Actually, Alan, I’m not particularly looking for an optimistic spin, but an assessment that is as realistic, honest and well-documented as possible. I asked the questions because I’ve done a bit of research and thinking myself, and have some expertise on one of the big issues (grid integration and hours to days ahead PV production forecasting due to weather).

I don’t buy the claim this is at all a done deal. PV is still tiny especially when you consider all energy use, not just electricity. It has not yet scaled up which will likely bring up big challenges in the areas of raw material limitations, capital costs, electric grid integration, and extension to uses that are traditionally non-electric (transportation, especially shipping, air and trucking), construction and mining, cement manufacturing and some other mineral refining, etc. It has gotten to this stage in electricity penetration due to huge subsidies, both explicit and implicit - especially not paying anywhere near the full price of grid integration for an electric source that has a huge, predictable daily cycle and large but not so predictable variability due to clouds.

I’m curious where you stand on the claims in your posts whether your own or those you cited. Do you believe them? Or do you have your doubts. I was under the impression that you do believe them, but perhaps I was mistaken. A question, though: if you do doubt them, why bring them up without mentioning that fact? Because of that, your posts certainly came across to me as cheerleading for the solar will save the day crowd.

If you do believe them, I’ll leave it up to you to parse through the sources you refer to (but don’t provide specific links for). as I would assert that it’s your job to support your own claims. This is just a hunch, but I bet the “experts” (and I put it in quotes because the optimistic spin part raises a red flag for me about the seriousness of their analysis) that you cite have not done their homework on these questions and probably haven’t even considered some or most of them. The optimistic spin part is my biggest clue.

One bit of evidence that PV is still tiny, is that the curve of usage, which should be a logistic function, still looks exponential.

https://en.m.wikipedia.org/wiki/Logistic_function

It isn’t exponential, and won’t be.

Also, I said “should be logistic”; that isn’t accurate either, because some other energy form may overtake it, causing more of a curve like what you see in peak oil. Or we might have a population crash (or boom) in human terms, which would also affect the curve.

Granted, a population boom seems highly unlikely to me; but it isn’t impossible.

A few specific responses, as promised:

alan-

I asked your opinions on these various scenarios because, in other places, you spoke in absolutes. I felt like I was listening to the Popes of old speaking on matters of faith. Ex Cathedra, they call it. “I’m Pope, and what I say is infallible.” Did you mean to speak this way? That’s sure how it comes off.

For instance:

Battery cost will continue to plunge. Pumped hydro will be installed in many utility-level systems...I hear you saying this is a guaranteed outcome, and in a near-term timeframe too. I'm a pretty smart guy, and I'm thinking, its not guaranteed at all. Lots of unpleasant events could derail this outcome, some for quite a while. Yet when I ask you directly for your specific assumptions, you plead ignorance. "Who me? I have no special expertise." And yet when it comes to the path of tech innovation, you have no problem speaking Ex Cathedra on matters that have these assumptions built into literally everything. Now then, regarding assets and liabilities, China, the West, etc. First some background about me. I've spent lots of time in Asia, I even speak (one of the) languages, after a fashion, which turns out to be super useful in understanding culture. Long story short, I'm fairly well plugged in on the realities - both good and bad on the ground. My sense is, China has good stuff, and bad stuff. Lots of awesome trains, that's for sure - a match for anything I saw in Europe. Pollution too - and we know pollution kills. Their pollution is really bad. Corruption. And a massive property bubble that's just guaranteed to end badly. A huge manufacturing infrastructure that employs a large number of the population, designed to service the West's desire for consumer products. As long as the West keeps buying, China will continue to move forward, even with the friction from pollution and corruption. The whole thing is powered by a constant expansion of private debt. That's my view of China. Now then, about assets & debt. Your claim was that China has invested in stuff. This implies that all their debt was backed up (more or less) by assets of roughly equal value. The trains? Let's say you get 50% credit on the trains. They're great. How much money was siphoned off through corruption? I'm guessing, a lot, just based on my knowledge of how Asia (outside of Hong Kong) tends to work. But still, good trains. I'm a fan. I wouldn't be a holder of debt that was underpinned by those train assets, but even after the (likely inevitable) default, you'll still have trains left, and that's a good thing, not a mal-investment. Likewise, the factories are good stuff, many of them. All that equipment will still be there if the debt blows up. But then there is property. Do you know about the Minsky Financial Instability hypothesis? Debt goes through phases: hedged borrowing, speculative borrowing, and ponzi borrowing. China is well into the Ponzi borrowing phase when it comes to housing. Ponzi investment = malinvestment, by definition, since the debt taken on is not being paid back by an economic return from the property. From all the cases in history, this phase is guaranteed to blow up. There is NO MYSTERY about what the outcome will be. Price eventually drops back down to state #1, usually by a lot of defaults and write-downs of property prices to 50% or 75% of what they paid. I'll say it again: ponzi investment = malinvestment. There might be $1 of "true economic value" for every $3 of debt. I think TAE is right in this area. West has a similar situation. When your rents don't cover your payments, it never ends well. The ponzi phase will go on for long enough to convince everyone that "it's different this time." (It isn't, and never is) A likely trigger for this guaranteed ponzi disaster in China is a "problem in the west" that throws all those people in China's manufacturing industry right out of work. The combination of massive property losses plus massive unemployment could - very easily - could cause a revolution, if the West gets sick enough, for long enough. Do you know how that will play out in China? I'm pretty smart. I spend a good chunk of my time living in Asia. I even speak the language, one of them anyway. I have no idea how it will turn out. I believe there is a disagreeably high chance that, if we get that 30-year depression in the West, the PRC will have an involuntary change in government. It was apparently close in Tienanmen. How will battery tech development cycles fare during a revolution? My guess: poorly. What will be the situation after the revolution? My guess: chaotic. It's not the ideal environment for doing R&D. How long could it take before the West has its problem? Heck, it could happen next year. Or not. That can keeps getting kicked down the road. My sense: you're overconfident in your assessments in how things "must" proceed. Its a recency bias. Sure, if we remain in the status quo, I agree with you. I saw Moore's Law do fantastic work over my lifetime. I'm conditioned to agree with you. But after studying the causes of the 2008 crash, I just don't think the problems will come from tech.

