No plan of operations extends with any certainty beyond the first contact with the main hostile force.

~ Helmuth von Moltke the Elder

Everybody has a plan until they get punched in the mouth.

~ Mike Tyson

Scottish poet Robert Burns aptly penned the famous phrase: “The best laid schemes o' mice an' men/Gang aft a-gley.” (commonly adapted as "The best laid plans of mice and men often go awry.")

How right he was.

History has shown time and time again that the only 100% predictable outcome to any given strategy is that, when implemented, things will not go 100% according to plan.

The Titanic's maiden voyage. Napolean's invasion of Russia. The Soviet's 1980 Olympic hockey dream team. The list of unexpected outcomes is legion.

Dwight D. Eisenhower, the Supreme Commander of the Allied Expeditionary Forces in Europe during WW2, went as far as to say: "In preparing for battle, I've always found that plans are useless but planning is indispensable."

This wisdom very much applies to anyone seeking safety from disaster. Whether preparing for a natural calamity, a financial market crash, an unexpected job loss, or the "long emergency" of resource depletion -- you need to take prudent planful steps now, in advance of crisis; BUT you also need to be mentally prepared for some elements of your preparation to unexpectedly fail when you need them most.

Here are two recent events that drive that point home.

Lessons From Hurricane Florence

A family member of mine lives in Wilmington, NC, which received a direct hit last month from Hurricane Florence.

Being an avid "prepper" who has lived on the east coast all his life (i.e., well-experienced with the late summer/early autumn hurricane season), he was MUCH more geared up for this storm than his neighbors. He also had nearly a week's advance notice to top off his preparations as the media tracked Florence's trajectory following its formation off of the west coast of Africa.

But as ready as he thought he was, he still found he was vulnerable in places he hadn't anticipated.

While he and his family made it through the storm all right in the end, he experienced numerous failures in his preps throughtout. Here are just a few:

- Climate-related corrosion -- despite careful efforts to store his emergency gear responsibly, he discovered the humid North Carolina climate had ruined several pieces of equipment. The alkaline batteries used in the emergency radios had exploded, corroding the terminals and rendering the devices useless. Similarly, the wick controls on several kersosene lanterns had rusted to the point of inoperability. The lesson here? If you live in an area that experiences excessive conditions (heat/cold/humidity/mold/etc) for even part of the year, you must check your gear regularly to ensure it's still functional.

- Incorrect assumptions -- Several components did not work as expected when deployed. The "universal" gas line purchased in advance to connect his collection of camping stoves to a large propane tank simply didn't fit. Similarly, his Gas Tapper siphon failed to work, which he was hoping could help neighbors refuel their generators by transferring gas from their cars. But in every case but one, it simply didn't work. The takeway? If you haven't tested a specific piece of gear in advance, under non-emergency conditions, assume it won't work when you need it.

- Random fate -- Sometimes, as Burns said, plans just go awry. In this case, a diesel truck had been configured to act as a generator and provide electricity to key appliances (freezer, fridge, etc) should the power go out for a prolonged period -- which it did. But as random fate would have it, the starter motor failed. The truck sat there like a big useless brick during the blackout. Fortunately, there was another vehicle in the garage set up similarly that did work. The lesson? Always, always have backups in place for any resources that perform an essential function.

Lessons From The Nevada Desert

The 30+ Peak Prosperity members who spent last week at a defensive firearm training program in the Nevada desert received a similar 'reality check'.

Most who participated already owned firearms and had invested previous hours at their hometown ranges honing their shooting skills. Or so they thought.

What they quickly realized is that shooting at a stationary paper target under controlled conditions is easy. But maintaining the same accuracy and precision under stress is hard.

Simply adding time-pressure makes shooting well exponentially harder. From a distance as short as 5 yards, hitting the target center-mass repeatedly is an easy task when untimed. But put on a 1.5-second time limit to get your shots off -- which leaves little time for aiming and spikes your adrenaline levels -- and suddenly the misses multiply.

