Originally published at: https://peakprosperity.com/us-treasury-dept-says-were-on-a-fiscally-unsustainability-path/

The message from the US Treasury Department’s most recent annual report was stark:

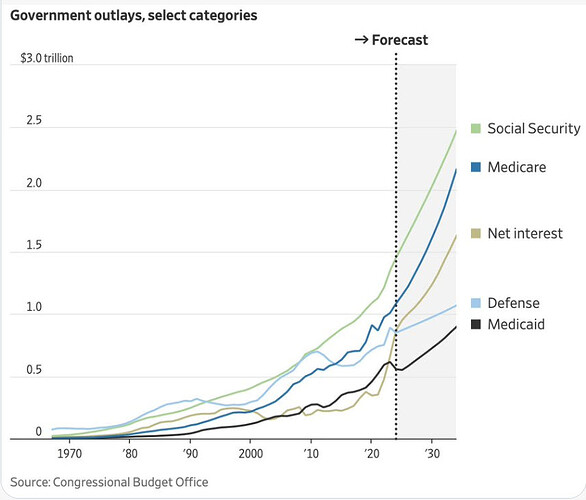

A sustainable fiscal policy is defined as one where the debt-to-GDP ratio is stable or declining over the long term.

The projections based on the assumptions in this Financial Report indicate that current policy is not sustainable.

“Not sustainable” is code-speak for “will someday breakdown spectacularly unless somebody does something about it.”

The main problem, of course, is that we no longer have the sort of politicians with the necessary background or experience to do anything about something this large and meaningful. So nothing will be done.

Are you prepared for that? Most aren’t. Heck, maybe nobody is.

This week Paul Kiker and I discuss these and many other issues.

Peak Prosperity endorses and promotes Kiker Wealth Management’s financial services. To arrange a completely free, no-obligation discussion of your personal financial circumstances and goals with someone who speaks your language and thoroughly shares your outlook on the world, please click this link to go to Peak Financial Investing to begin the process.

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOT PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.