Battery cost will continue to plunge. Pumped hydro will be installed in many utility-level systems...I hear you saying this is a guaranteed outcome, and in a near-term timeframe too. I'm a pretty smart guy, and I'm thinking, its not guaranteed at all. Lots of unpleasant events could derail this outcome, some for quite a while. Yet when I ask you directly for your specific assumptions, you plead ignorance. "Who me? I have no special expertise." And yet when it comes to the path of tech innovation, you have no problem speaking Ex Cathedra on matters that have these assumptions built into literally everything.

Luke, I’m not sure you understood my point. My point was that batteries will certainly continue to get cheaper, barring a force majeure (see above). A force majeure is an unpredictable, low-likelihood event. You might be right about batteries getting cheaper after a debt bubble collapse, but it seems to me more likely that they (and every other useful tangible thing) would get a lot more expensive – for a short while, or perhaps a longer while if your country was in such bad shape going in to the crash that recovery takes years or decades.

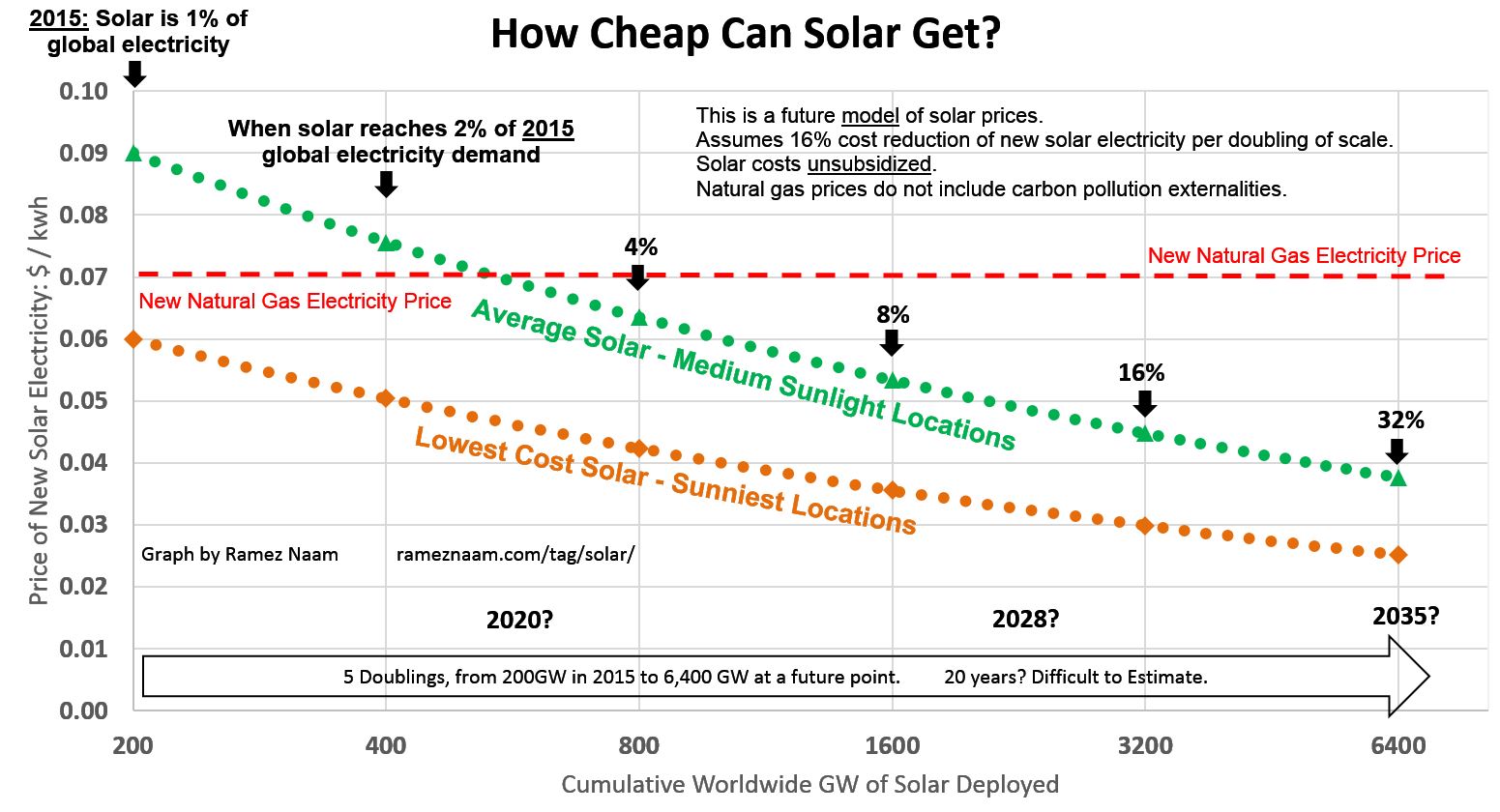

http://rameznaam.com/2016/09/21/new-record-low-solar-price-in-abu-dhabi-…

New Record Low Solar Price in Abu Dhabi – Costs Plunging Faster Than Expected

In fact, if anything, my forecasts were too conservative. The solar prices I expected have been smashed by bids in the Middle East and in Latin America. I will need to update the model above in a future post.

The latest record is an incredibly low bid of 2.42 cents / kwh solar electricity in Abu Dhabi. That is an unsubsidized price.