And of course, using a handgun in an acutal kinetic altercation is orders of magnitude more stressful than what we experienced. Low lighting, a moving target who may be armed and/or actively attacking, endangered loved ones, the threat of being seriously injured/killed -- these factors will undoubtedly handicap your proficiency to a MUCH greater extent.

We did one simulation drill 'clearing' a home, opening doors that may or may not have bad guys behind them. The added uncertainty and awkward 'real life' obstacles resulted in a lot of misses and accidentally-killed bystanders. Thank god it was just a simulation.

The hard-hitting insight learned during this experience is: If you haven't stress-tested your gear and your skills under the same conditions you plan to rely on them in, you're woefully underprepared. And to think different is dangerously deluding yourself.

For those of you with preparations in place -- in case of a home invasion, or a fire, or a week without access to the grocery store, or a grid-down event, etc -- have you actually done a 'dry run' to explore how smoothly/poorly your plans work in practice?

How Ready Are You, Really, For A Financial Crisis?

Here at PeakProsperity.com, we've been vocally warning about the high risk of another global financial crisis on par with (or worse than) that seen in 2008.

Quite honestly, we've been warning about this for a long while, as markets have powered higher. While that's been very frustrating to endure, we see the market's manic melt-up as further reason to worry -- as the fall from today's over-extended heights will be that much more painful.

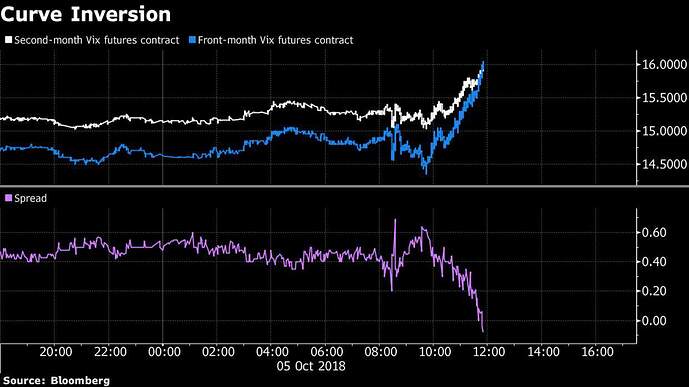

And we may finally be seeing the onset of a correction. Wall Street's 'Fear Gauge' is suddenly spiking, signalling that traders expect increased volatility along with falling prices:

Echoes of February Collapse Reappear in Friday Fear Gauge Inversion (Bloomberg)

October 5, 2018, 9:53 AM PDT

The scariest Halloween costume imaginable pales in comparison to a Friday inversion of the VIX futures curve.

A severe sell-off in technology stocks has pushed the front-month VIX futures contract to a premium relative to the second-month contract.

VIX futures are based off the Cboe Volatility Index, a measure of 30-day implied volatility for the S&P 500 Index that’s often called the “fear gauge.”

Typically, the curve is in contango -- that is, upward sloping -- because the outlook for U.S. equities is more uncertain over longer time periods than shorter ones. The historical pattern of realized volatility shows it’s prone to outsized spikes but generally trades in a modest range.

A curve that’s in backwardation -- the opposite of contango -- indicates traders are acutely concerned with the near-term outlook for equities. This structure also provides a tailwind to investors looking to go long volatility through exchange-traded products.

The same situation happened on a pair of inauspicious Fridays. The VIX futures curve inverted on Aug. 21, 2015 and Feb. 2, 2018.

Given the spasm of instability that has rocked the bond and stock markets over the past 48 hours, Chris Martenson just issued a warning to Peak Prosperity's enrolled subscribers, explaining why the recent activity is so concerning.

