Originally published at: https://peakprosperity.com/volatility-returns-with-a-vengeance-silver-shorts-play-with-fire/

Executive Summary

In this episode of Finance U, Paul Kiker (of Kiker Wealth Management) and I tackled a range of topics from market volatility, the CPI, and the dynamics of gold and silver, to the intricacies of oil prices and the rising interest rate situation in Japan.

Market Volatility and Strategy

Noting the lack of any bounces to sell into (so far), which is a departure from past patterns, Paul described the market as a “jungle.” Even seasoned investors are finding it challenging to navigate. At times like these, having rules and strategies to follow are vitally important.

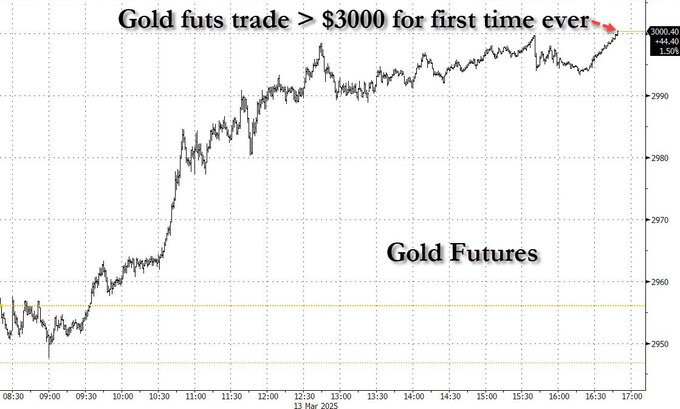

Gold, Silver, and Commodities

Gold and silver are sending signals that we both wish more people would heed. The significant interest from big players and institutions is especially noteworthy. More broadly, given the current strength and demand in commodities, Paul sees potential for that category to outperform equities in the coming years. But the time to go all in has not yet arrived. The signals are there, but not yet conclusive.

Oil Prices and Energy Strategy

For their part, oil prices reveal a disconnect between political narratives and economic realities. Despite Energy Secretary Chris Wright’s publicly stated expectations of rising oil production at $50 a barrel, the economics simply don’t support such a view. As an oil investor, I know the importance of price in determining output levels. The current price range of $70 to $80 is more realistic for profitable drilling. The only thing the Trump administration could do to boost oil production would be to reduce regulatory and tax burdens that would flow to the bottom lines of oil companies and their investors.

Conclusion

The key takeaway was the importance of having a strategy and being prepared for market volatility. Paul advised listeners to control their emotions and make decisions before the herd does. Whether it’s adjusting portfolios or building emergency funds, the focus should be on missed opportunities rather than lost capital. For those seeking guidance, Paul and his team at Kiker Wealth Management are available to help navigate these uncertain times. Remember, the worst thing you can do is hold on until the bottom and then panic sell. Be proactive, be prepared, and stay informed.