Let me put that in perspective. The cost of electricity from a new natural gas powerplant in the US is now estimated at 5.6 cents / kwh. (pdf link) That is with historically low natural gas prices in the US, which are far lower than the price of natural gas in the rest of the world.

This new bid in Abu Dhabi is less than half the price of electricity from a new natural gas plant.

What’s more, it’s less than the cost of the fuel burned in a natural gas plant to make electricity – without even considering the cost of building the plant in the first place.

The solar bid in Abu Dhabi is not just the cheapest solar power contract ever signed – it’s the cheapest contract for electricity ever signed, anywhere on planet earth, using any technology.

Nor is this bid a fluke. Three other bids in Abu Dhabi’s latest power auction came in at less than 3 cents / kwh:

Bidder

Bid per MWh (in USD)

Masdar, EDF, PAL Technology

25.4

Tenaga, Phelan Energy

25.9

RWE, Belectric

29.1

Nor is it limited to just Abu Dhabi.

In Chile, just a month ago, a new record low price for solar was set, at 2.91 cents / kwh. That record lasted less than 5 weeks.

In Mexico, the average price of new solar bids in April was 5.1 cents per kwh, and the cheapest solar bid in Mexico was 3.5 cents per kwh.

These price improvements are not coming primarily from the price of panels dropping. They’re coming from reductions in the total cost to deploy solar, increases in solar capacity factor, ever-lower operating costs, and fierce competition to win bids in the solar industry.

The solar industry is learning faster than expected.

Now, let’s watch and see if energy storage prices can drop as fast as solar.

