earned by these nations that has fuelled demand for gold since the late 1960s. There is precious little bullion left in the West today to supply rapidly increasing Asian demand. It is important to understand how little there is and the dangers this poses for financial stability.

An examination of the facts shows that central banks have been on the back foot with respect to Asian gold demand since the emergence of the petrodollar. In the late 1960s, demand for oil began to expand rapidly, with oil pegged at $1.80 per barrel. By 1971, the average price had increased to $2.24, and there is little doubt that the appetite for gold from Middle-Eastern oil exporters was growing. It should have been clear to President Nixon’s advisers in 1971 that this was a developing problem when he decided to halt the run on the United States' gold reserves by suspending the last vestiges of gold convertibility.

After all, the new arrangement was: America issued the petrodollars to pay for the oil, which were then recycled to Latin America and other countries in the West’s sphere of influence through the American banks. The Arabs knew exactly what was happening; gold was simply their escape route from this dodgy deal.

The run on U.S. gold reserves leading up to the Nixon Shock in August 1971 is blamed by monetary historians on France. But note this important passage from Ferdinand Lips’ book GoldWars:

Because Arabs did not understand bonds and stocks they invested their surplus funds in either real estate and/or gold. Since Biblical times, gold has been the best means to keep wealth and to transfer it from generation to generation. Gold therefore was the ideal vehicle for them. Furthermore after their oil reserves are exhausted in the distant future, they would still own gold. And gold, contrary to oil, could never be wasted.

According to Lips, Swiss private bankers, to whom many of the newly-enriched Arabs turned, recommended that a minimum of 10% and even as much as 40% should be held in gold bullion. This advice was wholly in tune with Arab thinking, creating extra demand for America’s gold reserves, some of which were auctioned off in the following years. Furthermore, Arab investors were unlikely to have been deterred by high dollar interest rates in the early eighties, because high interest rates simply compounded their rapidly-growing exposure to dollars.

Using numbers from BP’s Statistical Review and contemporary U.S. Treasury 10-year bond yields to gauge dollar returns, we can estimate gross Arab petrodollar income, including interest from 1965 to 2000, to total about $4.5 trillion. Taking average annual gold prices over that period, ten percent of this would equate to about 50,500 tonnes, which compares with total mine production during those years of 62,750 tonnes, over 90% of which went into jewellery.

This is not to say that 50,000 tonnes were bought by the Arabs; it could only be partly accommodated even if the central banks supplied them gold in very large quantities, of which there is some evidence that they did. Instead, it is to ram the point home that the Arabs, awash with printed-for-export petrodollars, had good reason to buy all available gold. And importantly, it also gives substance to Frank Veneroso’s conclusion in 2002 that official intervention – i.e., undeclared sales of significant quantities of government-owned gold – was effectively being used to manage the price in the face of persistent demand for physical gold as late as the 1990s.

Transition from Arab demand

Arabs trying to invest a portion of their petrodollars would have left very little investment gold for the advanced economies. As it happened, U.S. citizens had been banned from holding bullion until 1974, and British citizens were banned until 1971. Instead, they invested mainly in mining shares and Krugerrands, continuing this tradition by using derivatives and unbacked unallocated accounts with bullion banks in preference to bullion itself. This meant that, until the mid-seventies, investment in physical gold in the West was minimal, almost all gold being held in illiquid jewellery form. Western bullion investors were restricted to mainly Germans, French, and Italians, mostly through Swiss banks. The 1970s bull market was therefore an Arab affair, and they continued to absorb gold through the subsequent bear market.

By the late-nineties, a new generation of Swiss investment managers, schooled in modern portfolio theory and less keen on gold, persuaded many of their European clients to reduce and even eliminate bullion holdings. At the same time, a younger generation of Western-educated Arabs began to replace more conservative patriarchs, so it is reasonable to assume that Arab demand for gold waned somewhat, as infrastructure spending and investment in equity markets began to provide portfolio diversification. This was therefore a period of transition for bullion, driven by declining Western investment sentiment and changing social structures in the Arab world.