Here's just a small part of what he had to say:

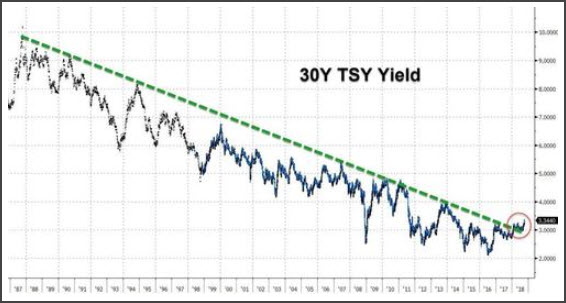

Joining the 10-year in breaking its long-term downtrend line are the 30-year and 5-year bond yields:

Dialing in a little closer, we see that the 30-year bond yield has more recently carved out a pretty convincing “head and shoulders” pattern which indicates a strong likelihood of heading higher:

Here’s the 5-year bond yield chart. It also looks like a breakout:

What’s fascinating is that as the stock market has only recently started to wobble a bit, the main US Treasurys have been declining in earnest since mid-August:

To recap: what we’re seeing now is very consistent with the end of a major credit-liquidity cycle. Everything is being sold. Stocks and bonds.

There’s been no ‘Jell-O moving around the plate’ -- which is the flight-to-safety effect where bonds do well on days stocks do poorly, and vice versa. Both stocks and bonds are being sold off, and bonds have been going first.

As they say on Wall Street: Stocks are for show, but bonds are for dough. Meaning the smart money is in bonds, and they tend to tell the tale first.

So how ready are you, really, if we're indeed headed into another 2008-style market crash?

One in which the major stock market indexes could drop 50% or more in a matter of just a few weeks? Where housing prices could drop by 30-40% (or more) and home buyers go on strike? Where bond prices relentlessly drop as interest rates march higher, freed from a decade-long supression at historic lows? Where mass layoffs return, and hundreds of thousands of workers lose their jobs each month?

Things could get ugly. Really, really ugly.

Are the steps you've put in place to-date sufficient? Have you simulated what's most likely to happen to your portfolio, your job, and your living standards under a variety of scenarios?

I think for most reading this, the honest answer is "no". No one is perfectly prepared. You can always do more.

For those feeling more vulnerable than they'd like, here are our recommendations for using the remaining time we have (which may not be much) wisely:

- Attend to any unfinished basics -- Money is just one component of the true wealth you need to protect. Another Great Recession will have impact on your home, your relationships, your community, your mental state, etc. First, take our Self-Assessment (it's free) to see where you're currently most vulnerable. Then, review our guide for developing resilience (also free) for guidance on the specific steps to take to best protect yourself.

- Crash-test your portfolio with a professional financial advisor -- How vulnerable are your current financial holdings to a major market disruption? If stock/bond/home prices suddenly drop from here, and/or you lose your job, what impact will that have on your lifestyle and your retirement plans? If asset prices fall and you have dry powder to put to use, what logic will dictate the investments you make at that time? These are all critical exercises to go through with your professional financial adviser before the next crash arrives. Contact your adviser to go through them soon -- or, if you don't have a good one, consider scheduling a crash-test consultation (it's free) with the adviser Peak Prosperity endorses.

- Monitor carefully the key crash indicators -- Watching the right indicators is the best way to avoid getting caught unawares by the next financial correction. This was a principal theme of our recent New York Summit featuring David Stockman, Chris Martenson and James Howard Kunstler. You can watch several short video clips from the event (again, for free) by clicking here.

And finally, read the report WARNING: The Markets Are Suddenly Looking Very Sick that Chris Martenson just released. It's an excellent composition of the recent developments that point to a market breakdown in-progress.

Remember: the only valueable preparations are those put in place before crisis arrives.

Or to put it more simply: To fail to plan is to plan to fail.

So get going.

Click here to read Chris' full report (free executive summary, enrollment required for full access)

This is a companion discussion topic for the original entry at https://peakprosperity.com/think-youre-prepared-for-the-next-crisis-think-again/