In fact, if anything, my forecasts were too conservative. The solar prices I expected have been smashed by bids in the Middle East and in Latin America. I will need to update the model above in a future post.

The latest record is an incredibly low bid of 2.42 cents / kwh solar electricity in Abu Dhabi. That is an unsubsidized price.

Let me put that in perspective. The cost of electricity from a new natural gas powerplant in the US is now estimated at 5.6 cents / kwh. (pdf link) That is with historically low natural gas prices in the US, which are far lower than the price of natural gas in the rest of the world.

This new bid in Abu Dhabi is less than half the price of electricity from a new natural gas plant.

What’s more, it’s less than the cost of the fuel burned in a natural gas plant to make electricity – without even considering the cost of building the plant in the first place.

The solar bid in Abu Dhabi is not just the cheapest solar power contract ever signed – it’s the cheapest contract for electricity ever signed, anywhere on planet earth, using any technology.

Nor is this bid a fluke. Three other bids in Abu Dhabi’s latest power auction came in at less than 3 cents / kwh:

Bidder

Bid per MWh (in USD)

Masdar, EDF, PAL Technology

25.4

Tenaga, Phelan Energy

25.9

RWE, Belectric

29.1

Nor is it limited to just Abu Dhabi.

In Chile, just a month ago, a new record low price for solar was set, at 2.91 cents / kwh. That record lasted less than 5 weeks.

In Mexico, the average price of new solar bids in April was 5.1 cents per kwh, and the cheapest solar bid in Mexico was 3.5 cents per kwh.

These price improvements are not coming primarily from the price of panels dropping. They’re coming from reductions in the total cost to deploy solar, increases in solar capacity factor, ever-lower operating costs, and fierce competition to win bids in the solar industry.

The solar industry is learning faster than expected.

Now, let’s watch and see if energy storage prices can drop as fast as solar.

alan-

You seem to believe that a debt bubble pop is some Act of God which cannot possibly be anticipated. I on the other hand believe it to be a very predictable result of a well-understood process, namely, the third phase in Hyman Minsky’s Financial instability Hypothesis.

If you are really enthusiastic about placing some sort of bet, I’m fine with that, but you need to be specific on just what it is you’re predicting, and you get no “Act of God” exceptions. If for whatever reason your endpoint doesn’t happen, you lose. (I.e. I will not accept you pretending that my central point is some unpredictable Act of God. Nice try!)

The specificity is important too. Nobody cares about cheap battery prices unless they are in electric cars in large enough numbers to move the needle on oil consumption.

Example:

“By 2020, electric cars will cost the same as gasoline-powered cars. They will have 300 mile ranges, they will constitute 50% of the auto production in , there will be enough solar panels deployed to power the fleet of EV cars, and as a result, in 2025, oil consumption in that country will be down by 30%.”

That’s just an example. Feel free to design your own prediction. If it doesn’t move the needle, then I won’t care, and neither will anyone else.

Aloha! I want to point out that I believe a lot of what Dave points out is true. While you cannot walk around Wall Street in 2007 and get that Bear Stearns and Lehmans would collapse you can get other red flags which I believe are indicative of excessive debt and margin. We all recall them in hindsight. The flood into the Tech bubble stocks and janitors getting McMansion loans following the advice of multiple “house flip tv shows”, which have seen a resurgence of late.

When I see people quoting expert analysts I cringe! Even Mad Money boy had to go on Oprah to apologize to everyone he advised to buy Bear Stearns stock the Friday before the weekend when Bear Stearns made their Sunday bankruptcy announcement. He ruined a lot of people’s financial future like the “smartest guys in the room” did at Enron! My former CPA was fallout from Enron when he lost his job at Arthur Anderson. Dominoes do happen!

To site one “expert” in China is ludicrous. How many credit agencies had AAA ratings on the junk that brought down half the financial industry including AIG who “guaranteed” a lot of that worthless paper. Lets not forget that the only thing that saved the US financial industry was that second visit to Congress to threaten the US government with financial Armageddon if they did not get their TARP. They got their TARP! The middle class got mugged and it has never been the same since.

There were some survivors from the Wall Street 2007 holocaust. One was Hawaii. Why? Because Hawaii does not like the big New York banks. Ever been here? Try to find a Bank America branch. No Chase high rise buildings in the Honolulu skyline. Perhaps that is why China survived the “US banking crisis”! In fact all through the 2007-2009 banking crisis Bank of Hawaii was rated one of the top five strongest US banks.