It also marked the beginning of accelerating demand in emerging economies, notably India, but also in other countries such as Turkey and those in Southeast Asia, which were rapidly industrialising. In 1990, the Indian Government freed up the gold market by abolishing the Gold Control Act of 1968, paving the way for Indians to become the largest officially-recognised importers of gold until overtaken by China last year.

Lower prices in the 1990s stimulated demand for jewellery in the advanced economies, with Italy becoming the largest European manufacturing centre. At the same time, gold leasing by central banks increased substantially, as bullion banks exploited the differential between gold lease rates and the yield on short-term government debt. This leased gold satisfied jewellery demand as well continuing Asian demand for gold bars.

So, despite the fall in prices between 1997-2000, all supply was absorbed into firm hands. When gold prices bottomed out, Western central banks almost certainly had less gold than publicly stated, the result of managing the price until 1985, and through leasing thereafter. This was the background to the London Bullion Market Association, which was founded in 1987.

The LBMA

In 1987, the unallocated account system became formalized under London Bullion Market Association (LBMA) rules, allowing the bullion banks to issue gold IOUs to their customers, making efficient use of the bullion available. The ability to expand customer business in the gold market without having to acquire physical bullion is the chief characteristic of the LBMA to this day. Futures markets in the U.S. also expanded, and so derivatives and unallocated accounts became central to Western investment in gold. Today the only significant bullion held by Western investors is likely to be a small European residual plus exchange-traded fund (ETF) holdings. In total (including ETFs), this probably amounts to no more than a few thousand tonnes.

The LBMA was established in 1987 in the wake of the Financial Services Act in 1986. Prior to that date, the twice-daily gold fix had become the standard pricing mechanism for international dealers, whose ranks grew on the back of the 1970s bull market. This meant that international banks established their bullion dealing activities in London in preference to Zurich, which was the investment centre for physical bullion. The establishment of the LBMA was the formalization of an existing gold market based on the 400-ounce "good delivery" standard and the operation of both allocated and unallocated accounts.

During the twenty-year bear market, attitudes to gold diverged, with capital markets increasingly taking the view that the inflation dragon had been slain and gold’s bull market with it. At the same time, Asian demand – initially from the Arab oil exporters but increasingly from other nations led by Turkey, India, and Iran – ensured that there were buyers for all the physical gold available. Mine supply, which benefited from the introduction of heap-leaching techniques, had increased from 1,314 tonnes in 1980 to 2,137 tonnes in 1990 and 2,625 tonnes by 2000. Together with scrap supply, London was in a strong position to intermediate between a substantial increase in gold flows to Asian buyers, and it was from this that central bank leasing naturally developed.

Gold backed by these physical flows was the ideal asset for the carry trade. A bullion bank would lease gold from a central bank, sell the gold, and invest the proceeds in short-term government debt. It was profitable for the bullion bank, governments were happy to have the finance, and the lessor was happy to see an idle asset work up some extra income. However, leasing only works so long as the bullion bank can hedge by accessing future supply so that the lease can eventually be terminated.

Before 2000, this was a growing activity, fuelled further by Swiss portfolio disinvestment in the late 1990s. As is usual in markets with a long-term behavioral trend, competition for this business extended the risks beyond being dangerous. This culminated in a crisis in September 1999, when a 30% jump in the price threatened to bankrupt some of the bullion banks who were in the habit of running short positions.

Post-2000

Bull markets always start with very little mainstream and public involvement, and so it has proved with gold since the start of this century. So let us recap where all the gold was at that time:

- Total above-ground gold stocks were about 129,000 tonnes, of which 31,800 tonnes were officially monetary gold. Of the balance, approximately 85-90% was turned into jewellery or other wrought forms, leaving only 10-15,000 tonnes invested in bar and coins and allocated for industrial use.