Then we get to the smoke and mirrors. These were the hypothecated and re-hypothecated assets that nobody knew who owned them. Some of those “assets” actually turned out to be huge repo liabilities once covered in AAA paper. If you do not know the “H and ReH word” google it!

I do believe whole-heartedly that Europe will stumble financially. Anytime one of the biggest trading partners falls down there is a ripple effect. There is no “expert” alive who would know the exact repercussions of that event. Even the politics in Europe is changing as it is in the USA. There is uncertainty. That alone causes people and businesses to cut spending and creates less desire for risk. Do not point to the stock market as proof of anything. Even in destitute Germany of the 1920s the stock market soared because people would move their cash into companies for safety as the government debt and its currency was completely discredited. Something that tends to repeat simply due to human nature, which is the only part of the Ponzi puzzle that never changes.

All in all I do not believe in “experts”. People who claim to be one or claim they swear by one because they have 40 years experience at some bank or credit agency forget that both Bear Stearns and Lehman Bros were 100+ year old institutions filled to the brim with highly paid “experts”! All of them now “non experts”! About the only success any of us can hope for is that we have had more winners than losers in our portfolios when we’re laying in our hospice bed! But even then it would matter not …

I’ll take that flurry of words you wrote as “no, I can’t/won’t come up with an explicit scenario.”

Nobody cares about either batteries or solar panels unless they get installed in large enough numbers to move the needle. They have to affect the system, or nobody cares.

As for your amusing charges of racism, anyone who knows me and my life would laugh at you. (In fact, when I read it, I laughed at you). Nice try!

I think there is certainty about China’s banking system blowing up. I do not think the WHEN is certain. I think the same thing holds true about the west. Our fortunes are tied together. I believe China knows this. They’d love to avoid both Japan’s 1990 fate, as well as the US 1929 fate. That’s pretty clear from all the statements I read from them. I’m just not sure how they’ll do this. Do the same rules not apply to them as they do to us - laws of financial gravity and so on? We’ll find out - and soon, I think.

It all comes down to this: if we go the next 10 years with the status quo (roughly) intact, then we’ll probably get to your EV happy point where there is price parity with FF units, shortages will be worked out of the supply chains, and as a result a large number of units are shipped, solar panels will power them all, and as a result oil consumption will drop significantly.

I put the odds of a near term (next 10 year) very severe credit accident at perhaps 60%. My definition of that event is, “people stop borrowing money for just about everything, for an extended period of time.” That’s why I’m willing to bet with you. That still gives a 40% chance you’ll be right, and we’ll all be picked up and dropped off in auto-driving Tesla robot cars that we’ll all be sharing, powered by ubiquitous solar panels that provide power that’s too cheap to meter.

To sum it up, I believe we have two differences:

- You seem to feel the odds of this credit event are very low and simply not worthy of consideration, I think its > 50%, and TAE thinks it is 110%.

- You seem to feel that such an event, even if it happens, will have little impact on our march towards our EV future. Both TAE and I feel that such an event would have a very large impact on world systems; on supply chains, corporate balance sheets, consumer demand, political system stability, and the desire/ability to execute R&D programs.

If I got your position on either 1) or 2) wrong, I invite you to clarify.

Alan2102- you may have your experts I have my experts.

Jim Rickards, previous guest of Chris on Featured Voices

“The thesis on China is independent of the election of Donald Trump. And Trump’s policies. There are bigger things going on in China that are true regardless of Trump’s policies, even regardlesss of his presidency.”

“China is going broke. And when you say that, people roll their eyes, and say what do you mean China is going broke? It’s the second largest economy in the world, it’s got the largest reserve position in the history of the world, it’s got a big trade surplus, and all those things are true. When I say China is going broke I don’t mean that China’s going to disappear or their civilization is going to collapse, What I mean is that they are running out of hard currency. They are going to get to the point where they don’t have any money, or at least any money that the world wants.”

Rickards goes on to explain the following:

End of 2014, China reserve position = $ 4 trillion USD (largest in the history of the world) due to the excess of trade balance

Today = $2.9 trillion, they have lost $1.1 trillion USD reserve position in a little over 2 years

Of the $2.9 trillion, about $1 trillion is not liquid- invested in hedge funds, overseas mines in Zambia, etc

Of the remaining $1.9 trillion, about another $1 trillion will need to be held in reserve to bail out the Chinese banking system. About 25% of outstanding loans are bad debt, supported by the typical 5-8% reserve capital, so banking capital is completely wiped out if 25% is bad debt. The Chinese banking system is technically insolvent, even though they cook the books. So China will have to bail out the banking system (as they have done in the past) with probably $1 trillion.

$900 billion of liquid assets left

Reserves are going out the door presently at a rate of $50-100 billion a month. China will be broke by the end of 2017. Where did the $1.1 trillion go from 2014 to 2016 and where are the reserves going- the Chinese are getting their money out. Luxury condos in Sydney. Scared of the yuan devaluing.

China is trying to maintaining its currency peg to the dollar (to effectively keep the yuan from weakening), so the central bank is taking its dollars and buying yuan, It cannot work, they will go broke, it always fails. China has few options, they can close the capital account- which takes them out of the international monetary system, which they can’t do. They can raise interest rates to 10% to keep yuan from fleeing, but if they raise interest rates, they will go broke faster due to the bad debt issues.

So the only choice is to devalue the yuan. Which will reverse the current policy of strengthening the yuan, the policy since 2014. China was devaluing from 2000 to 2014.

On Aug 10, 2015 China devalued the yuan 3% in two days and the U.S. stock market fell immediately 10% from Aug 10-31. The Fed propped up the stock market with happy talk, didn’t raise rates etc. and the market turned around, what will happen if China devalues 5% or 10%? (end of Mr. Rickards paraphrase).

If we ignore alan’s silly charges of racism, I do think there are some important deeper points here.

After spending the last few years working with AI, I believe there are some technical (technological) fixes that will help us out a lot, but I’m just not sure we have enough time left in this cycle to see them rolled out. I see a reasonable parallel with his observations about solar and battery tech.

Take AI. If you combine self-driving cars and a sharing mechanism (city car share), there is probably a revolution in there. Saving the capex cost, parking, insurance, repair cost, while keeping the availability of transport for city dwellers would be awesome.

What’s more, in an emergency, all by itself, AI-equipped cars could double the mileage of our existing fleet. How?

Even if they still use gasoline, every AI-equipped car can be a hypermiler. That’s an instant gas consumption improvement which could be rolled out nationwide in the event of a real fuel shortage. Software fix = double MPG. Maybe you don’t go crazy and instead just do a 50% improvement. Result? US is now energy independent, for real this time. Add a “temporary emergency rule” that says only AI cars in hypermiling mode can be on the road for the duration of the emergency. Never let a crisis go to waste.

http://www.motherjones.com/politics/2007/01/guy-can-get-59-mpg-plain-old-accord-beat-punk

But if we get a debt bubble pop before the big AI rollout…silicon valley venture funding dries up. IPOs dry up. Consumer buying power vanishes. Nobody borrows money and nobody buys cars. So even if the pieces of the puzzle are technically in place, nobody has the spare capital to give it a try.

During such an event, gas also remains really cheap, since the precipitous drop in economic activity from the credit bust decreases demand faster than the oil decline rates can take hold. So the motivation to execute the rollout is reduced, too.

So will things hold together long enough for the potentially-energy-saving revolutionary AI to roll out? I have no clue. AI will happen eventually, and even without help from EV, AI by itself can greatly aid in mitigating the peak oil transition. However, the speed of the commercial roll-out will be driven by the availability of capital. Scarce credit = a very, very slow rollout. Only the rich will have AI.

I feel the same way about EVs and solar panels. Tech isn’t quite there yet; we need another half-decade of dev to get to the point where it makes economic sense all on its own, and then another half-decade to seriously roll it out. And even that math is subject to “status quo” issues; if we have a credit event and the bottom drops out of the economy, fossil fuel prices go through the floor, and that makes the solar math a lot harder for the duration of the emergency. Plus, all the current players are structured to provide for an easy-capital economy, and the transition to a hard-capital economy tends to leave a lot of bodies on the floor. Maybe a whole bunch of solar companies go out of business during that time, taking a whole lot of promising R&D with them. I saw that happen with solar panel companies in the aftermath of 2008.

So will we get that development time or not? That’s the question. My gut says this current cycle probably tops out before the rollout can happen.

I hope I’m wrong. I want my hypermiling-AI/EV car to drive me around town in the style to which I’ve become accustomed. But as they say, “there’s many a slip twixt cup and lip.” Whatever can go wrong, will go wrong. And so on.