- Out of a maximum of 15,000 tonnes, coins (mostly Krugerrands) accounted for about 1,500 tonnes and other uses (non-recovered industrial and dental), say, 1,000 tonnes. This leaves a maximum of 12,500 tonnes and possibly as little as 7,500 tonnes of investment gold worldwide at that time.

- After Swiss fund managers disposed of most of the bullion held in portfolios for their clients in the late 1990s, there was very little investment gold left in European and American ownership.

- Frank Veneroso in 2002 concluded, after diligent research, that central banks had by then supplied between 10-15,000 tonnes of monetary gold into the market. Much of this would have gone into jewellery, particularly in Asia, but some would have gone to the Middle East. This explains how extra investment gold may have been supplied to satisfy Middle Eastern demand.

- Middle Eastern countries must have been the largest holders of non-monetary gold in bar form at this time. We can see that 10% of petrodollars invested in gold would have totalled over 50,000 tonnes, yet there can only have been between 7,500-12,500 tonnes available in bar form for all investor categories world-wide. This may have been increased somewhat by the addition of monetary gold leased by central banks and acquired through the market.

It was at this point that the second gold bull market commenced against a background of very little liquidity. Investment bullion was tightly held, the central banks were badly short of their declared holdings of monetary gold, and from about 2004 onwards, ETFs were to grow to over 1,500 tonnes. Asian demand continued to grow (led by India), and China began actively promoting private ownership of gold at about the same time.

Other than through physically-backed ETFs, Western investors were encouraged to satisfy their demand for bullion through derivatives and unallocated accounts at the bullion banks. There are no publicly available records detailing the extent of these unallocated accounts, but the point is that Western demand has not resulted in increased holdings of bullion except through securitised ETFs. Instead, the liabilities faced by the bullion banks on uncovered accounts will have increased to accommodate growth in demand. Therefore, the vested interests of the bullion banks and the central banks overseeing the gold market call for continued suppression of the gold price, so as to avoid a repeat of the crisis faced in September 1999 when the price increased by 30% in only two weeks.

Where are the sellers?

Price suppression can only be a temporary stop-gap, and there has never been sufficient supply to allow the central banks to retrieve their leased gold from the bullion banks. Therefore, Frank Veneroso’s conclusion in 2002 that there had to be existing leases totalling 10-15,000 tonnes is a starting point from which leases and loans have increased. There are two events which will almost certainly have increased this figure dramatically:

- When the price rose to $1900 in September 2011, there was a concerted attempt to suppress the price from further rises. The lesson from the 1999 crisis is that the bullion banks’ geared exposure to unallocated accounts was forcing a crisis upon them; if they had been forced to cash-settle these accounts, the gold price would almost certainly have risen further, risking a widespread monetary crisis.

- Through 2012, Asian demand, particularly from China, coinciding with continued investor demand for ETFs, was already proving impossible to contain. In February this year, the Cyprus bail-in banking crisis warned depositors in the Eurozone that all bank deposits over the insured limit risked being confiscated in the event of a wider Eurozone banking crisis. This drove many unallocated account holders to seek delivery of physical gold from their banks, forcing ABN-AMRO and Rabobank to suspend all gold deliveries from their unallocated accounts. This was followed by a concerted central- and bullion-bank bear raid on the market in early April, driving the price down to trigger stop-loss sales in derivative markets and subsequent liquidation of ETF holdings.

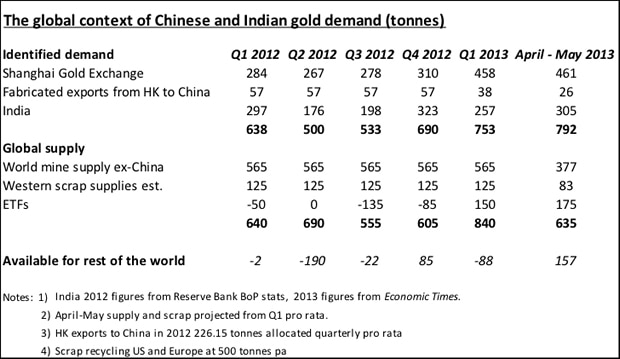

It is widely assumed that the unexpected rise in demand for bullion that resulted from the April take-down was satisfied through ETF sales, but an examination of the quantities involved shows they were insufficient. The table below includes officially reported demand for China and India alone, not taking into account escalating demand from the Chinese diaspora in the Far East and from elsewhere in Asia:

These figures do not include Chinese and Indian purchases of gold in foreign markets and stored abroad, typically carried out by the rich and very rich. Nor do they include foreign purchases by the Chinese Government and its agencies. Despite these omissions, in 2012, recorded demand from these two countries left the world in a supply deficit of 131 tonnes. Furthermore, ahead of the April smash-down in the first quarter of this year, the deficit had jumped to 88 tons, or an annualised rate of 352 tonnes.

Demands for delivery by panicking Europeans in the wake of the Cyprus fiasco could only provoke one reaction. On Friday 12th April, 400 tonnes of paper gold were dumped on the market in two orders, triggering stop-loss sales and turning market sentiment bearish in the extreme. Western investors started to think about cutting their losses, and they sold down ETF holdings to the tune of 325 tonnes in 2013 by the end of May. However, this triggered record demand among those who looked on gold as insurance against currency and systemic risks.

Later that year, in July, Ben Bernanke told the Senate Banking Committee he didn’t understand gold. That was probably a reference to the April gold price smash orchestrated by the central banks and how it unleashed record levels of demand. It was an admission that he thought everyone would follow the new trend by acting like portfolio investors, forgetting that if you lower the price of a commodity, you merely unleash demand. It was also an important admission of policy failure.

Since those events in April, someone has been supplying the market with significant quantities of gold to keep the price down. We know it is not Arab gold, because I have discovered through interviewing a director of a major Swiss refiner that Arab gold is being recast from LBMA specification bars into one-kilo .9999 bars, which has become the new Asian standard. Arab gold does not appear to be being sold, only recast, and anyway, it is only a small part of their overall wealth. We also know from our long-term analysis that any European gold bullion is relatively small in quantity and tightly held. There can only be one source for this gold, and that is the central banks.

I discovered that there was a discrepancy in the Bank of England’s custodial gold of up to 1,300 tonnes between the date of its last Annual Report (28th February) and mid-June, when a lower figure was given out to the public on the Bank’s website. This fits in well with the additional amount of gold needed to manage the price between those months. Furthermore, the Finnish Central Bank recently admitted that all its gold held at the Bank of England was “invested” – i.e., sold – and further added that the practice “was common for central banks.”

Bearing in mind Veneroso’s conclusion in 2002 that there must be 10,000-15,000 tonnes out on lease and loan from the central banks at that time, one could imagine that this figure has increased significantly. Officially, the signatories of the Central Bank Gold Agreement, plus the U.S. and U.K. own 20,393 tonnes. A number of other central banks are likely to have been persuaded to “invest” their gold, but this is bound to exclude Russia, China, the Central Asian states, Iran, and Venezuela. Taking these holders out (amounting to about 3,000 tonnes) leaves a balance of 8,401 tonnes for all the rest. If we further assume that half of that has been deposited in London, New York, or Zurich and leased out, that means the total gold leased and available for leasing since 2002 is about 12,000 tonnes. And once that has gone, there is no monetary gold left for the purpose of price suppression.

Could this have disappeared since 2002 at an average rate of 1,000 tonnes per annum? Quite possibly, in which case, the central banks are very close to losing all control over the gold price.

In Part II: The Very Real Danger of a Failure in the Gold Market, I discuss why the Chinese are buying so much gold and why the Reserve Bank of India is trying to suppress gold demand. I show that gold is substantially undervalued and why that undervaluation is likely to correct itself spectacularly, precipitating a financial crisis.

Click here to access Part II of this report (free executive summary; enrollment required for full access).

This is a companion discussion topic for the original entry at https://peakprosperity.com/there-is-too-little-gold-in-the-west/